Strategic Analysis

A process that entails performing research on the business environment

What Is Strategic Analysis?

Strategic analysis is a process of performing research on the business environment in which an organization operates.

Strategic analysis is required to develop strategic plans for decision-making and the smooth operation of an organization. The organization’s objectives or goals can be met with the help of strategic planning.

When a company has specific goals and a vision it wants to realize, strategic analysis becomes crucial. For instance, successful organizations have undergone extensive strategic planning over the years, resulting in well-known successes.

Strategic planning is a long-term task involving continuous and systematic planning and resource investment.

Organizations must conduct it to determine what areas need improvement and which areas are already performing well. It is critical to consider how improvements can be implemented for an organization to function.

Organizations must conduct strategic analysis to understand their competitors and define a strategy that will help them become unbeatable players in that market.

One of the most important functions of strategic planning is predicting future events and developing alternative strategies if a particular plan does not work out as anticipated.

Key Takeaways

- Strategic analysis is required to develop strategic plans for decision-making and the smooth operation of an organization.

- Strategic analysis is the process of researching an organization and its working environment in order to develop a strategy. There are numerous other definitions of strategic analysis from various perspectives. However, they all have a lot in common.

- Various tools and methodologies, such as Michael Porter's Four Corners Analysis (FCA), are employed in strategic analysis to assess competitors, evaluate strategies, and determine the effectiveness of implementation.

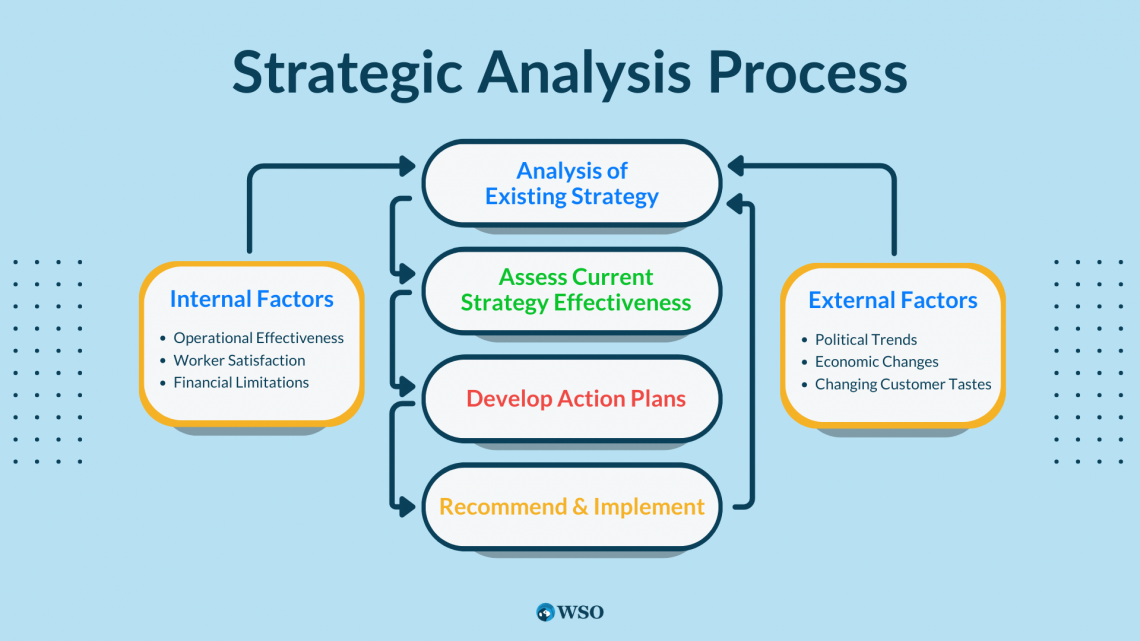

Strategic Analysis Process

As seen in the accompanying infographic, the strategy analysis process involves several essential steps:

1. Perform an Environmental Analysis of Existing strategies:

- To start, a business must carefully evaluate its current plans in light of both its internal and external settings.

- Internally, this entails assessing operational effectiveness, worker satisfaction, and financial limitations.

- It is necessary to take into account external elements such as political fads, economic changes, and changing customer tastes.

