Bullish and Bearish

A bearish market is where the stock market is trending downwards, while a bullish market trends upwards

The terms "bullish" and "bearish" often refer to the trends in the stock market. A bearish market is where the stock market is trending downwards, while a bullish market trends upwards.

These markets are not alike, as they move in different directions. As an investor, you want to lose as least money as possible, so paying attention to these trends will help you achieve that.

The long-standing stock market has gone through many ups and downs. The panic usually sets in through the downs as people anticipate those numbers going even lower. On the flip side, those who wait will most likely be rewarded in the long run.

Over the last 100 years, the market has beaten itself and has seen highs even after great downward turns.

These terms are opposites and essential to understanding the fundamental differences. As an investor, it is crucial to understand the status of the market to make the best decision to earn higher returns. Each market trend has its advantages and disadvantages, which we will understand here.

Bullish and Bearish History

The historical significance of the terms dates back centuries. Before the words used were "bearish" and "bullish," these terms' origins were unknown. The long-standing belief amongst entomologists is that the order in which they were invented was that "bear" came first.

According to Merriam-Webster, the coining of the term entomologists is linked back to a proverb written during the 18th century. The proverb states it is not intelligent "to sell the bear's skin before one has caught the bear." The saying was passed down for generations through the financial system when making transactions.

By the 18th century, it was more common slang of their time to say "selling the bearskin," which had become a famous saying for reselling a stock with the idea of repurchasing it and buying it later at a lower price.

This action is usually looked down upon, as it implies that there is a loss of some kind. Today, short selling a stock is what has come to be the name of this practice, and it is not the best for someone looking to see gains over time.

Over time, people who followed this term and made a profit off of "selling the bearskin" became known as "bearskin jobbers." This term was later shortened as it was passed down through the markets and individual transactions, where it was eventually shortened to "bear."

The origins of beginnings of the term "bull," as history points to, came about simply because investors and market analysts needed another animal to play off of and contrast with "bear."

To speak on how long these ideas have been talked about, famous writer and politician Richard Steele was quoted as talking about his views of the bear market by saying:

I fear the word "bear" is hard to understand among polite people, but I take the meaning to be that one who ensures a fundamental value upon an imaginary thing is said to sell a "bear."

—Richard Steele, The Tatler, 1709

These ideas are strongly correlated with each respective market and are an important trend of overall future performance in growing your income. You do not want to be caught making investments when prices are incredibly high and then being forced to sell them for less because the market is in a bearish downward trend.

Market Trends in History

Throughout history, many experts have seen cyclical market patterns and how they can bounce back over time. It is essential to disclose that patterns are not always the case, as anything can happen at any given time to cause a market spike or crash.

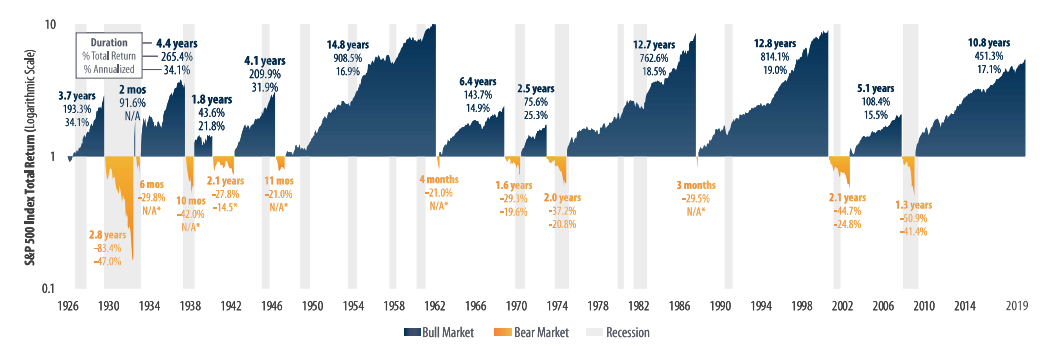

Here is an accurate depiction of the relative time frame of various differentiating bear and bull run markets from the University of Idaho over the past 100 years. It compares the close S&P 500 Index Total Returns seen, which determines a specific run based on the average returns seen over time.

We, as a country, have stayed the course and gone with the punches regarding the financial markets. In the long run, the markets will usually outperform themselves, and investors can see gains.

It is no secret, as evidenced by the chart, that times of significant growth in a bull market eventually coincided with a period of a bear market or loss. These bear markets are not nearly as long as bull markets, but the risk is still enough for many investors to take note.

Now the outline has been drawn for you to see the true up-and-down nature of how these markets work, it is essential to understand the market respectfully and what caused up or down trends and why.

