Fixed Capital

The term refers to the assets purchased/acquired by the business for the manufacturing/production of goods or services.

What Is Fixed Capital?

The term refers to the assets purchased/acquired by the business for the manufacturing/production of goods or services.

These assets are usually high ticket value; these items are generally expensive. But the working life of these assets is for an extended period, usually 15 to 20 years.

For Example, a firm purchases a machine to produce goods, let's say tennis rackets, or, for example, a firm acquires property to build an office to carry out consultation services.

These assets are not usually consumed; instead, they help create products and services essential for running the business.

The real asset is mostly illiquid and depreciated, as shown in the company's financial statements. The asset owner can only claim its residual value on the sale of such investments.

Fixed Capital Requirements

As we discussed the examples of real assets above, it becomes really simple to understand that any business requires real help in the first place.

An Asset like a Building, Plant, Machinery, Furniture, etc., is something without which a business can not proceed further. Hence, these assets are the fundamental requirements of any business.

Acquiring and purchasing these assets takes a lot of funds and time. As stated above, these assets are usually of ticket value. It becomes essential for any business to raise funds for acquiring/purchasing these assets.

Usually, businesses raise funds through the issue of shares, retained earnings, owner’s resources, or by raising debt from an external entity/institution, such as in a loan or issuing debentures.

After raising funds, it becomes equally essential for a business to evaluate the manner of acquiring the asset. It is to say that it is not always necessary or optimal for a business to purchase a real asset; it can even borrow on lease.

For Example, an oil exploration company does not usually buy digging machinery because it is of a significantly high value. Hence, the company borrows it on a lease contract.

Depreciation of Fixed Capital

Depreciation of real assets is shown in the company's financial statements. These assets do not necessarily depreciate in the same standardized format as computed in the financial statements. Still, they are calculated largely for the estimation of these assets' effect on the company's financial performance.

Usually, an estimated usage span is taken for the calculation of the depreciation of these assets. But in actuality, these assets sometimes work more or less than what was estimated.

Different depreciation methods are opted for by various companies according to their preference or as per the regulatory authorities. Various forms of depreciation are-

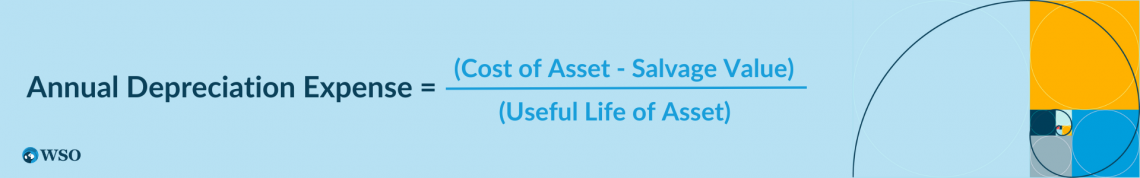

1. Straight-Line Depreciation

It is also known as the straightforward depreciation method. This depreciation method helps depreciate the cost of assets in a uniform trend.

The formula of the Straight-Line Depreciation method is:

Where;

- The asset's purchasing price is considered the asset's cost.

- At the end of its useful life, the asset's value is known as salvage value.

- The operating life of an asset, or the number of years it may be used, is known as its useful life.

2. Declining Balance Depreciation

It is a method to depreciate the asset quickly in the initial valuable years. This method is usually adopted in case of investments that get obsolete quicker.

For Example, a computer, car or mobile, etc. This method records higher depreciation in the beginning years of the useful years of the asset and lesser depreciation in later valuable years.

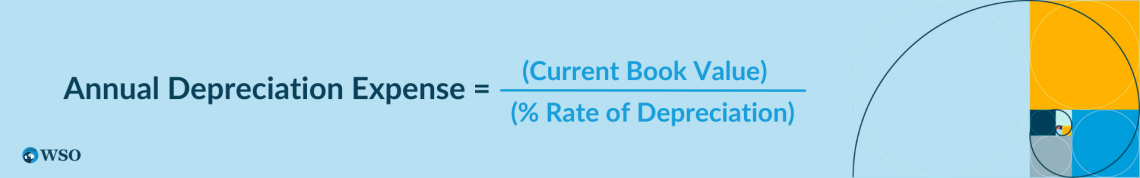

The formula of the Straight-Line Depreciation method is:

Where;

- Current Book Value is the value of assets in the book (not the market value)

- The rate of depreciation is the rate at which the company reduces the value of its asset

3. Sum-of-the-Years' Digits Depreciation

This method is similar to Declining Balance Depreciation in the context of the concept.

That is, this method records higher depreciation in the beginning years of the valuable years of the asset and lesser depreciation in later helpful years.

There is no specific formula for this method; its calculation can be simply explained with the help of an example. Let's say there is a machine ‘X’ with a useful life of 4 years.

Now, 1+2+3+4 = 10. After this, we will use the summation of these numbers, which happens to be 10, as the denominator of our interest rate calculation.

At the same time, the number of years will be used as the numerator, which looks like

And similarly for all other years.

4. Units of Production Depreciation

This method of depreciation concerns the production capacity of an asset rather than the useful life of the asset, which is to say that the amount of depreciation is charged in proportion to the intensity of usage of the support in that period.

