Personal Guarantee

It is a legally binding promise made by an individual to repay credit issued to a business in which they hold an executive or partner position.

What Is a Personal Guarantee?

A personal guarantee is a legally binding promise made by an individual to repay credit issued to a business in which they hold an executive or partner position.

In this way, it provides creditors with additional protection that ensures they will be reimbursed even when the undertaking fails to fulfill its obligations.

Lenders, landlords, and suppliers commonly require them to secure financing or establish business relationships, especially for startups or less-established businesses with limited credit history.

Business owners increase their chances of obtaining credit or funding by offering it, demonstrating their commitment and confidence in the business's ability to repay.

It gives creditors a sense of reassurance, allowing them to seek the guarantor's assets in case the business fails to repay the debt.

The guarantor is, however, exposed to inherent risks. The guarantor may be sued and have his assets seized to reimburse the debt when a company fails to repay its loans or defaults.

It is crucial for business owners to carefully review the terms and conditions of any credit application, paying attention to language that highlights personal liability. In many cases, these guarantees are required from individuals who own at least 20% of the business.

They are often provided as additional security for lenders and other collateral forms. Should the business default on the loan, anyone who signed a guarantee can be held responsible for the remaining balance.

Guarantors can be individuals, such as parents providing guarantees for their adult children or other organizations with a credit history.

It shall, in essence, be a legally binding undertaking made by an individual for repayment of the company's debt. It helps businesses secure credit when they have a limited credit history or are less established.

While they provide creditors with additional protection, they also pose risks for the guarantor, potentially leading to legal consequences and the loss of personal assets.

Business owners should carefully consider the implications before agreeing to a guarantee and thoroughly review the terms and conditions of credit agreements.

Key Takeaways

- A personal guarantee is a legally binding promise made by an individual to repay credit issued to a business in which they hold an executive or partner position.

- As a demonstration of commitment to their businesses' capacity to repay, business owners shall offer personal guarantees to the creditor to increase their ability to obtain credit.

- When lenders, tenants, and suppliers encounter new or less established companies with limited credit history, they often require a personal guarantee from the business owner or an associated individual. This helps reassure lenders, tenants, and suppliers that they can recover their funds or seek repayment if the company cannot meet its financial obligations.

- These guarantees may be subject to several terms and conditions, including limits on the guarantor's liability, e.g., an agreed dollar amount or time limit.

How Does Personal Guarantee Work?

A personal guarantee on a business loan provides security for the lender and works in the following way:

1. Promise of Liability

It is a guarantee provided by a person, often a business owner or executive, to accept accountability for repaying a loan or debt if the business cannot meet its obligations.

2. Access to Funding

They are commonly required for new or small businesses that may not have an established credit history or sufficient creditworthiness to qualify for loans or credit on their own.

Note

It helps the borrower secure the loan by leveraging the guarantor's personal assets and credit history.

3. Cosigner on the Application

The guarantee effectively makes the business owner or executive a cosigner on the credit application. The guarantor's personal credit history and profile are considered alongside the company's information in the underwriting process.

4. Asset Pledge

The guarantor may use his or her assets as collateral to support the loan. This provides additional security for the lender, as they have a legal claim to the guarantor's assets in case of default by the business.

5. Mitigating Lender's Risk

By including a guarantee, lenders reduce their risk because they have recourse to the guarantor's assets if the business fails to repay the debt.

Note

Mitigating the risk gives lenders more confidence in extending credit to businesses that may have a limited financial history or higher risk profiles.

6. Improved Credit Terms

Guarantees may influence loan terms, including interest rates and repayment terms.

To achieve more favorable lending conditions, if the guarantor has a strong credit record, the lender shall take into account both the business's balance sheet and an individual's creditworthiness in applying for loans.

7. Personal Investment and Responsibility

Business owners or executives often offer such guarantees because they have a vested interest in the success of their businesses.

Note

By pledging their assets, they demonstrate their commitment to the loan and willingness to take personal responsibility for the debt.

8. Monthly Installment Payments

If a guarantee is in place, the business may have to pay an installment to repay the outstanding debt every month. This ensures that creditors are paid regularly instead of relying on equity investors for returns.

In short, a guarantee provides security for lenders by leveraging a business owner or executive's personal assets and credit history.

