Direct Quote

Shows the value of one foreign currency in the domestic currency

The exchange of different currencies has been a fundamental requirement for businesses and individuals since the inception of international trade.

Various currency exchange methods have grown:

- Bartering

- Using gold and silver

- Using paper currency backed by precious metals

Direct quoting resulted from increased demand for a more standardized way of exchanging currencies, globalization, and the introduction of electronic trading.

They developed it to ease currency trading by providing a consistent way to express the value of one currency in terms of another. Understanding how it works can help investors and businesses manage currency risk and exploit international investment opportunities.

Direct quotations use the domestic currency as the base currency and the foreign currency as the quote currency to express the value of one currency in terms of another.

The direct quote displays the number of units of foreign currency required to buy one unit of domestic currency, and it also refers to the rate comparison between a fixed unit of a foreign currency and a variable amount of the local currency in the foreign exchange market.

Key Takeaways

- Direct quotations use the domestic currency as the base currency and the foreign currency as the quote currency to express the value of one currency in terms of another.

- A direct quote differs from an indirect quotation in that an indirect quote is a variable amount of a foreign currency against a fixed unit of the domestic currency.

- Various economic and geopolitical factors influence currency trading, such as interest rates, inflation, political events, and global events.

- Quoting directly is important in currency trading because they show the value of one currency relative to another, which traders use to decide whether to buy or sell a particular currency.

- Investors and traders must be able to read and analyze direct quoting in financial markets, which includes understanding the bid-ask spread and how quotes evolve.

- Direct quotes show the value of one foreign currency in the domestic currency, while cross-currency rates compare the value of two foreign currencies.

Direct Quote and Indirect Quote

Direct and indirect quoting are two methods for quoting exchange rates between two currencies. The cost of a foreign currency expressed in terms of the local currency is known as a direct quote.

For example, if USD/CAD is quoted directly at 1.25, that means one of the US dollars equals 1.25 Canadian dollars. Quote their currencies directly in the United States, Canada, and other nations where the local currency serves as the base currency.

The exchange rate of the local currency for the international currency constitutes an indirect quotation. For instance, we can exchange one Canadian dollar for 0.81 US dollars if the indirect price for USD/CAD is 0.81.

They frequently used indirect quotations in nations like Europe, Japan, and Australia, where the local currency is not the base currency.

A direct quotation differs from an indirect quotation in that an indirect quotation gives a variable amount of a foreign currency against a fixed unit of the domestic currency.

For instance, direct pricing of USD/GBP = 0.72 indicates that one US dollar can purchase 0.72 British pounds. In contrast, indirect pricing of GBP/USD = 1.39 indicates that 1.39 US dollars may be bought with one British pound.

Types of Direct Quotes

Having a solid understanding of direct quotes is essential for currency trading. Mastering this concept is crucial in international business or financial markets.

Direct quotes express the value of one currency in terms of another. The two most common types of direct quotes are fixed direct quotes and variable direct quotes.

1. Fixed direct quotes

A fixed direct quotation occurs when the exchange rate remains constant in a country where the money is tied to another currency, such as the US dollar. These countries have fixed the value of their currency to another currency.

The Hong Kong dollar is a pegged currency, which means they fix its value against another currency, the US dollar. The Hong Kong dollar to US dollar exchange rate is 1 to 7.8. This means that it always takes 7.8 Hong Kong dollars to buy 1 US dollar.

2. Variable direct quotes

We use variable direct quotes in countries where the local currency is not pegged to a foreign currency. People purchase and sell currencies in the foreign exchange market. When there are more buyers than sellers of a certain currency, its value increases.

Currency loses value when it is more available than there is a demand for it. The British pound isn't fixed to the US dollar.

NOTE

The rate at which the pound's value fluctuates compared to the economy and politics significantly influences the dollar.

When exchanging currencies, it is important to understand the difference between fixed and variable direct quotes. Fixed direct quotes are always the same, while variable direct quotes can fluctuate. The value of currencies can fluctuate daily.

Currency Trading

With over $6 trillion changing hands daily, FX is the world's biggest and most liquid currency market. Understanding the act of purchasing and selling currencies to profit is currency trading.

