Activity-Based Costing

It is the accounting of costs based on the activities

What Is Activity-Based Costing (ABC)?

Activity-based costing or ABC costing method uses cost pools and drivers to calculate cost driver rates. As the name suggests, it is the accounting of costs based on the activities. Overhead expenses are differentiated based on the activity they perform.

It is more efficient in a complex environment of an organization, which has multiple ranges of products and services and has many activities in the production process, where assigning costs is cumbersome.

It is an alternative to the traditional method of absorption costing. Traditional costing absorbs overhead costs based on production volume/hours. However, this absorption tends to be misleading as some overhead costs are unrelated to production.

Key Takeaways

-

Activity-Based Costing or ABC Method of Costing uses cost pools and cost drivers to calculate cost driver rates.

-

Cost pools are individual expenses pooled together and relate to a particular activity or operation used in the production process.

-

Cost driver refers to those activities that drive the behavior of the cost pool or cause changes to it as more or less of the activity takes place.

-

The overhead absorption was done based on production volume and absorbed as per machine hours or labor hours, even though not all overhead expenses are related to the production volume.

-

This assumption that all products and services use all the resources in proportion to the production volume in the traditional-based costing leads to the over-costing of low-volume products and the under-costing of high-volume products.

-

Activity Costing not only helps eliminate inefficiencies of conventional costing systems but also aids in better understanding the product costs of a business across all ranges.

-

Some of the advantages of Activity costing include accurately allocating costs, identifying the profitable avenues, better monitoring of costs, better product pricing, and optimizing the organization's productivity.

-

Some criticisms or disadvantages include the costly and time-consuming process, inefficient cost measurements due to incomplete information, and the cost driver selection is not always appropriate. In addition, it is unsuitable for smaller companies or organizations with a limited product or service range as it is not always practical.

Terms in Activity-Based Costing

Now let us look at some of the fundamental terms used in Activity-based costing!

Before we solve an Activity-Based Costing question, it is crucial to understand some basic terms used in the questions. Cost Pool and Cost Driver are two terms used extensively in an ABC question. Let us see what they entail.

What is a Cost Pool?

Cost pools are individual overhead expenses pooled together and relate directly or indirectly to a particular activity or operation used in the production process.

For example, the total salaries paid to the workers in the factory is a cost pool. It relates to the activity/work performed by the workers in the production process. If you add up the salaries of each worker, you get the total salary of all the workers, which is called the cost pool.

What is a Cost Driver?

It refers to those activities that drive the behavior of the cost pool or cause changes to it as more or less of the action occurs.

For example, the number of workers would be the cost driver for the total salary paid to the factory workers. More workers would drive the cost pool up, and fewer workers would bring down the cost.

| Cost Pools | Cost Drivers |

|---|---|

| Purchasing Department Costs | Number of Purchase Orders made |

| Maintenance Costs | Number of Machine Breakdowns |

| Production Run Costs | Number of Production Runs |

| Quality Control Costs | Number of Inspections |

| Ordering Costs | Number of Purchase Orders ordered |

| Dispatch Costs | Number of Customer Orders Dispatched |

| Material Handling Costs | Number of Production Runs |

How to Calculate Activity-Based Costing?

The step-wise calculation can be given as:

Step 1 - Identifying the activity cost pool

An organization has various activities as part of the production process. For example, the number of times a machine breaks down or the number of purchase orders dispatched.

Here, the maintenance cost associated with the activity of the machine breaking down is pooled together into one cost pool as 'Production maintenance cost.' The activity cost pool for the number of purchase orders dispatched would be 'Dispatch costs.'

Step 2 - Identifying the cost driver

Once we identify the activity cost pool, the next step is recognizing the cost driver for the said activity cost pool. The cost driver is the activity influencing the cost pool's behavior.

For example, the number of times a machine breaks down is the cost driver for production maintenance costs. The number of production orders dispatched is the cost driver for the dispatch costs.

Step 3 - Calculate the cost driver rate

We arrive at the cost driver rate by dividing the cost pool by the total number of cost drivers related to the cost pool. This is the activity rate for the said overhead expense or absorption rate.

Cost Driver Rate = Cost Pool/ Cost Driver

Step 4 - Prepare the Cost Statement

To arrive at the cost per unit of the product or service, we use the cost driver rate and multiply it by the assigned number of cost drivers for the particular product.

