FICO Score

It is a credit score showing the creditworthiness of an individual

What Is a FICO Score?

FICO score, more commonly referred to as a credit score, is a three-digit number that represents the creditworthiness of an individual. The higher the number, the better your credit score.

Several factors go into establishing a good credit score. With a respectable credit score, you can get better rates on insurance, qualify for lower credit card interest, and have more housing options.

The three-digit number that makes up a credit score measures how likely an individual is to pay off their credit card balance and loans that they take out. This three-digit number can range from 300 (worst) to 850 (best).

Specifically, this was created by the Fair Isaac Corporation in 1989. This is the most recognizable and commonly used credit scoring algorithm. There are three primary types of FICO scores available: FICO 8, FICO 9, and FICO 10 Suite.

The Fair Isaac Corporation is a large analytics software company, most commonly known for creating the credit scoring algorithm used in more than 90% of United States credit decisions.

This credit score can often be the sole determinant of whether a lender will loan a borrower money. In general, a score from 670 to 739 is considered favorable. A score from 580 to 669 may lead to difficulty obtaining low-interest rates on loans.

These scores are the cumulation of three credit reports from Experian, TransUnion, and Equifax. The Score is calculated using a formula that the Fair Isaac Corporation patented. The three credit bureaus monitor and note an individual’s credit/loan usage.

In some instances, a credit score is not the only factor that goes into a lending decision. Other elements such as income, job stability, and the type of credit requested can contribute to the lender’s decision.

With a higher credit score comes a lower interest rate on loans because the borrower is more likely to repay their debts.

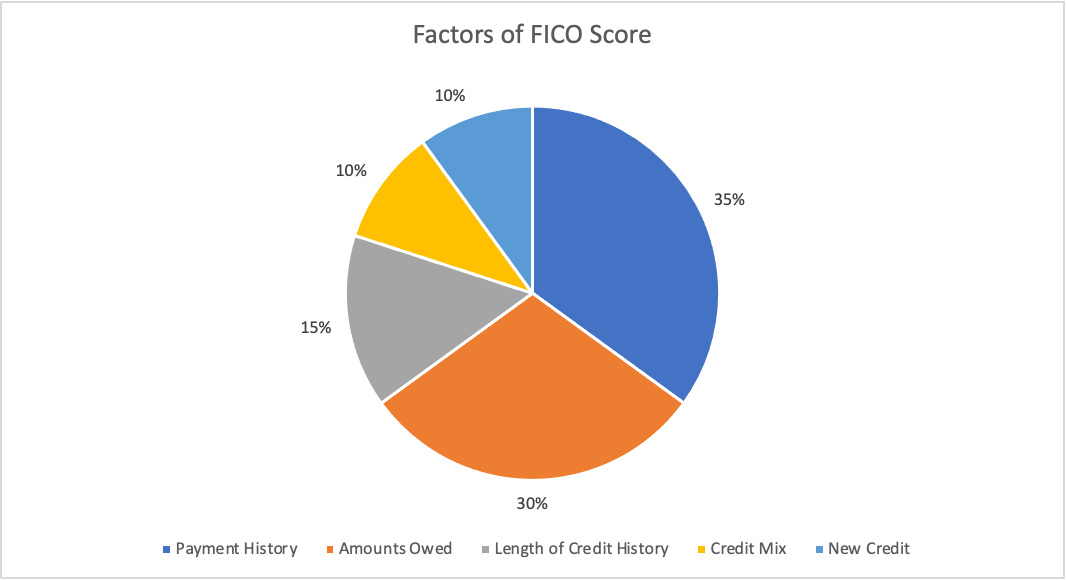

Factors affecting your credit score

The 5 factors that affect a credit score are:

1. Payment History (35%)

Payment history looks at how frequently an individual pays their credit accounts on time. Late or missed payments will bring down a credit score.

Payment history accounts for 35% of the credit score.

2. Amounts Owed (30%)

Amounts owed refers to how much of the available credit an individual uses. Most credit cards have a maximum limit an individual can spend, so using a high percentage of that limit can negatively affect a credit score.

Amounts owed account for 30% of the credit score.

3. Length of Credit History (15%)

Length of credit history looks at how long the oldest account has been open, the age of the most recently opened account, and the average length of credit card ownership.

Length of credit history accounts for 15% of the credit score.

4. New Credit (10%)

New credit refers to how many new credit accounts an individual has opened. More credit accounts opened in a short period of time will lower the credit score.

New credit accounts for 10% of the credit score.

5. Credit Mix (10%)

Credit mix refers to the variety of accounts an individual has open. A mix of retail accounts, credit cards, and installment loans (vehicle or mortgage loans) will increase the credit score.

Credit mix accounts for 10% of the credit score.

