Commercial Banking Training

It is a comprehensive training program to equip bankers with the necessary skills, knowledge, and ethical standards.

What is Commercial Banking Training?

Commercial banking training refers to the programs, courses, and educational initiatives designed to equip individuals with the knowledge and skills needed to work effectively within the commercial banking sector.

It serves as a driving force behind the economy, acting as an important facilitator of financial services for various stakeholders. The backbone of financial transactions, it offers stability and support to economic activities on a large scale.

This makes it imperative for institutions to establish training programs to equip individuals with the necessary expertise and proficiencies to excel in the field of commercial banking. Training in commercial banking is essential for creating a skilled workforce in the industry.

Key Takeaways

- Commercial banking training is crucial for individuals to thrive in the dynamic and evolving banking industry.

- Comprehensive training programs equip bankers with the necessary skills, knowledge, and ethical standards.

- Training programs contribute to the overall success and stability of the banking industry.

- Embracing technology prepares individuals for the digital era and enhances industry efficiency, security, and innovation.

- Commercial banking training is an investment that yields substantial benefits for individuals, banks, and the broader economy.

The Need For Comprehensive Commercial Banking Training

Commercial banking is a constantly changing field, demanding professionals to have a variety of skills and knowledge.

Comprehensive training programs play an important role in meeting this need, helping bankers build a strong base to gain the skills they need to work in the industry successfully.

By offering comprehensive training, organizations ensure that bankers are well-prepared to face the challenges and opportunities that arise in the commercial banking sector. Let's see what are the needs below:

1. Building Solid Fundamentals

A deep understanding of financial products, lending practices, and credit evaluation is crucial in banking. Training programs equip individuals with the necessary expertise to analyze financial statements, assess creditworthiness, and make informed lending decisions.

Note

By mastering financial analysis techniques, bankers can identify potential risks and develop risk management strategies to mitigate them effectively.

2. Customer Service Excellence

Providing excellent customer service is crucial in the banking sector. Training programs focus on enhancing interpersonal and communication skills, teaching bankers how to build strong relationships with clients, and providing personalized financial solutions.

By understanding customer needs and expectations, bankers can deliver exceptional service, foster trust, and maintain long-term relationships.

3. Regulatory Compliance

Training programs emphasize the importance of regulatory compliance and provide individuals with knowledge of applicable laws and regulations.

Note

By understanding and adhering to these guidelines, bankers ensure the integrity of financial transactions, protect against potential risks, and maintain the trust of clients and regulatory authorities.

4. Technological Proficiency

Digital transformation has significantly impacted the banking industry. Training programs equip individuals with the necessary technological skills to adapt to emerging trends and advancements.

From utilizing banking software and digital platforms to understanding cybersecurity protocols, bankers are trained to leverage technology effectively and enhance operational efficiency.

Note

By addressing key areas such as financial analysis, customer service, regulatory compliance, and technological proficiency, training programs equip bankers with the knowledge and skills needed to navigate the industry's complexities.

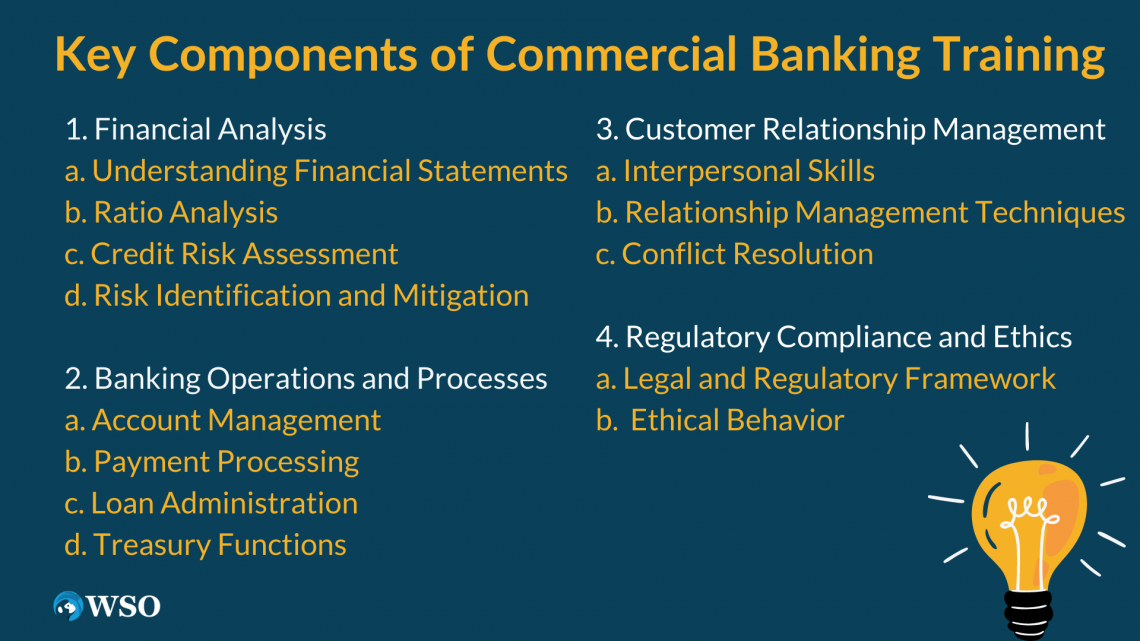

Key Components of Commercial Banking Training

Commercial banking training encompasses various key components that equip individuals with the necessary skills and knowledge to thrive in the industry.

