Commercial Lending School

These schools offer specialized education and training for individuals pursuing careers in commercial lending.

Commercial lending is vital for driving economic growth by providing businesses with the necessary capital to expand and pursue various initiatives. Individuals need specialized knowledge and skills to navigate the complex commercial lending landscape effectively.

This is where commercial lending schools come into play. These educational institutions offer comprehensive programs specifically designed to meet the unique demands of the commercial lending industry, equipping students with the expertise required to thrive in this dynamic field.

They play a crucial role in providing a solid base for individuals aspiring to pursue careers in the financial services industry, specifically focusing on commercial lending.

These schools provide specialized courses, certifications, and workshops that offer a deep understanding of the intricacies involved in commercial lending transactions.

The curriculum covers essential aspects such as credit analysis, loan structuring, risk assessment, and underwriting principles.

Additionally, they incorporate practical training components that allow students to apply their knowledge to real-world scenarios, enhancing their skills in:

- Evaluating creditworthiness

- Assessing risks

- Developing customized loan agreements

Attending a commercial lending school offers the advantage of earning professional certifications that validate one's expertise.

Certifications like the Certified Commercial Loan Officer (CCLO) and Certified Commercial Loan Underwriter (CCLU) enhance an individual's marketability and credibility within the industry.

These designations indicate to employers and clients that the individual possesses the necessary knowledge and skills to excel in commercial lending roles.

They play a vital role in preparing students for these certifications by providing comprehensive exam preparation and review materials, ensuring their success in achieving these esteemed credentials. They also establish strong connections and partnerships with financial institutions, banks, and lending organizations.

These relationships create networking opportunities, internships, and potential student job placements. Industry professionals often serve as guest lecturers or adjunct faculty members, sharing their extensive experience and insights.

Moreover, commercial lending schools offer continuing education programs catering to aspiring professionals and individuals already working in the industry.

These programs help bring lifelong learning, enabling individuals to adapt to changes in the industry and provide the highest level of service to their clients.

Attending a specialized commercial lending school is a valuable investment in a dynamic and highly competitive field like commercial lending. These institutions provide the necessary education, training, and networking opportunities to develop expertise in commercial lending.

By equipping students with the skills and knowledge required to assess creditworthiness, manage risks, and structure loan agreements, They play a pivotal role in shaping the success of individuals entering the financial services industry.

Key Takeaways

- Commercial lending schools offer specialized education and training for individuals pursuing careers in commercial lending.

- These schools provide comprehensive programs that cover essential aspects of commercial lending, such as credit analysis, risk assessment, and loan structuring.

- They offer professional certifications like CCLO and CCLU, which validate individuals' expertise and enhance their marketability.

- Networking opportunities provided by them enable students to connect with industry professionals, leading to potential job placements and mentorship opportunities.

- Continuing education programs offered by them ensure professionals stay updated on emerging trends and regulations in the industry.

- Attending a specialized commercial lending school is an investment that equips individuals with the skills and knowledge needed to excel in the dynamic field of commercial lending.

What is commercial lending?

Commercial lending holds significant importance within the financial services industry as it provides businesses with crucial financial support through loans or credit to meet their diverse requirements.

It allows companies to obtain capital for operations, expansions, acquisitions, and other initiatives when their internal resources fall short. The primary function of commercial lending is to evaluate the creditworthiness of businesses seeking financing.

To determine the risk involved in providing the loan, lenders assess factors like

- Financial statements

- Cash flow

- Business models

- Industry performance

- Collateral

- Credit history

Through this assessment, lenders can make well-informed choices regarding interest rates and loan amounts.

There are several types of commercial loans available based on specific business needs. Working capital loans offer immediate liquidity for daily operational needs, whereas term loans serve long-term purposes like investing in real estate or acquiring equipment.

NOTE

Lines of credit offer flexibility, allowing businesses to borrow and repay as needed, while equipment financing focuses on financing equipment purchases or leases. Commercial real estate loans are utilized for commercial property transactions.

These lenders evaluate loan applications and set terms and conditions accordingly. Factors like creditworthiness, loan purpose, market conditions, and lender policies influence interest rates, repayment terms, collateral requirements, and loan amounts.

The significance of commercial lending lies in its contribution to economic growth by enabling business expansion, job creation, and innovation. Access to financing empowers businesses to invest in projects, assets, and personnel, stimulating economic activity.

By implementing responsible lending practices, the financial system can maintain stability and efficiency by mitigating risks and avoiding excessive debt burdens.

Commercial lending plays a vital role in the financial services industry as it facilitates businesses in obtaining the necessary capital for their operations and growth.

Through diverse loan options, commercial lending institutions are pivotal in fueling economic development and supporting businesses in a competitive market environment.

Importance and Role of commercial lending schools

Commercial lending schools are of immense importance in the financial sector as they offer specialized education and training to individuals aspiring to pursue careers in commercial lending.

Here are some key roles and benefits of commercial lending schools:

1. Platform for Learning

Primarily, commercial lending schools serve as a platform for individuals to develop a profound understanding of the principles and practices underlying commercial lending.

