Accounts Receivable Financing

An arrangement where a company commits a part or all its accounts receivables in exchange for capital.

What is Accounts Receivable Financing?

Accounts receivable (AR) financing is an arrangement where a company commits a part or all its accounts receivables in exchange for capital. AR financing can be structured as a loan or an asset sale.

Accounts receivable is the revenue that a company has recognized on its books but hasn't received the actual cash for it.

Take, for example, buying a car from your best friend on credit. He's already given you the car, but you haven't paid cash yet. So he will recognize this sale on his books, but instead of recording cash, he will record accounts receivable under his assets until you finally pay him.

In a more formal tone, these usually include unpaid invoices for products or services.

AR financing is beneficial for those businesses that end up accumulating too many receivables and require some cash. You can think of it as receiving a kind of advance payment.

Effective cash flow management is one of the advantages of this type of financing. It clears cash flow clutter and gives the company access to more significant capital.

This capital may be used to take advantage of a new business opportunity, start a profitable project, or meet unexpected expenses.

Businesses in the growth stage may not have the capital to support their growth and may find AR financing appealing to meet their financial goals and obligations.

It is important for a business to consider the cost of accounts receivable financing before they enter into such an agreement. It is crucial for them to consider other forms of financing such as a loan to determine the best course of action.

Key Takeaways

- AR financing allows a company to sell its unpaid invoices to a third party (a factor) at a discounted price. The factor then collects payment from customers, providing the company with immediate cash.

- AR financing helps businesses manage cash flow effectively, access capital quickly, and seize growth opportunities. It's particularly useful for companies with high AR but limited cash on hand.

- Types of AR Financing include traditional factoring, asset-backed securities (ABS), account receivable loans, and selective receivables finance (SRF).

- Various industries, such as transportation, staffing, construction, manufacturing, and textiles, utilize AR financing to meet financial obligations and support growth.

How accounts receivable financing works

Accounts receivables exist because most businesses allow a part of their sales to be made on credit. ARs are considered a current asset that is liquid in theory. Its nature makes it attractive to lenders who would be willing to lend in exchange for this liquid asset.

Due to their high level of liquidity, accounts receivables are seen as assets of significant value to lenders and financiers. Companies may view them as a burden since the payments aren't received immediately and are yet to be collected.

AR financing allows a business to obtain cash by selling its unpaid invoices to a third party at a discounted price. It is a form of short-term financing that allows a company to quickly convert its receivables into cash without waiting for customers to pay their invoices.

You can think of AR financing as a line of credit backed up by outstanding debt yet to be received by the business from its customers. By selling or lending these receivables to a financing third party, the company can get access to capital.

The third-party organization, known as a factor, will purchase the accounts receivable from the business and then take responsibility for collecting payment from the customers.

The business will receive a percentage of the invoice value as an advance, with the remaining balance paid once the factor receives payment from the customer.

This financing is helpful for businesses with a large number of accounts receivable but not enough cash on hand to meet their financial obligations.

It can also be helpful for businesses that need cash quickly to take advantage of a new business opportunity or to meet unexpected expenses. However, it is essential to note that factoring can be costly since the business must sell its receivables at a discounted rate.

It is important for a business to carefully consider the terms and costs of accounts receivable financing before entering into a factoring agreement.

Accounts Receivable Financing Example

A firm called BuildX sells concrete slabs to building manufacturers. They receive a significant purchase order from a multinational building manufacturer (the customer). The customer is willing to buy concrete slabs worth $15 million.

The multinational company needs the concrete slabs right now, but it can only make the full payment in the next six months. BuildX accepts the terms, produces and delivers the concrete slabs, and issues an invoice for $15 million due in 6 months.

If the other clients of BuildX ask for similar payment terms, the firm might run into a cash flow shortage. Waiting for the payments can jeopardize the firm's ability to function.

BuildX understands the difficult times and decides to sell on those terms. Both parties need to find a middle ground during the negotiation.

BuildX approaches a financing third party and sells its receivables. The firm receives $10.5 million immediately.

Then, when the client pays off the total amount on due time to the financing third party, the financing company will release the remaining $4.5 million minus a factoring fee.

By doing this, BuildX gets access to cash immediately. The client receives the concrete slabs it needs and gets to pay later—the financing third party profits from the factoring fees.

