Deposit Slip

A small piece of paper that requires clients to fill in records, including amount, account range, date, and beneficiary.

What is a Deposit Slip?

A deposit slip is a small piece of paper that requires clients to fill in records, including amount, account range, date, and beneficiary. At financial institutions, deposit slips ensure the accuracy and performance of deposits.

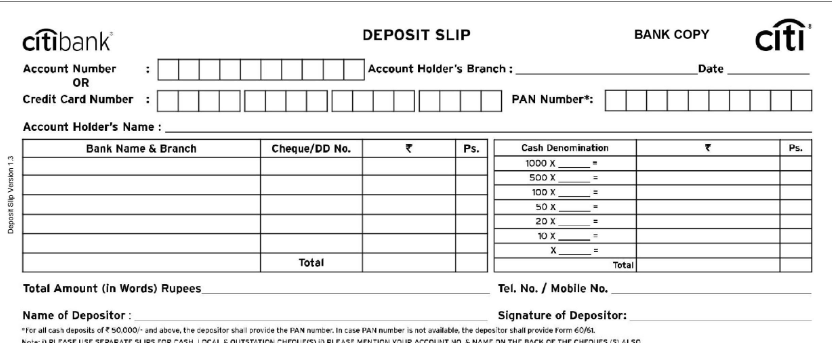

A sample of a deposit slip (Source)

Deposit slips provide advantages in terms of comfort and performance. They are especially beneficial for companies dealing with large deposits. With deposit slips, they could effortlessly tune multiple deposits and settle their accounts speedily.

These slips can also be used to keep a budget at ATMs or cellular banking apps. In these instances, the slip may be changed through a virtual form or virtual assist.

Key Takeaways

- Deposit slips summarize details of desired deposit transactions on a paper slip, including the amount to deposit, the sender, the receiver account details, bank code, and date.

- Deposit slips act as a record in the case of an audit, enabling individuals to review the transaction details for processing.

- These are accepted in person at banks or via an image that captures relevant deposit information from specific parts on the slip to make processing quick.

How Deposit Slips Work

A deposit slip is a compact yet indispensable document, acting as the conduit for adding funds to a bank account. It captures details such as the account holder's name, bank account number, deposit date, type of account, and the amount for deposit.

The Deposit Procedure is as follows.

- Completion of Details

- Tailored Sections for Accuracy

- Submission to the Bank

- Versatility for Various Funds

Particular sections are filled with details based on the account holder’s name, account number, cash denominations, identification number, deposit amount, and the type of deposit to ensure that they are recorded perfectly.

Once the deposit receipt is completed, the customer sends it along with the cash to the bank.

This initiates the deposit process, allowing the bank to credit the customer’s account quickly. The versatility of deposit slips allows for the inclusion of different types of funds, such as cash and checks, and provides dedicated sections for endorsing checks.

Having a record of the deposit can be useful for the account holder when balancing their checkbook or tracking their financial transactions.

Initiating a deposit often commences with completing a deposit slip, which may be available from the bank or through online platforms.

Once filled, customers submit the deposit slip alongside their funds, triggering a seamless process wherein the bank processes the deposit and allocates the funds to the respective account.

With this structured initiation, deposit slips pave the way for an organized, error-minimized deposit workflow. The act of completing a deposit slip serves as a deliberate and organized step, ensuring that critical information is presented accurately.

This careful approach sets the stage for efficient processing on the bank's end

Do Banks Keep Track of Deposit Slips?

It is important to understand whether banks keep records of transactions that are not recorded. Traditionally, completed investment documents were tangible records for customers and banks. But how do banks ensure accurate record-keeping as digital marketing takes off?

1. Beyond Information Sheet

The role of a deposit slip extends far beyond being a mere information sheet. It serves as a tangible and enduring record, pivotal in reducing errors and uncertainties associated with deposit registrations.

2. Ensuring Accuracy in the Digital Age

As digital banking gains prominence, the challenge lies in ensuring the accuracy and integrity of records. Despite the shift towards digital documentation, deposit slips continue to be a crucial aspect of maintaining a comprehensive transaction history.

- Banks employ advanced systems and technologies to seamlessly integrate digital transactions while preserving the accuracy and reliability of these records.

3. The Importance of Physical Records: The enduring significance of physical records becomes apparent in their ability to provide a tangible and verifiable trail of financial transactions.

Note

In the event of discrepancies or disputes, having a physical record becomes invaluable for both the bank and the customer.

It serves as a reliable source of information that transcends the digital realm, offering an additional layer of security and trust in the banking relationship.

4. Supporting Customers in Check Processing

One of the critical areas where the importance of deposit slips shines is the processing of checks. Documentation becomes a vital support mechanism for customers, allowing them to validate and confirm the authenticity of the deposited check.

Benefits of Deposit Slips

A closer look at the benefits reveals the cautious nature of deposit slips.

- Comprehensive Record Keeping: A closer examination of deposit slips underscores their cautious nature. They act as a comprehensive record, facilitating accurate transaction recordings and providing customers with legal assurance.

- Dual Functionality for Banks and Account Holders: Deposit slips serve a dual function, making them a crucial tool for banks and account holders. Their role in accurate record-keeping ensures transparency and reliability in financial transactions.

- Guiding Standard Format: The standard format of deposit slips serves as a guide, eliminating the need for bankers to manually enter comments. This not only saves time for both parties involved but also streamlines back-office operations, simplifying the processes of making deposits and reconciliations.

- Time-Saving Efficiency: The standardized format and the elimination of manual data entry contribute to significant time savings. This efficiency extends to the back office, making deposit processing and reconciliations much more streamlined and accessible.

- Faster Banking Processing: The use of equipment to process deposit slips, following their standardized format, results in expedited banking processing. This enhanced efficiency benefits both senders and receivers, making the handling of amounts faster and more seamless.

Further Reading

Banks have recently been integrating features into their proprietary banking applications that allow customers to deposit cheques using the camera function.

The digitization of this process eliminates the need for deposit slips, as customers can now simply capture an image of the cheque to proceed with transactions.

Moreover, customers submit completed deposit slips, and the digital processing system enables faster and more accurate data entry via optical character recognition at the bank’s end.

This efficiency translates into time savings for customers and bankers, resulting in a streamlined operation. This flexibility ensures that transactions can hold financial records if they’re particular and organized, contributing to basic performance.

In conclusion, beyond being mere information sheets, deposit slips serve as tangible records, reducing error and uncertainty in deposit registration.

Their standard format streamlines operations, saving time for both customers and banks while contributing to back-office efficiency. Deposit slips continue to play a vital role, offering a unique blend of tradition and efficiency to ensure the accuracy and reliability of financial transactions.

Everything You Need To Build Your Accounting Skills

To Help You Thrive in the Most Flexible Job in the World.

or Want to Sign up with your social account?