SWORD Financing

A specialized form of financing mostly used to fund a Research and Development (R&D) project within a biotech firm.

What is Sword Financing?

SWORD Financing or Stock Warrant Off-Balance Sheet Research and Development is a specialized form of financing mostly used to fund a Research and Development (R&D) project within a biotech firm.

In sectors characterized by substantial research and development expenditures, such as science and technology, traditional investments are often viewed as exceedingly risky. This perception arises from the inherent uncertainty associated with biotech projects.

This is because the majority of R&D projects in biotech fail to achieve their goal or get regulatory approval. Consequently, investors may lose their entire investment if a project fails to gain the green light from regulatory authorities.

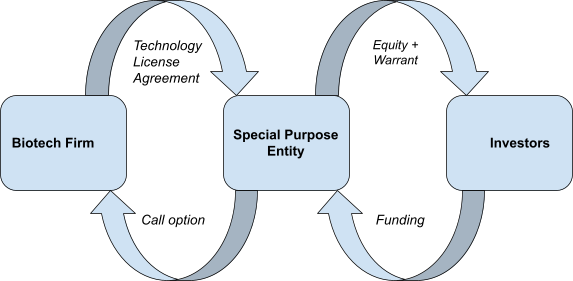

So, to reduce the risk when investing in a biotech firm’s R&D, SWORD financing is used. In this type of financing, a Special Purpose Entity (SPE) is incorporated, and investors then put the funds into this new company, which is separate from the biotech firm doing R&D.

Doing this creates a level of liability separation, and the investors who want to invest in this volatile field can have a level of stop loss to limit their losses.

Key Takeaways

- SWORD financing is an investment vehicle used by investors who want to invest in biotech R&D projects.

- While successful biotech products can yield substantial, long-term returns, the industry is inherently risky due to a high failure rate and stringent regulations.

- SWORD financing mitigates risk by establishing a Special Purpose Entity (SPE) to fund new R&D projects. Investors gain rights to innovations while keeping the biotech firm's finances separate from the project.

How does SWORD financing work?

SWORD financing is a sophisticated method of funding biotech firms' research and development (R&D) endeavors. It involves several key steps:

1. Formation of a Special Purpose Entity (SPE)

The process starts by incorporating a special purpose entity (SPE). This new firm then acts as a middleman between the biotech firm and investors.

2. IPO or Private Offering

SPE then goes for an IPO or a private offering where the investors buy the equity of this new entity, raising the required capital.

3. Utilization of Investor Funds

SPE then uses the funds received from investors to fund a Biotech firm's R&D project.

Additional Components for Fairness

To make things fairer for all the parties involved, there are additional components to this funding arrangement. These are:

- Technology Rights: SPE is granted the full rights to use and license the technology developed by the biotech firm using its funding. This ensures that the SPE can leverage the innovations resulting from the R&D project.

- Call Option for Biotech Firm: The Biotech firm is granted a call option for SPE, enabling them to purchase SPE shares at a predetermined price specified in the options agreement.

Investor Benefits: Investors fund the SPE and, in return, get its equity share. This gives them the right to a technology license developed by a biotech firm's R&D. Additionally, investors receive a warrant to buy the common stock of a biotech firm as insurance if the firm doesn’t exercise its call option.

Accounting Treatment of SWORD Financing

SWORD financing, a complex yet essential financing method, is subject to specific accounting treatment guidelines outlined by the Financial Accounting Standard Board (FASB).

FASB issued the Statement of Financial Accounting Standards No. 68 (FAS 68) in October 1982 to address the unique financial considerations of this type of financing.

FAS 68 guides the company on how its R&D program should be treated while preparing its accounts. It primarily focuses on accounting for ongoing R&D costs based on the company's obligations.

It lays out criteria for determining the type of obligation the research company has with its investors. FAS 68 asks three questions:

- Does the research company have the right to use the research and development results in its operations?

- Does the research company bear the risk of failure or success of the R&D project?

- Is there an obligation to repay any amounts received for the R&D regardless of the outcome?

If the answer to any of these questions is affirmative, it signifies that the research company is obligated to provide a return to its investors. In such cases, the financial risk associated with the R&D project is not entirely transferred to the SWORD company.

According to FAS 68, in these scenarios, the company conducting the R&D must expense the research and development costs as they are incurred and record the commitment to return as a liability on its balance sheet.

Conversely, if the company has transferred all the financial risk of the R&D project to the SWORD company and is not obligated to any type of return for its investors, then the research company is just acting as a contractor that is only obligated to perform R&D.

In this case, FAS 68 says that the accounting treatment for the obligation for the R&D should be treated as a contract to perform research and development for external parties.

Note

If you want to learn more about FAS 68, you can read the following PDF.

Comparison of SWORD financing to other financing methods

In the world of finance, there are many other methods a biotech firm can opt for to fund its R&D.

But why do Biotech firms prefer a SWORD financing route over simpler options?

Let's compare SWORD financing with these alternative funding methods to answer this.

Equity financing is expensive compared to SWORD if the goal is to fund R&D projects. In the case of equity financing, the company often faces dilution of ownership. New investors may not be too keen on the R&D project, which can put roadblocks in the development process.

2. Debt financing

Deb financing is less feasible in the highly regulated biotech sector, where government approvals and testing processes can span years. The extended timeframe and uncertainty surrounding government approval make it impractical.

Furthermore, biotech firms typically have limited assets that can serve as collateral, further limiting their options for debt financing.

Similar to equity financing, in venture capital funding, the company may experience a reduction in control, as venture capital funds often seek a larger ownership stake to mitigate potential losses in the event of project failure. This can potentially affect the company's autonomy and decision-making authority.

As the biotech field is all about innovation in the field of medicine, making strategic alliances will be difficult as every company operating in the field is very protective and secretive about its intellectual properties. Due to this reliance, an alliance where data and processes must be shared is mostly not on the table.

SWORD financing emerges as a preferred choice for biotech firms, offering a unique balance between funding and maintaining control over critical R&D projects.

Its ability to provide financial support without the drawbacks associated with other methods makes it an attractive choice in pursuing innovation and breakthroughs in the biotechnology field.

or Want to Sign up with your social account?