Long Strangle

A trading strategy where an investor purchases both a call option and a put option simultaneously

What Is A Long Strangle?

In a long strangle, an investor purchases both a call option and a put option simultaneously. The call option has a strike price surpassing the put option, and both options share an identical expiration date.

This approach becomes lucrative when the underlying asset's price experiences a significant movement in either direction. The risk for the investor is limited to the total premium paid for both options.

Conversely, a short strangle involves selling a call and a put option with different strike prices but the same expiration date. In this scenario, the trader profits from low volatility, expecting the underlying asset's price to remain within a specific range until expiration.

However, the risk in this strategy is theoretically unlimited, as the underlying asset's price can move significantly beyond the chosen strike prices.

The key to success with a strangle strategy is accurately predicting the magnitude of the price movement and the timing of such a move.

Traders often deploy these strategies in anticipation of events such as earnings reports, where a stock's price will likely experience significant volatility.

It's crucial for investors employing these to be aware of the associated risks and to have a solid understanding of options pricing and market dynamics.

While potentially rewarding, the strangle strategy requires careful consideration and is best suited for experienced traders who can effectively analyze and respond to market conditions.

The reader can read more about this option trading strategy and its application in hedging against a price increase here.

Key Takeaways

- A long strangle is an options trading strategy where an investor simultaneously buys a call and a put option with distinct strike prices but shares the same expiration date.

- A long strangle is utilized by investors anticipating significant price volatility in an underlying asset, providing the flexibility to profit from substantial moves in either direction.

- The strategy is named for its potential to "strangle" the market, capitalizing on pronounced price swings, and is often deployed ahead of events like earnings reports.

- A comparison with a short strangle emphasizes that while the long strangle offers a broader profit zone, it comes with limited risk, unlike the short strangle, which carries theoretically unlimited risk.

Using the Long Strangle Strategy

In a long strangle, an investor purchases both a call option and a put option, each with a different strike price but the same expiration date. This strategy is akin to setting up a wide profit zone around the current market price.

Option traders would make use of this particular strategy when they expect a large move in the price of the underlying asset. However, they aren’t sure which direction the price will move in this case. It could either move up or decline.

The underlying asset is expected to experience a significant move—either soaring above the higher strike price of the call option or plummeting below the lower strike price of the put option.

Because this strategy involves buying two options - a put and a call, the underlying asset must experience a rather large price change to go above or below the break-even point.

Strangles are often implemented before earnings reports are released, new products are introduced, and before FDA announcements.

The goal is to profit from the magnitude of the move, and the risk of this strategy is limited to the total premium paid for both options.

Profit and Loss with a Long Strangle

Imagine you're an options trader with a keen eye on company XYZ. You've been closely following the developments of this cutting-edge startup, and they’re about to release a revolutionary product.

The stock of this company has been relatively stable. Still, you anticipate that the impending product launch could lead to a substantial price swing.

To position yourself to profit from this volatility, you decide to implement a long strangle strategy, aiming to capture potential gains regardless of the direction the stock takes post-launch.

Let's say the current stock price is $100, and the product launch is scheduled for next month.

1. Buy a Call Option

- Buy one call option with a strike price of $110 for a premium of $5 per share.

- Cost of the call option = $5 * 100 shares (per contract) = $500

2. Buy a Put Option

- Buy one put option with a strike price of $90 for a premium of $4 per share.

- Cost of the put option = $4 * 100 shares (per contract) = $400

Total Cost of the Long Strangle = Cost of Call + Cost of Put = $5 + $4 = $9 per share

Since there are 100 shares in a contract, it would be $900 per contract.

Examples

Now, let's explore the scenarios:

Scenario 1: Stock Price Rises (e.g., $120) by Expiration

The call option is in the money and has a value:

$120 (stock price) - $110 (call strike) = $10

Remember, there are 100 shares in a contract. Therefore,

call option value = $10 * 100 = $1000

The put option expires worthless.

Net Profit = Value of Call - Total Cost = $1000 - $900 = $100

Scenario 2: Stock Price Falls (e.g., $80) by Expiration

The put option is in the money and has a value:

$90 (put strike) - $80 (stock price) = $10

Remember, there are 100 shares in a contract. Therefore,

Put Option value = $10 * 100 = $1000

The call option expires worthless.

Net Profit = Value of Put - Total Cost = $1000 - $900 = $100

Scenario 3: Stock Price Stays Between $90 and $110 by Expiration:

Both options expire worthless.

