Credit Utilization Ratio

It is credits used divided by all available credits, and the resulting number is used to calculate consumers’ credit scores.

What Is the Credit Utilization Ratio?

The ratio or rate determines how much of one's total revolving credit is being used by finding the quotient of all used credits divided by all available credits. Credit reporting and lending agencies often use this number to calculate and evaluate your credit score.

In this scenario, a lower percentage would signal a healthier financial situation when asking to borrow from a financial institution, directly correlating to having a higher credit score. Meanwhile, the same applies to the contrary; the higher the utilization, the lower the credit score.

This is because a lower credit-consumption rate shows lenders that there is less risk in you not repaying what you owe when you borrow from them. Thus, having more unused credit lowers the potential for a default.

Institutions also use thresholds when evaluating the ratio and categorizing them to determine the level of credit trustworthiness, similar to how lenders interpret and use the credit score as a measure of risk when lending their money.

The applicability of this rate ranges from credit cards and personal lines of credit to home equity lines of credit. Thus, it is a critical number that every individual should pay attention to, especially when trying to obtain a loan.

How Credit Utilization Works

When considering one's spending habits concerning their credit limit, the CUR helps to determine the individual's revolving credit management skills. It is common to see the rate increase and decrease and be volatile, but the consensus is that it should never exceed 30% of the overall limit.

It is also essential to note that this number, along with payment and credit history and credit mix, are the most significant factors when determining the credit score. Therefore, a lower ratio can grant larger loans and lower interest rates, making it easier to borrow from institutions.

Specifically, companies like FICO and Vantage–both large credit scoring agencies–rank credit utilization as the second most crucial factor when they analyze and give credit scores. Thus, overspending can cause major red flags that would hurt the overall credit rating.

In addition, the debt-to-income ratio would be another metric used when managing credit balances as it contains both revolving and non-revolving credits. Other helpful personal finance metrics include coverage, leverage, profitability, and liquidity ratios.

Per-Card Vs. Total Utilization

There are two ways the rate is used to assess an individual's ability to spend money reasonably with a healthy financial profile and degree of risk when lending an individual by measuring their ability to repay debt obligations.

The first measurement is called the per-card CUR, where the ratio is indicated on a card-by-card basis. This could be a way to redistribute the money one has in their bank account if one card has a low per-card rate while another is close to its limit.

For example, the rate would be a little different if credit card A had a limit of $4,000 and credit card B had a limit of $3,000. If the used credit for card A is $2,500 and B is $1,000, the per-card rate for A would be around 71.4%, whereas, for B, it would be 33.3%.

On the other hand, the total utilization rate would be as follows: if you have two credit cards that amount to a total of $7,000 in credit limit and you use $3,500 out of the total limit available, the rate would be 50%, without taking into account the credit used on each card.

What Is Revolving Credit?

A crucial part of understanding the utilization ratio is to know revolving credit. A credit account is open-ended, like a credit card where the user or account holder can keep borrowing money repeatedly up to the card's limit while paying back debt obligations.

The credit limit, in this case, is given based on the individual's credit score, credit history, income, and other factors that might influence one's ability to repay the loan. If the limit is exceeded, it might change as a penalty for violation. Furthermore, the account will stay open unless the holder or lender closes it, contrary to fixed credit accounts.

The most common users of revolving credit include founders of small corporations, as it provides convenience in expanding capital and regulating balance statements by preventing cash flow issues. In addition, individuals use this, especially for expensive purchases.

Similar to how credit scores work, if all debt obligations for loans are paid consistently, building up the individual's credit trustworthiness, the lender may choose to increase the customer's credit limit as they profit from revolving. Interest still accrues on these accounts, and the rates might change based on the individual's creditworthiness.

How to Calculate a Credit Utilization Ratio

Since per-card and total ratios go through the same calculation processes, we can use the total utilization ratio to illustrate how you can find your rate. Usually, we express this number in the form of a percentage.

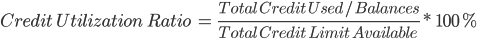

The general equation is as follows:

Example Of Credit Utilization Ratio

Suppose Bob has three credit cards with their corresponding limits and balances:

- Card A: Credit limit $12,000, balance $5,000

- Card B: Credit limit $7,000, balance $3,500

- Card C: Credit limit $8,000, balance $1,700

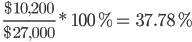

We can then add up all the limits ($12,000 + $7,000 + $8,000 = $27,000) and plug it into the equation’s denominator. Then, sum up all the balances ($5,000 + $3,500 + $1,700 = $10,200). Then, using the equation above, find the quotient and multiply it by 100%:

According to various credit reporting agencies, Bob would need to lower his ratio by at least 7.78%, if not 8%, to be considered an individual with' 'go'd' CUR to reach the 30% threshold. A reduction of at least 28% is necessary to obtain an excellent score of sub-10%.

