Equivalent Annual Annuity (EAA)

It is a tool used to compare investment projects or assets that have varying cash flows and lifespans.

What is Equivalent Annual Annuity (EAA)

The Equivalent Annual Annuity (EAA) is a tool used to compare investment projects or assets that have varying cash flows and lifespans.

It shows the yearly worth of investment cash flows, made comparable over the same period. The EAA tool helps compare investments by showing their cash flows as a consistent yearly sum.

EAA is valuable for comparing projects with varying durations, investments, and cash flows. It assists decision-makers in comparing how appealing different investment choices are each year. This aids in making informed investment decisions.

It also simplifies investment cash flows yearly, making comparisons and decisions easier. It aids in selecting investments that maximize value and match an investor's goals and risk tolerance.

Key Takeaways

- The Equivalent Annual Annuity (EAA) simplifies project comparison by converting varied cash flows to consistent yearly amounts.

- This tool standardizes evaluation, useful for both short and long-term planning. While beneficial, this tool relies on assumptions and might overlook the time value of money.

- Complex cash flow patterns and focus on annual values can limit the Equivalent Annual Annuity’s application

Understanding the Equivalent Annual Annuity Approach

Imagine you have various investment projects to choose from. Each project has different cash inflows and cash outflows, which are all over different periods. It is like trying to compare apples and oranges - it is difficult because they are not on the same scale.

The EAA simplifies the process of comparing investment options by leveling all different types of investment (the apples and oranges) onto a uniform scale. This aids in identifying which option provides the highest value annually.

Here is a breakdown of how this concept works:

- Comparing Apples To Oranges: Investment projects can have cash flows that happen at different times and in different amounts. Some might bring in more money initially, while others might have consistent payments over time.

- Uniform Annual Value: The EAA takes all these different cash flows and turns them into a uniform annual value. It is like saying, "What's the average amount of money this investment is yielding me every year?"

- Fair Comparison: Once you have the EAA for each investment option, it is easier to compare them. You can see which investment gives you the most value each year.

- Deciding Wisely: With the EAA, you can make smarter investment choices. You will know which option is giving you the most value annually, even if the investments have different timeframes and payment patterns. You can think of the EAA as a way to make all these different investment options speak the same language – the language being that of an annual value.

Note

EAA is a very useful tool that helps pick the best investment that fits your goals and needs.

What Is The Equivalent Annual Annuity Used For?

The EAA is used to compare and evaluate investment projects or assets. It serves several important purposes in the field of finance and investment analysis:

- Comparing Investments: This tool allows for a fair comparison between investments with varying cash flow timings, durations, and amounts. By converting all cash flows uniform annually, decision-makers can assess the relative attractiveness of different projects more easily.

- Standardized Analysis: The calculation simplifies comparing investments. It allows the analysis of projects with varying timeframes and cash flows. This is particularly useful when evaluating long-term projects against shorter-term alternatives.

- Decision-Making: The EAA tool also aids in decision-making by providing a clear annual value that an investment project contributes. It helps investors identify which investment option delivers the highest value per year, which allows them to make more informed decisions.

- Risk Assessment: When comparing investments, the EAA considers the entire cash flow profile over time. This can help assess the risk associated with different projects. It considers factors like uncertainty in future cash flows, inflation, and the time value of money.

- Capital Budgeting: In capital budgeting decisions, companies allocate resources to various investment projects. This calculation can assist in identifying projects that align with the company's financial goals and constraints.

- Long-Term Planning: This tool is useful when evaluating projects that generate cash flows over longer periods. It provides a clear picture of the annual impact of the investment on the company's financial performance.

- Comparing Leasing Against Buying: EAA can be used to compare the cost of leasing versus purchasing assets. Individuals or businesses can make cost-effective decisions based on long-term financial outcomes by performing this calculation for both options. The EAA simplifies the comparison of investment opportunities. It helps individuals and companies make better decisions by evaluating investments consistently and annually.

How to Calculate Equivalent Annual Annuity

To calculate the EAA, you need to follow a series of steps. Here is a brief guide to provide you with a clearer picture of the process:

- Gather Information: Collect data for the investment project you want to evaluate. This includes the initial investment amount, expected cash flows for each year, and the discount rate.