It allows businesses with limited creditworthiness to access funding and mitigates the lender's risk. These guarantees demonstrate the guarantor's commitment and responsibility for the loan, often resulting in more favorable credit terms.

Types of Personal Guarantees

Personal guarantees are legal agreements in which individuals assume responsibility for loan repayment if the borrower defaults. There are two main types of guarantees:

1. Limited Guarantee

The following elements characterize a limited guarantee:

- In agreements involving multiple owners or partners, each individual has a fixed percentage of ownership in the business.

- This means that each guarantor is limited to a sum or percentage of his responsibility in the event of default.

- Within the category of limited guarantees, there are two subtypes: several guarantees and joint and several guarantees.

- Several guarantees restrict the obligation to repay the outstanding debt strictly to the amount specified in the loan agreement.

- The joint and several guarantees stipulate that if one of the owners or partners does not fulfill their required portion of the debt, the remaining debt must be fully repaid by others.

2. Unlimited Guarantee

An unlimited guarantee entails the following characteristics:

- With an unlimited guarantee, the guarantor is fully responsible for repaying the loan if the borrower defaults, regardless of the guarantee amount.

- The guarantor becomes liable for the entire outstanding balance, even if it exceeds the guaranteed repayment amount.

When it comes to limited guarantees, lenders can collect a specific sum of money or a percentage of the outstanding balance from a principal or business owner.

This type of guarantee is commonly employed when multiple principals can contribute a designated portion of the debt. For example, if a business defaults on its loan, the lender can pursue each principal for a predetermined percentage of the remaining balance, such as 25%.

On the other hand, unlimited guarantees place the principal under the obligation to repay the outstanding balance. The SBA requires this kind of guarantee regularly.

Note

If a business fails to meet its loan obligations and has provided an unlimited guarantee, the lender can seek the principal's repayment of the entire outstanding balance.

In the absence of sufficient liquid assets, such as funds in checking accounts, the lender may also seize other assets like real estate or vehicles.

In short, such guarantees can be categorized into limited and unlimited guarantees. Limited guarantees involve guarantors being responsible for a specific portion or percentage of the loan, while unlimited guarantees hold guarantors fully accountable for the entire outstanding balance.

Understanding these types of guarantees is crucial for borrowers and guarantors in comprehending their obligations and potential liabilities in the event of loan default.