Types of Accounts Receivable Financing

There are several types of AR financing that a company could use for its benefit. Each of the types has its own strong and weak points. The kind of financing a business may choose also depends on that business's financial health.

For example, a business may be unable to choose a particular financing option because of too many liabilities or too few assets. Perhaps the business has poor credit quality or a poor debt servicing record.

The company needs to understand these differences and determine the right option for them.

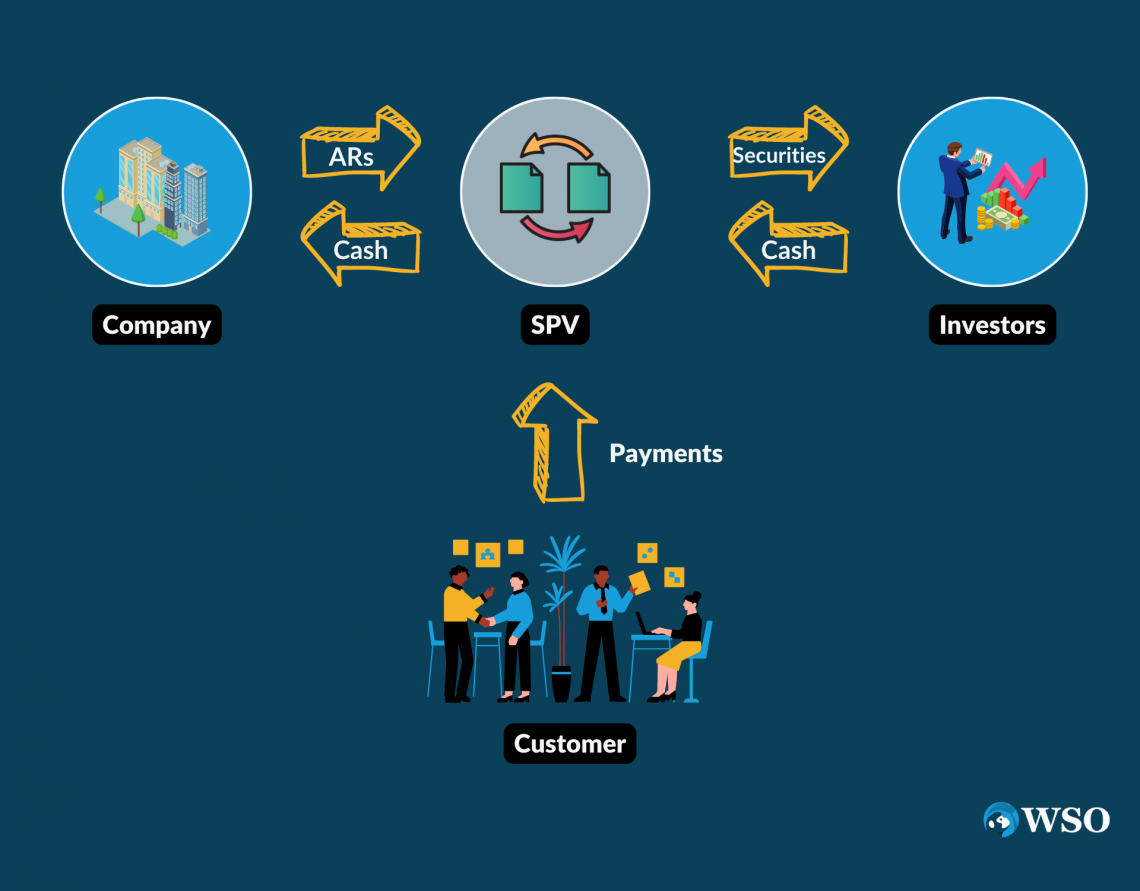

Asset-Backed Securities

Asset-backed security (ABS) is a security whose income payments and hence value are derived from and collateralized by a specified pool of underlying assets.

Receivable securitization is a well-established funding method whereby assets such as accounts receivable, credit card receivables, or other financial assets are packaged, underwritten, and sold in the capital markets as asset-backed securities.

Securitizing ARs allows a more prominent firm to turn its accounts receivable into cash all at once. Individual receivables are consolidated into a new security, which is marketed as an investment vehicle.

