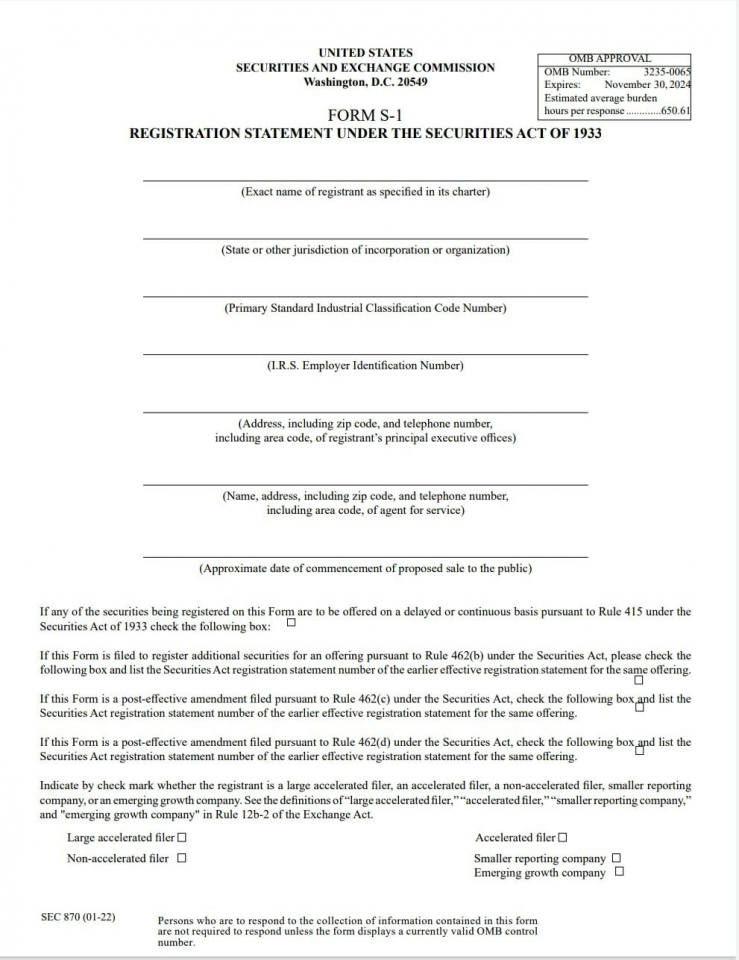

SEC Form S-1

It is the initial form for registration of new securities required by the Securities and Exchange Commission for public companies based in the United States.

What is SEC Form S-1?

SEC Form S-1 is the initial form for registration of new securities required by the Securities and Exchange Commission (SEC) for public companies based in the United States.

Securities that meet the criteria must have an S-1 filing before listing shares on a national exchange, such as the NYSE.

The S-1 form contains an OMB approval number of 3234-0065, and the online form is only eight pages long.

Companies file the SEC Form S-1 in anticipation of their initial public offering (IPO).

The form requires companies to provide information on the details of the current business model and competition and planned use of capital proceeds.

It also provides a brief prospectus of the planned security, offering price methodology, and if any dilution will occur to other listed securities on the stock exchange.

The SEC Form S-1 is also known as the registration statement under the Securities Exchange Act of 1933.

The SEC also requires the disclosure of any business dealings between the company, its directors, and outside counsel.

Since April 2012, it has been possible for "emerging growth companies" Under the Jumpstart Our Business Startups Act to file a Form S-1 on a confidential basis, only making the contents public 21 days before the road show for the IPO.

As a result, it quickly became a popular method for well-established companies to conduct securities offerings.

How to file SEC form S-1

Companies use the SEC's online EDGAR system to submit forms, including Form S-1, that the SEC requires. Individuals or companies must first fill out a Form ID, an electronic application used to apply for a CIK (Central Index Key), and get access codes to file on EDGAR.

EDGAR Filers Quick Reference Guides guide all the required steps, technical specifications, and FAQ answers.

What Information Does SEC Form S-1 Require?

Form S-1 has two parts: Part I and Part II.

Part I, which is also called the prospectus, is a legal document that requires information on the following:

- Business operations,

- The use of proceeds,

- Total proceeds,

- The price per share,

- A description of management,

- Financial condition,

- The percentage of the business being sold by individual holders and

- Information on the underwriters.

Part I includes the following items:

- Item 1. Forepart of the Registration Statement and Outside Front Cover Page of Prospectus.

- Item 2. Inside Front and Outside Back Cover Pages of Prospectus.

- Item 3. Summary Information, Risk Factors, and Ratio of Earnings to Fixed Charges.

- Item 4. Use of Proceeds.

- Item 5. Determination of Offering Price.

- Item 6. Dilution.

- Item 7. Selling Security Holders.

- Item 8. Plan of Distribution.

- Item 9. Description of Securities to be Registered.

- Item 10. Interests of Named Experts and Counsel.

