Simple Capital Structure

It contains no potentially dilutive securities—solely common stock, nonconvertible debt, and nonconvertible preferred stock.

What is a Simple Capital Structure?

A simple capital structure contains no potentially dilutive securities—it's solely common stock, nonconvertible debt, and nonconvertible preferred stock. It safeguards earnings per share value by excluding convertible securities that might dilute it.

In a corporation with a simple capital structure, there aren’t any convertible securities that could water down the value of its earnings per share, thereby preserving the interests of the existing shareholders.

Smaller companies often have simple capital structures, where only the company's board can issue or repurchase shares. Hence, the power to issue or buy back shares is exclusively vested in the firm's board of directors.

In contrast, complex capital structures allow convertible bonds or stock option holders to convert their holdings into more shares, diluting control over share issuance and potentially diluting the company’s earnings.

A simple capital structure provides clarity and transparency in financial decision-making. It protects against the company's potential dilution and contributes to a more understandable and investor-friendly financial environment.

Key Takeaways

- A simple capital structure contains no potentially dilutive securities—it's solely common stock, nonconvertible debt, and nonconvertible preferred stock.

- Smaller companies often adopt simple structures where only the company's board can issue or repurchase shares.

- Assessing the balance between utilizing these convertible instruments for fundraising purposes and safeguarding existing shareholders' interests becomes crucial for informed investment decisions.

Types of Capital Structure

There are two major types of capital structures based upon the inclusion or exclusion of potentially dilutive securities:

- Simple Capital Structure

- Excludes potentially dilutive securities that might dilute the company’s earnings, offering a stable financial foundation.

- Comprises exclusively common shares, nonconvertible debt, and nonconvertible preferred stock.

- Provides a clear financial structure, aiding stakeholders' understanding and decision-making.

- Complex Capital Structure

- Includes dilutive securities with the potential to impact the company’s basic EPS.

- Companies with this structure require reporting both basic and diluted EPS in their financial statements.

- This structure contains stock options, warrants, and bonds that can be converted into common shares, adding intricacy to financial evaluations.

Investor Perception:

A simple structure is seen by investors as less risky since there are no hidden securities that could diminish the company's earnings. However, they consider complex structures risky because of the possible dilution of the company’s earnings.

Therefore, understanding these capital structures helps investors evaluate a company's risk management efficiency and make informed investment decisions.

Understanding Potentially Dilutive Securities

Securities that may dilute existing shareholders' profits may be changed into common shares of a company. Let us examine a few of these dilution securities.

1. Convertible Preferred Stock

It allows holders to convert their preferred shares into a predetermined number of common shares after a specified date.

For example, a holder may convert one preferred stock into ten common shares upon the company's public offering.

2. Convertible Debt

It allows the holder to convert existing debt into a fixed amount of common stock.

For example, a person has $1,000 worth of bonds with an interest rate from the coupon at 7%, which could be changed into 15 common shares for every $1,000 bond.

In that case, he can either change each of his bonds to 15 common stocks or keep them until their maturity, whichever suits the holder.

3. Stock Options

Stock options confer the privilege upon employees to acquire company shares at a predetermined rate following a specified timeframe.

For example, envision an employee possessing stock options exercisable after a 5-year interval, with a designated cost of $20. The employee can profit by exercising these options if the company's market price exceeds the predetermined cost.

4. Warrants

Warrants, akin to stock options, share a resemblance but are commonly issued in conjunction with debt or equity securities, making the deal more appealing to investors.

For example, a company might contemplate appending five warrants to each $1,000 par value bond. Each warrant holds the potential for conversion into 15 common shares at a strike price of $10, and this conversion can extend until March 1, 2027.

Identifying a Company’s Capital Structure

By looking at a company's income statement, we can identify its capital structure. A significant variance between the basic and diluted EPS figures may indicate potentially dilutive securities.

For instance, a lower diluted EPS than basic EPS suggests potentially dilutive securities, signaling a complex capital structure.

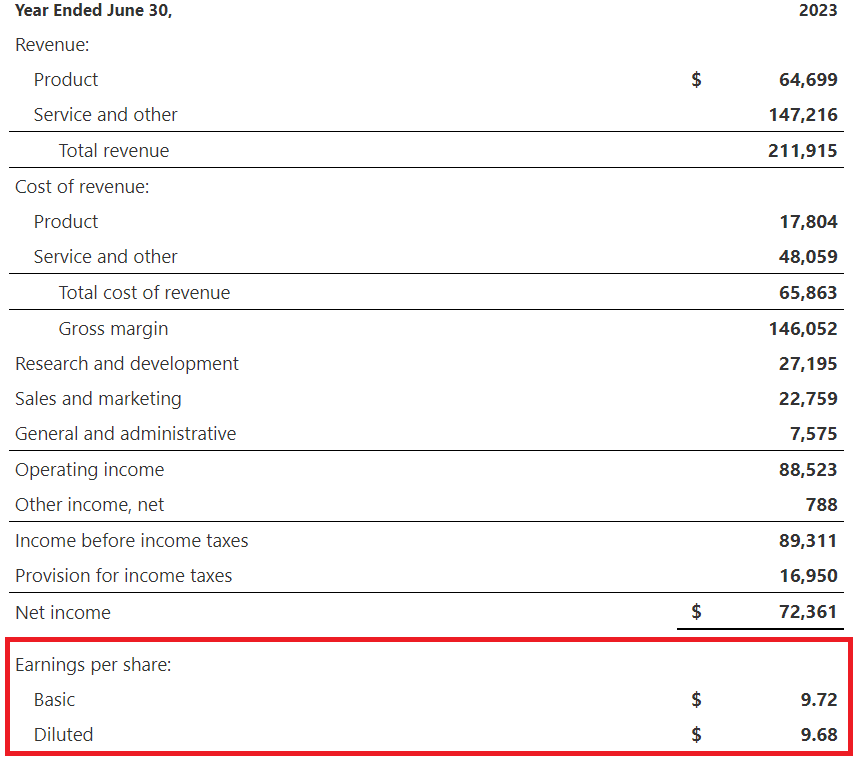

So, let us go ahead and identify Microsoft's capital structure. We have extracted the following financial data from the company’s annual report for 2023.

Note

We have included only those parts of the financial reports needed to identify the company’s capital structure.

By analyzing the EPS figures from the income statement, it's clear that the company reports a basic EPS of $9.72, slightly higher than the diluted EPS of $9.68. This discrepancy hints at convertible securities that impact the company's earnings. Therefore, Microsoft has a complex capital structure.

Investors may also look into footnotes or disclosures, which the company often includes alongside financial statements that provide insights into convertible instruments or outstanding stock options.

These notes can highlight potential dilution factors, shedding light on convertible debt or employee stock options, which helps identify the company’s capital structure.

Conclusion

A simple capital structure offers companies a simple financial framework without potentially dilutive securities.

This structure is more transparent to investors as they do not need to consider the impact of potentially dilutive securities such as convertible bonds, stock options, or warrants while evaluating a company's net earnings.

The absence of convertible instruments in a simple capital structure means existing shareholders can handle their ownership interests being diluted. It offers stability and a clearer view of the actual earnings attributable to each outstanding share.

It also signifies a certain level of sustainability and control, as the company's financial makeup remains less susceptible to drastic alterations caused by dilutive securities.

We hope this article has helped you enhance your knowledge about simple capital structure and how it protects the company against potential dilution, safeguarding its shareholders’ interests.

or Want to Sign up with your social account?