Note

Securitization is a complex and time-consuming process. Setting up an SPV and managing the payments and cash flows of the securities issued to the investors can be inconvenient to the borrowing firm.

Because a liquid form of collateral backs the securities, securitization might result in low-interest rates for the issuing institution.

A pool of ARs is sold to a particular purpose vehicle (SPV), which issues debt securities and then uses the proceeds of the securities to fund the purchase of the ARs. The cash generated by the ARs will be used to service the securities that were issued to the investors.

Securitization is a complex and time-consuming process. Setting up an SPV and managing the payments and cash flows of the securities issued to the investors can be inconvenient to the borrowing firm.

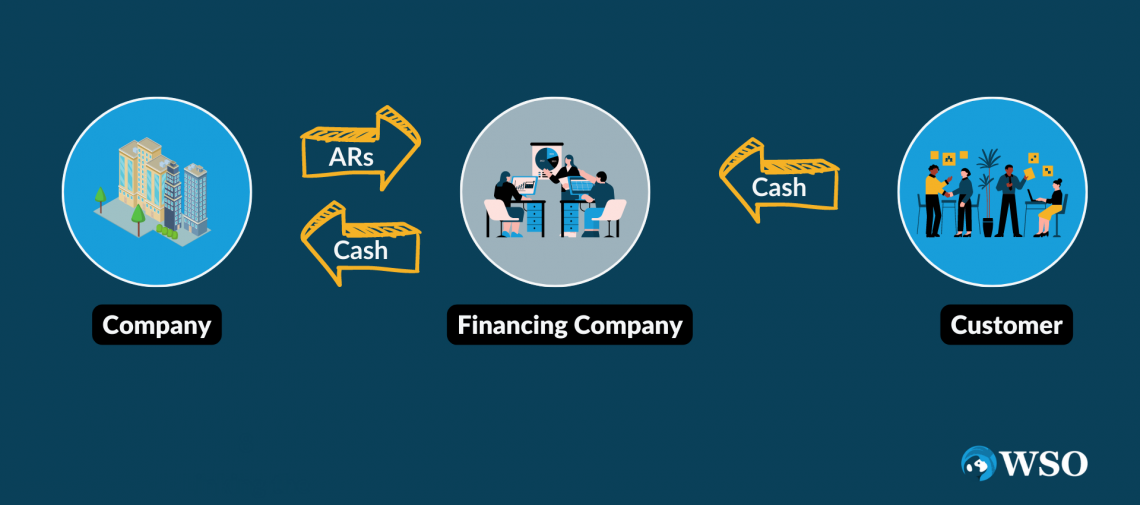

Traditional Factoring

Traditional Factoring, also known as Factoring, is another way of using AR financing. It involves the process of an outright sale of your account receivable to a funding third party in exchange for cash.

This arrangement no longer requires the borrowing company to collect the payments from the customer. That responsibility relies upon the third party.

Since the responsibility of collecting the payments is now on the third party, the borrowing company must sell these receivables at a discount depending upon the quality of the said receivables. A company may receive only 70% of the total value of the ARs as an early payment.

The borrowing company may prefer the factoring method over asset-backed securities (ABS) because it gives the company greater freedom to select the kind of receivable it wants to put up for sale. In contrast, ABS may require the pooling of all the receivables.

Most companies that would buy these ARs would not be looking to buy long-term receivables as this would increase the probability of customer default. They would instead look to purchase those receivables that are shorter term in nature as this increases the likelihood of collecting the due payments on time.

The factoring method can be costly due to the larger fees and shorter lines of credit. For this reason, the factoring method would be a lot more profitable for the financing company.

