Clearing House

Any two businesses or parties involved in a financial transaction

What is a Clearing House?

A clearing house's primary responsibility is to ensure the transaction goes off without a hitch, with the seller receiving the correct amount for the tradable items they are selling and the buyer obtaining the goods they intended to buy.

Any two businesses or parties involved in a financial transaction can use a clearing house as a mediator.

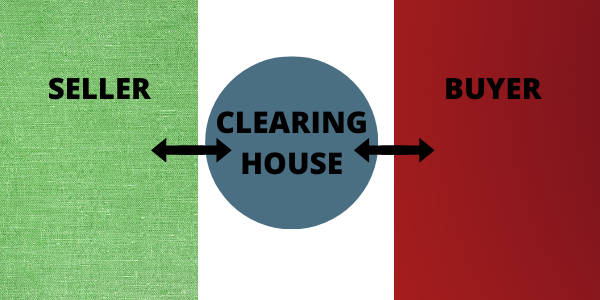

In a financial market, a clearing house is an authorized middleman between a buyer and a seller. By validating and completing the transaction, it makes sure that both the buyer and the seller adhere to their contractual commitments.

Every financial market has an internal clearing section or a recognized clearing house to execute this task.

Its duties include "clearing" or concluding trades, settling trading accounts, gathering margin payments, controlling asset delivery to new owners, and disclosing trading information.

When it comes to futures and options transactions, these serve as both buyers and sellers, acting as buyers for every clearing member seller and sellers for every clearing member buyer.

Understanding Clearing House

Following the execution of trades between a buyer and a seller, it comes into play. Its task is to perform the actions that complete the transaction and validate it.

The firm serves as a middleman and offers the efficiency and security necessary for a financial market to be stable.

The cost and danger of settling numerous transactions among numerous parties are significantly reduced when one of these middlemen takes the opposite position on each trade to act swiftly.

While it is part of their responsibility to limit risk, the fact that they must simultaneously function as buyer and seller at the beginning of a transaction exposes them to default risk from both sides. They apply margin requirements as a preventative measure.

-

In two weeks, Mr. A commits to selling Mr. B his Cooldown Ltd. stock. In exchange, Mr. B gave him a 20 percent advance today and agreed to provide him the remaining money for all the shares on the agreed-upon date.

On the same day he receives the shares, Mr. B strikes an agreement with Mr. C to sell those shares to him.

-

What danger is Mr. B currently in? The possibility of Mr. A. not delivering the shares. What danger does Mr. C currently face? The possibility of Mr. B. not delivering the shares. What danger does Mr. A currently face? The chance of failure.

-

Mr. B has stated that he will delay the payment. This could throw the whole series of transactions into disarray.

-

If someone in between the transactions accepts responsibility for default, such risks are avoided. That is the function of a clearing house.

They make it easier to conduct payment transactions or other kinds of transactions involving derivatives or securities. The major goal is to lower the danger of obligations for trade settlement not being honored.

-

If you pay attention, the house will always adopt a viewpoint that is utterly opposed to that of each trade side. It serves as a buyer for the party selling the asset and acts as a vendor to the recipient of the asset. These firms are crucial to the financial markets.

The Significance Of Clearing Houses

Getting involved in deals that don't go as planned, with one of the parties not upholding their half of the bargain, is a prevalent concern among traders regarding the market.

It offers additional security so that investors may trade freely and trust that the clearing firm would respect and uphold their investment agreements.

The Importance:

By serving as a middleman between buyers and sellers, they give the financial markets they service efficiency and stability. However, they assume many risks because they briefly serve as both the buyer and the seller in practically every transaction.

The house must either pursue recovery of funds or wait for them to become available if a buyer fails to pay for the securities they have purchased.

It typically won't execute transactions for traders who take on too much risk because they are responsible if either party violates the terms of the agreement.

To reduce risk, these middlemen frequently demand that traders put more money into their brokerage accounts to meet minimum "margin requirements."

These funds guarantee that the house will have access to sufficient funds to cover losses incurred by traders who overextend themselves and fail to fulfill their financial responsibilities.

A Clearing House's Operations

They adopt a stance that differs from each side of a trade. They serve as both the buyer and seller in a transaction when two parties agree on its conditions. They are there to make sure that the financial markets run smoothly.

If sellers feared that buyers would not pay them, and vice versa, there would be fewer transactions. These firms make sure that transactions go according to schedule.

For instance, the clearing house will see that John receives the 100 shares of Company XYZ that you agreed to sell him for $10,000 and that you receive the $10,000.

Additionally, it documents the transaction and notifies all parties involved. In any case, the house is in charge of ensuring that the transaction is correct and timely.

Most industries in business have middlemen. For instance, they monitor the underlying instrument in the futures markets and ensure that buyers and sellers meet their obligations linked to the futures contract being exchanged.

Checks, interbank payments, foreign currency deals, and other financial transfers in the banking system are cleared by the central bank of a nation (the Federal Reserve in the U.S., for example).

What a Clearing House Does

As previously mentioned, it is a middleman between two transacting parties. However, there is significantly more to what clearinghouses do. Let's examine some of their features in greater detail.

-

It guarantees the seamless operation of the transactions and the payment of all debts owed to both parties. This is accomplished by examining each party's financial capacity to engage in a legal transaction, whether they are an individual or an organization.

