Mundell–Fleming model

An economic model that analyzes the relationship between an economy's nominal exchange rate, interest rate, and output

What is The Mundell–Fleming model?

The Mundell Fleming Model employs the method of IS-LM BoP. This is postulated by Robert Mundell and Marcus Fleming, stating the short-run relationship between output, rate of interest, and exchange rate.

It states under a flexible exchange rate system; monetary policy proves more effective. When a fixed exchange rate system is applied. Fiscal policy is efficient.

The model's approach was developed in the 1960s by Robert Mundell and J. Marcus Fleming. The early 1960s showed developments by Mundell, a Canadian economist, and Fleming, a British Economist.

Mundell held a Nobel prize in 1999 for Economics. During this period, the economists were affiliated and members of the International Monetary Fund’s Research Department.

The relevant feature of modern economies is the amount of integration offered between financial and capital markets. This rests on the capacity of policymakers. This is based on the considerations of foreign exchange rates and interest rate movements while formulations of domestic monetary and fiscal policies.

Mundell Fleming works on the desirability of producing optimum results using monetary and fiscal policies and exchange rate systems. It offers an optimal solution to policymakers. Thus, offered a pathway to the political systems during the reign post world war.

Foreign trade and policies offer a glimpse into the functioning of the markets, governments, and trade interactions.

Key Takeaways

- The Mundell-Fleming model is an extension of the IS-LM Model, combining International Economics with Macroeconomics. It applies to a small, open economy with foreign trade, unlike the closed economy focus of the conventional IS-LM model.

- The model highlights the importance of foreign trade and policies in understanding market dynamics, governmental actions, and international trade interactions.

- Mundell-Fleming suggests that fiscal policy is less effective under a flexible exchange rate system, while monetary policy is more impactful. The reverse is true for a fixed exchange rate system.

Understanding the Global Context of IS-LM

The Mundell-Fleming model acts as an extension of the IS-LM Model. The Investment-Savings and Liquidity-preference Money Supply model is a Keynesian macroeconomic model postulating the relations of economic goods with the liquidity market.

It offers a modeling framework for working the policies in the goods and assets market with application to a small, open economy.

The IS-LM model works in a closed economy without foreign trade, focusing on investment, savings, and liquidity.

It offers an integration of International Economics with Macroeconomics. The difference between the conventional IS-LM model and Mundell Fleming lies in applying the theory.

This model works in a small open economy with the presence of foreign trade, unlike the former, which operates in a closed economy.

It argued for the lack of simultaneous operations between fixed exchange rates, free capital movement, and independent monetary policy. It states that only two factors can be maintained, as stated above.

The above-stated principle is often termed the ‘impossible trinity’ or the ‘Mundell Fleming Trilemma’.

Assumptions :

- Identical Spot and Forward exchange rates. It is based on nominal exchange rates.

- The values of existing exchange rates are assumed to continue for an indefinite period.

- The money wage rate is assumed to be of a fixed value. There is a fixed price value.

- The unemployed resources are assumed to be a constant value.

- There are constant returns to scale.

- There is a small open economy with perfect capital mobility.

Exploring the Significance of the Mundell-Fleming Model

The restrictive assumptions of the Mundell fleming Model allow further key postulations:

- The economy's behavior is predictable from the manner of adoption of the exchange rate system in the prevalent economy.

- It states that fiscal policy can't affect output under a flexible exchange rate system. The Monetary Policy proves to be more fruitful in this case. This contradicts and holds vice-versa when a fixed exchange system is employed.

- The Monetary Policy works on activating the external balance, and the Fiscal policy can restore the internal balance.

| Floating Exchange Rate | Fixed Exchange Rate | |||||

|---|---|---|---|---|---|---|

| Policy | Income (Y) | Exchange Rate (e) | Net Exports (NX) | Income (Y) | Exchange Rate (e) | Net Exports (NX) |

| Fiscal Expansion | No effect | Rises | Falls | Rises | No effect | No effect |

| Monetary Expansion | Rises | Falls | Rises | No effect | No effect | No effect |

The postulations state the short-run effects of various kinds of policies under respective exchange rate systems on various parameters. These include Income (Y), Exchange Rate (e), and Net Exports (NX).

