International Swaps and Derivatives Association (ISDA)

The group strives to create and manage rules and laws governing the trading of derivatives.

What Is the International Swaps and Derivatives Association (ISDA)?

The International Swaps and Derivatives Association comprises about 800 participants from over 60 nations globally. In 1992 this association created a contract that helped regulate the derivative transactions in the financial markets.

The ISDA Master Agreement was formed as a guiding light for financial institutions as well as individual traders and investors.

The group strives to create and manage rules and laws governing the trading of derivatives.

The persons and organizations included in the ISDA typically use derivatives. These entities are industries that use over-the-counter (OTC) derivatives, dealers, and service providers.

The InternationalSwaps and Derivatives Association additionally assists in regulating the Financial products and Markup Language (FpML), which is the terminology used to transact in derivatives.

ISDA was founded in 1985 and later renamed “Swaps and Derivatives.”

The change came primarily because the organization wanted to focus on diverse subjects that included derivatives and swaps. It did not want to look like it was focusing just on the swaps markets.

After approving regulatory changes to the CDO payouts (Pay as You Go), individuals, investors, and banks benefited immensely from this move.

This move came in 2005, and a few banks that made it big during that period include Goldman Sachs, Deutsche Bank, and others.

Scott O’Malia had been appointed as the CEO of the ISDA. Along with Singapore, ISDA has Washington, D.C., Brussels, Hong Kong, London, New York, and Tokyo offices. Spread over six continents, it has more than 800 member organizations.

Around 900+ service providers, end users, and derivatives dealers from 75 countries are members of the ISDA.

A Brief Introduction to Derivatives

Derivatives are contracts or products that derive their value from something else. In finance lingo, a derivative contract derives its value from an underlying asset: a stock or an index.

Derivatives are generally based on a very wide range of underlying assets.

These are:

- Energy stocks (such as oil, crude oil), electricity, coal, natural gas, etc.).

- Foreign Exchange

- Metal stocks (such as gold, silver, aluminum, copper, zinc, nickel, tin, etc.).

- Agricultural commodities (such as cotton, coffee, pulses, wheat, etc.).

- Financial assets (such as shares and bonds)

History Of Derivatives

It is possible to map the history of derivatives back several centuries. The major milestones in the evolution of the derivatives markets have been mentioned below:

- 12th Century: During this period, the sellers in the European trade fairs signed contracts that promised the future delivery of the items they sold.

- 13th Century: This period set an example of a ‘contract.’ The English Cistercian monasteries frequently sold their wool up to 20 years in advance, using such contracts to foreign merchants.

- 1634-1637: The famous ‘Tulip Mania’ in Holland, where fortunes were lost after there was a speculative boom in the future tulip burst during that period.

- 17th Century: A futures market in rice was established in Japan at Dojima, near Osaka, to protect the interests of the rice producers from war and bad weather.

- 1848: Trading in forward contracts on various commodities was established by the Chicago Board of Trade (CBOT) for the first time.

- 1865: They went a step further, and the CBOT released the first ever ‘exchange traded’ derivative contract in the United States. These contracts were referred to as “futures contracts.”

- 1919: The first ever organization to facilitate trading in futures contracts was the Chicago Mercantile Exchange (CME).

- 1972: Currency futures trading began around this year. It was established by the CME and introduced the International Monetary Market (IMM), which allowed trading in currencies

- 1973: During this period, the Chicago Board of Options Exchange became the first marketplace for facilitating trading in listed options.

- 1975: The first successful pure interest rate futures contracts, i.e., “Treasury Bills,” were introduced by CBOT.

- 1982: The CME introduced the Eurodollar futures contracts. Additionally, the first stock index futures were launched by the Kansas City Board of Trade.

- 1983: The first options on stock indices with the S&P 100 (OEX) and the S&P 500 (SPXSM) indexes were introduced by the Chicago Board of Options Exchange.

The Need For a Regulatory Body like ISDA

The International Swaps and Derivatives Association was founded to regulate the swaps and the derivatives markets while ensuring effective transactions.