Currency trading involves speculating on changes in exchange rates between different currencies, determined by factors like:

- Interest rates

- Inflation

- Political events

- World events

Traders carry out transactions, view real-time market data, and also view their positions through an online platform powered by a broker.

Pairing currencies, such as EUR/USD, which is the standard way in currency trading, helps to value one currency against another. It's important to quote currencies directly in currency trading because they show their value to each other.

Traders use direct quotations to determine the exchange rate between two currencies, then make decisions based on their knowledge of economic, political, and global market issues. Currency trading can be unpredictable and dangerous, but it also has the potential for large gains.

How To Read And Interpret Direct Quotations

Investors and traders must be able to read and analyze direct quotes in financial markets. The direct quote can be used to determine the worth of overseas investments and the exchange rate between two currencies.

To comprehend and interpret the currency pairs which are quoted directly, you must first understand their components.

The home currency is the base currency, while the foreign currency is the quoted currency when quoting directly. The number of units of the quoted currency required to purchase one unit of the base currency is quoted directly.

For example, a direct price of USD/JPY at 109.85 means that 109.85 Japanese yen will be converted into one US dollar. The US dollar is the base currency in this situation, while the Japanese yen is the quoted currency.

It is important to understand how quotes evolve. Economic data releases, political events, and changes in the global market are among the variables that can lead to fluctuation when quoting currencies directly.

For example, if EUR/USD is quoted directly at 1.20 and later climbs to 1.25, it indicates that the euro has grown more valuable than the US dollar.

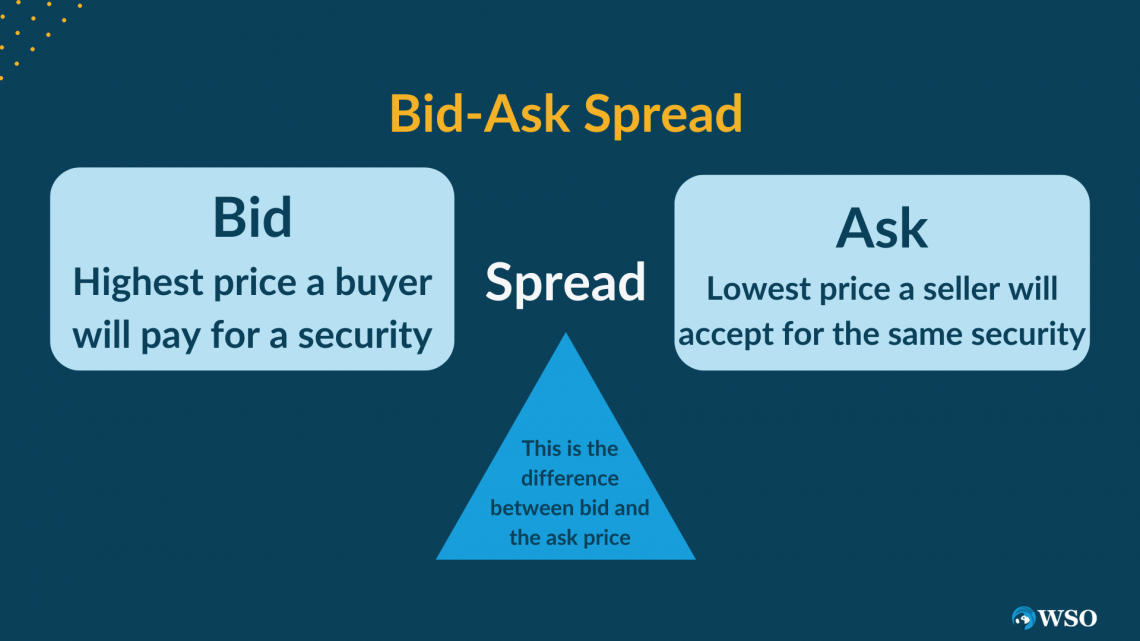

Bid-Ask Spread In Currency Trading

Buyers offer the bid price, and sellers ask for the asking price.

The bid-ask spread is the difference between these two prices.

Bid - Ask= Spread

The bid-ask spread in currency trading represents the difference between a currency pair's purchasing and selling price.