It states that the various kinds of policies, i.e., fiscal, monetary, or trade policy, are predetermined by the kind of exchange rate of the system, i.e., fixed exchange rate and flexible exchange rate.

It shows how proper policy usage can produce the required macroeconomic objectives. The influence of policies determines the effects.

Monetary policy can alter national income. The effect of expansionary fiscal policy is neutralized by currency appreciation. Under a fixed exchange rate system, only fiscal policy can affect Y or national income.

A serious criticism of the model is that it mixes the stocks and flows. This has been used for directing policies of open economies for more than four decades. The stock constitutes the LM curve, and flow makes the BP curve.

The Central Bank loses control over the money supply since it has adjusted the upward or downward movement to maintain the exchange rate at a predetermined level.

The dismantling of restrictions on the free movement of capital. This capital moves from a country offering a lower risk-adjusted yield to a country offering a higher risk-adjusted yield. The expansionary monetary policy works in the direction of reducing the yield of assets by raising the prices.

When this yield falls to the point of the global interest rate, foreign investors start withdrawing money. They transfer money to other economies. This capital mobility offered relevance to the integration of asset markets.

Key Assumptions of the Mundell-Fleming Model

The determination of the equilibrium of Investment (I) is for a small open economy. Exports (X) are seen in injection into the economy stream. The imports (M) and savings (S) are called leakages from the stream.

The equilibrium of determination of the income stream is defined by:

I + X = S + M……………. Injection = Leakages

X - M = S - I ……………. Net Exports = Net Foreign Investment

In this equation, if imports exceed exports. It implies a negative value. Thus, domestic investment exceeds domestic savings. This is by the amount of net foreign disinvestment.

Implications of Assumptions

- The model is an open economy version of the IS-LM Model.

- The most important assumption is extreme. It is a small, open economy with perfect capital mobility.

- This implies the economy can borrow or lend to its desirable capacity. Thus, equating the economy's interest rate to global interest rates.

Open Economy Models

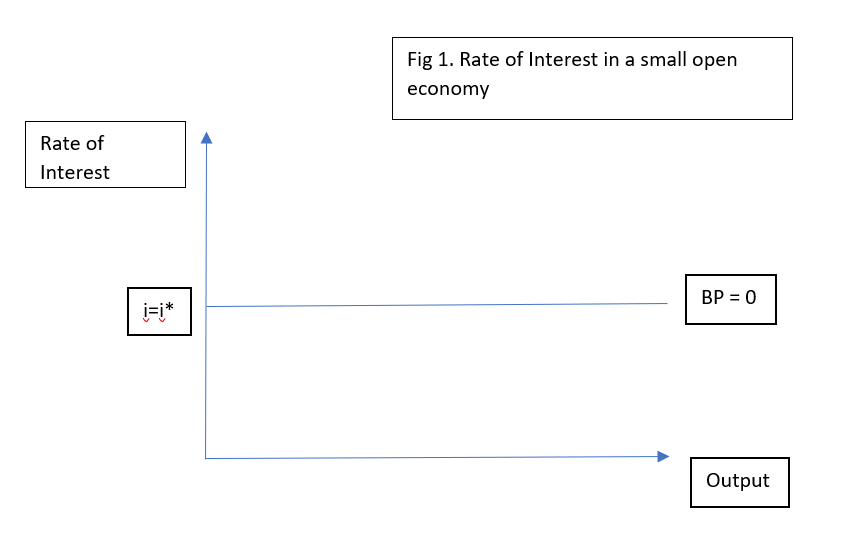

The Perfect Capital Mobility: It states investors purchase assets in a country of choice, fast with low transaction costs, and in desirable quantities. Thus, a change in the interest rate will alter it globally.

