Dry Powder

A slang term refers to cash or highly liquid assets that can be converted into cash.

What Is Dry Powder?

The expression "dry powder" is often used in the financial industry as a slang phrase familiar to investors from all major global capital markets. This essay will examine the definition, its background, and a few possible uses for investors.

Dry Powder (DP) is the financial slang term for highly liquid securities that can be quickly converted into cash. Investors keep DP on hand if they need the liquid cash to make acquisitions, cover unexpected costs, or use the dollar cost average to lower their costs.

DP can also refer to cash reserves kept on the balance sheets of companies, VC firms, or even individuals. DP is often used to cover future obligations, purchase assets, or provide emergency funding.

Armies at war utilized gunpowder to fire guns and cannons in the 1600s, which is how the phrase "dry powder" first appeared.

Soldiers had to store stashes of the powder for use at any given time and keep it dry for it to be effective in combat. This is similar to how the phrase is used in finance. It refers to the reserves of cash or liquid assets that can be converted to cash.

There is a common theme in many professions and businesses, particularly the financial sector, of having a reserve that may be drawn upon.

Key Takeaways

- DP is a slang term used to refer to cash or highly liquid assets that can be converted into cash.

- Firms typically hold DP to capitalize on investment opportunities and to protect themselves from emergencies.

- The term is often used in terms of venture capitalists and PE firms, where DP allows them to invest in opportunities as they arise.

- DP can also refer to individuals' cash reserves in case of an unexpected cost.

- For retail investors, DP refers to the cash reserves in brokerage accounts. These cash reserves are typically used to make new investments.

- In corporate, DP is the funds that are kept to meet the organization's financial needs in case of emergencies, uncertainties, or opportunities.

- In 2020, firms had more DP than ever. As of June 30th, 2020, private debt funds had about $273 billion of DP available to be deployed.

Understanding Dry Powder

In simple terms, DP is the term that refers to the cash reserves or liquid assets that are available for use. These liquid assets and cash reserves are usually kept on hand to cover emergency obligations and make acquisitions.

The term applies to personal finance, corporate environment, venture capital, and private equity investing. Understanding the concept is essential for investors.

While dedicated to a private equity manager or other investment managers, this unallocated capital remains in reserves as those managers look for the best investment opportunities.

Private equity firms have a history of giving investors large returns while also building up reserves for ongoing integration and deployment when opportunities present themselves.

Having DP on one’s balance sheet allows investors to deploy cash into an investment on short notice strategically.

How to Leverage Dry Powder?

DP can be leveraged for many different uses. For example, a VC firm could deploy its cash reserves to invest in a promising tech startup.

An investor could use his or her cash reserves to dollar cost average on a stock that has decreased in price, lowering his average cost. In addition, a family could use their DP to pay for emergency costs.

A private equity firm could use its DP to buy out a distressed company, and finally, a corporation may use its cash reserves to prepare for an acquisition. Here are some of the ways different investors could leverage DP:

1. To Fuel Growth

Investment firms often go into bidding wars, and more cash on hand in situations like this could mean the difference between closing a deal or not.

A firm with cash on hand will always be prepared to make acquisitions, unlike a firm without much cash reserves.

When it comes to investment firms, investors also use their cash to fuel growth in areas that need it. The risk is that having too much DP could limit growth or the value of the investment.

2. Safety Net

DP can also be used as a safety net. In the financial markets, risk and volatility are a given. As a result, firms with cash reserves are better positioned to survive an economic downturn than firms with low dry powder.

Companies with no cash reserves on their balance sheets are the first to go under in an economic slowdown. DP is like the lifeline of a business; it is the first thing a firm will turn to when it needs short-term liquidity.

3. To Capitalize on Investment Opportunities

Market volatility also presents opportunities for investors to take advantage of. 2020 was a wonderful example of market volatility being taken advantage of. At that time, firms had more capital than ever.

These firms were able to capitalize on the market volatility and take advantage of the low prices the market presented.

A good recent example of this is META. Unfortunately, META’s products have been losing popularity to TikTok recently. Still, because META has a ton of cash on its balance sheets, they were able to pivot into the Metaverse, investing billions of dollars in that industry.

Dry Powder in Corporate, Private Equity, VC, and Personal Finance

Dry powder is the funds that are kept to meet the organization's financial needs in case of emergencies and uncertainties. It would be familiar to discuss how uncertainties and contingent situations have affected the lives of individuals and corporations.

Below are some of the uses of dry powder in the respective areas.