Net Loss = Total Cost of the Long Strangle = $900

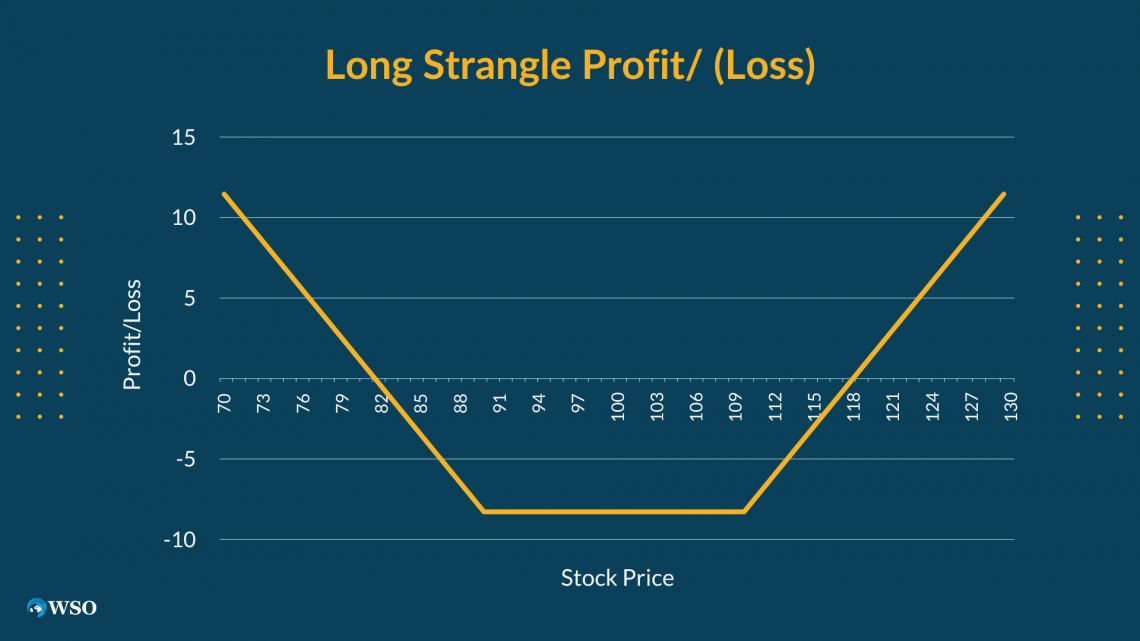

Here is a diagram depicting the payoff profile of this option trading strategy. From this diagram, we can see that there are 2 break-even points (BEP):

BEP 1 = Lower Strike Price - Total Premium = $90 - $9 = $81

BEP 2 = Higher Strike Price + Total Premium = $110 + $9 = $119

A long strangle is a strategy used when an investor anticipates a significant price movement but is uncertain about the direction. The loss is limited to the total cost of the options, and the strategy profits from a substantial price swing in either direction.

This strategy requires careful consideration of the time decay and volatility factors, and it is typically employed when the investor expects a high degree of price movement.

Short Vs. Long Strangle

Deciding whether you should execute a short or a long strangle is quite important; they’re both very different strategies that one would employ based on one’s market expectations.

The main differences between these two option trading strategies are highlighted in the table below:

| Aspect | Long Strangle | Short Strangle |

|---|---|---|

| Position | Buys a call option and a put option | Sells a call option and a put option |

| Expectation | Anticipates significant price movement, unsure of direction | Anticipates minimal price movement within a specific range |

| Risk and Reward | Limited risk (total premium paid for both options), theoretically unlimited profit | Theoretically unlimited risk (no cap on price movement), limited profit to the premium received from selling options |

Your pick depends on how you see the market and how much risk you're okay with.

Conclusion

The long strangle is a dynamic options trading strategy investors employ to capitalize on significant price movements in an underlying asset, embracing uncertainty and profiting from volatility.

This approach entails acquiring a call option at a higher strike price and a put option at a lower strike price, both set to expire on the same date.

The goal is to benefit from a substantial move in either direction, providing a flexible approach to navigating unpredictable market conditions.

While this strategy offers a wide profit zone, accommodating both upward and downward movements, it comes with the risk of a limited loss, restricted to the total premium paid for both options.

Traders often deploy this strategy to anticipate events like earnings reports, where heightened volatility is expected.

The strategy's success hinges on accurately predicting the magnitude and timing of price movements, demanding a nuanced understanding of options pricing, market dynamics, and effective risk management.

Compared to its counterpart, the short strangle, which profits from low volatility but carries theoretically unlimited risk, the long strangle is well-suited for experienced traders who can analyze and respond to market conditions effectively.

We see the importance of strategic decision-making in options trading, considering market outlook, risk tolerance, and the expected level of volatility.

It is crucial for investors to be aware of the associated risks and to approach this strategy with a solid understanding of options pricing, market behavior, and effective risk management practices.

or Want to Sign up with your social account?