It postulates the interest rate in the economy (i). This i = i*. The global interest rate is exogenously fixed. An increase in rates implies an increase in exchange rates leading to an increase in flow, and vice-versa for outflows. Thus, the state of equilibrium is assumed in parallel with the flows.

The price level at home and globally does not vary much. Thus, P = P*. The model is assumed for the analysis of short-run fluctuations.

The 'e' is the nominal exchange rate. It is defined as the domestic currency per unit of foreign currency.

A decrease in the nominal exchange rate. This further states appreciation makes foreign goods cheaper relative to domestic goods. This will cause a proportionate decrease in the real exchange rate.

ɛ = eP*/p

Equilibrium Conditions for Balance of Payments in the Mundell-Fleming Model

The Monetary and Fiscal Policy's efficiency is in modifying income and interest rates. This is under the two exchange rate regimes - fixed and floating. It is explained using the IS-LM curves framework. The IS curve results from various combinations of interest rate (i) and national income (Y). This results in equilibrium in the goods market.

The Goods market equilibrium can be expressed as:

Y = C(Y - T) + I(i) + G + NX(Y, e)

In this equation,

- Y represents aggregate income.

- C represents Consumption dependent on disposable income (Y- T).

- In this, T is the taxes, and

- I is an investment.

- I is investment inversely related to the global interest rate - i*.

- Also, Net exports (NX) are a negative function of National Income (Y) and a positive function of Nominal Exchange Rate (e).

The IS curve has a negative slope. This is due to low-interest rates and a high level of investment. The LM curve shows various combinations of interest rates (i) and national income (Y) such that the demand and supply of money equal and the equilibrium in the money market is established.

The LM curve doesn't alter with an introduction of net exports and remains the same under a closed economy. This implication can be brought under an equation.

M/P = L(i, Y)

where M is the money supply, and P is the price level. L is demand for real money; i is interest, and Y is income.

The Balance of Payments curve consists of various combinations of interest rates and national income at which BOP is in equilibrium at a given exchange rate.