Let us look at an example below to apply the steps learned above!

Activity-Based Costing Examples

Let's take a few examples to understand the concept better.

Example 1

Question: Oasis Company produces four products Alpha, Beta, Gamma, and Delta. The table below shows the information related to its product for the last year.

| Particulars | Alpha | Beta | Gamma | Delta |

|---|---|---|---|---|

| Production and sales (in units) | 20,000 | 15,000 | 18,000 | 25,000 |

| Selling price per unit (in $) | 5 | 10 | 8 | 4.5 |

| Raw material consumption per unit (in kg) | 10 | 3 | 6 | 7 |

| Direct labor hours (per unit) | 0.5 | 0.2 | 1 | 1.5 |

| Machine hours (per unit) | 1.5 | 1.2 | 3 | 0.8 |

| Number of production runs (per annum) | 20 | 15 | 18 | 25 |

| Number of purchase orders (per annum) | 15 | 20 | 15 | 30 |

| Number of delivery (per annum) | 30 | 45 | 50 | 40 |

The price of raw materials is constant throughout the year at $1.5/kg. The labor cost is $20/hr.

The annual overhead cost for the year was as follows:

| Overhead Expenses | Amount (in $) |

|---|---|

| Raw material procurement cost | $25,000 |

| Delivery costs | $30,000 |

| Machine set-up costs | $5,000 |

| Machine running costs | $7,500 |

Solution:

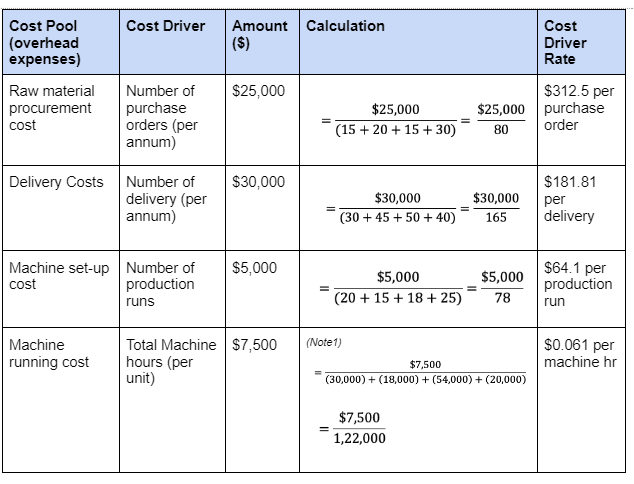

1. Calculating the overhead absorption rate/cost driver rate

*The cost pool has been identified with their cost drivers in the table itself. Therefore, we can now directly proceed to calculate the cost driver rate.

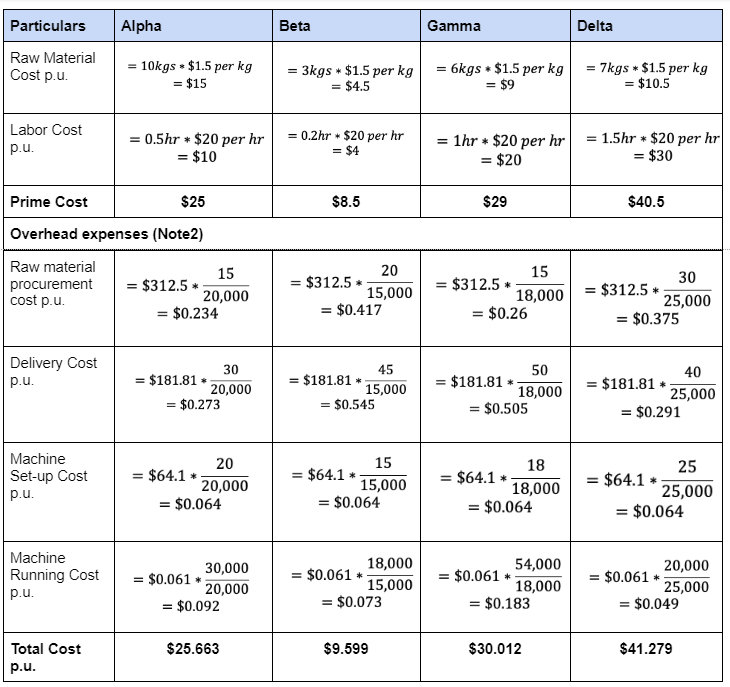

2. Statement of Cost (As per Activity-Based Costing)

Working Notes:

Note 1

Total Machine Hours = Machine hours per unit * Total units produced

Alpha = 1.5 hr p.u.* 20,000 units = 30,000 units

Beta = 1.2 hr p.u.* 15,000 units = 18,000 units

Gamma = 3 hr p.u.* 18,000 units = 54,000 units

Delta = 0.8 hr p.u.* 25,000 units = 20,000 units

Note 2

Overheads cost p.u. = Cost Driver Rate * (Number of cost drivers used by one unit of a product p.a. / Total number of units produced p.a.)

