Subsidy

Financial aid or support provided to an economic sector to promote social and economic policy is known as a subsidy or government incentive.

What Is a Subsidy?

Financial aid or support provided to an economic sector to promote social and economic policy is known as a subsidy or government incentive. The government generally offers this help to businesses and individuals.

The goal is to remove some burden and is usually only considered when it is in the public's interest. These can be direct, like cash payments, or indirect, like a tax break, given to promote an economic policy or social good.

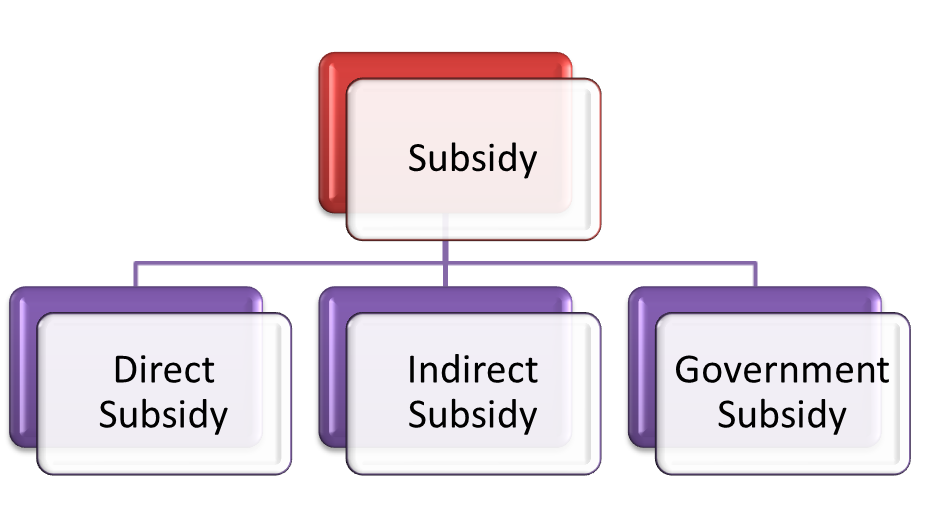

These benefits come with an opportunity cost, as the money used for providing aid is taxed on individuals' income. Consumers get a double hit if they pay a higher price for the utilities they consume. It can be categorized as

1. Direct

This involves an actual payment of funds to an individual, a group, or an industry

2. Indirect

Unlike cash outlays, aids are provided through price reductions for required goods and services involving the purchase of commodities at a price lower than the current market price, supported by the government

3. Government

The objective of these subsidies is to help people who are suffering temporarily from economic conditions. The most common incentives are welfare payments and unemployment benefits.

Key Takeaways

- Subsidies are financial aids provided by governments to sectors, businesses, or individuals to promote economic and social policies, ranging from direct cash payments to tax breaks.

- The WTO's Agreement on Subsidies and Countervailing Measures (SCM agreement) sets rules and remedies to address trade effects, categorizing them into prohibited, actionable, and non-actionable types, with specific provisions for dispute resolution and review mechanisms.

- While subsidies can lower production costs, prevent industry decline, and enhance social welfare, they may also lead to market distortions, increased government spending, and potential inefficiencies.

- Subsidies come in various forms, including production subsidies, consumption subsidies, export subsidies, import subsidies, employment subsidies, tax subsidies, healthcare subsidies, and more, each serving specific economic objectives.

Advantages and Disadvantages of Subsidies

There are both advantages and disadvantages of subsidies.

Advantages are:

-

Can help lower the prices of production inputs and control inflation. This situation happens when the government intervenes by subsidizing commodity prices to avoid ballooning prices.

-

Helps prevent the long-term decline of industries, keeping them alive and functional. Apart from the sectors essential to support the population, new and fast-growing industries also benefit from it.

-

By providing incentives in the form of tax credits or cash, the government tends to increase the population’s access to resources.