The equation of the BP curve can be written as,

X - M(Y) + F(i) = 0

Balance of Payments Curve under three different scenarios

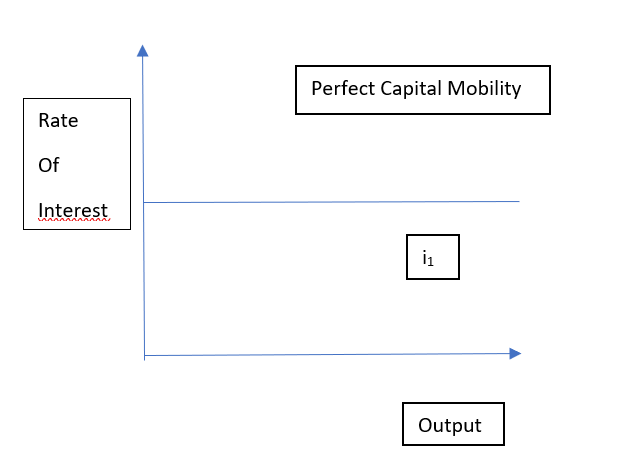

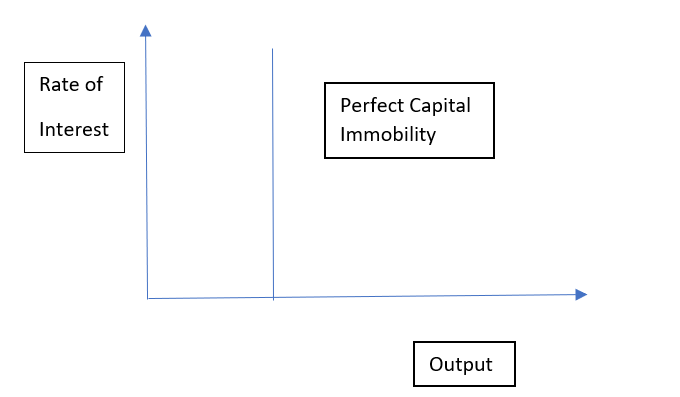

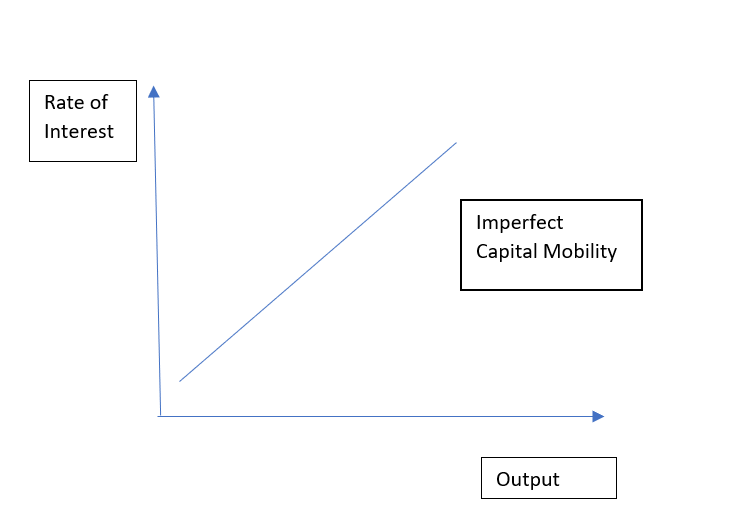

In reality, however, capital is neither perfectly mobile nor perfectly immobile. The B curve is drawn on the assumption of a constant exchange rate.

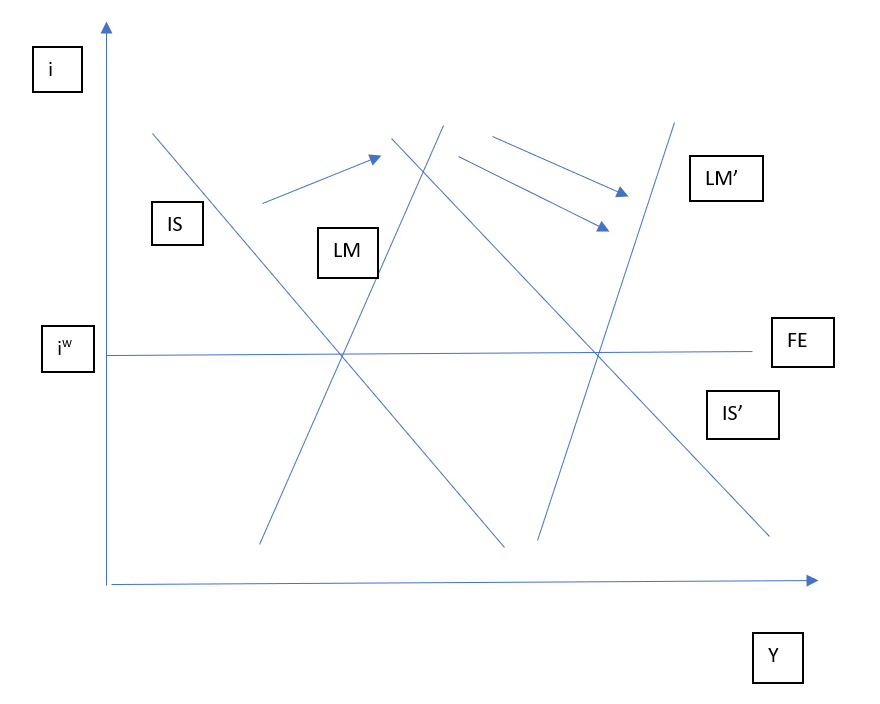

The above diagram illustrates the balance of the Payments curve under three different scenarios.

