Flow-Through Entity

A flow-through entity, also known as a pass-through entity, is a business entity where the profits are not subject to the corporate income tax rates.

What Is A Flow-Through Entity?

A flow-through entity, also known as a pass-through entity, is a business entity where the profits are not subject to the corporate income tax rates. Instead, the profits "pass through" the business to the owners, and are reported on the individual owners' tax returns, being subject to the individual income tax rates.

This distinctive entity ensures that only the individuals involved, rather than the entity itself, bear the taxation responsibility for the revenues generated.

By implementing such a mechanism, flow-through entities effectively evade the burdensome issue of double taxation, which commonly plagues income derived from regular corporations.

The essence of a flow-through entity lies in its ability to bypass the concept of corporate-level taxation. Instead, it embraces a more streamlined approach by shifting the tax liability onto individuals with a stake in the entity.

This means that the business's income is not subject to taxation at the entity level. Instead, the profits flow to the shareholders, proprietors, or traders, who then file and pay taxes on their personal profits tax returns.

This tax-efficient shape holds excellent appeal for entrepreneurs, small groups, and partnerships because it eliminates the need for the entity to report a separate tax return.

By avoiding double taxation, flow-through entities provide a valuable means for individuals to retain a larger portion of their income through their business endeavors.

There are various forms of inflow-through entities, each with its series of characteristics and regulations.

Limited liability companies (LLCs), partnerships, and S corporations are some common examples.

While the specific requirements and tax implications may vary among jurisdictions, the underlying principle remains consistent: enabling the flow of income directly to the stakeholders, thereby fostering a more favorable tax environment.

Flow-through entities offer a strategic and tax-efficient business structure that allows income to pass directly to the shareholders, owners, or investors.

By sidestepping the issue of double taxation, these entities empower individuals to retain greater control over their earned income.

As such, flow-through entities continue to be popular for those seeking to optimize their tax obligations while running a successful business.

Key Takeaways

- Flow-through entities allow income to flow directly to shareholders, owners, or investors, thereby avoiding taxation at the entity level.

- By bypassing the double taxation issue faced by regular corporations, flow-through entities enable individuals to bear the taxation responsibility on the income generated by the business.

- Flow-through entities offer tax efficiency by allowing income to pass directly to stakeholders, avoiding double taxation, and simplifying the tax filing process.

- Limited liability companies (LLCs), partnerships, and S corporations are typical examples of flow-through entities, each with its characteristics and regulations.

- Flow-through entities provide individuals with the advantage of utilizing any losses incurred by the business to offset their personal income, providing flexibility in tax planning.

Understanding Flow-Through Entity

Flow-through entities, also referred to as pass-through entities, operate under a distinct tax framework compared to traditional businesses. While both individuals and businesses bear the burden of taxation, flow-through entities offer a unique advantage regarding tax liability.

In the realm of taxation, individuals are familiar with income tax, where their wages are subjected to taxation. Similarly, companies face the prospect of corporate tax, which is levied on their overall revenue. However, the scenario changes for businesses structured as flow-through entities.

These entities are exempt from corporate income tax, enabling them to enjoy a different tax treatment altogether.

The income generated by a flow-through entity is not directly subject to corporate taxation. Instead, it is regarded as the personal income of the investors, stockholders, or owners.

This means that any earnings the business makes seamlessly "flow-through" to the individuals and the corresponding tax liability.

Individual stakeholders of flow-through entities are responsible for paying taxes on the business income as if it were their personal earnings.

These taxes are calculated based on their ordinary income rate, ensuring a consistent approach. Furthermore, the owners can utilize any losses incurred by the company to offset their personal income, providing them with additional flexibility.

In terms of tax regulations, flow-through entities generally align with C corporations when it comes to aspects like inventory accounting and depreciation. However, there is a crucial distinction. Unlike C corporations, flow-through entities avoid double taxation.

For C corporations, earnings are initially subjected to taxation at the corporate tax rate.

When these earnings are distributed as dividends to shareholders or when shareholders realize capital gains from retained earnings, they face another round of taxation.

The contrast between flow-through entities and C corporations in terms of tax treatment highlights the advantage of the former. Flow-through entities enable a more streamlined tax process, where earnings are taxed only once, benefiting the business and its stakeholders.

Flow-Through Entity Key Pointers

Here are some insights to understand this topic thoroughly:

1. Overview

Flow-through entities represent a distinctive business structure that facilitates the direct transfer of income to shareholders, owners, or investors, effectively bypassing taxation at the entity level.

2. Taxation

Unlike regular corporations, flow-through entities are not taxed on their revenues. Instead, the tax liability is shifted to the individuals who possess the earnings.

3. Double Taxation

By eliminating the need for the entity to pay taxes on its income, flow-through entities help avoid double taxation, a common issue traditional corporations face.

4. Shareholders, Owners, or Investors

The income generated by a flow-through entity is distributed to individuals with a stake in the business.