2. Assess the Effectiveness of Current Strategies:

- The primary objective of strategic analysis is to evaluate the efficacy of current strategies in the context of the present business environment.

- The right questions to ask as a strategist include:

- Is our plan succeeding in reaching its goals?

- Can we reach the objectives we've set?

- Do our goals, purpose, and values line up with our overall strategy?

3. Develop Action Plans:

- When the evaluation shows that present strategies are failing or unknown, it is time to move on to the planning step.

- The firm then develops strategic alternatives at this time.

- This might entail optimizing cost structures, simplifying operations, or suggesting changes to corporate procedures.

4. Recommend and Implement the Best Strategy:

- Following a thorough review and proposal of alternatives, a recommendation is given.

- For execution, the most practicable and quantitatively favorable option is chosen.

- It is important to note that this procedure is iterative.

- Recognizing that the business environment is dynamic and ever-changing, strategies must be implemented, regularly examined, and updated as appropriate.

types of strategic analysis

There is no single strategy for evaluating an organization's work environment, but numerous ways can assist acquire the essential data to pave the way for strategic development.

SWOT and PESTLE are two frequently used analysis tools in this area, each providing unique views useful for strategy creation. While SWOT follows a more internal strategic analysis process, PESTLE is more oriented for an external strategic analysis.

In the section below, we will look at both approaches.

Internal Strategic Analysis

As the name implies, internal strategic analysis comprises an introspective assessment within the organization to discover its strengths and flaws in order to improve its market image. This form of analysis is largely concerned with determining the organization's ability to fulfill its goals.

SWOT analysis, which stands for Strengths, Weaknesses, Opportunities, and Threats, is a well-known and widely utilized approach for internal strategic analysis. SWOT analysis entails the following steps:

- Strengths: These are the in-house qualities that fuel an organization's steady expansion. In the midst of any changes, it is vital to protect and capitalize on these areas.

- Weaknesses: Together with strengths, weaknesses are areas of the organization that need to be fixed and present a chance for competitive advantage.

- Threats: Predictable outside variables that might have an influence on the organization but that could be reduced with good risk control.

- Opportunities: Finding potential sources of external development that the firm may use to advance.

External Strategic Analysis

Examining external elements that may be able to obstruct an organization's growth is crucial when internal analysis is finished and the internal environment has been strengthened.

A thorough knowledge of market dynamics and the effects of different marketing tactics, goods, and services on customers is essential for reliable external analysis.

PESTLE analysis, which includes Political, Economic, Social, Legal, and Environmental issues, is a widely used approach for external analysis. The PESTLE analysis helps with:

- Recognizing outside influences that are beyond your control, such as political or environmental developments.

- Figuring out how each aspect could affect the expansion of the organization.

- Understanding possible difficulties the organization may face.

- Determining the possibility that these difficulties may arise.

components of strategic analysis

Strategic Analysis includes the following components:

-

Understand the strategy level for which the analysis is being performed.

-

Carry out an internal analysis.

-

Carry out an External Analysis.

-

Share Significant Findings.

Strategy level

The strategy has different levels depending on where you are in an organization and the size of your organization.

You could be developing a strategy for an entire organization with multiple businesses, or you could be developing a strategy for your marketing team.

As a result, because each level has different objectives and needs, the process will differ. The three levels of strategy are as follows:

-

Corporate strategy: Defines the overall direction of the organization as well as high-level ideas for how to get there. These plans are typically developed by a select strategy group, including the CEO and top management.

-

Business strategy: The strategy hierarchy's second tier. The business strategy, which is part of the corporate strategy, is a means of achieving the goals of a specific business unit within the organization.

-

Functional strategy: This is the level of an organization's operations.

Employee decisions are frequently referred to as tactical decisions at the functional level of strategy. They are concerned with how an organization's various functions contribute to the other strategy levels.

Marketing, finance, manufacturing, human resources, and other functions may be included.

Internal strategy

An internal growth strategy refers to the growth within the organization by using internal resources.

Internal growth strategies focus on developing new products, increasing efficiency, hiring the right people, better marketing, etc. An internal growth strategy can take place either through expansion, diversification, or modernization.

The steps for completing an internal analysis are:

-

The first step is deciding on the tool or framework you will use to conduct the analysis.