The interaction of interest rate and output represents capital mobility.

It shows three instances of horizontal, vertical, or upward sloping.

This includes perfect capital mobility, perfect capital immobility, and imperfect capital mobility. Moreover, the balance of payments curve is a horizontal line at the level i=i* under perfect capital mobility. It is a vertical line under imperfect capital immobility. Also, it is upward-sloping under imperfect capital mobility.

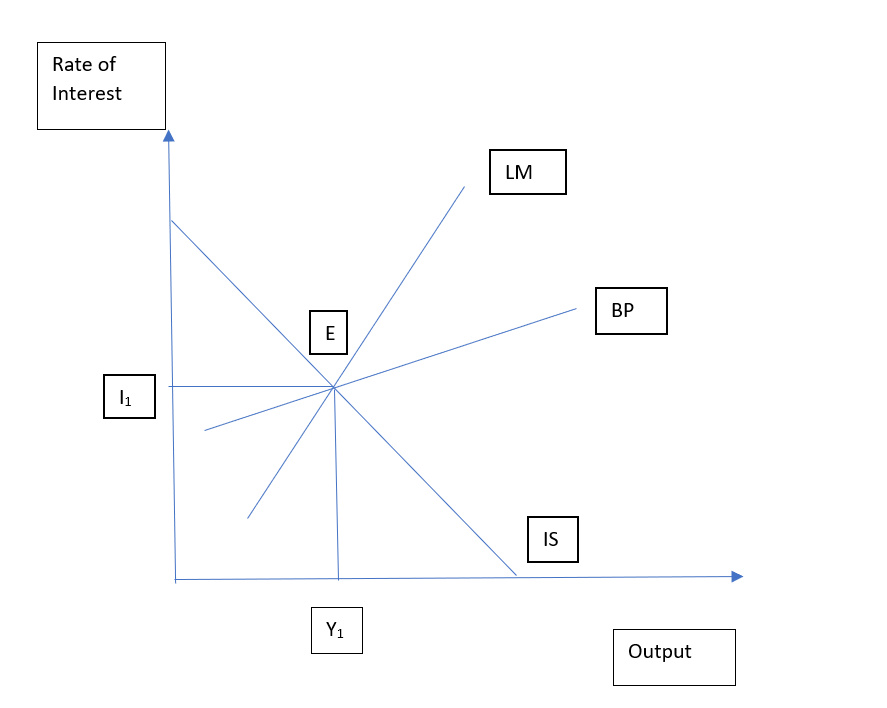

The Equilibrium in the Goods Market, Money Market, and Balance of Payments.

The figure illustrates the equilibrium point between the goods market, money market, and balance of payments. Point E intersects the IS curve, LM curve, and BP curve. Including all or most elimination controls on foreign capital flows among the industrial countries.

In this graph, the mechanics of the Mundell-Fleming Model can be illustrated. This graph of IS-LM - BoP is plotted. The vertical axis represents the domestic interest rate, and the horizontal axis shows output or real GDP.

The interactions show the relationship between various aspects:

- Investment

- Savings

- Liquidity

- Money Supply

- Balance of Payments

In this IS-LM -BoP graph, the IS curve is downward-sloping, and the LM curve is upward-sloping. This is similar to the conventional IS-LM model. The B lance of Payments curve is upward sloping unless there is perfect capital mobility which shows a horizontal line.

interplay between Monetary and Fiscal Policies

The Monetary and Fiscal Policies impact the capital account of the balance of payments. This is through fluctuations in the rates of interest.

The Policies influence rates of interest, eventually impacting the following aspects:

- Flows of Capital

- Changes in Capital Account

- Changes in Balance of Payments

The contemporary relevance of the Mundell Fleming model answers the heated debates of International Economics. These include the adoption and creation of a common global currency in various economies worldwide.