What is a good Credit Utilization Ratio?

Although different credit rating agencies and financial institution lenders may have different cut-offs in categorizing the varying degrees of risk associated with giving money to borrowers with different CURs, here are some ranges for reference.

The Consumer Financial Protection Bureau and major credit-scoring agencies like Experian state that scores below 30% are considered 'good.' Most people have been doing pretty well in this regard, as the reported average CUR in 2010 was 27%, 2019 with 29%, and 2020 with 25%.

However, it is considered the best if the ratio is in the single digits less than 10%. So, for example, this would mean you have to spend less than $1,000 if the total limit is $10,000 across all credit cards to obtain a 'best' ratio.

The lower ratios resemble higher credit trustworthiness because it shows agencies and lenders that you are not overspending and has a lot of credit under secured management with lower risks of defaulting or being unable to pay back debts.

Is it Good to Have 0 Credit Utilization?

Although it won't affect the credit score, a zero means there is no history of transactions or payments associated with the credit card, making it impossible for creditors to verify your ability to repay debt and handle personal finances. This means that it does not help in securing future loans.

More specifically, the inactivity signal makes it less beneficial when lenders assess your financial situation compared to single-digit, excellent CURs. Still, having a 0% is better than a CUR of above 30%.

Credit Utilization Ratio's Impact on Credit Scores

According to Experian, five main factors are considered when evaluating an individual and assigning them a credit score, including amounts owed, payment history, new credit cards opened, credit history, and credit mix.

Out of the five elements, payment history is the most influential piece in determining the FICO score as it is weighed at 35%, with amounts owed being highly effective at 30%, credit history as moderately significant at 15%, and credit mix and new credit both at less influential with 10% each.

In this case, the ratio falls within the amounts owed category, the second most important piece that factors into the credit rating system. Remember that per-card and total rates are both considered during this process.

Remember that Experian also has categories for interpreting how good someone's credit score is, where utilization ratio plays a significant role in determining. For example, a score of 300-579 is poor, 580-669 is fair, 670-739 is good, 740-799 is very good, and 800-850 is exceptional.

To break down these statistics further, 67% of Americans have good credit or FICO scores, with 21% in the 'good' an' 'exceptional' categories and 25% in 'very good.' On the contrary, 15% is in the 'poor' range, while 17% falls under the 'fair' assessment.

In another metric called the VantageScore 3.0 provided by Vantage, the rating of importance for the following factors with their corresponding importance in determining the credit score is listed as follows, with some similarities with the FICO assessment:

- Payment history: 40%

- Age and type of credit: 21%

- Credit utilization: 20%

- Balances: 11%

- Recent credit: 5%

- Available credit: 3%

This makes the CUR the third most important factor when assessing the credit score, making it a consistent top contributor.

How to Improve Credit Utilization?

There are several ways one can improve the rate, and they are as follows:

- Paying off credit card balances several times a month more than the minimum would help reduce the CUR and total debts, hitting two birds with one stone. This also reduces the interest that you would otherwise need to pay on the balances you did not pay off.

- Refinancing credit card debts with personal loans or through balance transfer credit cards can help manage personal finances while using the lower, if not no, interests on a single card concentrated with all the monthly loan payments for better management.

- Requesting a credit limit increase by contacting your credit card issuer could help make the financing more manageable. A survey by CreditCards.com reports that 89% of askers were granted an increase. This could drastically decrease the CUR.

- Applying for a new credit card helps to increase the total credit limit, and supposing that your credit use does not increase, the overall ratio would decrease, though it will not impact it. Other benefits include credit card rewards and sign-up bonuses.

- Leaving the cards open after paying them off would help to lower the CUR as it will still play a role in the overall rate. However, closing the card would exclude its low per-card ratio, which would have otherwise positively contributed to lowering the total rate.

Once you achieve a good score, maintain it by managing debt obligations wisely and never charging more than what you can pay off; in other words, avoid long-term loans that pose difficulty for repayment. Also, if possible, keep all accounts open to maintain the total limit.

Special considerations & limitations

Some things to be aware of when trying to manage balances or lower your rates. For example, if you shift the balance from one credit card to another, the CUR would not change as the total sums remain unchanged.

However, transferring the balance to a card with lower interests could help hedge your necessary spending while lowering your balances, reducing the CUR.

Furthermore, closing your credit card account that was either paid off or is not being used would hurt your ratio because your total credit limit is lower. Unless you reduce your spending and balances proportionally, the rate will increase.

This is why applying for new credit cards can help to increase the score and limit as the utilization would decrease.

However, keep in mind that opening too many accounts will add a burden to not only more necessary finances but also lower average account longevity and inquiries.

Limitations

Lastly, there are also limitations to the utilization score. For instance, the score is based on the credit report and not the instantaneous balance amounts in your account, making it incapable of identifying positive fluctuations.

or Want to Sign up with your social account?