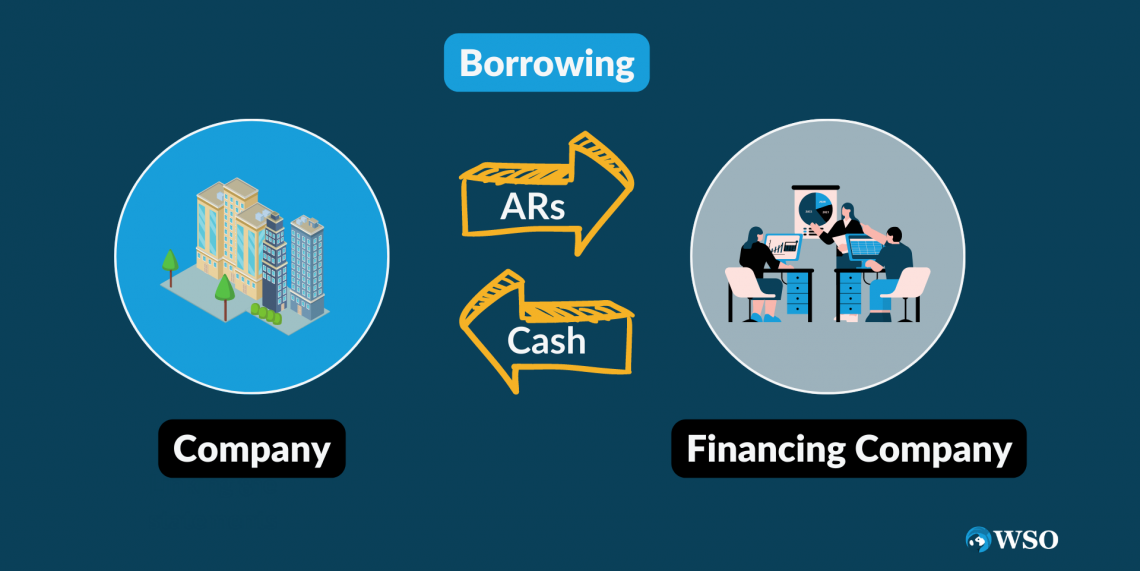

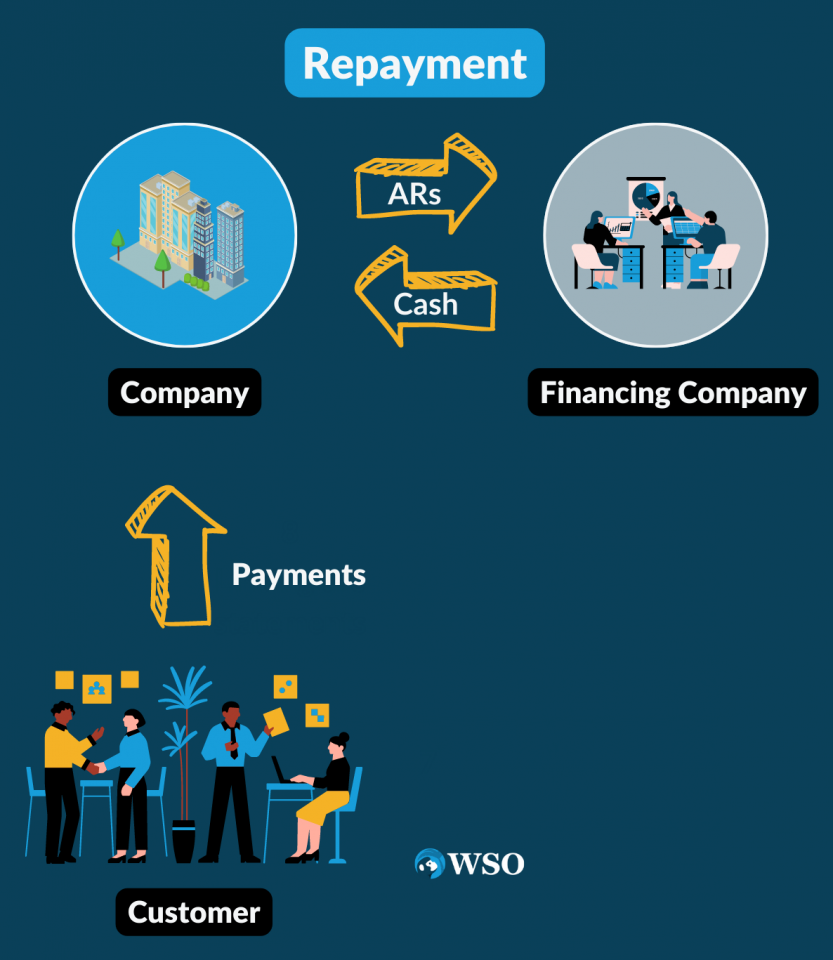

Account receivable loans

Loans are another form of financing using ARs. They are most commonly called loan receivables. The receivables are held as collateral, and a loan is taken against them by the borrowing firm.