This draws implications over the exchange rate systems and the influence of congregations on monetary and fiscal policies. The impact under various kinds of exchange rate systems illustrates the feasibility of policy choices under various exchange rate systems.

1. Fiscal Policy Effect under Flexible Exchange Rate

Expansionary fiscal policy in a small open economy leads to exchange rate appreciation. This does not affect income. Thus, a fall in exports can compensate for the loss of income. The fiscal expansion under planned expenditure leads to a rightward shift of the IS curve.

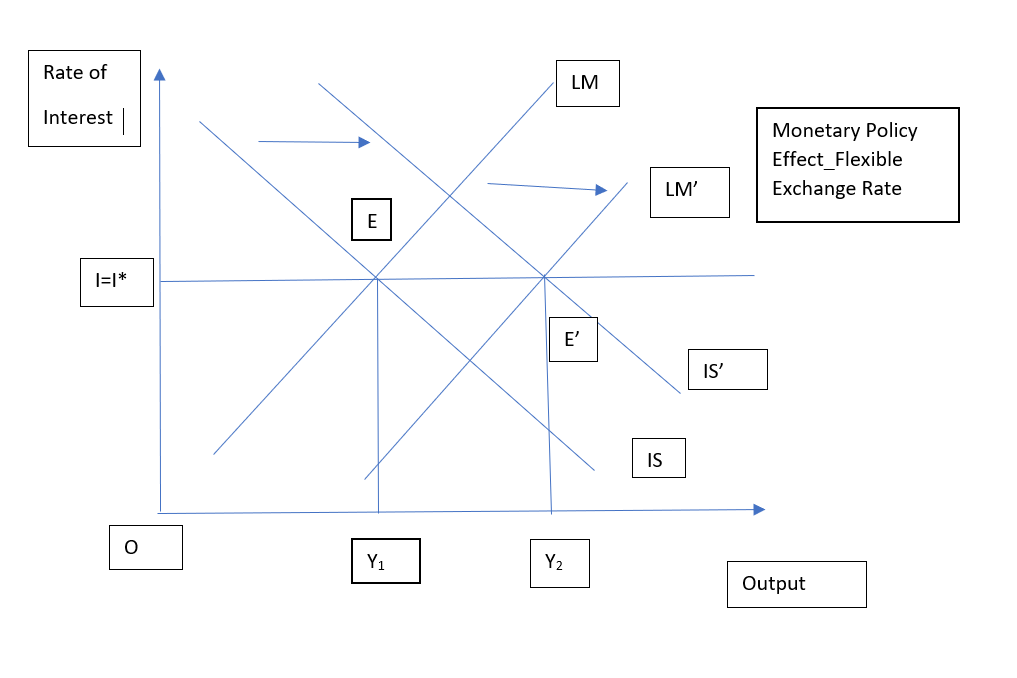