For example, given that the bid price for USD/CAD is 1.05 and the asking price is 1.07. Therefore, the spread is 0.02 or 2 pips.

A trader who buys USD/CAD at the asking price of 1.07 will immediately incur a loss of 2 pips, as they can only sell the currency pair at the bid price of 1.05.

Similarly, a trader who sells USD/CAD at the bid price of 1.05 will also incur a loss of 2 pips if they decide to repurchase the currency pair at the asking price of 1.07.

NOTE

When the spread is wide, waiting for a narrower spread may be advisable before placing a trade.

The bid-ask spread is an important consideration for currency traders because it represents the cost of trading. A wider bid-ask spread indicates that buying and selling currencies is more expensive and can also be a sign of lower liquidity and higher volatility in the market.

Traders can utilize the bid-ask spread to find the ideal timing to enter and exit deals. When the spread is narrow, it may be a good moment to enter a trade because there is minimal difference between the buying and selling prices.

Furthermore, traders can use limit orders to try to achieve a better price by selecting a target price between the bid and ask prices and expecting to execute the deal at that price if the market moves in their favor.

The Importance of Direct Quoting

A direct quote is important in financial markets because they are used in currency trading and can affect businesses and consumers. It can also assist investors in making more informed decisions and managing currency risk.

Currency trading is one of the best applications. Direct quoting of a currency helps to establish the value of a currency against another, so understanding it is important when trading currencies.

Direct quotation is particularly crucial because they can greatly impact organizations and consumers. Changes in direct quoting, for example, might impact the cost of imports and exports, affecting the overall economy.

Furthermore, these changes can affect the value of investments and savings, making it critical for investors to maintain track of the most recent direct quoting to make informed judgments.

Also, varieties of economic, political, and global market issues can influence it. Understanding these characteristics can assist investors and traders in managing currency risk and making better judgments.

NOTE

Inflation, interest rates, and economic growth can all have an impact when quoting currencies directly.

Managing Currency Risk with Direct Quote

Directly quoting currency can be used to reduce currency risk by evaluating the profitability of overseas assets and making better financial decisions. Assume a corporation situated in the United States is contemplating a business opportunity in Japan.

A business conducting transactions in Japan must exchange US dollars for the Japanese yen. If the yen value increases against the US dollar, then the corporation may take a loss when converting the yen back.

The following approach the corporation could use to minimize currency risk using quoting directly to assess the possible profitability of the transaction includes:

1. Hedging

Hedging is a risk management strategy that involves taking an opposite position in the market to offset potential losses.

For example, a business that imports goods from a foreign country can mitigate the risk of currency fluctuations by entering into a forward exchange agreement. This will protect them against potential losses if the price quoted increases.

2. Speculation

This involves taking a position in the market based on future expectations of the currency's direction.

An individual may speculate that the direct price of a foreign currency will increase in the future and buy it at a lower quote. If the quoted price of a currency increases as expected, the individual can sell the currency for a profit.

3. Diversification

Diversification involves spreading investments across different currencies to reduce risk. For instance, a business can diversify its investments by buying and holding different currencies with varying direct prices. This will minimize their exposure to fluctuations in any single currency.

Factors Affecting Direct Quoting

Some economic, political, and market-wide variables have an impact on direct quoting:

Economic factors may affect a direct quotation, including:

- Inflation

- Interest rates

- Economic growth

For example, the value of a country's currency can depreciate against other currencies caused by high inflation, and this can result in a decrease in the currency's direct quote.

They can do so by raising their interest rate, which will directly increase the foreign exchange rate of the currency quote, as the value will increase.

NOTE

Political variables like government initiatives and elections may also affect it. Suppose a country's central bank wants to keep prices from growing too fast (inflation).

Also, government policy changes or elections can change market sentiments, affecting the country's currency value.

Quoting directly can also be affected by several global market dynamics, such as currency supply and demand and foreign exchange reserve movements.

For instance, when demand for a country's currency increases due to strong economic growth or higher-than-usual interest rates, the quotation for that currency may also increase.

Also, increasing a country's foreign reserve can strengthen the value of its currency, leading to an increase in its direct quotation.

