Tax Depreciation

Depreciation that can be claimed as an expense on a tax return for a specific reporting period

What is Tax Depreciation?

Depreciation that can be claimed as an expense on a tax return for a specific reporting period is known as tax depreciation. The depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in value of tangible assets utilized in income-generating activities.

It is used by businesses to lower the amount of taxable income they report. Depreciation attributes a fixed asset's cost to expense over its useful life.

Tax depreciation, like accounting depreciation, distributes depreciation costs across several years. As a result, depreciable asset tax values drop over their useful lives. As a result, the IRS often treats depreciation expenses as tax deductions.

In other words, taxpayers can deduct depreciation charges from their taxable income and lower their tax liability by claiming depreciation expenses for certain tangible assets.

There are five main procedures that an individual to qualify to depreciate an asset.

- When a taxpayer is an owner of an asset.

- The asset cannot be certain types of property that the IRS has expressly excluded.

- When the asset has a predetermined lifespan.

- When the asset's useful life exceeds more than a year.

If these procedures are not followed, the total amount must be charged to the expense when it occurs. Although, from the viewpoint of tax deferral, setting a cost to fee all at once is not bad, it minimizes the amount of income that must be taxed in the short term.

What Assets are Eligible for Tax Depreciation?

Depreciation rules on tax may vary depending on where you live. As a result, the assets eligible for tax depreciation expense claims may differ by country.

However, there are a few essential requirements that an individual must be able to meet for assets to be eligible for depreciation claims in different jurisdictions:

- When a taxpayer is an owner of an asset: Depreciation expenses can only be claimed for items regarded as property owned by the taxpayer.

- When the asset is used in income-generating activities: Depreciation expenses can only be deducted for assets used in a business or for income-generating activities. As a result, purchases used only for personal purposes are not eligible for depreciation.

- When the asset has a predetermined lifespan: The asset that is eligible for depreciation must have a reasonably useful life. In simple terms, one may estimate the years the asset will remain in operation before it becomes obsolete or ceases to give any economic benefits.

- When the asset's useful life exceeds more than a year: Only long-term assets can claim depreciation. It means that the assets have a longer useful life than a year.

Tax Depreciation Impact

The amount of earnings on which taxes are calculated is reduced by an organization's depreciation expense, lowering the amount of taxes owed.

The higher the depreciation expense, the lesser the taxable income; thus, it lowers the tax payment for the business. Conversely, the lower the depreciation expense, the more taxable income and tax payments are due.

Depreciation is shown as depreciation expenses on the income statement after all revenue, cost of goods sold (COGS), and operating expenses have been recorded, but before earnings before interest and taxes (EBIT), which is used to calculate a company's tax expense.

On a company's balance statement, the total amount of depreciation expense is shown as accumulated depreciation, which is deducted from the gross value of fixed assets.

As monthly depreciation charges are charged against a company's assets, accumulated depreciation grows over time.

The accumulated depreciation on a company's balance sheet is reversed when the assets are eventually retired or sold, removing the assets from the financial statements.

Each method of depreciation is treated differently, affecting the amount by which the expense decreases a company's taxable earnings and, as a result, is taxed.

The IRS stated that - if you're depreciating an asset that was put into service before 1987, you'll need to use the Accelerated Cost Recovery System (ACRS) or the same method used in the past.

The Modified Accelerated Cost Recovery System (MACRS) is usually required for the property after 1986.

How is Tax Depreciation Calculated?

When a company purchases an asset, it can deduct the cost as a business expense. However, tax laws require businesses to amortize the cost of that asset over its expected useful life.

In accounting, depreciation expense is utilized to distribute the cost of a tangible asset out over its useful life. In other terms, it decreases an asset's value over time due to use, wear and tear, or obsolescence.

Depending on the type of company, various depreciation methods may be used to determine the current value of firm assets. For example, depreciating equipment earlier in its life cycle, evenly over time, or closer to the end of its estimated life cycle may be more advantageous.

A corporation can figure out the optimum way to depreciate assets to balance profits in a way that allows the company to develop.

There are various methods for calculating depreciation which comprise the straight-line depreciation method, the unit of production, the accelerated depreciation, the sum of years digits method, and the double-declining balance method, and we shall delve into them one after the other.

Straight-line depreciation (SLD)

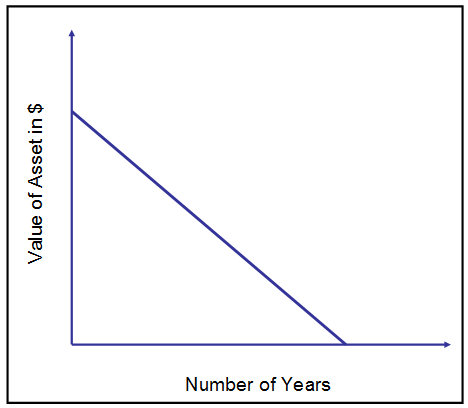

A fixed asset is depreciated over its useful life using a straight-line depreciation method.