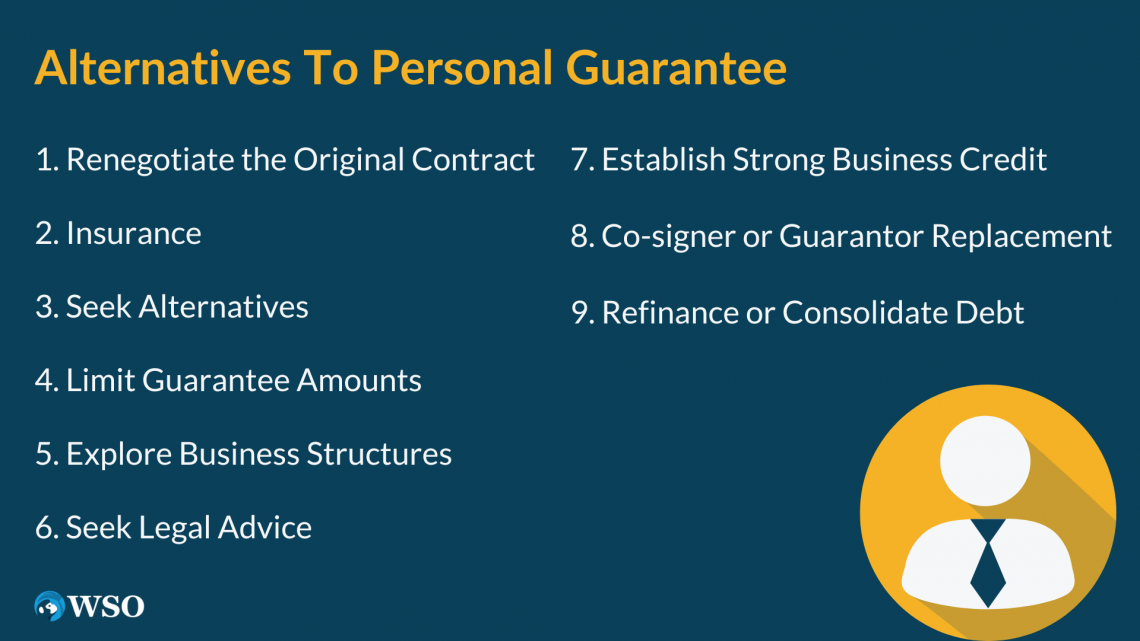

Alternatives To Personal Guarantee

While it is challenging to eliminate a guarantee once it has been signed, some strategies can potentially help mitigate its impact or avoid the need for one altogether. Here are some approaches to consider:

1. Renegotiate the Original Contract

Before a company reaches insolvency, it may be possible to negotiate revised terms with the lender. This could involve limiting the assets that can be seized in the event of default or negotiating a reduced guarantee amount.

Note

Legal assistance is crucial to navigating this process effectively.

2. Insurance

Some insurance providers offer personal guarantee insurance, which can provide peace of mind in case the limited company faces financial difficulties.

In the event of default, this insurance may help cover a part or the entire balance. It is essential to explore insurance options and negotiate them at the time of signing the contract.

3. Seek Alternatives

When obtaining financing, explore alternative options that do not require personal guarantees. For example, consider securing the loan with specific collateral or assets instead.

This way, if there is a default, the lender would have recourse to those assets rather than relying solely on these guarantees.

4. Limit Guarantee Amounts

If guarantees are necessary, negotiate to limit the amount you are personally liable for.

Note

Negotiation can help reduce the potential financial impact if the borrower defaults.

5. Explore Business Structures

Consider restructuring the business into a different legal entity that provides limited liability protection.

For example, forming a limited liability company (LLC) or incorporating the business can help separate personal assets from business obligations, potentially reducing the need for such guarantees.

6. Seek Legal Advice

Consult a qualified attorney who specializes in business and contract law. They can provide personalized guidance based on your specific circumstances and help identify strategies to minimize personal liability or negotiate more favorable terms.

7. Establish Strong Business Credit

Building a solid business credit profile can increase your chances of obtaining financing without the need for such guarantees.

Note

Focus on maintaining timely payments, keeping credit utilization low, and establishing a positive credit history for your business.

8. Co-signer or Guarantor Replacement

If possible, explore the option of substituting or adding another individual as a co-signer or guarantor to share or assume the personal liability associated with the loan.

This approach may require lender approval and careful consideration of the new party's financial stability and creditworthiness.

9. Refinance or Consolidate Debt

Refinancing or consolidating existing debts can sometimes provide an opportunity to renegotiate the terms or remove them altogether. This can be done by securing new financing or consolidating multiple loans into a single loan with revised terms.

Note

It is important to note that while these approaches may offer potential ways to avoid or mitigate guarantees, lenders often require them to secure repayment.

Before adopting any financing agreement, there must be a careful assessment of risks, consulting legal experts, and exploring all available options.

Advantages Of Personal Guarantees

Personal guarantees provide distinct advantages, some of which are:

1. Enhanced Creditworthiness

A guarantor's credit record and rating are considered in addition to the borrower's credit history and score when providing a guarantee.

This can strengthen the overall creditworthiness of the loan application, increasing the chances of approval and potentially securing more favorable loan terms.

2. Improved Access to Funding

Personal guarantees can open doors to funding for small and medium-sized businesses that may have difficulty accessing funds through traditional commercial sources due to a lack of credit history.

Lenders may be more willing to extend loans based on such guarantees, as they provide an additional layer of security and assurance.

3. Expansion of Borrowing Capacity

By offering this guarantee, individuals or businesses may be able to secure a higher loan amount than they would otherwise qualify for. Lenders may be more willing to lend larger sums when they have the added security of personal guarantees.

Note

Expansion enables borrowers to access the necessary capital to pursue growth opportunities or support important initiatives such as product development or research.

4. Increased Business Opportunities

Obtaining funding through such guarantees can provide small and medium-sized businesses with the means to acquire essential resources and pursue business objectives that may have been otherwise unattainable.

Note

The availability of funds can stimulate growth, support expansion plans, and enable strategic investments, helping businesses reach their full potential.