AR lenders will have a security agreement in place and will secure their funding based on the ARs; hence this sort of loan should be classed as debt on the balance sheet.

The borrowing company would still own these receivables, and the ultimate responsibility of collecting the payments from the customers is theirs alone.

Like the factoring method, the third-party lender, typically a bank, would lend a fraction of the face value of the ARs.

The quality of the ARs will significantly determine the loan-to-value (LTV) ratio. Typically, banks would lend 80% of the total face value of the accounts receivable. The bank may require a down payment.

The credit quality of the borrowing company is of utmost importance to the bank when assessing accounts receivable loans. The higher the credit rating, the less interest expense the borrowing company will have to absorb while at the same time receiving more capital from the bank.

For example, banks would be more willing to lend 90% of the total face value of the ARs if the borrowing company has a higher credit rating than a lower credit rating.

Selective receivables finance (SRF)

SRF involves carefully selecting ARs, which enables the borrowing company to pick and choose the receivables. Furthermore, selective receivables finance allows businesses to receive advance payments for the total amount of each receivable.

Financing rates are typically lower than other options, and depending on the program structure, this financing method may not count as debt. Because selective receivables financing is not a balance sheet transaction, it does not affect debt ratios or other outstanding lines of credit.

Therefore, it is an attractive funding source for companies looking to grow and expand their operations.

Purchase Order Financing Vs. Accounts Receivable Financing

Accounts receivable and purchase order financing are two types of financing that a business can choose from to help manage its cash flows effectively.

The two types may appear similar but differ in their requirements and uses. A business will have to choose between the two depending on several factors, such as the purpose of the financing, the size of the firm, the relationship with the suppliers, etc.

The following table will help to clarify the main differences between these two types of financing:

| Accounts Receivable Financing | Purchase Order Financing |

|---|---|

| Used after a project has been completed | Used in the beginning stages of the project |

| The financing is received after the revenue has been earned | The financing is received before earning the revenue |

| Financing is used to gain quick access to the amount that’s due to the company from its customers | Financing is used to pay suppliers to receive necessary supplies, which are more often expensive in nature |

| Most commonly used by mature companies to solve inefficient cash flow, especially in regard to working capital | Most commonly used by high-growth companies with insufficient cash flow |

| Industry examples are Trucking & Transportation, Textile Apparels and Wholesalers | Industry examples are Construction, Manufacturing, and Contracting |

| The collateral used is Accounts Receivables | The collateral used is the Purchase Invoices/Orders |

| The responsibility of collection of the amount due is upon the lender in the case of factoring | The responsibility of paying the lender is upon the borrower of the funds |

| The lender considers the creditworthiness of the customers | The lender considers the creditworthiness of the suppliers |

| The transaction is typically completed within one week | The transaction could take up to 2-4 weeks |

As you can see, AR financing aims to use a company's accounts receivables to gain capital access quickly. This capital may be used for a variety of reasons without any mandate. Typically, AR financing is used to finance working capital and manage cash flow gaps.

On the other hand, in Purchase Order (PO) financing, a loan is taken against the purchase order or invoice received by a business to pay the suppliers. This loan has certain clauses and mandates. It cannot be utilized for any other purpose besides fulfilling the obligation to the supplier.

Note

Purchase order financing is usually used to purchase expensive supplies, something a business cannot afford, especially when it is in the growth stage of its life cycle.

Factors Affecting the Quality of Receivables

There are risks for the third party, which would either be buying or lending. There could be a situation where the financing third party buys these ARs from the company but never gets the payments from the customers; in essence, the customers default on their debt purchase. This could be a problematic situation for the financing company.

It is standard practice for the company to sell the ARs for a discount or receive a loan that's worth less than what the account receivables are worth.

For example, if the ARs are worth $10 million, the purchase amount or the loan granted upfront would be $8 million, so a 20% discount.

The quality of the account receivables is important for making such financing decisions. The factors that one should be on the lookout for are as follows:

1. The credit rating of the company

The creditworthiness of the company is important. If the company's credit rating is poor, it makes it all the more difficult for them to get a loan on their receivables, as the company would ultimately make the payments.

