Forex Trading

The World's Largest Financial Market

The forex market is often regarded as one of the most liquid markets. Liquidity refers to the ease of making a transaction with a particular asset due to the availability of more buyers and sellers in the market.

Currency trading may be challenging and risky. For example, rogue traders find it challenging to affect the value of a currency because of the system's massive transaction flows.

Investors with access to interbank dealing can benefit from this system's contribution to market transparency.

Retail investors should take the time to educate themselves on the forex market before deciding which forex broker to work with. They should also determine whether the broker is regulated in the US, the UK, or a nation with looser regulations and monitoring.

Finding out what kind of account protections are offered in the event of a market crisis or the insolvency of a dealer is also a smart idea.

The worldwide forex market is a decentralized market, unlike equities, which are traded on a centralized stock exchange like the NYSE or NASDAQ.

The majority of forex transactions are conducted off-exchange or over-the-counter. It is a decentralized global market in which all currencies can be exchanged with one another.

With millions of players, the forex market is huge, even bigger than modern-day equity markets. Thousands of people, money changers, banks, and hedge fund managers all participate in the currency market.

Forex trading volume is estimated to be around $5.5 trillion per day. In comparison, the bond market trades about $600 billion every day, while the stock market trades around $200 billion per day.

Every day, the total daily value of all global stock trading is about the same as one hour of trading within the FX market.

Key Takeaways

- The forex market is highly liquid, making it easy to transact due to numerous buyers and sellers.

- Currency trading can be challenging and risky, but rogue traders have limited influence due to the massive transaction flows.

- Retail investors should educate themselves about forex trading, choose regulated brokers, and consider account protections.

- The forex market is decentralized, with currencies traded off-exchange, with a daily trading volume of over $5.5 trillion.

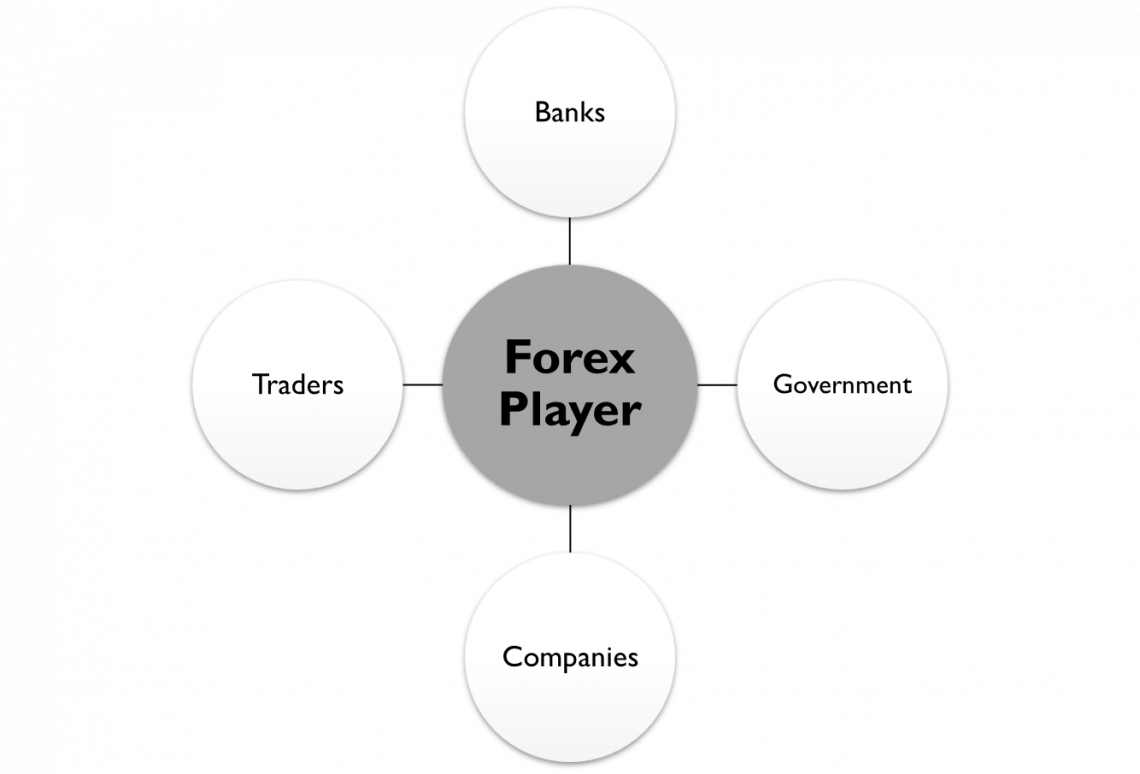

- The forex market involves various participants, including banks, governments, companies, and individual traders, with the US dollar dominating major currency pairs.