Bearish Markets

As mentioned before, most investments occur when the market is in a downtrend at the appropriate points. A downward trend in terms of overall prices of stocks and other assets can be seen as a potential buy sign as the store is at one of its lowest moments, given that the market is volatile.

It is considered a bear market when there is usually a drop that is more than 20% from the recent highs. This declining optimism with every single loss on investments continues this downward spiral.

Bearish markets have been seen throughout history, and they have lasted for a long duration. The same goes for bullish markets, but bearish markets usually tend to be shorter. The longest bear market in history was seen, spanning 929 days, or just short of three years.

That is a severe problem in terms of economic growth. While if we look on the flip side, some of the best times to invest. Investors love seeing lows, which can signify supporting more to gain high returns.

The Great Depression was the longest bear market in history. Following one of the worst economic hardships ever felt by Americans in the Great Depression, the financial hardship coupled years after was handled as well.

During this period, the stocks within the DowJones lost about 50% of their value. That bear market lasted 2.8 years.

Another huge bear market occurred following the Watergate scandal and OPEC Oil Embargo in 1973. The news about Nixon and his ties to the breaking-in at the Democratic National Convention declined stock prices as many investors were pessimistic about the market.

Likewise, the ban on oil caused many global economies to suffer, like the United States. The following year, prices started to climb back out of a pretty deep hole, but they did indeed manage to climb. This bear market lasted about 630 days or about 21 months.

In 1987, one of the more prevalent market crashes occurred on October 19th, known as Black Monday. Black Monday was caused as a result of an overcorrection that took place from a previous bull market that lasted about five years.

After enough time of things going well, it is wise to prepare for a potential freefall in the market, as these cycles tend to go.

It is essential to remember that a bearish market is one without the approval of the market. It is a tough time to make predictions, and the same can be for bullish markets at any given time.

As with any trend, what goes up, must come down. In the case of bear markets, one would say the opposite, as what goes down must come up.

It is always interesting to see the different mindsets of traders and those pessimistic in a bear market versus those highly positive in a bull market.

Bullish Market

These markets are very emotion-based. It can say that aside from potentially being one of the drivers of markets, it is also about people and their attitudes toward certain things.

Bull markets provide the most optimism for the market, with signs of sustainable growth in price rises.

Bull Markets are the dream of any struggling economy. They provide sustainable growth, usually over a long period, encouraging people to invest more money than in a bear market.

If you bought a stock before a significant bull market or "run" takes place, you will be pleased with the high returns.

The longest bull market ever recorded was in 1981. It was when interest rates were at an all-time high of 21%. It made more sense to keep your money in the bank because overnight, no matter what happened, you'd be making 21% interest on your savings.

In that same year, 1981, the Fed came out with a surprise announcement that they were cutting interest rates by 10%. The whole country was on edge about this long drought of inflation, and any sign of improvement was in high demand.

This slight 10% cut in interest rates caused money to fly out of the banks and into circulation. The anticipation of the change in the trends during these times of high inflation causes these quick changes in the markets, which is crucial to watch out for.

Supply and demand during a bull market are pretty scarce. The same goes for securities, as specific needs fly off the shelves. Investors take their money out in a bear market and move it from equities to safer fixed-income securities.

As they wait for a bull market, the combination of many investors doing this same thing continues to drive the price down.

On the flip side, when a bull market is seen, the common consensus is for investors to "rally" and try and get in to receive any profits they can. The ones that get in sooner, or even bought when prices were still bearish, will see the most significant returns.

There is undoubtedly a psychological factor that goes into these markets, which drives them. As mentioned, a lot of what drives the ups and downs is based mainly on the emotion of market participants. We know by now that bull markets have high rates of optimism versus that bear markets and the trends they possess.

A lot of what goes into these market drives is based on the buyer's confidence. If a buyer truly feels that there are roadblocks ahead that could cause prices to go even lower in a bull market, trust will be low.

Consumer confidence drives many economic markets in America, especially in the case of stocks.

Key Takeaways

-

The trend between bullish and bearish markets is the major driving factor between the failure and success of a given market. It can be straightforward to fall into the trap of having a knee-jerk reaction to a change in the market, thinking it will go one way or another.

-

Sometimes, the market needs a few months to stabilize, plateau, and find direction before any actual change can be seen. It is usually wiser to hold and wait for growth.

-

Before investing your money, look at specific market trends and how they can affect or will affect your investments. If you catch the market at the right time, such as right before a bull run, you will be running around very happy with your returns.

-

Nobody will get it 100% correct, as nobody has a crystal ball. Most bullish and bearish markets still have some volatility to watch out for.

-

Always be aware of the market at hand and how it may be reacting for months. Be mindful of current events, make informed decisions, and do what you can to be ahead of any potential market hits.

Researched and authored by Daniel Bartels | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?