Merger Monday

A Monday on which several mergers and acquisitions are announced

What is Merger Monday?

A “Merger Monday” is a Monday on which several mergers and acquisitions are announced. These are typical when the details of the unions are finalized over the weekend and announced on Monday to help drive up the stock price over the week.

It is a term coined on Wall Street to describe groups of companies that announce their mergers and acquisitions (M&A) deals on a Monday.

The goal of announcing major deals on Monday is to help sway stock prices in favor of the companies making major plays in the market while also allowing the stock price to increase over the week.

For a time, Monday announcements of mergers and acquisitions became less popular, with companies choosing to release news of their deals as they occurred. Though after 2019, Merger Mondays have increased in popularity as, of the $1 trillion in sales done in 2019, nearly 30% were announced on a Monday.

The Death of Merger Mondays

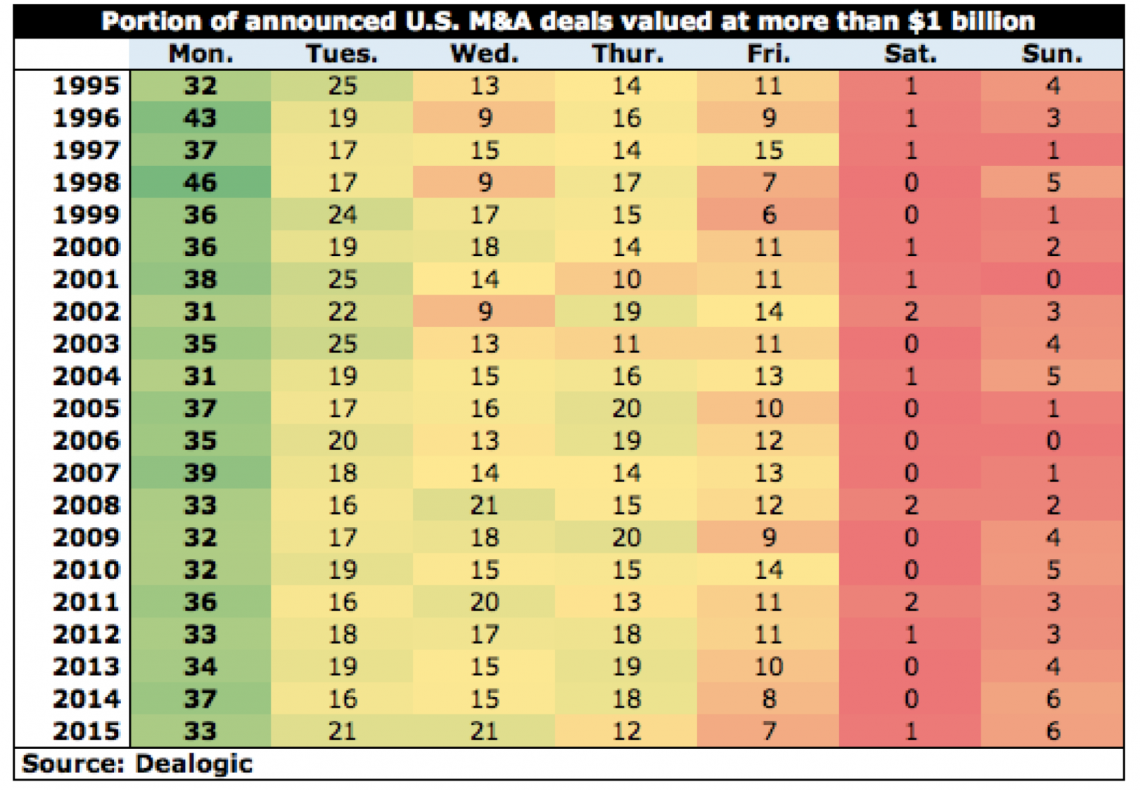

The strength of Merger Monday has been evident since 1995, with Mondays being the most popular day to announce U.S. M&A deals, followed by Tuesdays and Thursdays, which have also been growing in popularity over recent years.

In 2019, Merger Mondays regained popularity with announcements of major deals such as Pfizer's purchase of Array Biopharma for $11.4 billion, Blackstone Group LP's acquisition of some of GLP Pte's warehouses for $18.7 billion, and the purchase of El Paso Electric Co. by JPMorgan Chase & Co. for $2.78 billion.

In 2020, its popularity went back down due to the total global M&A deal value being roughly one-third of the size compared to 2019. It has, however, made a strong recovery in 2022, given their significant impact.

As you can see in the chart above, in 2015, 33 percent of U.S. M&A deals valued at more than $1 billion were announced on a Monday, down from 2014's 37 percent but on par with recent years.