Various participants in the forex market?

Whether you're a novice trader or an investment specialist, you will have the opportunity to earn money in the foreign exchange market.

1. Banks

Commercial and investment banks make up the largest category of forex traders in terms of the overall dollar worth of trading they account for.

Banks handle a significant amount of currency trading for their clients that undertake international commerce and trade.They also trade aggressively in their accounts and act as market makers in currency trading.

So, for example, if a banker ever warns you against forex trading, you should inquire as to why their bank invests so much in the currency market if it is such a terrible investment.

2. Government

Governments have a significant role in the FX market through their central banks.

A country's central bank would frequently take huge positions in purchasing or selling its currency to regulate the currency's relative value and battle inflation or enhance the country's balance of trade.

Interventions by central banks in the foreign exchange market are comparable to policy-driven interventions by central banks in the bond market.

3. Companies

Large international companies are also heavily involved in forex trading, with yearly transactions totaling hundreds of billions of dollars. Corporations can hedge their core business activities in other nations by using the FX market.

4. Trader

Individual forex traders, or speculators who trade the forex market in search of investment rewards, are last but not least.

This group comprises a diverse cast of characters, ranging from professional investment fund managers to individual small investors with varying degrees of experience, expertise, and resources when they enter the market.

More about the forex Trading

Forex trading, or the exchange of foreign currencies, has become an increasingly popular method of investment for traders around the globe.

As the world's largest financial market, with a daily trading volume exceeding $6 trillion, Forex provides an exciting and complex dynamic environment.

The following insights will offer more about overview of what Forex trading entails:

1. Currency Pairs

The forex market deals in various exchange rates of currency pairings such as the Euro and the US dollar.

The first currency in an exchange rate quotation is known as the base currency, and the second currency is known as the quote currency.

A currency pair's exchange rate is represented by a number such as 1.1235. For example, if the pair EUR/USD is stated at 1.1235, it signifies that one EURO costs $1.12 (35/100th) in US dollars.

Naturally, the most commonly traded currency pairings are those involving the most widely used currencies in the world: the US Dollar, the Euro, the British Pound, and the Japanese Yen.

2. Pips

A "pip" is the smallest change in the exchange rate between two currencies in general. A pip equals 0.0001 in most currency pairings that are quoted up to four decimal points.

The lone exception is the Japanese Yen currency pairings, which are only quoted to two decimal places, equating to a pip of 0.01. Many brokers now quote to the fifth decimal place, with the final digit being a fractional 1/10th of a pip.

FX traders now have access to non-standard lot sizes. For example, a regular lot consists of 100,000 units of any currency, whereas a mini-lot is 10,000 units and a micro-lot is 1,000 units.

The value of a pip is determined by the currency pair being traded as well as the lot size. A pip is generally equal to $10 (US) for one regular lot, $1 for trading mini-lots and 10 cents for trading micro-lots.

A pip's value changes significantly depending on the currency pair being traded, although the statistics are quite accurate for all pairs.

3. Liquidity

The degree to which an item may be purchased or sold in the market rapidly at a price that reflects its intrinsic value is referred to as liquidity. The average daily volume traded in the currency market in 2022 will be above $6.6 trillion.

4. Diversity

The pairings are derived from the eight major currencies (USD, EURO, GBP, CHF, CAD, AUD, NZD, and JPY). Furthermore, several regional currency pairs are accessible for trading. There are more possibilities, which means more opportunities to trade and earn.

5. Accessibility

The FX market is open twenty-four hours a day and five days a week (24/5). As a result, you have complete control over when and how you trade.

6. Margin

A large portion of forex currency pairs is traded on margin. This is because leverage may be utilized to assist you in purchasing and selling large amounts of current assets. The more the quantity, the higher the profit or loss potential.

7. Minimal commissions

When compared to other markets, Forex has very low expenses and fees. Some businesses don't even charge a fee; you only pay the bid/ask for a spread. True Electronic Communication Network firms could even provide a zero-spread alternative.

Type of Currency Pairs

The US dollar is the most traded, prominent, and powerful currency in the world. The main reason for this is the size of the US economy, which is the largest in the world.

In most currency exchange operations, the US dollar is a globally favored base or reference currency. The currency pairings listed below are some of the most traded (high liquidity) in the world:

- EUR/USD (Euro versus US Dollar)

- GBP/USD (British Pound-United States Dollar)

- USD/JPY (United States Dollar-Japanese Yen)

- USD/CHF (United States Dollar-Swiss Franc)

- EUR/JPY (European Union versus Japanese Yen)

- USD/CAD (U.S. Dollar–Canadian Dollar)

We may divide currencies into three broad categories based on the amount of trading volume they generate:

1) The Majors

All currencies that are traded against the US dollar are the main currency pairings that have the highest liquidity, with EUR/USD being the most liquid.