- Calculate Net Present Value (NPV): Calculate the NPV of the investment's cash flows using the given discount rate. Remember, the NPV is the sum of the present values of all future cash flows minus the initial investment.

- Determine Investment Duration: Identify the number of years the investment will last. This is important to convert the NPV into an annualized value.

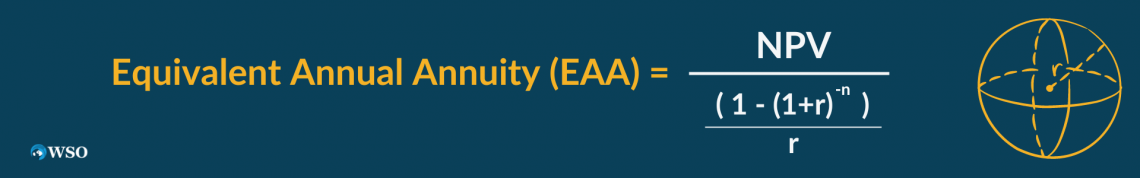

- Calculate EAA: Use the following formula to calculate the Equivalent Annual Annuity (EAA):

Where:

Where:

- NPV = Net Present Value of the investment's cash flows

- r = Discount rate (expressed as a decimal)

- n = Number of periods of investment duration

- Interpret EAA: The final value represents the annualized value of the investment's cash flows over the investment duration. This value allows for a comparison of different investment options on an equal, yearly basis.

Note

Remember that this is a simplified explanation, and real-world calculations might involve more complex scenarios, such as uneven cash flows or changing discount rates.

Calculating the EAA helps you determine which investment option provides the most value per year and aids in making informed decisions when comparing different projects.

Equivalent Annual Annuity Examples

To deepen our understanding of this concept, let's explore a few illustrative examples. In these scenarios, let us consider a constant discount. Additionally, the cash flows will be given as annual amounts.

Example 1

You are currently evaluating a pair of investment ventures: Project A and Project B. Each of these endeavors requires an initial investment of $10,000. Here, we present the cash flow projections for both projects:

| Project A | Project B | |

|---|---|---|

| Year 1 | $3,000 | $2,000 |

| Year 2 | $4,000 | $3,000 |

| Year 3 | $5,000 | $6,000 |

The discount rate for both projects is 8%.

Step 1: Calculate Net Present Value (NPV) For Each Project

Using the discount rate of 8%, calculate the NPV for both projects:

For Project A:

NPV(A) = ($3,000 / (1 + 0.08)^1) + ($4,000 / (1 + 0.08)^2) + ($5,000 / (1 + 0.08)^3) - $10,000

NPV(A) = $2,777.78 + $3,309.94 + $3,630.89 - $10,000 = $128.61

For Project B:

NPV(B) = ($2,000 / (1 + 0.08)^1) + ($3,000 / (1 + 0.08)^2) + ($6,000 / (1 + 0.08)^3) - $10,000

NPV(B) = $1,851.85 + $2,723.01 + $4,966.74 - $10,000 = $417.60

Step 2: Calculate EAA For Each Project

Now, use the formula to calculate the Equivalent Annual Annuity for both projects:

For Project A:

EAA(A) = $128.61 / [((1 - (1 + 0.08)^(-3)) / 0.08)] = $128.61 / 2.577098 = $49.94

For Project B:

EAA(B) = $417.60 / [((1 - (1 + 0.08)^(-3)) / 0.08)] = $417.60 / 2.577098 = $162.08

Step 3: Interpret Results

According to the computations, the Equivalent Annual Annuity for Project A is around $49.94, whereas for Project B, it is approximately $162.08.

Essentially, this implies that if you aim for a consistent yearly cash flow for each project, Project B offers a greater annual value than Project A.

In this situation, if your priority is to select the investment with a higher annual return, you likely lean towards Project B because it has a higher EAA.

Example 2

You are investigating two investment opportunities: Project P and Project Q. The initial investment required for both projects is $50,000. Here, we outline the cash flows for each project:

| Project P | Project Q | |

|---|---|---|

| Year 1 | $12,000 | $8,000 |

| Year 2 | $10,000 | $9,000 |

| Year 3 | $8,000 | $10,000 |

| Year 4 | $6,000 | $11,000 |

| Year 5 | $4,000 | $12,000 |

The discount rate for both projects is 12%.