For using the straight-line method, taxpayers must know the cost of the depreciating asset, its estimated useful life, and its residual value, which is the price an asset that is expected to sell for at the end of its useful life.

For instance, let's take an example of Acer Computer, which buys a $2,000 McAfee antivirus software that won't be used for five years, and its estimated residual value is $500.

Let's put the values in the calculation and find out the depreciation value using SLM; the total cost of an asset is $2,000, the residual value is $500, and the estimated lifespan is five years.

Depreciation = [Cost of an asset - Residual Value]/ Estimated useful life of an asset

(2000 - 500)/ 5 = 1500/ 5 = $300

Here, in SLD, every year, the MacBook depreciates by $300.

Double Declining Balancing Method (DDB)

This method depreciates assets twice as fast as the usual decreasing balance method. It also considers that depreciation charges are higher in the early years of an asset's life and lower in the later years.

Formula used is

Depreciation = Depreciation Rate (%) * Book Value

Depreciation = 2 * (1/Useful life of an asset)

= 2 * (1/5) = 0.4%

Let's take the same problem above and try solving it using the double declining balance method.

Applying formula,

In the 1st year it will calculated as 0.4 * 2000 = 800; (2000 - 800 = 1200)

for 2nd year it will calculated as 0.4 * 1200 = 480; (1200 - 480 = 720)

for 3rd year it will calculated as 0.4 * 720 = 288; (720 - 288 = 432)

for 4th year it will calculated as 0.4 * 432 = 173 (432 - 173 = 259)

for 5th year it will calculated as 0.4 * 173 = 69; (259 - 69 =190)

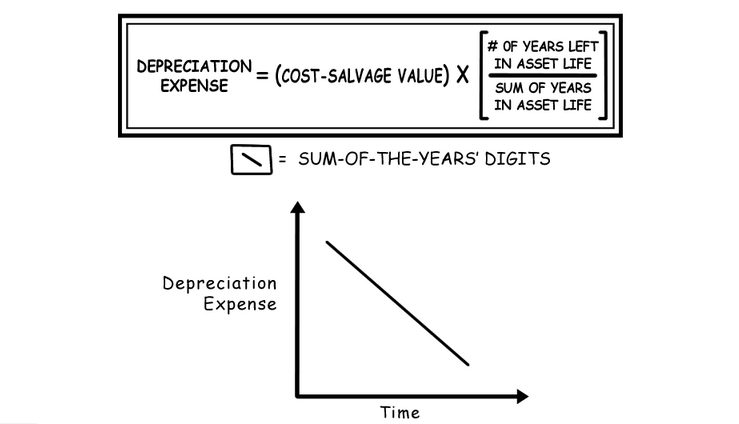

Sum of the Years Digit Method (SYD)

The sum-of-the-years digits method is an accelerated depreciation calculates a percentage by adding the years of an asset's useful life together.

Formula used is

Depreciation = Total cost of an Asset * (Remaining life of an asset/ Sum of years digit)

We were driving through the same example mentioned above.

Here, the total cost of an asset is 1500; the remaining life of an asset = five years, and the sum of years digit for years 1+2+3+4+5 = 15.

So, the total cost of an asset * remaining life of an asset/sum of years digit.

For 1st year it will be calculated as 1500 * 5/ 15 = 500

for the 2nd year, it will be calculated as 1500 * 4/ 15 = 400

for the 3rd year, it will be calculated as 1500 * 3/ 15 = 300

for the 4th year, it will be calculated as 1500 * 2/ 15 = 200

for 5th, it will be estimated as 1500 * 1/ 15 = 100

Unit of Production

When a business uses this method, they get more deductions. This is because an asset's worth is determined by the number of units it produces rather than the years it uses.

The modified accelerated cost recovery scheme (MACRS) is a widely used method of tax asset depreciation.

This depreciation method involves calculations that result in the asset's value being depreciated with a declining balance for a set period.

Then it switches to a straight-line depreciation method to finalize the depreciation schedule, rather than depending on the number of units an asset may create.

The IRS mandates businesses to depreciate an asset using the Modified Accelerated Cost Recovery System (MACRS) for tax purposes. Still, it enables firms to exempt a purchase from this method if it can be depreciated accurately using another way, such as the production unit.

To adopt this technique, the asset owner must choose MACRS exclusion by the return due date for the tax year in which the asset is first put into service.

Researched and authored by Savan Sabu | LinkedIn

or Want to Sign up with your social account?