Merger Monday 2019

In November 2019, over $180 billion in deals were announced in the U.S., the largest of which was announced on Mondays. A few examples of transactions that occurred on a Monday in November are:

1. Charles Schwab acquired its rival broker TD Ameritrade in an all-share deal for $26 billion.

2. The world's largest luxury goods company, LVMH Moët Hennessy Louis Vuitton, acquired one of the most famous jewelry companies, Tiffany, for $16.2 billion.

3. Swiss pharmaceutical company Novartis paid $9.7 billion for U.S. biotech. The Medicines Co. Japan's Mitsubishi agreed to pay $4.5 billion to Dutch energy firm Eneco.

4. Lastly, eBay sold its StubHub ticketing subsidiary to Swiss-based Viagogo for $4.05 billion.

However, one of the year's biggest deals was not announced on Monday. It was the $79.6 billion to be paid for Time Warner Cable. Although, this was the one day after Memorial Day (on which stock markets are closed), which was on Monday.

Which sector announces the most M&A deals on Monday?

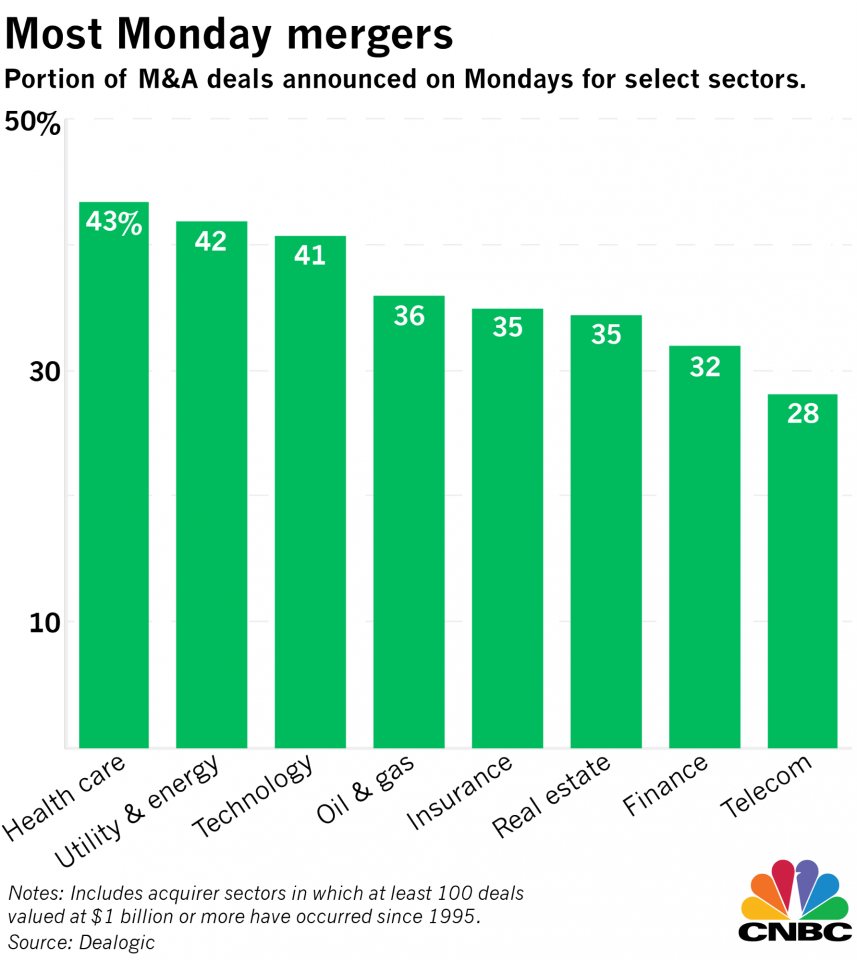

The healthcare, utility & energy, and technology sectors have the highest portion of mergers and acquisitions announced on Mondays.

This is because these sectors are more established and can wait for Monday to drive their stock price, compared to Telecom and Finance, which need to be announced when deals occur due to implications on the broader financial markets.

Merger Monday FAQs

Across all sectors for M&A activity, January and February have seen the fewest Merger Monday activities since 1995, ranging between 6.8%-7% of the year's total Merger Monday announcements.

On the other hand, months like June and July often have the highest rates of M&A announcements, with close to 9.6%-10% of the year's total Merger Monday announcements.

It has been found that companies are slower and undergo lesser M&A deals during colder months than warmer months.

Most M&A transactions occur on Monday, followed by Tuesday and Thursday, popularizing the term Merger Monday.

The healthcare, utility & energy, and technology sectors are the most common sectors to observe this behavior, with over 40% of companies announcing their M&A deals on Monday.

Researched and authored by Aimaan Shergill | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?