These institutions offer various courses that encompass a wide range of topics in commercial lending. The educational programs cover a range of subjects, including financial analysis, credit evaluation, risk management, loan structuring, and regulatory compliance.

NOTE

Engaging in these courses empowers students to acquire valuable insights into the complexities of commercial lending, helping them with the ability to make informed decisions and accurately evaluate the creditworthiness of potential borrowers.

2. Practical skills, knowledge, and Networking Opportunities

Furthermore, they provide students with practical skills through real-world case studies and simulations. By working on realistic scenarios, students develop a strong foundation for assessing risks, identifying opportunities, and structuring loans effectively.

These practical skills are vital for success in the commercial lending industry, where sound judgment and critical thinking are indispensable. Moreover, they create networking opportunities among students, faculty, and industry professionals.

These schools establish partnerships with financial institutions and business firms, enabling students to access internships, mentorship programs, and job placement opportunities.

3. Evolve according to market trend

Additionally, they ensure that individuals stay updated on evolving trends and regulations in the financial industry. The lending landscape is constantly evolving, with new regulations, technologies, and market dynamics shaping the operations of lending institutions.

NOTE

They prioritize maintaining an up-to-date curriculum that incorporates the latest industry practices and regulatory requirements. This enables students to develop a forward-thinking mindset and adapt to the changing landscape, making them valuable assets to lending institutions.

4. Contributing to growth and stability

They contribute significantly to the overall growth and stability of the economy. By producing competent and knowledgeable professionals, these schools enhance the efficiency and effectiveness of the commercial lending process.

Highly skilled commercial lenders are vital in promoting economic growth by offering businesses the capital needed for expansion, investment, and job creation.

Additionally, these professionals contribute to risk management and the financial system's stability, safeguarding against excessive lending practices that can result in economic downturns.

NOTE

By producing competent professionals, commercial lending schools contribute to the growth, stability, and efficiency of the economy, making them an indispensable component of the financial ecosystem.

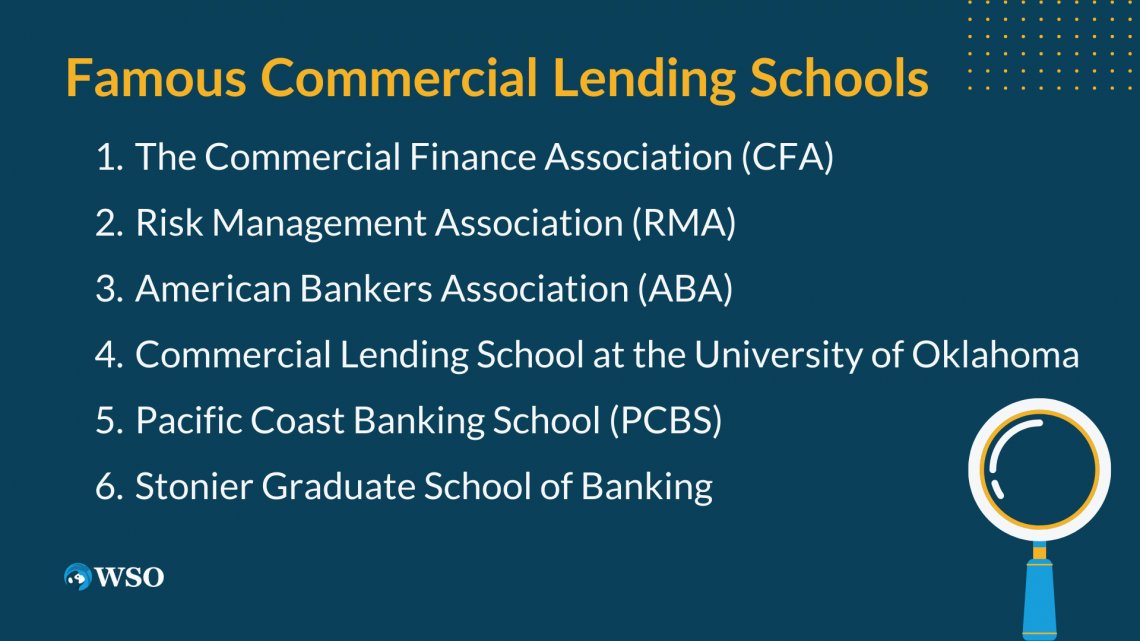

Famous commercial lending schools

Several commercial lending schools are known for delivering specialized education and training in commercial lending.

Here are some renowned institutions:

1. The Commercial Finance Association (CFA)

CFA is recognized as a prominent institution in the industry, providing educational programs, training, and certifications tailored to commercial lending and asset-based lending.

NOTE

Their courses cover financial statement analysis, risk management, loan structuring, and portfolio management.

2. Risk Management Association (RMA)

RMA is a professional association providing educational resources and training programs that emphasize credit risk management. Their courses encompass credit analysis, loan structuring, risk assessment, and regulatory compliance.

3. American Bankers Association (ABA)

ABA offers diverse educational programs and certifications related to commercial lending. Their courses delve into commercial lending principles, credit analysis, loan documentation, and financial statement analysis.