1. In Corporate

When a company refers to its dry powder, it refers to the amount of cash and liquid assets that can be quickly converted to cash. Therefore, if a company decides to deploy all of the cash on its balance sheet, it is effectively reducing the amount of DP it has.

As mentioned above, having no DP can present a risk in an economic downturn.

Companies will generally try to maintain a sufficient amount of DP on their balance sheets to prepare for a downturn but will only keep a little DP because that means their cash is not being used to its potential.

2. For Venture Capitalists and Private Equity

Dry powder in VC and PE firms refers to cash that's been committed by investors but has yet to be allocated to a specific investment.

DP is a common term in the VC and PE world. This is because all of these firms do make investments and acquisitions. So having enough cash is the most important aspect for PE and VC firms.

Healthy balance sheets mean these firms have sufficient DP to invest in new opportunities, like tech startups, or to provide more funding to fuel growth.

Therefore, keeping cash reserves on hand is a very common practice for venture capitalists and PE firms. In 2020, firms had more dry powder than ever. As of June 30th, 2020, private debt funds had about $273 billion of DP available to be deployed.

3. For Personal Finance

Just like any business, individuals should ideally also keep DP in case of emergencies, opportunities, or obligations.

When you keep the DP or cash reserves, you can protect yourself from unexpected events and capitalize on investments when the opportunity presents itself.

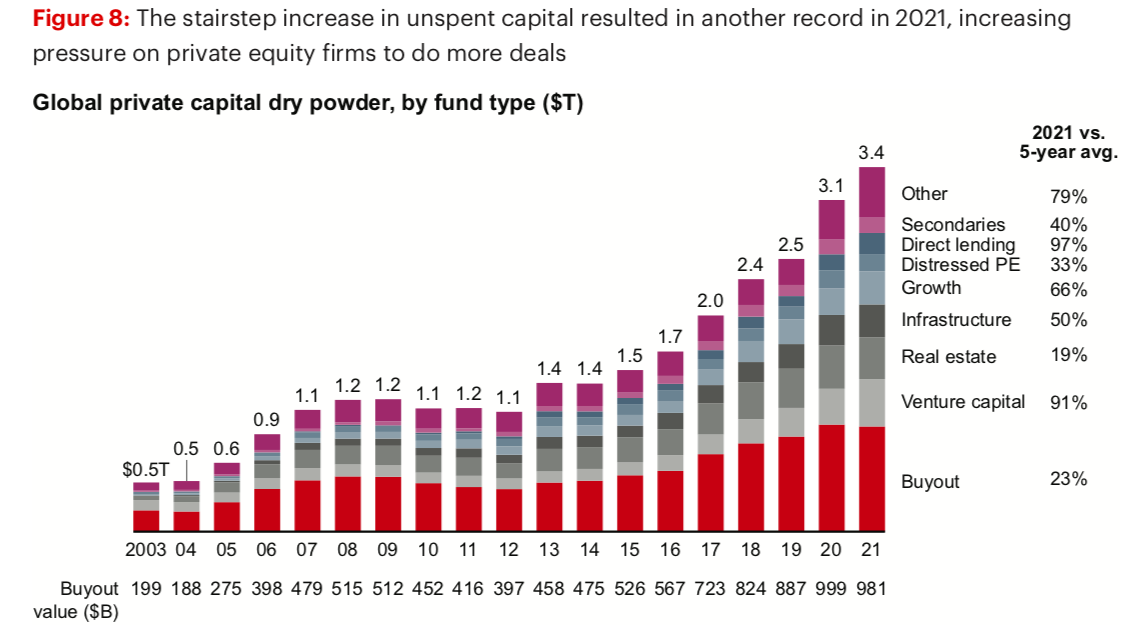

Dry Powder PE/VC 2021 - 2022 Trends

The trends are:

2021:

Since 2008, 2021 has been the most successful year in private fundraising capital. 2020 completely upended the market, especially during volatile stages.

Following the turmoil brought on by the pandemic, which had slowed fundraising and deal activities, the stock markets led a recovery, and the private markets saw a notable increase in 2021.

This was ultimately why 2021 was a record year for private capital fundraising.

2022:

The market consensus at the beginning of 2022 was extremely bullish, with predictions of a breakthrough year for values and the quantity of leveraged buyouts.

However, investors appear to have pulled back due to the rapid interest rate increase and increased geopolitical risks in 2022.

As a result, many investors have increased their real estate investments because they believe that this asset class is generally more resilient during times of high inflation, which is supported by the development of opportunistic and value-added investment methods.

or Want to Sign up with your social account?