When learning how to trade forex, the great majority of individuals focus on the seven most liquid currency pairs forex trading world:

- EUR/USD (euro/dollar)

- USD/JPY (dollar/Japanese yen)

- GBP/USD (British pound/US dollar)

- USD/CHF (US dollar/Swiss franc)

- AUD/USD (The Australian dollar/US dollar)

- USD/CAD (Dollar/Canadian dollar)

- NZD/USD (New Zealand dollar/US dollar)

These primary currency combinations, together with a variety of other combinations, account for more than 94 % of all speculative and retail forex trading in the forex market.

You have probably noticed that the US dollar dominates the major currency pairs. This is because it's the most frequently utilized reserve currency in the world, accounting for around 88 percent of all currency transactions.

2) The Minors

These are currency pairs that do not trade against the US Dollar. They are also known as “cross-currency pairs”. For example, EUR/GBP or EUR/CHF. They provide less trading liquidity.

As a reason, minor currencies such as the British pound, Euro, and Japanese yen are among the most frequently exchanged:

- EUR/GBP (euro/pound sterling)

- EUR/AUD (euro/Australian dollar)

- GBP/JPY (British pound/Japanese yen) is a currency pair

- (CHF/JPY) Swiss franc/Japanese yen

3) The Exotics

They are currencies that are tied to rising economies throughout the world. Examples of exotic currencies that can also be traded are:

- South African Rand

- Brazilian Real

- Turkish Lira

- Indian Rupee (INR)

- Thai Baht (THB)

- Norwegian Krone (NOK)

In the past, brokers would only enable currency exchange to USD. If someone wishes to swap a currency other than the US dollar, they must first convert to the US dollar and then back to the chosen currency.

This was an extremely stressful and time-consuming procedure. As a result, companies progressively began to provide certain currency combinations in order to remove these limits and expedite the processing of requests.

On the other hand, these unexpected contributions came with a higher amount of risk and instability.

Although there is no such thing as an "optimal" currency for trading, a trader does want a certain amount of liquidity and accessibility.

How to Choose the Best Forex Broker

So, where do you begin when it comes to FX trading? You can't trade forex without a broker, so you'll need to find one first.

It's common to gravitate towards major brands or companies in the forex sector, but the "best" forex broker is typically subjective, with each having its own set of advantages and disadvantages.

It should come down to personal preference, the pairings you want to trade, the platform you want to use, whether you want to trade spot markets or per point, or just simplicity of use.

Below is a list of comparative considerations that should be reviewed before saying yes or no to a broker. Some may be more essential to you than others, but they all deserve consideration. All of these criteria are detailed in the individual reviews for each brand.

1) Lowest Transaction Fees

Spreads, commissions, and overnight costs are all factors to consider when calculating your profit on a single trade.

Due to the high frequency of trading, these charges can quickly escalate, so evaluating fees will be an important part of your broker selection process. Commission-free trading is available from brokers like RobinHood, although this is generally offset by higher spreads.

Inactivity or withdrawal fees are also worth noting because they might deplete your account balance.

2) Spreads

Although spreads are partially covered by trading expenses, they are frequently used as a comparative factor on their own. The difference between the bid and ask prices quoted by the broker is known as the spread.

With forex trading, spreads can fluctuate dramatically and significantly impact profitability.

Remember that you are not bound to a single broker, so if you trade many currency pairs, you may compare brokers to get the best spreads. Multiple accounts can also give diverse teaching resources while learning how to trade forex.

Having many accounts is acceptable to take advantage of the best spreads on each deal. However, watch for slippage that frequently 'hides' larger spreads. Slippage is the discrepancy between the price at which an order is expected to be executed and the price at which it actually is implemented.

The term slippage is widely used in the financial industry and refers to FX and stock markets. Slippage might result in a lower profit or a bigger one. Knowing how it happens and how to mitigate its adverse effects is crucial.

The Profit Opportunity Forex Market

The forex market is one of the most tempting markets for traders. Forex trading has increased in popularity since retail trading by individual small investors became more freely available at the turn of the century.

The chance to create a trading account with as little as $50 - $100 and transform that modest sum into millions in a matter of years is extremely tempting.

On the other hand, the allure of "quick money" from FX trading might be deceiving. The truth is that most forex traders lose money, and just a small fraction of traders consistently make money in the market.

Not only is a strong, effective trading technique important in forex trading, but also traits like trading discipline, patience, and risk management play a crucial factor.

As a lot of super-successful forex traders have summed up the key to their success: "Just avoid incurring significant losses until you stumble onto a gigantic profit."

Most traders fail because they risk all of their trading capital and are left with no money to deal with when a million-dollar trading opportunity arises.

or Want to Sign up with your social account?