5. Demonstrates Commitment and Assurance

Offering this guarantee to a lender demonstrates a strong commitment to repaying the loan.

It shall ensure that the lender is in a position to be confident and strengthen its trust in the ability of the borrower to meet his financial obligations by ensuring that the borrower willingly takes personal responsibility for paying back the debt.

6. Overcoming Limited Credit History

For startups or businesses with limited credit history, such guarantees can serve as a viable option to secure financing.

By leveraging personal assets and creditworthiness, individuals can overcome the challenges associated with a lack of established business credit and still access the necessary funds for growth and development.

Disadvantages Of Personal Guarantees

While personal guarantees offer advantages, they also come with risks and disadvantages, some of which are:

1. Financial Liability

When you sign an individual guarantee, you essentially assume personal responsibility for your business's debts.

When you sign this guarantee, you are legally obligated to use your personal finances to repay the debt if your business fails to fulfill its borrowing obligations or meet its financial responsibilities.

2. Risk to Personal Assets

If the business cannot repay the loan, creditors can pursue your assets to fulfill the debt. This means your savings, retirement funds, real estate, and other valuable possessions may be seized and used for repayment.

Note

It is important to note that this could affect your financial stability and long-term objectives.

When this guarantee is invoked and you are required to pay, it can negatively impact your credit rating. A personal guarantee is a commitment to take responsibility for someone else's debt if they fail to repay it.

If the borrower defaults on the loan or credit, and you are required to step in and make the payments, it can indicate to lenders that you are associated with a financial obligation that was not fulfilled.

4. Legal Consequences

Signing a guarantee creates a legally binding agreement. Creditors may file a breach of contract suit against you if the guarantee is not fulfilled. Your case might be brought, and the costs of legal fees and court proceedings will rise if that happens.

5. Bankruptcy Risk

There may be circumstances where bankruptcy proceedings are necessary if your undertaking cannot fulfill its obligations and cannot repay the debt.

Note

It is important to note that this may result in lasting consequences on your financial position, making it difficult to obtain credit or loans in the future.

6. Strained Personal Relationships

Such guarantees can put a strain on personal relationships, especially if you involve family members or friends as guarantors. If the business fails and the guarantor is held responsible, it can lead to tension, conflict, and damaged relationships.

7. Limited Financing Options

Many lenders require guarantees as a way to mitigate their risk. It may limit the possibility of obtaining business loans if you are not willing to guarantee yourself or cannot do so.

Alternative financing options, such as crowdfunding or microloans, may have limitations regarding available funds or higher interest rates.

Note

Seeking legal advice and thoroughly understanding the terms and liabilities associated with personal guarantees can help you make informed decisions regarding your financial obligations.

Personal Guarantee FAQs

No, personal guarantees are typically binding, even in insolvency situations. Besides settling the debt, the only option to consider is negotiating revised terms with the lender to remove the requirement for this guarantee.

Personal guarantees are legally enforceable if the proper contract has been completed according to legal requirements.

Although there are instances where paperwork may be missing, or the guarantor may not have fully understood the document they signed, it is risky to assume that such a guarantee cannot be enforced.

Banks and lenders request personal guarantees to provide additional security when lending money. They want assurance that the business owner is personally invested in the business's success and willing to risk their assets.

Such guarantees help lenders assess the likelihood of business bankruptcy and their ability to recoup their money if the business fails.

The duration of this type of guarantee is specified in the agreement.

Some guarantees have a time limit, after which they become ineffective, and the creditor loses the right to make a claim. The length of the guarantee depends on the specific contract, so it's essential to read the agreement carefully and potentially seek legal advice.

In some cases, business credit card applications may require a personal guarantee, especially for small businesses. However, it's worth researching and exploring options as there may be credit cards available that do not require guarantees.

A personal guarantee is a promise from the guarantor to repay the loan if the borrower defaults, while collateral is when an asset is used to secure a loan. Guarantees involve a third party, whereas collateral does not.

In guarantees, the borrower does not have to pledge any specific asset, while collateral requires the borrower to pledge an asset.

To be enforceable, a guarantee, like any contract, requires consideration. Without proper consideration, this guarantee is not legally binding. However, once the contract is valid, this guarantee can be upheld in court as a binding commitment.

or Want to Sign up with your social account?