-

The second step is you will start researching and collecting data.

-

The third step is following the data research and collection stage, and you must begin analyzing the data and information you have gathered.

-

The fourth step is sharing your conclusions.

After the internal analysis is completed, the organization should clearly understand where they are excelling, where they are doing well, and where their current deficits and gaps are.

The analysis will provide management with the information they need to capitalize on their strengths and opportunities. It also enables management to devise strategies to counteract potential threats and compensate for identified weaknesses.

Starting the strategy formulation process, This analysis will ensure that your strategic plan has been developed to capitalize on strengths and opportunities while mitigating or improving weaknesses and threats.

External strategy

An external analysis examines an organization's environment and how those factors influence or could influence the organization.

The organization has little to no control over external components, which is a key distinction between external and internal factors.

On the one hand, the organization has complete control and influence over internal factors. On the other hand, they simply scan and react to their surroundings, rarely influencing them.

External factors of the organization include the industry in which it competes, the political and legal landscape in which it operates and the rules it must follow, and the communities in which it operates.

Types of the external strategy analysis:

-

First is integration because it involves bringing two or more businesses together to some extent. Mergers, acquisitions, and takeovers are all examples of company amalgamations that necessitate a permanent change in ownership.

-

Second, external growth can take the form of Joint Ventures (JV) and Strategic Alliances (SA), which are more equivalent to business partnerships with other firms and do not necessitate a permanent change of ownership.

Strategic Analysis Advantages and Disadvantages

Strategy Analysis is a continual and iterative process that does not end with the execution of plans developed. The cycle continues with execution, assessment, and future planning after analyzing the elements impacting the company and developing plans.

This cyclical strategy provides adaptation and constant development as dynamics change.

Strategic Analysis entails various merits that contribute to the firm's growth and expansion, whereas it also comprises certain demerits that might hinder the performance of a company.

Some of the Advantages are:

- Internal Strength Identification: It aids in the identification of an organization's internal strengths that actively contribute to its growth.

- Consistent Growth: Emphasizes the need of safeguarding and preserving internal qualities in order to achieve long-term success.

- Holistic Strength and Weakness Assessment: Identifies internal and external strengths and weaknesses that affect the growth of the organisation.

- Competitive advantage: Allows for the discovery of internal factors that drive company improvements, resulting in a competitive edge over competitors.

Some of the Disadvantages are:

- Choice Overload: It creates a large number of innovative ideas but does not provide clear direction on which one to choose, potentially resulting in choice overload.

- Time-consuming: The process might take a long time, taking resources away from other vital breakthroughs like product or service development.

Four Corners Analysis in Strategic Analysis

Michael Porter's Four Corners Analysis is a model that can help company strategists assess a competitor's intent and objectives and the strengths they are using to achieve them.

It is a useful technique for evaluating competitors, generating insights about likely competitor strategy changes, and determining competitor reactions to environmental changes and industry shifts.

The FCA assists analysts in answering four key questions by examining a competitor's current strategy, future goals, market assumptions, and core capabilities.

a) Drivers

-

Financial goals and external constraints.

-

Corporate culture and business principles.

-

Organizational structure.

-

Leadership team background.

b) Current strategy

-

How business creates value.

-

Where the business is choosing to invest.

-

Relationships and networks the business has developed.

c) Capabilities

-

Marketing skills.

-

Ability to service channels.

-

Skills and training of the workforce.

-

Patents and copyrights.

-

Financial strength.

-

Leadership qualities of CEO

d) Management assumptions

-

Company's perceptions of its strengths and weaknesses.

-

Cultural traits.

-

Organizational value.

-

Perceived industry forces.

-

Belief about competitor's goals.

Conclusion

Strategic analysis is an indispensable tool for organizations aiming to thrive in a dynamic business environment. Understanding internal and external factors provides a clear picture of a company's current standing and potential pathways for growth.

While tools like SWOT and PESTLE offer insights into internal capabilities and external threats, other models, such as Michael Porter's Four Corners Analysis, provide information about a competitor's intent and strategies.

A well-executed strategic analysis identifies strengths and opportunities and equips organizations with the foresight to adapt to potential threats and weaknesses.

Researched and authored by Ranad Rashwan | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?