A mathematical representation of the relation stated above can be

the Amount of Depreciation expense = Usage of an asset in the given period.

That is, the more the usage, the more the expense, and vice versa.

The formula of the Straight-Line Depreciation method is:

Where

- The Original value is the asset's current market value.

- In contrast, Salvage Value is the asset's value after its expired useful life.

The projected volume of units the asset can create is called Approximate Production Capability. The number of units produced by the asset is indicated by Units Produced.

Liquidity of Fixed Capital

What is Liquidity? It is a property of an asset that can be converted into cash in a short period at a fair value.

Real assets are highly illiquid. The reason for the same can be two-fold:

1. High Value

These are generally of high value and the market value of most of the Real assets; for example, a vehicle, machinery, or equipment gets depreciated the moment they are out of the dealership.

Hence, selling them without utilizing them is nothing but distress selling. Hence, owners of these assets don't usually plan to sell them frequently.

2. Time Consuming

Since the market for such commodities as heavy machinery and production equipment is not significant, finding buyers becomes time-consuming, because of which selling these assets takes time.

The fixed assets or capital have a prolonged period for their conversion into ready cash. Real estate, estates, and intangibles may take up to 1 year for their transformation.

Fixed vs. Circulating Capital

Fixed Capital refers to the real assets of the business that are acquired/purchased with the intent to use for a longer period, let's say 15 to 20 years. Circulating Capital is purchased with the intent to utilize it in the regular operations of the business (production).

However real assets are involved in the business's regular operations, but it is not consumed or sold off at frequent intervals like circulating Capital.

For Example, Inventory is a circulating capital involved in the daily production operations of the business. In contrast, Machinery is a real asset used daily for production that isn't consumed and replaced regularly.

Difference Between Fixed and Working Capital:

| Metric | Fixed Capital | Working Capital |

|---|---|---|

| Meaning | It refers to the investment made by the company in a long-term asset. | It refers to the investment made by the company in day-to-day operations |

| Liquidity | Nonliquid | Highly liquid |

| Asset type acquired/purchased | Non-Current | Current |

| Utility Span | Very long (5 to 20 years) | Very short (A week to anywhere within a year) |

| Engagement in Day-to-Day Operations | Indirect Engagement | Direct Engagement |

Incremental Fixed Capital: This refers to the additional stock of fixed Capital; that is, it is the purchase of asset stock that not only replace the worn-out fixed Capital but adds to the current stock level of fixed level.

For Example, Firm X has real assets worth $100,000, out of which $25,000 worth of real assets need to be replaced as it has worn out during production.

Management of Firm X decided to buy actual asset stock worth $35,000. Hence, the total real asset increases to $110,000.

Fixed Capital Example

Although, this Capital in itself is subjective for different types of businesses. But largely, assets like Land, Plant, Machinery, Equipment, Vehicles, Office Furniture, and Buildings are some common examples of real assets.

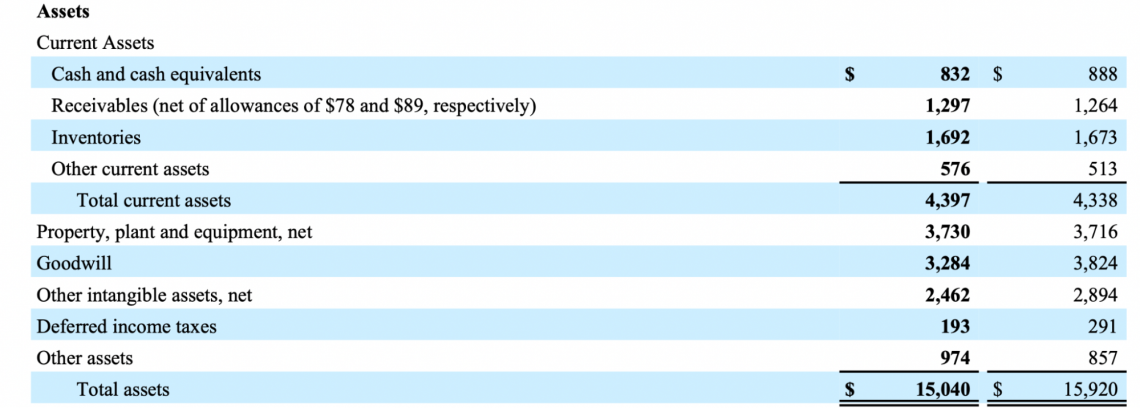

The following is an excerpt from Colgate Palmolive’s SEC Filing. Here, we can find real asset examples and how they are shown in the financial statements:–

Fixed Capital FAQs

It refers to the assets purchased/acquired by the business for the manufacturing/production of goods or services.

These assets are the fundamental requirements of any business, without which a business can not proceed further. For Example, Machinery, Buildings, Plant, etc.

The reduction in the price of a non-current tangible asset reduces the asset’s monetary value due to reasons like wear and tear caused by continuous use of the asset.

Circulating Capital is purchased with the intent to utilize it in the business's regular operations (production)

At the end of its useful life, the asset's value is known as salvage value.

It refers to the additional stock; that is, the purchase of asset stock replaces the worn-out fixed Capital and adds to the current stock level fixed level.

Researched and authored by Dhanraj Johari | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?