Authorized Stock

It indicates the total number of stock ownership units that a firm can offer to investors, both now and in the future.

The maximum amount of shares that a corporation is able to issue legally is referred to as approved stock, also known as authorized shares or authorized capital. It indicates the total number of stock ownership units that a firm can offer to investors, both now and in the future.

The idea of approved stock is an essential part of corporate governance since it influences a corporation's capital structure and fundraising capacity.

When a business is established, its corporate charter or articles of incorporation specify the number of authorized shares. This figure might vary based on the jurisdiction and other factors.

The approved stock establishes the maximum number of shares the firm may issue, but it does not imply that all authorized shares will be issued immediately or at any moment. It also enables the corporation to adjust to changing business requirements and future development prospects.

A corporation with approved shares can issue new shares without the need for complicated and time-consuming legal formalities. It is critical to understand that approved stock does not represent the actual number of shares outstanding or held by shareholders.

The shares issued to investors and kept by shareholders are known as issued shares or outstanding shares. The significance of approved stock in corporate governance and investor protection is critical.

It helps to guarantee that the firm does not exceed its authorized equity ownership limits and informs shareholders about the possible dilution of their ownership interests.

NOTE

The approved stock also serves as a regulatory safeguard against corporations issuing an infinite number of shares without sufficient authorization.

In summary, the approved stock is the maximum number of shares a firm can legally issue. It allows for greater flexibility in generating financing, adjusting to changing demands, and pursuing future development prospects.

Understanding approved stock is crucial for firms and investors since it determines the company's capital structure and the possibility of future equity issuance.

Key Takeaways

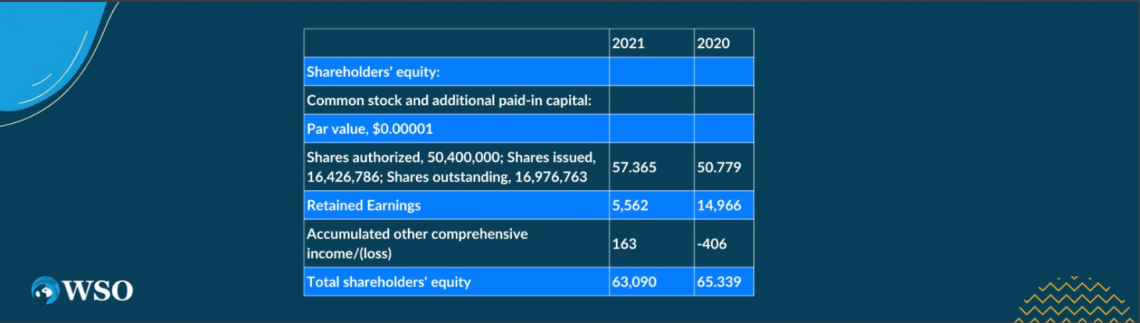

- Authorized stock is found on the balance sheet.

- Issued stock is the number of shares currently issued.

- Outstanding stock is the total stock issued to shareholders, which does not include treasury stock.

- It provides flexibility for the company to generate financing, adjust to changing demands, and pursue future growth prospects.

- The approved stock limit helps maintain investor confidence by preventing the company from issuing an unlimited number of shares without shareholder approval, protecting existing shareholders from excessive dilution.

- Authorized stock can act as a defensive measure against hostile takeovers by making it more challenging for acquirers to gain majority control without shareholder cooperation.

- Companies can adjust their approved stock limit by amending their articles of incorporation or corporate charter with shareholder approval.

- Understanding approved stock is essential for companies and investors as it determines the company's capital structure, fundraising capabilities, and potential dilution impact on existing shareholders.

Importance of Authorized Stock

The importance of approved stock lies in its role in corporate governance, capital structure, and fundraising capabilities for a company. Here are some key reasons why approved stock is important:

1. Flexibility in Capital Structure

Authorized stock allows a company to issue shares as needed for various purposes, such as raising capital, acquiring other businesses, or incentivizing employees through stock options or grants.

The Licensed Stock acts as a predetermined pool of shares that can be utilized when required, providing the company with financial maneuverability.

2. Investor Confidence

The Licensed Stock limit ensures that the company cannot issue an unlimited number of shares without shareholders' approval.

