Annualized Rate of Return

The scaled return an investor receives over a period of one year.

What Is an Annualized Rate of Return?

The Annualized Rate Of Return (AROR) is the scaled return an investor receives over one year. Scaling investment returns down to a 1-year (or 365-day) period lets investors objectively compare asset returns over any period.

The one-year minimum is a Global Investment Performance Standard (GIPS) that disallows the annualization of portfolio or composite returns for less than one year. It prevents projecting the performance of the remainder of the year.

It is essential to understand that AROR is different from annual performance. Using an investment's annualized performance as a gauge, one can estimate how much it will grow over time. However, the actual yearly performance might be different per year.

In other words, AROR is meant to provide an average growth rate per year. It is what it means to annualize the returns of a portfolio or composite.

To annualize the returns of an asset, we need to calculate the AROR. It can be done in multiple ways, depending on the information. AROR can be calculated with the investment's initial and final values, cumulative return, or geometric mean of the ROI per year.

Key Takeaways

- Annualized Rate of Return (AROR) is crucial for evaluating the performance of investment portfolios over time, enabling comparisons across different investments or portfolios on an equal footing.

- Compliance with reporting standards such as the Global Investment Performance Standards (GIPS) requires the use of AROR, ensuring standardized and comparable performance metrics for investors.

- AROR plays a vital role in calculating risk-adjusted returns, allowing investors to assess the excess return generated by an investment relative to the risks undertaken.

- AROR assists in long-term financial planning by helping individuals make informed decisions about asset allocation and expected growth rates for goals such as retirement or education savings.

Calculating Annualized Rate of Return from ROI

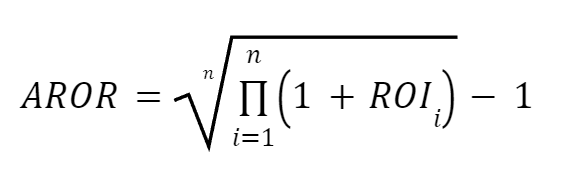

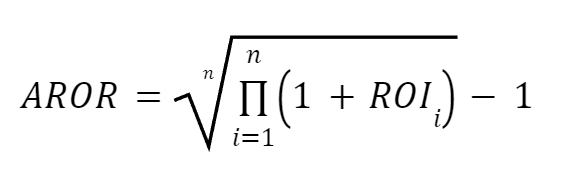

AROR is an average rate of growth per year. That is because AROR can be found using the geometric mean of each year's rate of return (ROI). It is calculated as follows:

Where,

- ROI = investment's rate of return

- i = each year (i = 1,2,3,...,n)

- n = number of years

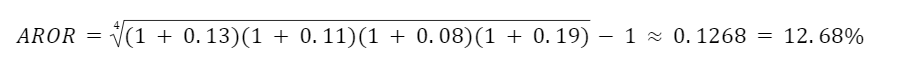

For example, suppose that a portfolio had the following rates of return during the past four years: 13%, 11%, 8%, and 19%. Using the previous formula, we can calculate its AROR to 12.68%.

The geometric mean is used because the interest is compounded over the period. Not only that, but the rate of return per year is independent of the rate of return for any other year.

Calculating AROR by Comparing Initial and Final Values

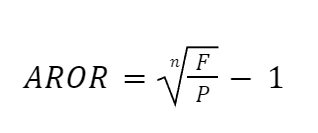

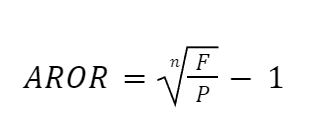

Another way of determining AROR is with the ratio of the final value to the initial value, as given by the following formula.

- F = final value of the investment

- P = initial value of the investment

- n = number of years

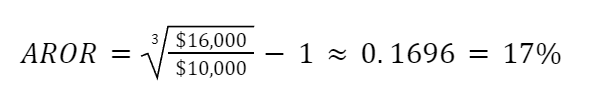

For example, suppose a portfolio was created with an initial investment of $10,000 and then had a value of $16,000 after three years. Its annualized rate of return is approximately 17%.

In this example, we did not need to know the portfolio's performance in each of those three years specifically. However, we can average the portfolio's yearly rate of return to approximately 17%. It could be that the return was less than or greater than 17% in any of those three years.

Thus, AROR can be used as a gauge to predict the future value of an investment in a certain amount of time (years). For example, if this portfolio had an AROR of 17%, we might project that it will have a return of $2,720 after the 4th year, which is 17% of its current value.