Note

These individuals report and pay taxes on their personal income tax returns.

5. Popular Examples

Limited liability companies (LLCs), partnerships, and S corporations are common examples of flow-through entities. Each has requirements and regulations, but the core principle remains the same: directly passing income to stakeholders.

6. Tax Efficiency

Flow-through entities offer a tax-efficient structure that allows individuals to retain a larger portion of their earned income, making them an attractive option for entrepreneurs and small businesses.

Note

Flow-through entities are business structures that enable the direct flow of income to shareholders, owners, or investors while avoiding double taxation.

By understanding these entities' key aspects and benefits, individuals can make informed decisions about their business ventures and optimize their tax obligations.

Types Of Flow-Through Entity

In business and taxation, flow-through entities have become a prominent choice for entrepreneurs and business owners.

These entities offer a unique structure that allows income and losses to flow directly through to the owners or shareholders, bypassing the entity itself. This arrangement simplifies the tax imposition and provides certain benefits, like avoiding double taxation.

From the widely recognized partnerships and limited liability companies (LLCs) to the lesser-known S corporations and business trusts, these entities offer flexibility and advantageous tax treatment for those seeking to navigate the complex landscape of business ownership.

Here, we delve more into understanding these types:

Partnerships

Partnerships are a widely utilized form of the flow-through entity where two or more individuals join forces to embark on a business venture. They offer a flexible structure for business operations and taxation. Here are the key aspects of understanding partnerships:

1. Ownership and Allocation

Partnerships distribute ownership interests among the partners in the form of partnership units or shares. Profits and losses are allocated based on each partner's ownership percentage or as defined in the partnership agreement.

2. General and Limited Partnerships

General partnerships involve partners with unlimited personal liability for the partnership's debts and obligations. In contrast, limited partnerships consist of both general partners (with unlimited liability) and limited partners (with liability limited to their investment).

3. Flexibility in Management

Partnerships allow partners to participate actively in the management and decision-making processes.

Note

They can share responsibilities and contribute their skills and expertise to the business.

4. Pass-through Taxation

Partnerships do not pay income taxes at the entity level. Instead, profits and losses flow through to the partners, who report them on their tax returns. This avoids double taxation and allows for tax planning based on individual circumstances.

Limited Liability Companies (LLCs)

Limited Liability Companies, or LLCs, have gained significant popularity as versatile and protective forms of business entities. Then is what you need to know about LLCs

1. Limited Liability Protection

LLCs offer limited liability protection to their proprietors, known as members. This means that members' particular assets are generally shielded from the company's debts and arrears.

2. Pass-through Taxation

Similar to partnerships, LLCs also benefit from pass-through taxation. The company itself is not taxed at the entity level, and instead, the profits and losses flow through to the members, who report them on their tax returns. This avoids double taxation and allows for tax planning based on individual circumstances.

3. Operational Flexibility

LLCs provide flexibility in terms of management and ownership. They can be managed either by the members themselves or by appointed managers. LLCs have the privilege of operating with a single member and multiple members as per requirement.

Note

This flexibility allows for customized management structures and facilitates ease of decision-making.

4. Legal Formalities

Compared to corporations, LLCs have fewer formal requirements. They typically do not require regular shareholder meetings or extensive record-keeping, making them more straightforward to operate.

S Corporations

S Corporations, or S-corps, are corporations that elect to pass corporate income, losses, deductions, and credits to their shareholders. Consider the following aspects of S Corporations:

1. Pass-through Taxation

S-corps enjoy the advantage of pass-through taxation. Like partnerships and LLCs, they do not face double taxation since the corporate income is passed through to the shareholders and reported on their tax returns.

2. Shareholder Limitations

Certain restrictions must be met to qualify as an S-corp, such as having no more than 100 shareholders and only one class of stock. This limitation ensures the S-corp maintains its flow-through status and avoids becoming subject to C corporation taxation.

3. Limited Liability Protection

Similar to other entities, S-corp shareholders have limited liability protection. This means their personal assets are generally shielded from the company's liabilities.

Note

The shareholders' liability is typically limited to their investment in the corporation.

4. Formalities and Compliance

S-corps have more formalities compared to partnerships and LLCs. They must adhere to corporate governance requirements, maintain proper records, hold shareholder meetings, and comply with state regulations.

Limited Liability Partnerships (LLPs)

Limited Liability Partnerships, or LLPs, uniquely combine limited liability protection and partnership flexibility. Here are the key points to understand about LLPs:

1. Liability Protection

LLPs shield individual partners from personal liability for other partners' or employees' misconduct or negligence. However, partners are generally not personally responsible for the LLP's obligations.

2. Management and Decision-making

LLPs offer partners the freedom to participate in the management and operation of the business.

Note

They can actively contribute to strategic decisions and day-to-day activities.

3. Professional Services Industry

LLPs, such as law, accounting, or consulting firms, are commonly used in professional service industries. They provide a suitable structure for professionals who want to work together while maintaining personal liability protection.