A poor credit rating would entail giving steeper discounts to the lender or paying higher interest rates. However, if the company has a strong credit rating, it would be easier for them to get loans at lower interest rates than a company with a weaker credit rating.

2. Duration of the receivables

The longer the duration of the receivables, the greater the risk of default and hence ARs of lower quality. Longer durations would also increase the cost of financing. Usually, ARs that are more than 90 days outstanding is considered defaulted.

Note

The longer the duration, the higher the risk associated with these loans and accounts receivables.

3. Company sector

Some industries and sectors are more or less volatile than others. We classify them as cyclical and non-cyclical. Companies operating in cyclical industries are riskier than companies operating in non-cyclical industries.

For these reasons, the quality and riskiness of the ARs of the company also depend on the industry in which it operates.

For instance, most companies in the financial sector operate in non-cyclical industries, and therefore their receivables are generally of higher quality than those from companies in the manufacturing sector.

4. Documentation quality

Last but not least, the quality, precision, and accuracy of the documents submitted for financing by the company also play an essential role in getting a suitable and acceptable offer from the financing third party.

Therefore, the invoices and supporting documents must be accurate and verifiable to avoid delays.

The less accurate and precise the documents submitted are, the higher the probability of getting a poor offer, either in the form of high-interest rates or giving steeper discounts.

Industries that use Accounts Receivable Financing

AR financing is used by most industries that have commercial clients. The industries that use them are as follows:

1. Trucking, Transportation, and Logistics

Transportation and logistics companies have many invoices for services rendered but often have to wait for payment from their customers. Factoring allows them to quickly convert their receivables into cash to meet their financial obligations.

2. Construction

Construction companies often have many accounts receivable, as they bill customers for work completed over time. Factoring allows them to quickly convert their receivables into cash to meet their financial obligations.

3. Staffing Firms and Agencies

Staffing and temporary employment companies often have many accounts receivables because of the nature of the industry and the fact that they bill clients only after the employee completes the job.

Note

Factoring allows them to quickly convert their receivables into cash without waiting for payment from clients.

4. Manufacturing

Manufacturing companies often have many accounts receivable due to long production cycles and lead times for payment. Factoring can provide them with the cash they need to cover expenses and invest in new equipment or inventory.

5. Textile and Apparel

For textile and apparel companies, which usually have a long production cycle and long lead times for payment, Factoring allows them to convert their receivables into cash quickly to cover expenses and invest in new inventory.

It's worth noting that these are common industries that use accounts receivable financing, but it can be used by any business that has a lot of ARs but not enough cash on hand to meet their financial obligations.

Accounts Receivable Financing Advantages and Disadvantages

Some of the main advantages are:

- AR financing provides quick access to cash without waiting for customers to pay their invoices. This advantage for a business with high growth but limited cash flow enables it to maximize the potential of its assets.

- AR financing provides an alternative to taking out high-interest loans to cover sudden cash needs. This helps businesses to meet their demands without incurring additional debt.

- Compared to taking out a loan, accounts receivable financing requires less paperwork and can be obtained faster than other loan processes.

- The borrowing firm does not need to worry about repayment schedules in the case of Factoring and asset-backed securities since the responsibility of collecting the payments no longer leans on its shoulders.

On the other hand, the disadvantages are listed below:

- Companies with poor credit ratings may have to pay more for AR financing than traditional loans. It can be particularly costly for companies with an adverse credit history and a poor credit rating.

- The lack of control and uncertainty over payments yet to be received paints a bad image of the company, indicating that there is no assurance of incoming cash flow.

- The borrowing company can get squeezed by interest expenses and fees between the debtor and the lender.

Conclusion

Accounts receivable financing gives companies a useful instrument for cash flow management, fast capital availability, and growth support. Businesses can obtain quick funding from outside lenders by using their outstanding invoices, freeing up funds for investments in new ventures or payment obligations.

Even while AR financing has many advantages, such as speed, flexibility, and accessibility, it's crucial that organizations carefully weigh the prices, risks, and ramifications that come with it.

Various factors, including credit ratings, market dynamics, and financing agreements, are significant determinants of whether AR financing is appropriate for a certain company.

Ultimately, companies may maximize their financial strategies and ensure their long-term success by having a thorough awareness of the forms, processes, benefits, and drawbacks of accounts receivable financing.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?