While AROR is not the same as the actual rate of return, it is still helpful as a way to predict expectations for the growth of an investment. Using the same example as before, if we wanted to project the portfolio's value after three more years, it is expected to reach $25,626, as seen below.

$16,000 (1 + 0.17)3 ≈ $25,626

Calculating AROR from Cumulative Return

The cumulative return on an investment is the amount the asset has changed over time, regardless of how much time has passed. In other words, it is the percent change of an investment's final and initial values.

CR = [F/P] - 1

- F = final value of the investment

- P = initial value of the investment

Notice that this is calculated without taking its absolute value. The cumulative return can be harmful, indicating that the investment has lost weight over time.

For example, if an initial investment of $100,000 has a $175,000 value after three years, its cumulative return is 75%.

CR = [$175,000/ $100,100] - 1 = 0.75 = 75%

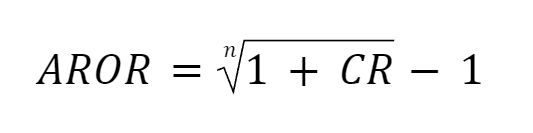

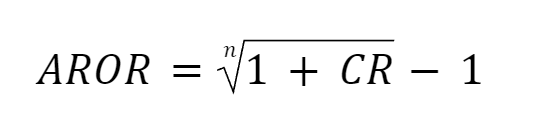

If the cumulative return is known or has already been calculated, then the AROR can be calculated as follows.

- CR = initial value of the investment

- n = number of years

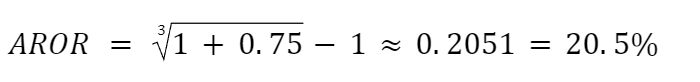

Using the information from the previous example (cumulative return of 75% and duration of 3 years), the portfolio's AROR is 20.5%.

Annualizing by Days

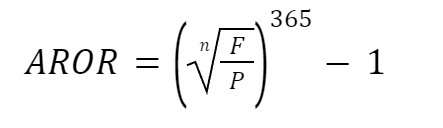

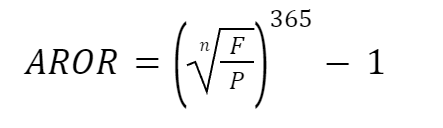

For most investments, annualized returns are calculated according to industry standards. It requires annualizing in terms of days rather than years. In this case, the previous formulas for years are adjusted slightly to become as follows.

Comparing initial and final values:

- F = absolute value of the investment

- P = initial value of the investment

- n = number of days

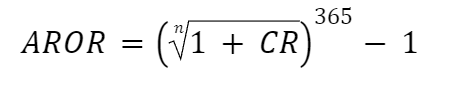

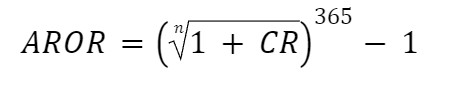

Using cumulative return:

- CR = initial value of the investment

- n = number of days

Notice that the only difference is raising the radical to the power of 365, the number of days in a year, and the radical's index being the number of days instead of years.

Recall that GIPS disallows the annualization of portfolio or composite returns for less than one year. It means that annualization is allowed for any period beyond one year. In other words, we can annualize the rate of return using any number of days beyond 365.

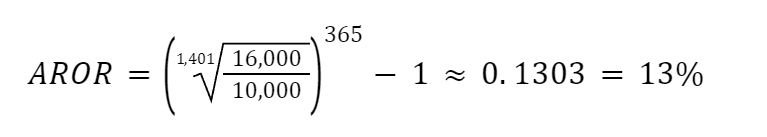

For example, suppose a portfolio was created on March 1, 2019, with an initial investment of $10,000 and then had a value of $16,000 on December 31, 2022. Its annualized rate of return is 13%. (There are 1,401 days from 3/01/2019 to 12/31/2022.)

In this case, since the information known was the initial and final values of the investment, the formula used was the one with investment value inputs.

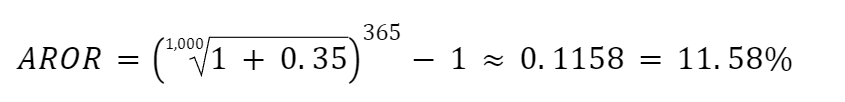

Let's look at another example. Suppose an investment was held for 1,000 days, earning a cumulative return of 35%. Its annualized rate of return is 11.58%.