From financial analysis and risk management to banking operations and customer relationship management, these components form the foundation of a comprehensive training program. Some of these are:

1. Financial Analysis

- Understanding Financial Statements: It focuses on developing the ability to interpret and analyze financial statements, including balance sheets, income statements, and cash flow statements. Bankers learn to extract meaningful insights from these documents to assess a company's financial health. Additionally, they gain knowledge of common financial statement red flags that indicate potential risks or irregularities.

- Ratio Analysis: It teaches individuals how to calculate and analyze financial ratios, such as liquidity, profitability, and leverage ratios. These ratios provide valuable insights into a company's financial performance and assist in making informed lending decisions.

Note

Bankers also learn how to benchmark ratios against industry standards for better comparative analysis.

- Credit Risk Assessment: The assessment undergoes training to evaluate creditworthiness by assessing factors such as a borrower's financial history, collateral, and repayment capacity. This component equips individuals with the skills to identify potential risks and determine appropriate credit terms.

Note

The individuals learn how to assess the impact of industry trends and economic conditions on credit risk.

- Risk Identification and Mitigation: Here, it also focuses on identifying and mitigating various types of risks, including credit, market, and operational risks. Bankers learn risk management techniques and strategies to minimize potential losses and ensure the stability of the bank's operations.

Note

Bankers gain knowledge of early warning signs and indicators that signal increased risk exposure.

2. Banking Operations and Processes

- Account Management: Its programs provide an in-depth understanding of account management processes, including account opening, maintenance, and closure. Bankers learn to handle customer requests, manage transactions, and effectively address account-related inquiries.

- Payment Processing: It covers the intricacies of payment processing, including electronic funds transfers, wire transfers, and automated clearing house transactions.

Note

Bankers acquire knowledge of payment systems and procedures to ensure efficient and accurate transaction processing.

- Loan Administration: This training component focuses on loan origination, documentation, and servicing processes. Bankers learn how to evaluate loan applications, structure loan terms, manage documentation, and monitor loan repayments.

- Treasury Functions: Actually, it includes an overview of treasury functions, such as cash management, liquidity management, and foreign exchange operations.

Note

Bankers acquire knowledge of treasury instruments and strategies to optimize the bank's liquidity and mitigate foreign exchange risks.

3. Customer Relationship Management

- Interpersonal Skills: These programs emphasize the development of strong interpersonal skills, including active listening, effective communication, and empathy. Bankers learn how to build rapport with customers, understand their financial needs, and provide personalized solutions.

- Relationship Management Techniques: Training equips bankers with relationship management techniques to foster long-term customer relationships.

Note

The technique includes maintaining regular contact, anticipating customer needs, and proactively offering relevant banking products and services.

- Conflict Resolution: Bankers learn conflict resolution strategies to address customer complaints and concerns effectively. Training programs emphasize the importance of resolving conflicts fairly and on time to maintain customer satisfaction and loyalty.

4. Regulatory Compliance and Ethics

- Legal and Regulatory Framework: They provide individuals with an understanding of the legal and regulatory framework governing the industry. Bankers learn about banking laws, regulations, and compliance requirements to ensure adherence and avoid legal issues.

- Ethical Behavior: It emphasizes the importance of ethical conduct in banking. Bankers learn about ethical principles, confidentiality obligations, and responsibly handling customer data and information.

Note

Training programs ensure that individuals are equipped with vital skills and knowledge, enabling bankers to navigate industry challenges effectively. This preparation enables them to offer exceptional services to clients while upholding legal and ethical standards.

Lifelong Learning in Commercial Banking Training

The banking industry constantly evolves, driven by technological advancements, regulatory updates, and changing customer expectations.

By embracing continuous learning, commercial bankers can stay abreast of these changes and adapt their skills and knowledge accordingly. This enables them to navigate new technologies, understand emerging trends, and offer innovative solutions to clients.

Some of the learnings include:

1. Enhancing Professional Competence

Continuous learning empowers bankers to enhance their professional competence and stay ahead in a highly competitive industry.

Through ongoing training programs, individuals can acquire new skills, expand their knowledge base, and develop a deep understanding of complex banking concepts. This boosts their confidence and positions them as trusted advisors to clients.

2. Promoting Employee Engagement and Retention

Investing in continuous learning initiatives demonstrates a commitment to employee development, fostering a sense of engagement and loyalty among commercial bankers.