-

It empowers marginalized and poor people by making essential items affordable and brings social and economic efficiency.

Note

Some subsidies, like those for research and development (R&D) or small businesses, are designed to spur innovation and entrepreneurship, driving long-term economic competitiveness and technological advancement.

Disadvantages are:

-

Low prices can lead to a sudden increase in demand and, eventually, to a shortage of supply. The newly raised need may be complex for producers to meet, resulting in higher prices.

-

It is hard to quantify the success of financial support.

-

Higher taxes imposed to raise funds to subsidize industries induces pressure on the general population and unsupported firms.

-

In some cases, it can result in political corruption. For example, politicians may be bribed to support a bill providing subsidization to a particular industry.

Types of Subsidies

The various types of government incentives are

1. Production subsidies

These encourage suppliers to increase output by partially offsetting production costs without raising the consumers' final price.

Apart from channeling cost, it helps create new firms, industries, and development. Enterprise investment schemes, industry policy, and regional policy are examples of where these subsidies are used.

2. Consumption subsidies

They are used when the government wishes to offset the cost of food, healthcare, water, or education. They are generally observed in developing countries and can amount to several percentage points of gross domestic product.

These programs can cause a shift in demand as the subsidies are provided directly to the consumer of the good or service, increasing the overall cart capacity of consumers.

3. Export subsidies

They Are the support given by the government for the products that assist a country’s balance of payment by means of exports. Traders benefit from this without creating real trade value for the economy.

It can be a direct payment, a grant of tax relief and subsidized loan to the exporters, or low-interest loans to foreign buyers to stimulate the nation’s exports.

Adam Smith observed that special government incentives enabled exporters to sell to the rest of the world at substantial ongoing losses. These export bounties are a means of enforcement of business capital into channels it would not enter by itself.

Note

Governments worldwide spend trillions of dollars on subsidies each year, covering a wide range of sectors including agriculture, energy, transportation, healthcare, education, and housing, reflecting their significant role in shaping economic policies and social welfare programs.

4. Import subsidies

These reduce the price of imported goods for customers. Consumers of imported goods are better off and enjoy lower prices. Also, a decrease in the price of domestic substitute goods is usually observed.

The importing country's producers experience a gain as there is greater demand even though they sell their products at the same price.

5. Employment subsidies

These serve as an incentive to businesses to generate more job opportunities and improve research and development, thereby reducing unemployment in the country.

Providing wage assistance and social security benefits ensures the maintenance of a minimum standard of living.

6. Tax subsidies

Tax breaks are different from cash payments. For example, an electric car company may receive tax breaks to incentivize green vehicles. It is also referred to as a tax expenditure incurred by the country's government.

Note

Subsidies can lead to increased accessibility to essential goods and services by lowering prices for consumers, particularly in sectors like healthcare, education, and public transportation.

7. Transport subsidies

To decrease the congestion and pollution generated by private transport, governments may choose to subsidize public transport like railways and buses in an attempt to curb these issues.

8. Fossil fuel subsidies

These aim to decrease the overall price of oil, natural gas, coal, etc., in the form of tax breaks on consumption or assistance on production. Some subsidies come from electricity generation, such as one for coal-fired power stations.

9. Healthcare subsidies

These assist the middle class, and the poor receive healthcare coverage under programs like Medicare, Medicaid, children’s health insurance programs, etc. Grants also encourage medical research and development in a country.

Note

Subsidy programs vary greatly in their design, implementation, and impact across different countries and regions, influenced by political priorities, economic conditions, regulatory frameworks, and public demand for social services.

10. Housing subsidies

These subsidies promote homeownership and the construction industry by assisting with down payments or reducing mortgage interest rates. Reducing the mortgage interest rate is one of the most common forms of this aid.

11. Agriculture subsidies

These are used to supplement income, manage supply, and influence the cost of commodities like wheat, cotton, milk, feed grains, oilseeds, and meat products.