-

The clearing company ensures that all parties respect the system and adhere to the correct protocols to complete the transaction successfully. Market liquidity increases as smooth transactions are made easier to complete.

-

The house offers both parties a level playing field where they can settle on the terms of their negotiation. This involves determining the contract's pricing, quality, quantity, and maturity.

-

To avoid disputes and the need for arbitration after the transaction, the house ensures that the buyer receives the proper commodities in quantity and quality.

Initial and Continuation Margin:

Every transaction in the futures market involves a margin, which is a deposit equal to a portion of the contract's entire value. This is done to protect traders.

The terms "initial margin" and "maintenance margin" refer to the initial deposit amount necessary and the amount that must be kept in the trader's account to maintain their trading position, respectively.

Let's take the scenario where a futures contract for prawns needs a $1,000 initial margin deposit (kept by the clearing house) and an $800 maintenance margin.

The buyer will need to deposit extra money into their trading account if the value of the prawns' contract drops by more than $200 ($1,000 - $800 = $200) before the contract's maturity. If not, the clearing company will sell the holding at the best price on the market.

Advantages and Disadvantages of Clearing Houses

The drawbacks of it are minimal. The old physical settlement system in the early days of the markets had problems. This is what led to the development of the current system.

The public at large benefits from these middlemen. Due to the government's strict controls, they can, at least theoretically, never default. Instead of calling them drawbacks, we should call them restrictions.

The ability to pass payment for various checks and other payment orders is the house's key benefit. They provide several advantages:

Benefits

-

Transaction simplicity

-

A safe and inexpensive way to conduct a financial transaction

-

Reduction of errors caused by people

-

Faster transaction processing

-

No need to locate an eligible counterparty/party for the transaction.

Disadvantages

-

Limited settlement times due to the exchange's non-24/7 availability

-

Only takes a certain number of orders; therefore, trading odd lots is prohibited

-

Order placement can take longer if your internet connection is slower

-

There is a small chance that sub-brokers will default to the house

Regulations that the government has put in place influence these firms. Traders rely on the system since they are regulated. The stock exchange serves as a mediator nowadays.

Today’s markets allow for an unfathomable number of transactions. Automatic clearing mechanisms make this possible.

Clearing Houses And Futures Market

Due to the leveraged nature of futures, the market is heavily dependent on these middlemen. In other words, futures frequently involve borrowing to invest, which calls for a reliable middleman.

There are clearing houses opening in every exchange. After each trading session, every member of the exchange must clear their trades through this middleman and deposit funds that, based on the house's margin requirements, are adequate to cover the member's debit balance.

Example of a Futures Clearing House:

Let's assume a trader purchases a futures contract. The initial and maintenance margin requirements have already been established by the house at this time.

A good faith guarantee that the trader can afford to retain the position until it is closed can be shown in the initial margin.

These funds are kept in the trader's account by the clearing company but cannot be utilized for other trades. The goal is to make up for whatever losses the trader could incur while they hold the contract.

The amount that must be available in a trader's account to keep the trade open is known as the maintenance margin, which is typically a smaller amount than the initial margin requirement.

A margin call will be sent to the account holder if the trader's account equity falls below this level, asking that it be topped off to meet the margin requirements.

The deal will be closed if the trader does not meet the margin call because the account cannot logically tolerate more losses.

In this case, the house has ensured that the account has enough funds to cover any losses the account holder might incur during the deal. The remaining margin funds are released to the trader when the trade is completed.

The procedure has reduced the probability of default. Without it, one party can withdraw from the deal or refuse to hand over the money owed at the end of the deal.

This is typically referred to as transactional risk and is eliminated when a house is involved.

Stocks Market Clearing Houses

Clearing divisions of stock exchanges, like the New York Stock Exchange (NYSE), ensure that traders have adequate funds in their accounts to cover the trades they are placing. As a middleman, the clearing division assists in ensuring a smooth transfer of both shares and funds.

When selling stock, an investor needs to be sure that the money will arrive. The clearance divisions see to it that this occurs.

Example

Anyone who does any form of financial transaction desires transactional protection. Both the buyer and the seller want to be certain that they will receive the products or services they ordered. To ensure that both parties are happy, the house mediates the situation and considers both sides.

Think about a shareholder who wants to sell 500 shares of Emirates Airlines stock to another investor. Its responsibility is to ensure that the investor receives the correct payment for his 500 shares and that the purchaser receives the total number of shares he paid for.

Both parties can be confident that a successful transaction will occur when a clearing house is involved. The transaction between two parties—the seller and the buyer—and the firm standing between them is depicted in a simplified manner in the diagram above.

It participates in both standard trades of marketable items and trades using futures contracts. Futures are contracts entered into by two parties wherein the buyer is obliged to buy an asset and the seller to sell an asset for an agreed-upon price on an agreed future date.

It is advantageous to have a third party (the clearing business) to ensure the contract is not breached because future contracts require time to be completed.

The seller delivers the items to the clearing house, which subsequently delivers them to the future buyer, as shown in the diagram from earlier. The house will then hand the payment to the seller after receiving it from the future buyer. Both parties are safeguarded and guaranteed to receive their just compensation under such a deal.

or Want to Sign up with your social account?