- Item 11. Information concerning the Registrant.

- Item 11A. Material Changes.

- Item 12. Incorporation of Certain Information by Reference.

- Item 12A. Disclosure of Commission Position on Indemnification for Securities Act Liabilities.

What Information Does SEC Form S-1 Not Require?

Part II is not legally required in the prospectus. This part includes:

- Recent sales of unregistered securities,

- Exhibits and

- Financial statement schedules.

Part II includes the following items:

- Item 13. Other Expenses of Issuance and Distribution.

- Item 14. Indemnification of Directors and Officers.

- Item 15. Recent Sales of Unregistered Securities.

- Item 16. Exhibits and Financial Statement Schedules.

Note

The issuer will be liable for material misrepresentations or omissions.

Amending form S-1

The Form S-1 is amended as general market conditions cause a delay in the offering or 'material' information changes. In this instance, the issuer needs to file Form S-1/A.

The Securities Exchange Act of 1933 is often called the Truth in Securities law. This law requires that these registration forms be filed to disclose important information upon registering a company's securities.

This helps achieve the Act's objectives: requiring investors to receive critical information regarding securities offered and prohibiting fraud in selling the offered securities.

Stakeholders, like investors, look at a company's information in its SEC Form S-1 filing to decide whether they want to invest in its stock during an initial public offering.

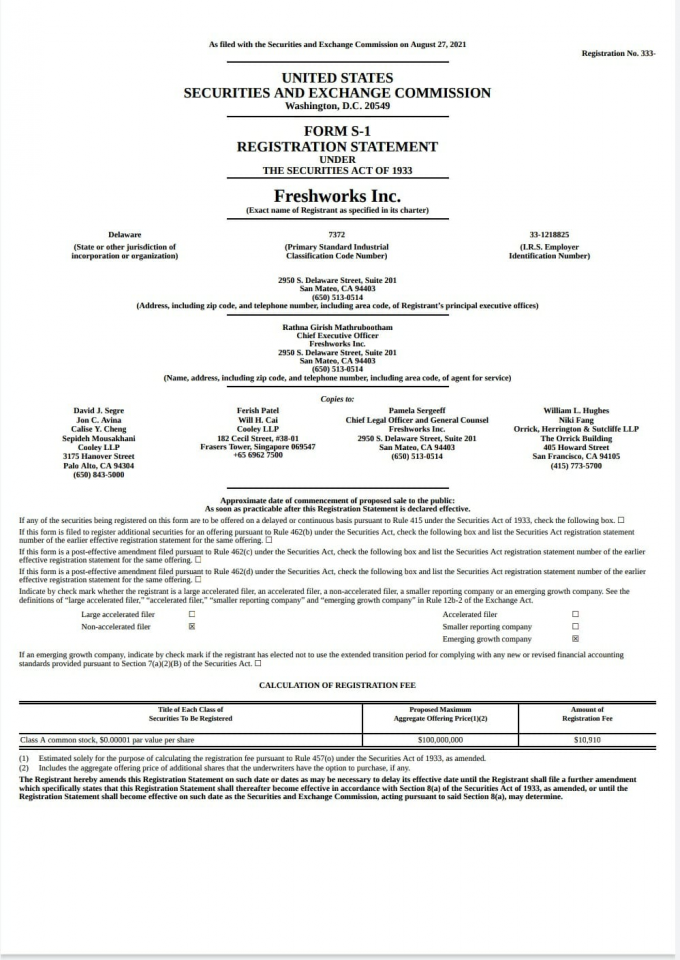

SEC form S-1 registration fee

The registration fee required to submit Form S-1 with the SEC varies by company and also depends on factors including:

- The number of securities to be registered.

- The proposed maximum offering price per unit.

- The suggested maximum aggregate offering price.

Example

Freshworks, Inc., a tech company founded in India, completed its IPO on August 28th, 2021, pricing 28.5 million shares at $36 per share. Form S-1 was filed on August 27th with the SEC.

SEC Form S-1 FAQs

Yes, filing the SEC Form S-1 is mandatory only when registering new securities.

No, a company must file an S-1 only when registering new securities.

No, S-4 are documents that are made publicly available, free of cost.

Foreign companies in the U.S. do not use SEC Form S-1 but instead submit an SEC Form F-1.

An abbreviated registration form is Form S-3, which is for companies that do not have the exact ongoing reporting requirements.

To file amendments to a previously filed Form S-1 with the SEC, the company must file the SEC Form S-1/A.

No, the company is not obligated to file another form S-1 with the SEC. Instead, the registrant may file a separate registration statement that consists only of the following:

- The facing page

- Any price-related information the earlier registration statement omitted

- A statement that the contents of the earlier registration statement are incorporated by reference

- Required opinions and consent

- The signature page

All S-1 filings are available to the public via the SEC's EDGAR database or on the company's own website.

Researched and authored by Rohan Kumar Singh | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?