Evaluating the Implications of Direct Quotes

Whether you're a trader, business owner, or just a trader in foreign exchange trading, there are some implications of using direct quotations to be aware of. The following are some of the consequences:

1. Trading foreign exchange

It's saying how much your home currency is worth to a foreign currency, and it can be more or less.

A higher quote indicates a more substantial or appreciated domestic currency than foreign currency, while a lower section shows a weaker or depreciated home currency.

2. International commerce, investment, travel, and other forms of economic activity

A higher quote leads to cheaper imports and more expensive exports in the local country, while a lower quote results in more costly imports and cheaper exports.

NOTE

If the U.S. dollar loses value relative to the British pound, then one U.S. dollar will have the same purchasing power as one British pound. Therefore, importing products and services from the UK costs more for people in the US, but British citizens receive more for their money when they do so.

3. Profitability and riskiness of foreign exchange transactions

For instance, if your quote is greater when you purchase or sell foreign currency in US dollars, you're more likely to profit. If you receive a lower quote, you have a lower expected profit but a lower risk of loss.

Uses of Direct Quote

A direct quote is a currency pair quote, where the foreign currency is expressed in per-unit terms of the domestic currency. A direct quote gives you the quantity of local currency needed to purchase one unit of foreign currency.

Many participants in the foreign currency market use direct quotation, including central banks, commercial banks, brokers, dealers, traders, investors, etc.

1. Central banks

Use this to intervene in the market to influence the exchange rate and achieve their monetary policy goals.

NOTE

If the European Central Bank (ECB) wishes to weaken the euro, it might sell euros on the open market. This would improve the supply of euros and lead the price to fall.

2. Commercial banks

Use direct quoting to provide foreign exchange services to their customers and manage their foreign exchange exposure and liquidity. A customer walks into a commercial bank to buy 10,000 euros.

The bank provides a direct quote, stating that 1.15 euros are needed to purchase 1 unit of the customer's local currency. Based on this quote, the customer understands they must exchange 11,500 units of their local currency to obtain the desired amount of euros.

3. Brokers

They facilitate currency exchanges and generate commissions or other fees.

Example

A broker might connect a buyer of euros with a seller of euros. The broker would earn a commission for its services, which would be based on the difference between the bid and ask prices for the euros.

4. Dealers

Use direct quotations to buy and sell currencies on their behalf and to profit from spreads or price changes. A dealer might buy euros at 1.15 euros per US dollar and sell them at 1.16 euros per US dollar. The dealer would profit from the difference of 0.01 euros per US dollar.

5. Traders

Traders use direct quotation to carry out a variety of trading techniques based on technical or fundamental research, as well as forecast the future movement of currency rates speculatively.

6. Investors

This is a tool that investors use to diversify their holdings and manage the foreign exchange risk connected with their international assets and obligations.

7. Multinational firms and other organizations

Multinational firms and other organizations conduct business in several nations and currencies. Frequently use a direct quotation for financial reporting, accounting, budgeting, and planning needs.

NOTE

Multinational firms may employ direct quoting to make foreign direct investments abroad and hedge the foreign exchange risk resulting from their international activities.

Direct Quoting Vs Cross-Currency Quoting

A cross-currency quote is different from a direct quote.

The differences include the following:

| Direct Quoting | Cross-currency Quoting |

|---|---|

| A domestic currency is always one of the currencies being exchanged in direct quotes. | A cross-currency quote expresses the exchange rate of two currencies that are not the native currency. The two currencies being exchanged in a cross-currency quote are the base currency and the quote currency; neither is the domestic currency. |

| The bid-ask spread in direct quotations is defined as the difference between the bid and ask prices for the foreign currency in terms of the domestic currency. | Analysts determined the bid-ask spread in cross-currency quotes as the difference between the bid and ask prices for the base currency in terms of the quote currency. |

| They commonly used this quoting method in the US. | They commonly employ it in Europe and other regions. |

| This is the price of a unit of foreign currency in terms of the home currency. | This quote is the price of a foreign currency in terms of another foreign currency. |

In summary, a direct quote expresses the exchange rate between domestic and foreign currencies, while a cross-currency quote expresses the exchange rate between two foreign currencies.

or Want to Sign up with your social account?