This limit helps maintain investor confidence and protects existing shareholders from excessively diluting their ownership stakes. By knowing the maximum number of authorized shares, investors can evaluate the potential dilution impact of future stock issuances.

3. Legal Compliance

The concept of approved stock is essential for legal compliance. It ensures that a company does not exceed its authorized limit of shares while issuing stock to shareholders.

4. Protection against Hostile Takeovers

Authorized stock can act as a defensive measure against hostile takeovers.

By having a significant number of authorized but unissued shares, a company can make it more challenging for potential acquirers to gain majority control without the cooperation of the existing shareholders.

5. Facilitating Future Growth

Companies often set their approved stock at a higher level than their current needs to accommodate future growth and expansion.

This allows them to issue additional shares in the future without the need for immediate amendments to their articles of incorporation. It streamlines the process of capital raising when the company seeks to expand its operations or pursue new opportunities.

Categories of Authorized Stock

Authorized stock can be categorized in several different ways:

1. Issued Stock

Issued stock is the number of shares that currently exist for a particular company. This can include common, preferred, and restricted stock. The number of shares issued can meet but never exceed the level of Licensed Stock.

The number of issued shares can be increased in the following ways:

- Additional offerings to raise capital for the company quickly.

- Stock options being called by their holders.

- Vesting requirements met by employees holding restricted stock.

2. Outstanding Shares

Outstanding shares are the total number of shares made available to the public for trade. This number is determined at the IPO. It is increased if the company decides to make additional offerings. Outstanding shares do not include any restricted shares held by the company in the treasury.

Understanding X in Accounting

Example of X/Types of X

“Source”: Apple Balance Sheet (Edgar-SEC-filings-APPL)

In accounting, authorized shares may be referenced on the balance sheet under the "stockholders' equity" section.

Let us understand what is X here

"X" is used as a placeholder or variable. It is the total number of shares that a business is legally allowed to issue, as stated in its articles of formation or corporate charter.

The corporation would establish the true worth of "X," which may vary based on the unique demands and conditions of the business. By using "X" as a placeholder, the content aims to clarify the concept and implications of authorized stock without specifying a numerical figure.

Balance sheet:

Authorized = Treasury + Outstanding

Issued to shareholders

Outstanding = Issued - Treasury

Float = Outstanding - Restricted

Float is the total amount of shares of stock currently available to the public for trade. This categorization is similar to outstanding shares but does not include restricted shares.

Different Types of Stocks Commonly Found in the Stock Market

1. Common stock

- Most prevalent: most of a company's shares are publicly traded.

- Equity: Common stock gives the stockholder ownership in a company and the rights that go with it, including:

- Voting rights: can be exercised to dictate decisions that a company makes

- Dividends: based on company performance

2. Preferred stock (characterized by the following)

- Greater claim to assets in the event of liquidation

- Equity- ownership in the company

- No voting rights

- Dividends received more consistently, scheduled, before common shareholder

3. Restricted stock

- Held only by employees of the company, most often upper-level management or executives

- A form of stock-based compensation

- Performance-based motivational tool

- Conditionally transferable

- Becomes transferable via vesting schedule over time or when performance/production goals are achieved

Why might a company not issue all of its authorized shares?

A company might not issue all of its authorized shares due to various considerations. Here are common factors influencing this decision:

1. Strategic Capital Management

A company may decide to issue shares gradually to manage its capital structure strategically. By controlling the dilution of ownership, the company can strike a balance between existing shareholders and potential new investors.

This approach allows the company to access capital as needed while preserving flexibility for future funding requirements.

2. Market Conditions

Companies often monitor market conditions before deciding to issue additional shares. By waiting for more favorable market conditions, the company can potentially maximize the value it receives for each share issued.

3. Financing Alternatives

Authorized shares represent one of many financing options available to a company.

NOTE

Depending on the specific circumstances, the company might explore alternative sources of capital, such as debt financing or strategic partnerships, before resorting to issuing authorized shares.

4. Internal Capital Needs

A company may reserve a portion of its authorized shares for internal purposes. For example, if the company has an employee stock option plan or an employee share purchase plan, it may allocate a specific number of shares for these programs.

This reserved pool of authorized shares ensures that the company can fulfill its obligations to employees or directors without issuing additional shares.