Significant events involving credit or loans can have detrimental impacts on a credit score. Instances like bankruptcies, foreclosures, and vehicle repossessions can have long-lasting and severe effects.

FICO Score Ranges

Your FICO Score can range from 300 to 850. Generally, the less experience you have with credit, the lower your credit score. However, multiple instances of poor credit management can have severe effects on your Score.

It’s important to check your credit score a few times a year to ensure there are no issues.

If you can stay in the range of 670 to 850, it will be easier to qualify for a loan and obtain lower interest rates.

| FICO Score | Rating | What the Score Means |

|---|---|---|

| < 580 | Poor |

|

| 580 - 669 | Fair |

|

| 670 - 739 | Good |

|

| 740 - 799 | Very Good |

|

| 800+ | Exceptional |

|

Fun Fact: As of 2021, the average Score in the United States was 714.

What is left out of FICO Scores?

While credit scores take into account an abundance of credit-related information, some things it does not include in the calculation are:

♦ Race, color, religion, national origin, age, sex, and marital status

♦ Salary

♦ Employment information

♦ The geographic location of residency

♦ The interest rate being charged on a credit card or other account

♦ Items such as child/family support

♦ Any information not found in the credit report

These scores are solely based on the utilization and management of credit cards and accounts.

Importance of a good credit score

When you apply for credit, such as a credit card, auto loan, mortgage, or student loan, the lender will check your credit score from the three major credit bureaus (Equifax, Experian, TransUnion).

These three companies collect consumer credit information from lenders. If you have a credit card or have taken out a loan, you could have a credit file with one, two, or all three bureaus.

A higher credit score can qualify you for lower interest rates on loans. This is the primary motivation for maintaining a high credit score. Lower interest rates can save thousands of dollars in interest payments.

For example, if you were to purchase a car, an auto lender may provide lower interest rates for an individual with a credit score above 680. Whereas another auto lender may provide lower interest rates to someone with a score above 720.

Additionally, a good credit score can allow you to increase your credit limit. A credit limit is the maximum amount you can charge to your credit card. In order to increase your credit limit, the credit card company will look at your past management of credit and credit history.

If your credit score is too low, it can be difficult to recover from. Not only will it be more difficult to qualify for a loan, but it can harm your chances of getting a house as well.

When should you pay off your credit card?

If you were to pay off your credit card in full once a month, it would ensure that you don’t have to pay interest on late payments.

However, if you use a significant proportion of your total credit available, it could bring your Score down.

The most effective method to pay off your credit card is to pay the amount when it is posted to your account.

So, for example, if you made one purchase on Monday for $250, you should just pay the $250 when it’s posted to your account (likely by Thursday).

However, the most important thing to do is to pay off the total amount every month so you won’t be charged a late penalty. This is the most effective method of avoiding credit card debt, which can tank your credit score.

What’s the ideal utilization ratio?

The utilization ratio refers to how much of your available debt you have taken out as a loan.

No utilization ratio is optimal but generally, the lower the utilization ratio, the better the effects on your credit score. Maxing out your credit card can be a sign of financial irresponsibility, meaning more credit risk.

The general rule of thumb is that you want to keep your utilization rate under 30%.

Some experts argue you should keep it under 10% to ensure an excellent credit score.

For example, to have a 10% utilization ratio would mean, with a credit limit of $10,000, you would only ever allow a maximum credit card balance of $1,000.

However, you also do not want your utilization ratio to be 0%.

Occasional use of more than 30% will not severely bring down your credit score as long as you pay off the balance in full.

Paying attention to your credit utilization is important because it accounts for 30% of your credit score.

FICO versions

The Fair Isaac Corporation has updated the calculation methods numerous times since the scoring system’s birth in 1989. It is up to the lender’s discretion which method to use to calculate credit scores.

In most instances where a lender will check your credit score, they will check your FICO 8 score.

There are 3 primary versions of calculating it:

1. FICO 8

This is the most commonly used version as of 2021, despite it being the oldest version among the three. This is the Score that will be used a majority of the time when applying for a credit card or personal loan.

This scoring model is more sensitive to high credit utilization, and single instances of late payments may not be as damaging as having multiple late payments.

However, regardless of which Score is used, the same rules apply for maintaining a good score.

2. FICO 9

This model was created in 2016 but is not as commonly used.

Third-party collection accounts that are paid off no longer result in a negative impact on credit scoring. The impact on your credit score from unpaid medical collection accounts is mitigated compared to other collection accounts.

Debt in collections means that the original creditor sent the debt to a third-party agency to collect it. Some examples of debt sent to third parties include credit card debt, mortgages, auto loans, and student loans.