Since the information is the cumulative return, the formula used was with the incremental return input.

Annualizing by days is more convenient when an investment's period is not within a full year. Since annualization cannot be reported for less than one year, using days past the one year can yield a better average of this metric.

Reporting Annualized Rate of Return

Per the GIPS standards, investment firms must follow specific ethical principles when making reports. Almost all of these require annualization. This annualization is from inception as of each annual period end.

Due to their nature, annualized rates have stringent and precise reporting procedures. Since they are essentially a yearly geometric growth average, presenting the results only in the best light is possible. This is why annualization for less than a year is disallowed.

One such requirement is when calculating money-weighted returns. The firm must calculate them annualized since inception. For those that are less than one year, the non-annualized rate of return since inception is reported.

For composites, the firm needs to present the corresponding annualized return of not just the composite but also the benchmark. The model refers to whatever the firm used to compare results, whether the S&P 500, Russell, or others.

These are just some examples of why AROR is essential. GIPS-compliant firms must report the annualized rates of multiple things as part of the reporting requirements. These standards are meticulous and precise in how these metrics must be reported.

When to use Annualized Rate of Return?

One useful statistic that is applied in a variety of financial situations is the Annualized Rate of Return (AROR). Here are a few situations when it's frequently used:

1. Evaluation of Investment Performance: AROR is a commonly used metric for evaluating an investment portfolio's long-term performance. By annualizing returns, investors can compare the performance of various assets or portfolios on an equal basis, irrespective of their time horizons.

2. Hedge funds and mutual funds: Investors frequently utilize AROR to assess the past performance of hedge funds and mutual funds. This enables users to evaluate the fund's annual performance, making it easier to compare it to other investment options or benchmarks.

3. Risk-adjusted Returns: The Sortino ratio and the Sharpe ratio are two examples of risk-adjusted returns that are calculated using AROR. These ratios calculate the excess return on investment for each unit of risk assumed.

Note

Standardizing the measuring period requires annualizing returns.

4. Reporting Standards Compliance: As previously indicated, AROR is necessary to meet reporting requirements such as the Global Investment Performance Standards (GIPS). Annualized returns must be reported by investment businesses in order to give investors consistent and similar performance measurements.

5. Forecasting Future Returns: While past performance is not indicative of future results, AROR can still be useful for forecasting future returns. By analyzing historical annualized returns alongside other factors, such as market trends and economic indicators, investors may gain insights into potential future performance.

6. Long-Term Financial Planning: AROR is valuable for long-term financial planning, such as retirement planning or education savings. By understanding the annualized returns of various investment options, individuals can make informed decisions about asset allocation and expected growth rates.

Conclusion

The Annualized Rate of Return (AROR) is a crucial financial indicator that provides investors, analysts, and regulatory authorities with valuable information and strategic advantages.

Our investigation has clarified AROR's complex nature, including its function in risk assessment, forecasting, compliance reporting, performance evaluation, and long-term financial planning.

Through the utilization of AROR, stakeholders can obtain standardized performance measures that are crucial for assessing investment portfolios, contrasting various investment possibilities, and arriving at well-informed judgments that are consistent with their financial goals.

Adherence to industry norms like the Global Investment Performance Standards (GIPS) emphasizes how crucial AROR is for offering comparable and transparent performance data, which builds credibility and trust in the investing community.

Moreover, AROR is a crucial metric that helps investors evaluate how well investment strategies generate returns in comparison to the risks they take.

Its usefulness goes beyond looking backward; it provides insightful information for predicting future returns and directing long-term financial planning projects like funding education and retirement accounts.

Annualized Rate of Return FAQ'S

AROR is the scaled return an investor receives over one year. It is not the same as the annual rate of return.

Calculating AROR depends on the information used to determine it and the timing.

a. Calculating AROR from ROI

- ROI = investment’s rate of Return

- i = each year (i = 1,2,3,...,n)

- n = number of years

b. Calculating AROR by Comparing Initial and Final Values

i. By years

- F = final value of the investment

- P = initial value of the investment

- n = number of years

ii. By days

- F = final value of the investment

- P = initial value of the investment

- n = number of days

c. Calculating AROR from Cumulative Return

i. By years

- CR = initial value of the investment

- n = number of years

ii. By days

- CR = initial value of the investment

- n = number of days

AROR can be used to either:

- Compare the performances of investments

- Forecast investment growth

- Meet GIPS requirements when reporting for GIPS-compliant firms

Everything You Need To Master DCF Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?