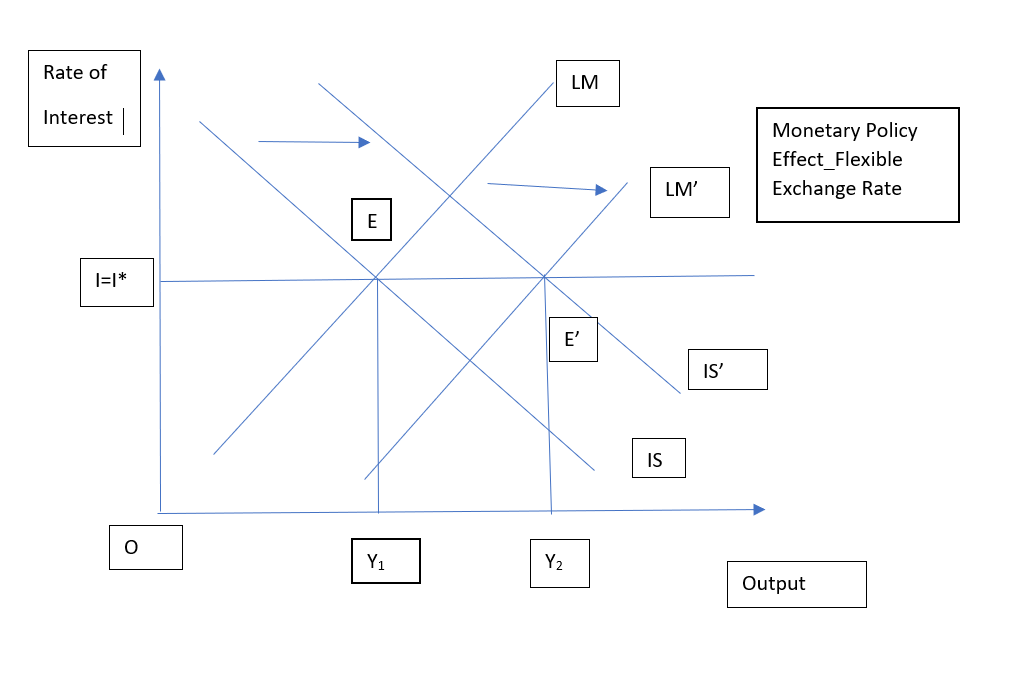

2. Monetary Policy Effect under Flexible Exchange Rate System

Similarly, the various forms of police effects can be studied. The increase in money supply applies downward pressure on domestic rates, causing an outflow of money.

The increase in the supply of money by the central bank leads to a rightward shift of the LM curve. This leads to a depreciation of the exchange rate, which stimulates net exports.

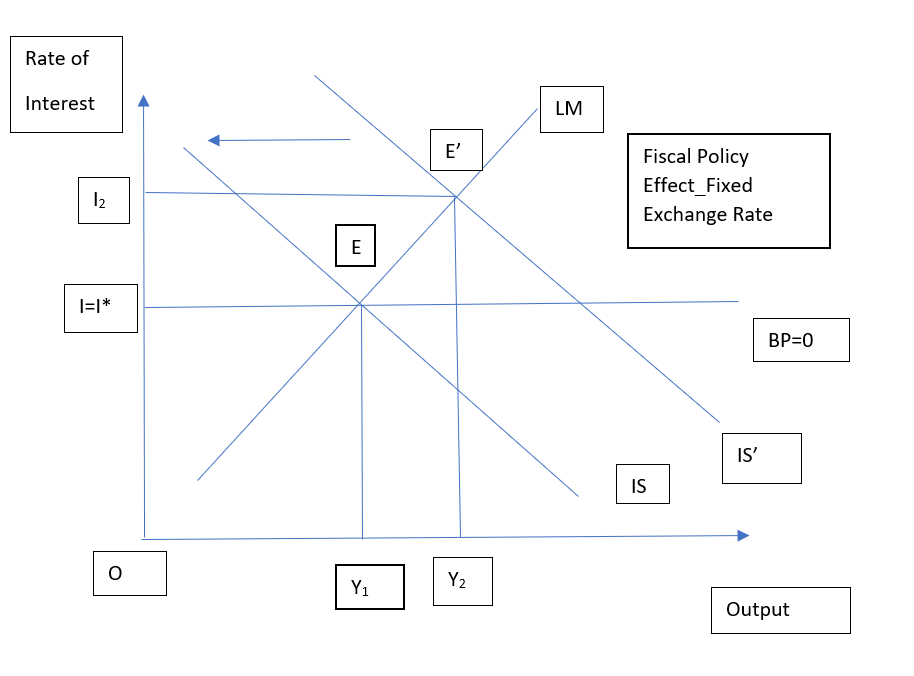

3. Fiscal Policy under Fixed Exchange Rate System

The fiscal expansion leads to a rise in income. The exchange rate system's value remains fixed under fiscal expansions.