With this model, rental payment history can be included in calculating credit scores. So, if you consistently make your rental payments, this can improve your credit score. Your landlord must report payment history to credit bureaus.

3. FICO 10

This model was released in 2010. It uses the same algorithm as 8 and 9 but also utilizes trended data.

This utilization of trends takes into account credit history from years ago to determine credit risk.

The company expects this model to eventually replace FICO 8 as the most commonly used scoring model.

How to Improve Your FICO Score

Every month your Score is updated based on the five aforementioned factors. Some ways to improve your credit score are:

- Pay your bills on time every month. One method is to pay it off multiple times a month to limit your credit utilization. To see a significant score change, you must make on-time payments for at least six months.

- Similarly, in order to limit your credit utilization, after at least 6 months, contact your credit card company to ask for a credit limit increase. This will decrease the proportion of the credit limit that you use. However, do not ask for a credit line increase often.

- It’s better to stop using a credit card instead of closing the account. Closing your account will likely decrease your Score depending on the age and credit limit on the card. This can decrease your available credit and increase your credit utilization rate.

- If you are comfortable with one credit card and consistently make your payments, look into having a mixture of credit. Having a credit mix can increase your credit score.

- If you have a relative or friend that reliably pays off their credit card and has a high credit limit, you can “credit piggyback.” This means you can be added as an authorized user, decreasing your credit utilization. You don’t even have to use the card.

- Regularly check your credit report for errors that could be dragging your Score down. If an error is found, dispute it with the credit bureaus.

- If you are young (you must be at least 18 years old in the U.S.), get a credit card and learn to manage the balance. This not only provides a valuable lesson in personal finance but allows you to start to build your credit score.

How can you lower your credit utilization ratio?

Some of the ways are:

- Pay down your credit card balances: When you have a balance on your credit card posted to your account, try to pay it off as soon as possible to ensure you won't have any late payments.

- Request a credit line increase: After having a credit card for a while, ask your card issuer for a credit line increase. The company has no obligation to fulfill this request but is more likely to accept it if you have a good credit score.

- Open a new credit card: Opening a new credit card increases your total credit limit among all of your accounts. However, ensure that you do not open too many accounts because this could be damaging to your credit score.

- Keep your credit cards open : Even if you don’t use a specific credit card, keep it open because that increases the total credit limit available. Rather than closing an account, contact your issuer to see if you can exchange it for a different card.

FICO Score FAQs

Every lender has different standards for approving credit applications and establishing interest rates.

For instance, one lender may provide lower interest rates for someone with a credit score of 730, but then a different lender only provides the lower rate for a score above 760.

That being said, a score above 670 is considered to be good, while anything below that is considered below average.

FICO Score and credit score are basically the same things. A FICO Score is a certain type of credit scoring model created by the Fair Isaac Corporation.

FICO creates other products as well, but it is most well known for its credit score model.

While FICO is by far the most used calculation model, other companies calculate scores such as:

♦ Vantage Score Model

♦ TransRisk

♦ Experian’s National Equivalency Score

♦ Credit Xpert Credit Score

♦ CE Credit Score

♦ Insurance Score

No credit score is considered to be more accurate than another, but FICO is the industry standard as they are used in over 90% of lending decisions. Other scores will provide a different number, which can vary significantly.

The Fair Isaac Corporation has not released the formula they use to calculate your credit score. As a result, it is impossible to calculate your credit score.

However, there are many free resources you can use to find out your credit score.

Many websites can be utilized to get your credit score for free. Some of the most popular are:

These sites can provide insight into your credit history as well.

Many credit card companies provide access to look at your credit score. Some of the most prominent ones are:

Knowing your credit score can be instrumental in your financial health. You should know your credit score before applying for a loan or a new credit card.

By looking at your credit report, you can figure out what to do to improve your credit score.

Employers have access to credit reports, which is a summary of how you have handled credit accounts in the past.

Each individual has their own credit score. Married couples do not have a joint credit score.

However, if you and your spouse open a credit account under both of your names, then the actions that happen with that account affect both of your credit scores.

For example, if both you and your spouse continuously fail to make payments on time in a joint account, then both of your credit scores will take a hit.

Having more than one credit card can help increase your total credit limit, minimizing your credit utilization ratio. More cards can also expand the rewards and cashback options you can get from various companies.

An Experian report found that the average American has 4 credit cards.

The total number of credit cards you own is up to your discretion. More credit cards are only harmful to your credit score if you cannot pay them off.

Additionally, having too many credit cards may lead to the desire to close an account, but this would be harmful to your credit score.

In essence, the ideal amount of credit cards solely depends on your spending and whether you need to limit your utilization or can pay off balances on multiple cards.

More FAQs can be found on the Fair Isaac Corporation Website.

or Want to Sign up with your social account?