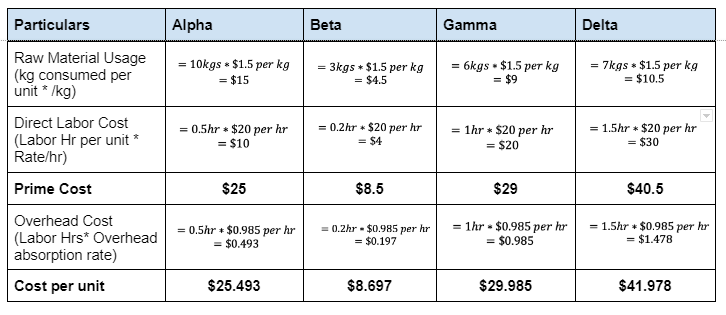

To compare how cost per unit differs, let's calculate cost per unit as per traditional costing.

1.

| Particulars | Amount ($) |

|---|---|

| Raw material procurement cost | $25,000 |

| Delivery costs | $30,000 |

| Machine set-up costs | $5,000 |

| Machine running costs | $7,500 |

| TOTAL | $67,500 |

2.

| Particulars | Production Volume (in units) (1) | Labor Hour per unit (2) | Total Labor Hours (1) * (2) |

|---|---|---|---|

| Alpha | 20,000 | 0.5 | 10,000 |

| Beta | 15,000 | 0.2 | 3000 |

| Gamma | 18,000 | 1 | 18,000 |

| Delta | 25,000 | 1.5 | 37,500 |

| TOTAL | 68,500 |

Overhead Absorption Rate = $67,500/ 68,500 Hrs = $0.985 per hr

3. Cost Statement (as per traditional based costing)

Example 2

This video explains another example; refer to it for further practice.

Reasons for the development of Activity-Based Costing

In the past, businesses used traditional-based costing across all industries due to its widespread prevalence. It often didn't factor whether the business was in the manufacturing, service, or trading industry.

The overhead absorption was done based on production volume and absorbed as per machine hours or labor hours, even though not all overhead expenses are related to the production volume.

It assumes that all products and services use all the resources in proportion to the production volume in the traditional-based costing leads to the over-costing of low-volume products and the under-costing of high-volume products.

With the development of consumerism and the advent of globalization, the production of multiple products and services across the manufacturing streams became the norm.

This concept was first defined in the 1980s by Kaplan and Bruns and was often said to be the modern way of absorption costing. Not only does it help in eliminating inefficiencies of conventional costing systems, but also in better understanding the product costs of a business across all ranges.

Use in the services industry

With more service industries on the rise, ABC is helping businesses recognize the profitability of a particular product or service to better serve the customer's needs.

Service industries such as banks, leasing, hospitals, hotels, etc., follow different operating structures. In addition, it differs from the manufacturing industry as a substantial part of the costs are in the form of overheads, and there's no residual inventory to be valued.

The service business is gradually shifting its focus on accurately calculating costs to make short-term and long-term strategic decisions. Resource consumption patterns, quantity produced, and product costs are some of the information better interpreted.

In conclusion, using this in accounting costs for service businesses results in better pricing decisions and new adoption of customers.

Therefore, rethinking its usage in different areas can help the management optimize the production process and develop the most appropriate marketing strategies for the product's deployment.

To read more about the application in the service sector, refer to this article here.