4. Compliance and Regulation

LLPs are subject to specific state regulations and compliance requirements. These may include registration with relevant authorities, filing annual reports, and adhering to professional conduct rules.

Understanding the nuances of each type of flow-through entity is crucial for selecting the most suitable structure for a business. Seeking guidance from legal and tax professionals can provide valuable insights and help navigate the complexities of business formation and operation.

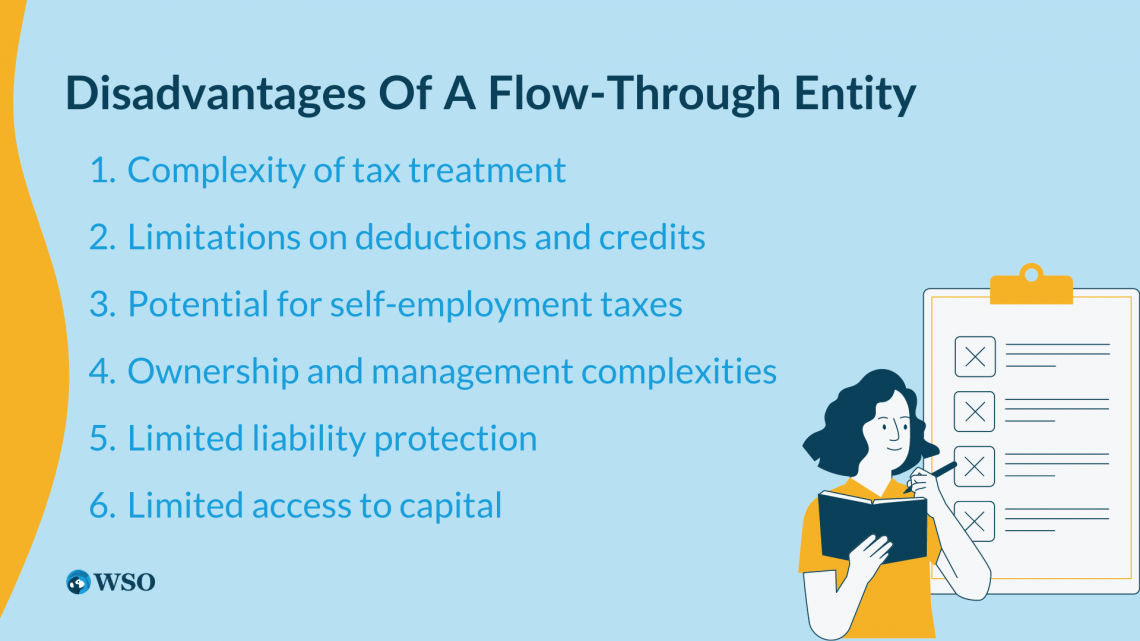

Disadvantages Of A Flow-Through Entity

Flow-through entities, despite being touted as advantageous for businesses, are not without their drawbacks.

Similar to partnerships, limited liability companies( LLCs), and S corps, these entities pass their revenue, deductions, and tax arrears to their proprietors or shareholders. While this structure may seem enticing initially, several demerits accompany it.

Here are the flow-through entities' demerits:

1. Complexity of tax treatment

Flow-through entities require owners or shareholders to report income and losses on their personal tax returns, leading to a more intricate tax filing process with additional forms and schedules.

2. Limitations on deductions and credits

Flow-through entities may have limitations on accessing certain tax benefits, such as research and development credits or energy-related incentives.

Note

Individual owners may not be able to fully utilize these deductions and credits, potentially missing out on valuable tax savings.

3. Potential for self-employment taxes

Owners actively participating in the business of a flow-through entity may be subject to self-employment taxes, increasing their tax burden compared to traditional corporations that only pay employment taxes on employee wages.

4. Ownership and management complexities

Flow-through entities like partnerships and LLCs require well-drafted operating agreements to address rights, responsibilities, and potential conflicts among owners, which can affect the stability and success of the entity.

5. Limited liability protection

While flow-through entities provide limited liability protection to owners, personal assets may still be at risk under certain circumstances.

Example

If an owner engages in fraudulent or unlawful conduct, they may be personally liable for the entity's liabilities, undermining the limited liability protection.

6. Limited access to capital

Flow-through entities may face challenges when it comes to raising capital. Unlike traditional corporations that can issue stock and attract investors easily, flow-through entities often rely on the owners' personal funds or loans.

This limited access to external capital can hinder their growth potential and limit their ability to undertake large-scale investments or expansion.

It is crucial for business owners to carefully evaluate these factors, including the complexity of tax treatment, limitations on deductions and credits, potential self-employment taxes, ownership and management complexities, and limited liability protection when considering the use of flow-through entities.

Note

It's pivotal to consult with tax professionals and legal counsels to completely comprehend the impeachments and make well-informed opinions grounded on the business's specific circumstances.

or Want to Sign up with your social account?