Platform Company

A type of business that uses technology to create a shared space where multiple parties can connect and interact

What is a Platform Company?

A platform company is a type of business that uses technology to create a shared space where multiple parties can connect and interact. The platforms created by these companies allow users to exchange information, goods, or services.

These companies create value through exchanges between groups (consumers and producers) through a large network of resources and users.

Platform companies are often disruptive forces in their industries, as they upend traditional business models and create new ways of doing things.

Platform corporations differ from traditional business models by not owning the means of production, but rather focusing on the creation of networks and connections between the users and resources.

Some of the most successful ones, such as Facebook, Uber, and Alibaba, have created platforms that are used by billions of people around the world. These companies have been incredibly successful, in part because of the network effects that their platforms offer.

It is a relatively new phenomenon, and there is still much to learn about them. However, they have the potential to be extremely successful and to have a major impact on the world.

These companies often have an "ecosystem" of other companies that build on their platform. This ecosystem can provide a valuable source of revenue and growth for the platform company.

Another example of a successful platform corporation is Apple.

Consider this, Apple's App Store is an ecosystem of over two million apps built on top of its iOS platform. These apps generate billions of dollars in revenue for Apple and support a wide range of businesses, from small developers to large corporations.

Key Takeaways

- Platform companies utilize technology to create shared spaces for multiple parties to connect, interact, and exchange information, goods, or services. They are often disruptive forces, creating new business models.

- Successful examples include Facebook, Uber, Alibaba, and Apple. Apple's App Store, for instance, serves as a platform for millions of apps, generating revenue and supporting various businesses.

- In Private Equity, the term is used to describe a company that is acquired as a means to enter a new market or expand one's existing operations in that market.

- A platform company should facilitate a smooth transition for users, integrate acquired products sensibly, and ensure the seamless integration of acquired services. The focus is on user experience and consolidation of offerings.

Understanding platform company

Today, the definition is much broader than it was in the past. In general, it is a business that uses technology to create a system that can be used by other businesses or individuals to build new products or services.

Typically, platform companies provide a base of infrastructure and tools for creating new products or services.

Successful platforms tend to build massive networks that allow millions of businesses and individuals to create new products and services.

While each of these companies started with a different focus, they all share a common goal: providing a base of infrastructure and tools that can be used to create new products and services.

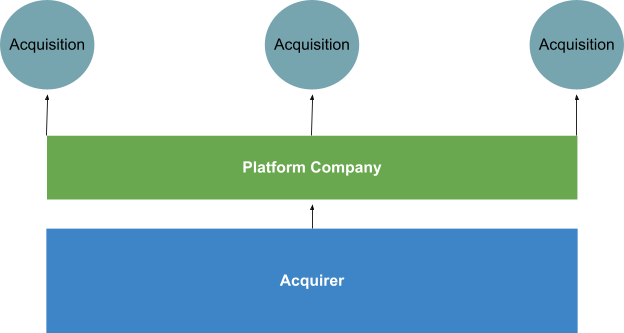

In Private Equity, the term "platform company" describes an initial acquisition made by a private equity group to enter a new market or industry or expand its existing operations in that market.

In other words, it is acquired not for its products or services but for its strategic value.

These acquisitions are a starting point for future acquisitions within the same industry. Platform corporations under private equity provide value by facilitating the exchanges between consumers and producers, constructing a large network of resources and users to aid the transactions between the groups.

These are usually large, well-established companies with a strong presence in their industry. They often have a wide range of products and services and a large customer base. Their size and stature give them a lot of bargaining power in the M&A process.

Target companies will often try to acquire a company to gain a foothold in a new market or to expand their operations in an existing one. The challenge for buyers is that these companies are usually very expensive and difficult to integrate.

Types Of Platform Companies

Platform companies are diverse in nature, and each type serves a unique utility, that facilitates varied interactions between users. Below we will discuss some of the important types of platform companies.

- Payment Platform Companies: The platform offers peer-to-peer (P2P) or business-to-customer (B2C) payment services. These services allow firms to transfer funds between accounts, make international payments, and pay for goods and services online.

- Social Networks: Platforms like social networks provide the facility to connect with an individual's family, friends, colleagues, and other users by sharing pictures and videos. They create a safe space for individuals for productive or leisureful interactions across the globe.