Activity-Based Costing Vs. Traditional Based Costing

Let's understand the difference by looking at the table below:

| Basis | Activity-Based Costing | Traditional-Based Costing |

|---|---|---|

| Overheads Allocation | Overheads are allocated as cost pools. Service department costs are not allocated to the production department. | Service department costs are allocated to the production department. |

| Overheads Absorption | Overheads are absorbed as cost pools based on the cost drivers (number of orders, number of setups) that drive their behavior. | Absorbed based on either machine hours or labor hours. |

| System | Complex and expensive to implement and use | Easy to use and inexpensive |

| Assumption | It assumes non-linearity in cost and accepts that not all costs are related to the number of units produced. | It assumes that all resources are used to generate the product or service and are directly related to the production volume. |

| Suitability | It is suitable for larger companies with multiple products and service ranges, high overhead costs, or diverse operations across the production process. | Suitable for smaller companies with limited products and service range with low overhead costs. |

| Level of Activity | Activities of all levels - unit, batch, product, and facility- can be identified. | Unit level and facility level activity are identified. |

| Cost Control | A complete summary of product costs helps the management prioritize the efforts toward the value-generating cost. | It is more of a departmental effort to control costs rather than a functional one. |

Benefits of Activity-Based Costing (ABC)

The advantages of this method of costing are

1. More accurate allocation of overheads

ABC apportions overheads to those products and processes associated with a particular activity. This apportionment is a more accurate allocation of overheads as one can directly see the relation between that specific activity and the overhead cost.

For example, manufacturing overheads are related to the number of raw materials used in production and allocated per the number of raw materials used.

2. It helps identify profitable avenues.

Applying this method to the product helps the organization identify the product ranges that are commercially viable apart from those which are draining resources and adding up the cost.

As the cost statement lists all the activities that make up the cost of a product, it forces the organization to look into its non-value-adding activities, which the management can eliminate. Removing these inefficient activities can help businesses improve their financial performance.

3. Better monitoring of the costs

With a better breakup of costs, it is easy to reanalyze the production process to search for improved areas.

Also, with the management having necessary information about activities, informed decisions can help reduce costs without compromising product quality or service quality. This reduction will make them cost-conscious and plan a better output/product mix.

4. It helps in better product pricing

A better grasp of the cost structure and activity costs that contribute to making the product helps the organization better price their product. It can result in potential savings for the organization during production and earn profits from better pricing.

It helps the management re-examine its business strategy and suggests improvements in the production process.

5. Productivity Management

It is also an approach to improve the production productivity of an organization and thus improve the overall financial performance.

Business Process Reengineering and Total Quality Management are tools that help transfer pricing, service/product pricing, and cost management.

Limitations of Activity-Based Costing (ABC)

The disadvantages of this method of costing are

1. Costly and Time-consuming

ABC is known as a high-cost accounting technology. Installing it requires highly educated and experienced workers and the organization's investment of time and money.

It is also expensive to maintain, as it is more complex than the traditional-based costing system. It also takes a lot of time to devise a costing structure that is best suited for the said organization

2. Measurement

The organization has to estimate the costs of its activity pool and allocate a cost driver. Estimating costs requires measuring cost value across all operations and levels.

The organization needs to obtain complete information for measuring cost, which tends to be expensive and time-consuming.

The data also tends to change over time in a dynamic industry, which makes the previously collected data redundant.

3. Cost Driver Selection

There is a risk of over-costing or under-costing due to the irrelevant assignment of cost pools with cost drivers leading to unreliable product or service costing. This imprecision can further affect the pricing of the product.

The management may also find it challenging to devise appropriate marketing strategies to achieve maximum profits.

4. Difficulty in comparing costs across the industry

An organization using a traditional-based costing system in an industry would produce reports that are different from the ones issued by the organization using ABC. This is due to the difference in how costs are added up to arrive at the total figure.

While traditional-based costing will include all production costs based on machine or labor hours, ABC only includes activity costs. As a result, the difference in the cost and pricing of the competitor's product will make it difficult for the organization to cost and price its product to remain competitive.

5. Not suitable for smaller companies

ABC is suitable for companies with diverse products and services. Hence, restricting its suitability.

Since smaller companies use smaller amounts of resources and do not have too many activities/operations, the cost of transactions tends to be low. Thus, making it difficult for smaller companies/organizations to adapt ABC for its products.

6. Not always effective

For example, businesses with lower overhead costs like consulting and designing should opt for traditional-based costing as it is more efficient than ABC.

It's also not worth investing time and money to implement ABC in an organization where cost data is constantly changing, and business is still efficient with traditional costing.

Researched and authored by Samridhi Singh | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?