4. Commercial Lending School at the University of Oklahoma

It is a recognized and prominent institution in the industry, providing educational programs, training, and certifications tailored to commercial lending and asset-based lending. It includes credit analysis, loan structuring, risk management, and regulatory compliance.

5. Pacific Coast Banking School (PCBS)

PCBS is a prestigious graduate-level banking school that incorporates commercial lending courses into its curriculum. They offer extensive training in commercial lending principles, credit analysis, loan underwriting, and relationship management.

6. Stonier Graduate School of Banking

Stonier delivers a specialized curriculum that encompasses multiple facets of commercial lending. Their program includes courses on credit risk assessment, loan structuring, portfolio management, and commercial real estate lending.

NOTE

These reputable commercial lending schools have established their status by delivering high-quality education and training in the field.

They offer various programs, certifications, and courses that equip individuals with the necessary knowledge and skills for success in commercial lending.

Attending these schools can provide enhanced career prospects and valuable networking opportunities within the commercial lending industry.

Future of commercial lending schools

The future of commercial lending schools will evolve and adapt to the changing financial services industry. As technology advances and new challenges arise, these schools will play a crucial role in equipping professionals with the necessary skills and knowledge for success.

Here are some key aspects that will influence their evolution:

1. Fintech and digital transformation

As technology becomes more integrated into the industry, these schools will offer specialized education and training in areas like blockchain, artificial intelligence, machine learning, and data analytics.

This will enable students to navigate digital lending platforms, automate processes, and leverage data-driven insights for credit decisions.

2. Risk Management education

There will be an increased emphasis on risk management education. They will provide comprehensive training in risk assessment, risk mitigation strategies, and regulatory compliance.

NOTE

They will keep up with evolving regulations to ensure students are well-prepared to navigate complex compliance requirements.

3. Sustainable and ESG lending education

Sustainable and ESG lending education will also gain prominence. They will incorporate education on sustainable lending practices, ESG frameworks, and impact assessment methodologies.

This will allow professionals to evaluate the sustainability performance of borrowers and align lending decisions with ESG goals.

4. Developing soft skills

Commercial lending schools will recognize the importance of developing soft skills alongside technical knowledge. They will recognize the importance of effective communication, critical thinking, negotiation, and relationship management skills.

NOTE

They will integrate training programs to develop these skills, producing well-rounded graduates who build strong client relationships and collaborate within lending teams.

5. Industry collaboration and partnerships

Industry collaboration and partnerships will play a significant role. They will strengthen their relationships with financial institutions, banks, and lending organizations. This will give students access to industry experts, guest lectures, internships, and mentorship opportunities.

By fostering these connections, schools will stay relevant, keep pace with industry trends, and provide practical insights and experiences to students.

6. Continuing education and lifelong learning

Continuing education and lifelong learning will become crucial. As the financial services industry evolves, professionals in commercial lending will need to stay updated on emerging trends, regulations, and best practices.

NOTE

They will offer continuing education programs, webinars, and professional development courses to enhance skills, expand knowledge, and adapt to industry changes. Lifelong learning will be essential for professional growth and success in commercial lending.

They will adapt to the future by integrating technology, focusing on risk management and sustainability, developing soft skills, fostering industry collaboration, and emphasizing continuing education.

Summary

Commercial lending schools are specialized educational institutions that provide comprehensive programs and training for individuals aspiring to enter the commercial lending industry.

These schools offer courses and certifications that cover essential aspects of commercial lending, such as credit analysis, risk assessment, and loan structuring. Practical training components allow students to apply their knowledge to real-world scenarios.

They also facilitate networking opportunities, internships, and potential job placements through partnerships with financial institutions. They offer professional certifications that validate individuals' expertise and enhance their marketability.

In addition to theoretical knowledge, they provide practical training components. By engaging in real-world case studies and simulations, students can put their learning into practice in practical scenarios.

This hands-on approach enriches their analytical skills and decision-making capabilities, empowering them to:

- Assess risks

- Identify opportunities

- Effectively structure loans

The practical skills developed through these training components are invaluable for success in the commercial lending industry, where sound judgment and critical thinking are essential. Another significant advantage of them is the networking opportunities they offer.

These schools often establish strong connections and partnerships with financial institutions, banks, and lending organizations. As a result, students have access to internships, mentorship programs, and potential job placements.

NOTE

Industry professionals often serve as guest lecturers or adjunct faculty members, sharing their extensive experience and insights. Engaging with these experts allows students to better understand industry trends, challenges, and best practices.

Their networking opportunities can lead to valuable connections, mentorship opportunities, and collaborations with established professionals in the field.

Professional certifications such as the Certified Commercial Loan Officer (CCLO) and Certified Commercial Loan Underwriter (CCLU) are highly valued in the commercial lending industry and play a crucial role in preparing students for these credentials.

They provide comprehensive exam preparation and review materials, ensuring the success of their students in achieving these esteemed certifications.

Possessing such credentials demonstrates to employers and clients that individuals have the necessary knowledge and skills to excel in commercial lending roles.

or Want to Sign up with your social account?