The fixed exchange rates facilitate the operations of change in the rates of exchange in the hands of the government. Thus, government intervention ensures a fall in interest rates ensures capital outflows and a rise in rates creates capital inflow.

The fiscal expansion causes a rightward shift of the IS curve. This creates a tendency to raise the interest rates, but perfect capital mobility at the rate raises inflows and creates a balance.

As a result, there is a rightward shift of the LM curve. The capital inflows stabilize, and the result is an expansion of income.

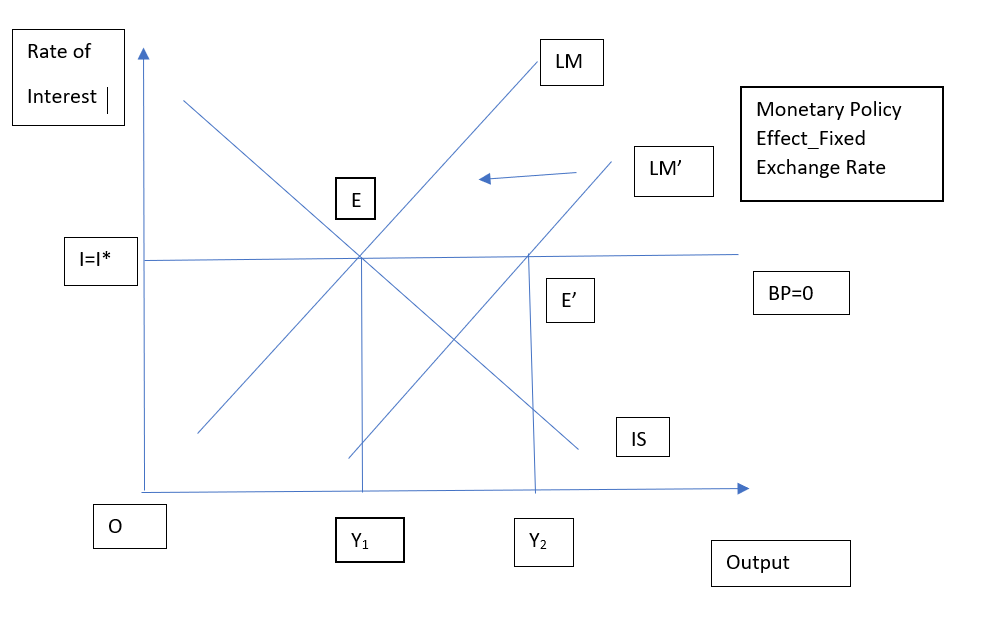

4. Monetary Policy under Fixed Exchange Rate System

The depletion of reserves reduces the central bank’s control over income. The expansionary monetary supply in the initial stages shifts the LM curve. This causes a fall in interest rates. This results in an outflow of capital and causes a reduction of money supply back to LM.

The raised controversy sparking the unanswered questions rests on a few fundamental parameters.

The preferable form of the exchange rate of the system and its choice depends on the impact. This reflects the slow transition from fixed to flexible, initially done to fiat currencies.

The Mundell Fleming Model marks the initial steps in this direction. Yet, it serves with fundamental limitations. They further elaborate on the static nature of the model, answering questions in the short run. Further expansion rests in the traditional dynamic of economics and finance.

Mundell–Fleming Model FAQs

The policy-making process for International Trade offers an equilibrium to optimize trade efficiency with the domestic economy.

A detailed analysis should be drawn depending on the state of affairs of the economy. Accordingly, monetary and fiscal policy should be exercised under various exchange rate systems.

The Mundell Fleming Model is an extension of the IS-LM model with the extension of the small, open economy allowing free trade. This facilitates understanding the goods and assets market with liquidity and balance of payments.

The structural framework postulates the required policy interventions in various policy circumstances. This allows the policymakers to suggest interventions.

Researched and Authored by Anannya Sahani

Reviewed & Edited by Ankit Siha | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?