Step 1: Calculate NPV For Each Project

Using the discount rate of 12%, calculate the NPV for both projects:

For Project P:

NPV(P) = ($12,000 / (1 + 0.12)^1) + ($10,000 / (1 + 0.12)^2) + ($8,000 / (1 + 0.12)^3) + ($6,000 / (1 + 0.12)^4) + ($4,000 / (1 + 0.12)^5) - $50,000

NPV(P) = $10,714.29 + $7,331.42 + $5,439.57 + $3,503.62 + $2,317.21 - $50,000 = -$20,694.89

For Project Q:

NPV(Q) = ($8,000 / (1 + 0.12)^1) + ($9,000 / (1 + 0.12)^2) + ($10,000 / (1 + 0.12)^3) + ($11,000 / (1 + 0.12)^4) + ($12,000 / (1 + 0.12)^5) - $50,000

NPV(Q) = $7,142.86 + $6,099.89 + $5,266.76 + $4,375.28 + $3,515.68 - $50,000 = -$23,999.53

Step 2: Calculate EAA For Each Project

Now, use the formula to calculate the Equivalent Annual Annuity for both projects:

For Project P:

EAA(P) = -$20,694.89 / [((1 - (1 + 0.12)^(-5)) / 0.12)] = -$20,694.89 / 3.604776 = -$5,740.09

For Project Q:

EAA(Q) = -$23,999.53 / [((1 - (1 + 0.12)^(-5)) / 0.12)] = -$23,999.53 / 3.604776 = -$6,667.71

Step 3: Interpret Results

Based on the calculations, the Equivalent Annual Annuity for Project P is approximately -$5,740.09, and for Project Q, it's approximately -$6,667.71.

Both projects have negative EAA values, resulting in annualized expenses rather than benefits. In this scenario, Project P has a slightly less negative EAA, suggesting that it may be the more favorable option if minimizing expenses is a priority.

This example is similar to what is known as the Equivalent Annual Cost (EAC). More information on EAC can be found here.

Pros Of Equivalent Annual Annuity

Some of the pros Of EAA are:

- Uniform Comparison: EAA helps compare investments with differing cash flow patterns, durations, and sizes. This lets decision-makers evaluate projects equally, making it easier to identify the most favorable option.

- Better Decision-Making: It aids in making well-informed investment decisions. By expressing cash flows in an annual amount, companies and individuals can assess which projects offer the best value over time. This enables them to make better decisions

- Long-Term Planning: It is particularly useful for evaluating projects with extended durations. It provides insight into the annual impact of an investment. This helps companies plan for the long-term financial implications of their decisions.

- Comparing Diverse Projects: It is also useful for comparing investments with different characteristics, like varying starting investments, cash flows, and lifespans. This flexibility makes it suitable for evaluating a wide range of projects across various industries.

Cons Of Equivalent Annual Annuity

The cons of EAA include:

- Assumptions And Discount Rates: EAA calculations rely on certain assumptions, such as consistent cash flows and discount rates. Variations in these assumptions can impact the accuracy and reliability of the results.

- Omission Of Time Value: This tool assumes that all cash flows are equally important regardless of their timing. This might not accurately capture the time value of money, where money received sooner is preferred over money received later.

- Complex Cash Flow Patterns: It might not be well-suited for projects with irregular cash flow patterns that do not align with a uniform annual value. In such cases, simplifying cash flows could lead to misleading conclusions.

- Focus On Annual Values: This tool emphasizes annual values and may not properly capture the full financial picture. It might not account for factors such as lump-sum payments, non-annual costs or revenues, or changes in the business environment.

- Limited Application: Although this tool helps compare projects using yearly values, it's not the only factor for investment decisions. Strategic fit, quality factors, and industry-specific aspects also matter.

- Dependence On Data Accuracy: Accurate data, including cash flow projections and discount rates, are necessary for a reliable calculation. Inaccuracies in these inputs can lead to flawed outcomes and potentially misguided decisions.

The EAA approach offers several advantages, such as standardized comparison and improved decision-making. Nevertheless, it does have its limitations, including its dependence on assumptions and simplifications.

Although this tool is a valuable instrument for assessing investments, combining it with additional financial tools and qualitative evaluations is advisable to form comprehensive investment decisions.

Everything You Need To Master 13-Week Cash Flow Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?