Employees who perceive that their organization values their growth are more likely to stay motivated, engaged, and committed to their roles. This ultimately reduces turnover rates and helps retain top talent within the banking industry.

Note

Training programs introduce bankers to fresh ideas, perspectives, and methods, encouraging creative thinking and inspiring them to find inventive solutions to difficult issues. This creates an atmosphere where innovation flourishes, resulting in enhanced products, services, and customer experiences.

3. Addressing Skills Gaps

Identifying and addressing skills gaps is crucial to continuous learning in commercial banking. Organizations can identify areas where additional training and development are needed by regularly assessing employees' competencies.

This enables targeted learning interventions that bridge the skills gaps and ensure that bankers have the necessary expertise to excel in their roles.

4. Fostering a Learning Culture

It goes beyond offering training programs; it involves fostering a learning culture within commercial banks.

This can be achieved by encouraging knowledge sharing, providing opportunities for professional development, and creating platforms for collaboration and mentorship.

Note

By investing in ongoing learning initiatives, commercial banks can develop a highly skilled and adaptable workforce, leading to long-term success and competitive advantage in the banking industry.

A learning culture nurtures an environment where individuals are motivated to expand their knowledge and share insights, driving collective growth and success.

Embracing continuous learning in commercial banking training is essential for keeping up with industry changes, enhancing professional competence, and fostering a learning culture.

Technological Advancements in Commercial Banking Training

As the banking industry continues to embrace digital transformation, commercial banking training programs must incorporate technology-driven modules to equip future bankers with the necessary digital skills.

This includes training in financial technology (fintech), digital banking platforms, data analytics, and cybersecurity.

By incorporating fintech training, future bankers can adapt to the evolving needs of tech-savvy customers and leverage digital tools to streamline banking operations.

They will be equipped with the knowledge to facilitate digital transactions, implement efficient payment solutions, and explore opportunities presented by emerging fintech solutions.

Fintech Training

Fintech training plays a crucial role in preparing future bankers to meet customers' evolving needs in the digital age.

As technology continues to reshape customer expectations, training programs must focus on equipping bankers with the necessary knowledge and skills to navigate FinTech solutions effectively.

Note

By understanding fintech, bankers can optimize banking operations, enabling efficient digital transactions and implementing cutting-edge payment solutions.

Fintech training empowers bankers to explore emerging opportunities presented by fintech innovations, allowing them to stay ahead of the curve and deliver exceptional customer experiences.

Through adopting fintech training, commercial banking institutions can create an atmosphere of innovation and competitiveness, guaranteeing their ongoing success in the digital age.

Data Analytics

Moreover, data analytics has emerged as a powerful tool in banking. Training programs should include comprehensive modules on data analysis techniques, data visualization, and predictive modeling.

By leveraging data analytics skills, bankers can enhance their ability to serve clients effectively, identify market trends, and proactively identify opportunities for business growth.

Note

Data visualization and predictive modeling empower bankers to anticipate customer needs and provide personalized solutions, further enhancing the overall customer experience and driving organizational success.

Cybersecurity

Training programs should emphasize the importance of cybersecurity best practices and educate bankers on the latest threats and protection measures.

By instilling a strong cybersecurity mindset, future bankers can contribute to safeguarding sensitive customer information, preventing fraud, and ensuring the integrity of banking systems.

Through thorough cybersecurity training, bankers will have the skills to adapt to the changing cybersecurity challenges and safeguard both the bank's and its customers' interests.

Embracing technological progress helps individuals acquire the digital skills needed to navigate the fast-changing banking environment. This prepares them for future roles and enhances the overall efficiency, security, and innovation within the banking industry.

Note

Training programs in commercial banking need to constantly evolve by integrating technology-driven modules. This ensures that bankers acquire the necessary skills to excel in the digital age.

Conclusion

Commercial banking training prepares individuals to thrive in the dynamic and evolving banking industry.

The benefits of commercial banking training extend beyond individual professional development; they contribute to the overall success and stability of the banking industry.

In an industry where technological advancements, shifting customer expectations, and regulatory requirements are continuously shaping the landscape, embracing these training opportunities, banks can cultivate a highly skilled and knowledgeable workforce capable of meeting their client's diverse needs.

By emphasizing the importance of ethical conduct and compliance with regulatory frameworks, training programs contribute to maintaining a trustworthy and responsible banking sector.

Training programs instill a culture of professionalism, integrity, and ethical behavior among bankers.

In the ongoing digital transformation of the banking industry, embracing technology is important.

This can be accomplished by integrating modules on fintech, data analytics, and other technological advancements. These programs empower bankers with the digital skills essential for harnessing emerging technologies and fostering innovation within their organizations.

This positions banks to remain competitive in an increasingly digital and interconnected world. In summary, commercial banking training is an investment that yields substantial benefits for individuals, banks, and the broader economy.

or Want to Sign up with your social account?