The subsidies usually include providing fertilizers, pesticides, seeds, and agricultural equipment at cheaper rates.

12. Fisheries subsidies

Are government actions supplementing income and lowering the cost of extraction of fish for consumers or fishers?

Subsidy Distribution and Economic Effect

Let's take a look at both the distribution and the economic effect below:

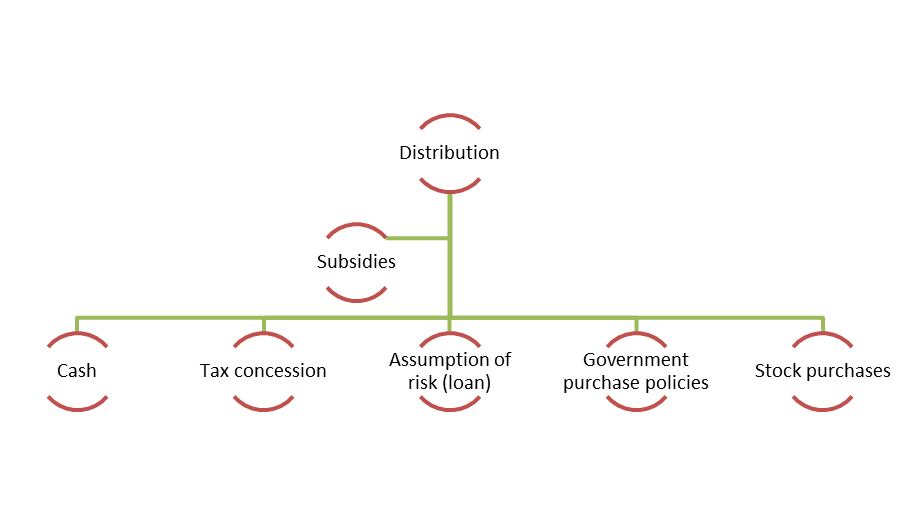

A. Distribution

There are different methods that a government uses for issuing subsidies depending on the sector they wish to target and the type of recipient. It can be in the form of:

-

Cash: A direct sum of cash given to the business or organization.

-

Tax concession: Lessening the tax burden on an industry or company by giving tax credits or incentives.

-

Assumption of risk: A form of a government loan to businesses or industries with an interest rate lower than the government’s cost of borrowing.

-

Government purchase policies: Direct purchasing of goods from firms to incentivize production and maintain a reserve in case of natural disasters or other supply-affecting events.

-

Stock purchases: Purchase of stocks by the government for price management above a certain level.

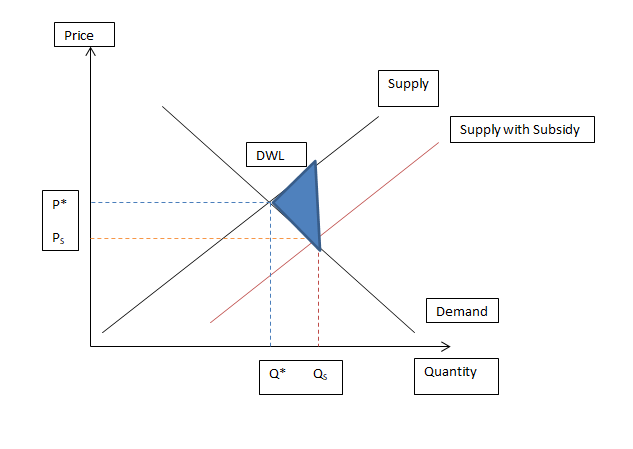

B. Economic effect

-

The economy is in equilibrium, i.e., a state of balance when quantity demanded equals quantity supplied at a particular price.

-

With a fall in price, the quantity demanded increases.

-

A subsidy shifts the supply to the right or increases the quantity demanded by the amount of aid provided.

-

When a consumer receives a subsidy, the lower price results in a rightward movement down the demand curve.