The association achieves this by offering templates to institutions and market participants. It helps to connect and discuss shared problems and concerns.

The three major areas of focus for the ISDA are

- Enhancing the industry's operational infrastructure for derivatives

- Minimizing the counterparty credit risk

- Increasing transparency

Some of the few challenges that were faced at the time of the creation of the derivatives markets led to the formation of the ISDA.

Derivatives being highly leveraged products, were in high demand as the world of finance became more globalized and interconnected.

Derivative transactions come with their set of pros and cons. However, the industry lacks to highlight these benefits and drawbacks. The ISDA plays a pivotal role in this scenario.

With the aim of delineating the world of derivatives and promoting its growth, the association was established with the objective of assisting institutions and individuals regarding ethical derivative practices.

The member institutions at the ISDA are constituted of participants from various levels in the derivative markets like

- Multinational banks

- Clearing houses

- Derivative exchanges

- Law firms

- Investment managers

- Commodities corporations

FpML and its Significance

The FpML is an electronic language used for trading and facilitates derivatives transactions. Trademarked by the International Swaps and Derivatives Association, the application is an open-source platform.

It is primarily used for sharing business information in the derivatives markets. It is used to process OTC derivatives.

Being an open-source platform, anyone who is a member of the International Swaps and Derivatives Association can contribute to it and access it for free. The FpML Standards Committee approves any modifications or additions to the FpML.

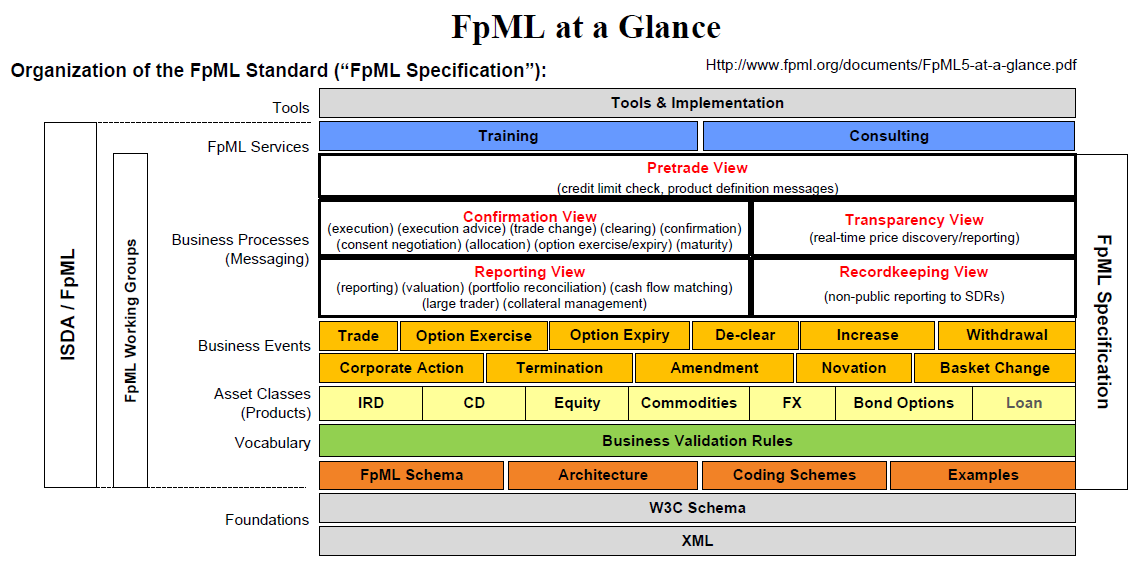

Below is the breakdown of the FpML specifications:

Significance Of FpML

- It is used in OTC derivative transactions between businesses as a commercial information exchange platform.

- It facilitates the sharing of information about OTC transactions within a company and participating firms. Additionally, it assists in sharing information with third-party entities and the participating company.

- FpML is primarily used for Forward Rate Agreements (FRA) and interest rate swaps, but it will eventually be adopted for all OTC transactions.