- Product Marketplaces: Platforms like these facilitate the connections between buyers and sellers who exchange their physical products online. Buyers and sellers can make online payments, receive products, and execute transactions without the need for physical interaction.

- Service Marketplaces: This platform focuses on the service segment and facilitates the exchange of services between parties. Services may include legal advice, design work, consulting, and more.

- Social Gaming Platforms: Users on this platform engage in online gaming and interact with other participants online simultaneously. Gamers can connect, play games together, compete, and interact with each other.

- Transaction Platforms: A prime example of a transaction platform is Stripe, which acts as an intermediary for different users, streamlining payment processes for businesses and consumers.

- Innovation Platforms: Innovation platforms give other businesses a starting point for developing goods and services using digital tools and technology. They use current platforms to facilitate the creation of new solutions.

- Integrated Platforms: The platform is a hybrid of transactional capabilities with innovation as its core. Such platforms serve as an intermediary offering innovative solutions.

- Investment Platforms: Investment platforms like Salesforce serve as holding corporations that support a verticalized product portfolio strategy by offering business apps like Slack that complement customer relationship management (CRM) solutions.

These diverse platform firms address distinct market demands by enabling user interactions, transactions, and connections while offering cutting-edge solutions for a range of industries, including e-commerce, social networking, and finance.

Characteristics of a good platform company

When looking at potential platform companies to acquire, certain characteristics make a company more attractive than others.

Some of these characteristics include a large and engaged user base, a strong team of employees, a robust technology infrastructure, and a proven business model.

There are several key characteristics that all platform companies share. Some of them are as follows

- Large User Base: It must have a large user base, which is essential for generating the data it needs to function. A large user base typically enables a wide reach, which can help the acquirer expand its customer base.

- Connectivity And Networking: It must be able to match users with the right suppliers. This matching can be done through an algorithm, as in Uber, or through a more human-driven process, as in Airbnb.

- Value Creation Process: A platform corporation must be able to connect, interact, and transact their businesses. It must have a way of monetizing its users.

- Data-Driven Approach: it typically has a large amount of data that can be used to drive decision-making and improve the efficiency of the acquired company.

- Timing And Distinctive Value Proposition: Good entry timing in the industry, a unique value proposition, and a new business operating model that allows for rapid adaptation and scaling are crucial for success.

- Investment And Momentum: Long-term success requires consistent investment to develop the platform and seed its many sides until it gathers enough traction.

- Strong Management Team: A strong, motivated, and experienced management team can solidify platform companies and form a solid foundation for future operations.

- Vision And Strategy: A company's success can be determined by the vision and strategies it employs to make its business a success. A platform company must be aware of the platform's business model, how to invest, where to invest, and how to face the challenges encompassing the model.

- Communication And Collaboration: Developing a successful platform that links stakeholders, lower transaction costs, and fosters innovation requires effective communication among all organizational roles, cooperation between business divisions, and a common vision.

- Scalability And Network Effects: Platform companies use network effects to link producers and consumers, get insights into customer behaviour through data collecting, and make money from market participants in the form of commissions or rent.

While many other factors can make a company attractive, these are some of the key characteristics to look out for:

-

A digital marketplace that connects different users

-

A large and active user base

-

A business model that encourages users to transact with each other

-

A focus on user interactions and user experience

-

A technology-based infrastructure

What should a platform company accomplish for the acquirer?

The answer to this question is not straightforward because it depends on the acquirer's specific goals and objectives.

When a platform company is acquired, the acquirer usually has a few key goals:

- Expand the reach of their existing products and services by integrating the acquired platform into their ecosystem.

- Acquire new customers and user groups that can be monetized through the platform.

- And lastly, the acquirer will often look to consolidate the platform space and reduce competition.

A platform firm should focus on a few key points when engaging with its potential users:

- Focus on creating a seamless transition for the acquired company's users. This means making it easy for them to transition to the new platform and continue using the acquired company's products and services.

- Secondly, it should focus on integrating the acquired company's products and services into the platform in a way that makes sense for the users.

- And finally, it should focus on ensuring that the acquired company's products and services are well integrated.

These are just a few of the things that an acquirer may be looking to achieve when they acquire a platform company. Of course, every acquisition is different, and the acquirer may have other goals in mind.

However, these are some of the most common objectives that we see in these types of deals.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?