5. Future Growth and Acquisitions

Keeping a portion of authorized shares unissued allows a company to be prepared for future growth opportunities and potential acquisitions.

Having unissued shares available, the company can respond quickly to expansion prospects, enter into strategic partnerships, or pursue mergers and acquisitions without the need for immediate authorization from shareholders.

NOTE

This flexibility can be crucial in fast-paced business environments.

6. Regulatory and Legal Considerations

Compliance with these regulations may influence the timing and extent of share issuance. Additionally, certain transactions or corporate events, such as stock splits or reverse stock splits, may require specific authorization from shareholders before additional shares can be issued.

A company may not issue all of its authorized shares to manage its capital structure strategically, respond to market conditions, explore alternative financing options, fulfill internal obligations, prepare for future growth and acquisitions, or comply with regulatory and legal requirements.

Each company's decision regarding the issuance of authorized shares is influenced by a range of factors that align with its specific financial objectives and operating environment.

Example of Authorized Stock

Let's consider an example of a fictional company called ABC Corporation to understand Licensed Stock.

ABC Corporation is a technology startup that is growing rapidly. During its incorporation, the company's founders, in consultation with legal advisors, decide to authorize 10 million shares of common stock. This means that the maximum number of shares ABC Corporation can issue to shareholders is 10 million.

In the initial phase, ABC Corporation raises funds through various sources, including venture capital firms and angel investors. As part of the investment agreement, ABC Corporation issues 2 million shares to these investors in exchange for their capital infusion.

After the initial funding round, ABC Corporation has 8 million authorized but unissued shares remaining. The company's management decides to hold off on issuing the remaining shares immediately for several reasons:

1. Future Financing

ABC Corporation anticipates the need for additional capital in the future to fund its expansion plans.

By retaining authorized but unissued shares, the company can quickly issue them when the need arises without requiring further approval from shareholders or amendments to its articles of incorporation. This helps streamline the capital-raising process.

2. Employee Stock Options

ABC Corporation wants to implement an employee stock option plan to incentivize and retain talented employees. The company reserves 1 million shares from its approved stock pool to grant stock options to its employees over time.

By setting aside these shares, ABC Corporation can reward employees with equity participation without diluting existing shareholders' ownership excessively.

3. Strategic Partnerships and Acquisitions

ABC Corporation is actively exploring partnerships and potential acquisitions in the industry. It keeps a portion of authorized shares unissued; the company can utilize them as part of future collaboration agreements or acquisition deals.

This allows ABC Corporation to negotiate favorable terms and react quickly to strategic opportunities.

4. Market Conditions

ABC Corporation's management closely monitors market conditions and the company's stock performance.

If the stock price is below expectations or market conditions are unfavorable, they may choose to delay issuing additional shares from the approved stock pool until the market improves. This approach helps maximize the value the company receives for each share issued.

Even though ABC Corporation has authorized 10 million shares, it has only issued 2 million shares to investors during its initial funding round. The remaining 8 million authorized shares are retained for future financing, employee stock options, strategic partnerships, and acquisitions.

This approach allows ABC Corporation to manage its capital structure strategically, respond to market dynamics, and facilitate its growth plans effectively.

Authorized Stock FAQ

According to a company's articles of incorporation or corporate charter, the approved stock is the most shares permitted by law to issue.

Companies have approved stock to provide flexibility in generating financing, adjusting to changing demands, and pursuing future growth prospects. It allows them to issue new shares without the need for complicated legal formalities.

While issued stock refers to the number of shares that have already been distributed to shareholders, approved stock denotes the maximum number of shares that a firm may issue.

No, a company cannot issue more shares than its approved stock. The approved stock serves as a limit to prevent the company from exceeding its authorized equity ownership limits and to maintain compliance with regulations.

Authorized stock can impact shareholders by potentially diluting their ownership stake in the company. If new shares are issued, the ownership percentage of existing shareholders may decrease unless they can purchase additional shares to maintain their ownership proportion.

Increasing approved stock gives the company greater flexibility for future financing and growth. However, it can dilute existing shareholders' ownership stake and may impact the company's stock valuation.

Yes, a company can decrease its approved stock by amending the articles of incorporation or corporate charter with the shareholders' approval. This may be done if the company wants to reduce the potential for dilution or adjust its capital structure.

or Want to Sign up with your social account?