- With the help of FpML, negotiations of OTC contracts can be done electronically. Likewise, risk assessment, settlement information sharing, and contract execution are also held electronically.

- To increase transparency.

- To improve the industry’s operational infrastructure.

OTC contracts shared by two businesses are individualized according to the entity's requirements. Due to this, the OTC contract process could not be completed online until the development of the Internet and XML.

FpML has been examined and adopted by Chase Manhattan Bank for their OTC interest rate derivative applications. In addition, Fuji Capital Markets Corporation utilized the FpML definition to develop their XML-based FRA confirmation prototype.

J.P. Morgan, Bank of America, Citigroup, Deutsche Bank, IBM, and PWC also created fpML interest rate swap prototype applications.

The Bible for Derivative Transactions: ISDA Master Agreement

The ISDA Master Agreement is for those who engage in over-the-counter derivative transactions. It is a universally accepted document that focuses on giving specific legal and credit protection.

OTC derivatives are mainly used for hedging. Entities wishing to transact in such OTC derivatives have to adhere to the terms of the Master Agreement that serve as a guide.

By executing an interest rate swap to "lock in" a set interest rate for a fixed length of time, a business, for instance, may desire to protect itself against adverse movements in medium or long-term interest rates.

Moreover, the use of OTC derivatives for speculating is also possible. The Agreement is divided into 14 Sections in both situations, each describing the concerned parties' contractual obligations.

In addition, it contains typical clauses that describe what happens if one of the parties defaults, such as bankruptcy, and how OTC derivative transactions are ended or "closed out" after a default.

events of default under the ISDA Agreement

There are eight standard events of default, along with five standard termination events, that generally address the various situations where an entity may default, leading to adverse outcomes for one or both parties involved.

A schedule is a subject of negotiation that enables the entities to add or alter the standard terms in addition to the Master Agreement language.

The most frequently triggered event of default under normal circumstances is the Bankruptcy Event of Default.

Negotiating the schedule's conditions typically takes two to three months. The length of time often depends on how difficult the changes must be made.

When parties conduct separate transactions, a confirmation detailing those specific transactions is created (either on paper or electronically).

The conditions of the Agreement are then applicable to all of the deals. The most important point to remember is that all transactions depend on one another and that the ISDA Master Agreement is a netting agreement.

Failing to comply with one transaction constitutes a failure to comply with all transactions.

The single agreement notion is described in Section 1(c), which is essential since it serves as the foundation for close-out netting. The idea is that all transactions will be canceled without exception if an event of default takes place.

The close-out netting idea forbids a liquidator from "cherry picking," or picking and choosing certain transactions to pay for on behalf of his insolvent client and foregoing those that are not profitable.

OTC derivative trades may be entered into without an ISDA Master Agreement, and when this occurs, the confirmation frequently contains a commitment from the parties.

Initially, it can appear intimidating due to its lengthy text (28 pages in the 2002 version), numerous defined terms, and cross-references.

The confirmation is generally in regards to a Master Agreement that will be developed and signed within a 30, 60, or 90-day time period.

It has to be ascertained that all issues have been addressed appropriately.

Achievement Of ISDA

The sole aim of establishing such an organization was to regulate and ensure the smooth functioning of the derivatives and swaps markets.

Some of the achievements of ISDA are listed below.

- It focused on standardizing the derivatives markets for various market participants such as clearing houses, institutional banks, investors, etc.

- It assisted in creating an infrastructure and framework that enabled these entities to transact ethically in the derivatives and swaps markets.

- It can be utilized by any company or individual engaged in the buying or selling of derivatives.

- Its primary contribution is the open-source platform “FpML,” which has significantly brought about positive changes to the derivative markets throughout the globe.

- The goal behind establishing this contract was to mitigate the risks around trading in derivatives. As derivatives are high-risk instruments, such a system was highly needed.

Along with financial institutions, the association also assists individuals in trading in the derivative markets.

Since its inception, the association has led efforts to pinpoint and eradicate the risks associated with derivative trading and establish a well-defined risk management methodology.

or Want to Sign up with your social account?