-

When the supplier receives a subsidy, the supply curve shifts to the right because of more production at any given price.

-

The imbalance caused by increased supply beyond equilibrium quantity creates deadweight loss.

-

It also creates a spillover effect in other industries and economic sectors of the country.

-

If demand is elastic, a bigger percentage rise in demand is observed with a slight fall in price. A producer benefits here, as producer surplus is greater than consumer surplus.

-

If demand is inelastic, a fall in price increases demand by a small amount.

-

There may be a positive externality to providing services like public transport. An increase in public transport helps reduce pollution and congestion.

-

Farming or agriculture subsidies lead to an oversupply of food, causing inefficiencies in the market.

-

Apart from the impact, subsidies come with an associated cost to the government and, ultimately, the taxpayers.

-

This is demonstrated in the equation below, where S is equal to the value of subsidy and Qs is equal to the quantity subsidized

Subsidy cost = S * QS

WTO subsidies agreement

The Agreement on Subsidies and Countervailing Measures (subsidies agreement or SCM agreement) of the World Trade Organization lays down rules and remedies to address the trade and commercial effects of incentives.

The agreement divides the practice of providing grants into three classes: prohibited (for example, export subsidies and import substitution), permitted yet actionable, and permitted and non-actionable.

It can prohibit grants that are contingent on export performance or the use of domestic goods over imported goods. A grant by a government that is a WTO member is actionable if it causes injuries to the domestic industry of another country.

The agreement facilitates compliance with rules through notifications. All members of the WTO must notify the committee about the grants they provide every year in their country.

Four types of specificities come under the SCM Agreement:

| S.no. | Specificity | Target for subsidization |

|---|---|---|

| 1. | Enterprise specificity | Particular company or companies |

| 2. | Industry specificity | Particular sector or sectors |

| 3. | Regional specificity | Producers in specific parts of the world |

| 4. | Prohibited specificity | Export goods or goods using domestic inputs |

A dispute can be raised with the WTO if any country suspects another country’s harmful offering of grants. The WTO will then try to bring them together and enter them into a consultation process to establish facts.

A few innovations in the Agreement are:

-

In numeric terms, sufficient support from a domestic industry is required to submit a complaint.

-

Before the imposition of preliminary measures, the Agreement ensures the conduction of a preliminary investigation.

-

Limitations on undertaking use are imposed to avoid the Voluntary Restraint Agreement.

-

Unless it is determined that the continuity of a measure is necessary to avoid recurrence of the injury, termination of countervailing measures is required after five years.

-

Members create a tribunal to review the consistency of the investigation authority’s determinations with domestic law.

Subsidies make sense when one considers fairness and equity.

However, even though these subsidies aim to eliminate apparent inefficiencies in the market for necessary goods, they can sometimes prove ineffective or possibly only balanced out due to positive externalities.

Conclusion

Subsidies play a pivotal role in shaping economic policies and promoting social welfare by providing financial support to various sectors, businesses, and individuals.

They come in diverse forms, ranging from direct cash payments to tax incentives, each serving specific objectives such as stimulating production, mitigating market distortions, or enhancing accessibility to essential services.

However, the effectiveness of subsidies hinges on careful design and implementation, as they can lead to unintended consequences such as market inefficiencies or increased government expenditure

Note

By ensuring transparency and accountability in subsidy provision, the WTO aims to foster a level playing field in global trade and mitigate potential conflicts arising from subsidy practices.

Moreover, the regulation of subsidies on the international stage, as governed by the WTO's Agreement on Subsidies and Countervailing Measures, underscores the importance of balancing economic interests with fair trade practices.

This agreement establishes rules and mechanisms to address the trade effects of subsidies, categorizing them into distinct types and providing avenues for dispute resolution and review.

Effective subsidy policies should be guided by principles of efficiency, fairness, and sustainability, ensuring that they contribute positively to economic development and societal well-being in the long run.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?