Securities and Exchange Board of India (SEBI)

It is the statutory regulatory organization of India which regulates the securities market.

The Security and Exchange Board of India (SEBI) is the statutory regulatory organization of India which regulates the securities market.

It was primarily created to protect the investor's wealth in the securities market. However, it also regulates how the stock markets and mutual funds work.

It is under the ownership of the Ministry of Finance, Govt of India, and was established on 12th April 1988 but given its statutory powers on 30th January 1992.

It was founded under the Sebi Act of 1992, is Headquartered in Mumbai, Maharashtra, and has regional offices in Delhi, Kolkata, etc.

It is a market regulator that aims to maintain equilibrium in day-to-day stock market activity by establishing regulatory frameworks.

There are currently 17 exchanges in operation in India, all governed by SEBI norms, including the NSE and BSE.

It must respond to three segments that make up the market:

- The Issuer of securities

- The Investors

- The financial intermediaries

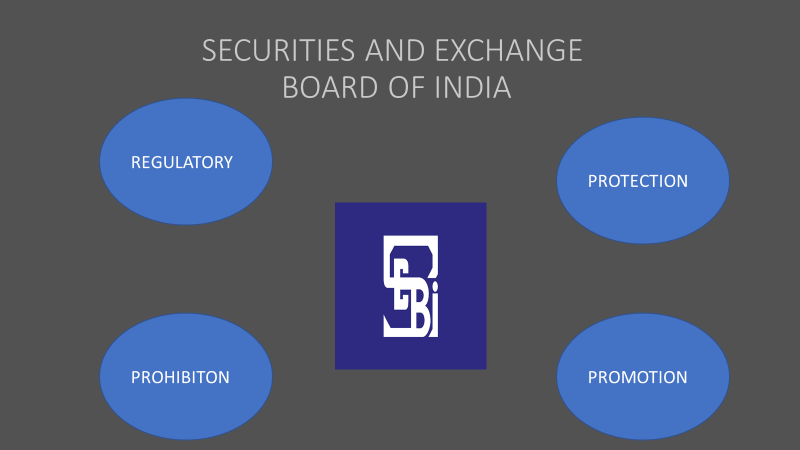

Purpose of SEBI

The purpose behind establishing this organization was mainly the protection of investors' rights in the securities market. The goal for which SEBI was set up was to provide an environment that paves the way for the mobilization and allocation of resources.

It provides practices, frameworks, and infrastructure to meet the growing demand. It meets the needs of the following groups:

- Issuer: It provides a marketplace for issuers that they can utilize to raise funds.

- Investors: To investors, it provides protection and supplies verified information maintained daily.

- Intermediaries: It creates a competitive market for intermediaries by putting in the required infrastructure.

It is an essential institution because it serves as a watchdog for all capital market participants and strives to establish an environment that allows the securities market to function efficiently and smoothly for all market participants.

It also plays an essential role in India's economy by safeguarding investors' interests, supervising intermediaries' operations, and preventing fraud. So now we'll take a closer look at its functions and goals.

Objective

The organization's creation was motivated by various goals, some of which are listed below.

- Investor Protection: The first and most significant goal in establishing SEBI was safeguarding investors. Investor protection entails protecting investors' interests by giving proper counsel and ensuring secure investments.

- Avoiding trading malpractices and controlling stock exchange activity.

- To create a code of conduct for financial intermediaries such as underwriters, brokers, and other financial intermediaries.

- Maintaining a balance between legislative and self-regulatory requirements.

- To control intermediary financial operations such as brokers, underwriters, portfolio managers, and mutual funds. Furthermore, it encourages professionalism among intermediaries.

- To foster a healthy market environment that allows enterprises (capital issuers) to raise sufficient funds for their operations through the issuance of securities (stocks, debentures, and bonds).

- To offer investors appropriate knowledge and counseling so that they can defend their interests.

In summary, it safeguards investors, regulates stock exchanges and financial intermediaries, and promotes the healthy expansion of India's capital market.

Functions

The functions are noted down below:

- Primary Market: SEBI has regulated the primary market through issuer access to market regulation. As a result, all the operations in the primary market are done under its purview.

- Information production regulation at publication and conducting investigations and exchange audits.

- It teaches investors by holding in-person and online workshops that cover topics including money management and market insights.

- To complete the registration of Mutual Funds and Systematic Investment Plans. (SIPs), and to ensure that all such funds follow the mutual fund and SIP laws and regulations.

- Regularly provide training to market participants.

- To bring firms and organizations under its jurisdiction so that investors' interests are not jeopardized; to stop unethical trading, including insider trading; and to assist in developing the capital market so that commercial activities are not inhibited.

- Corporate Governance: It has worked tirelessly to improve India's corporate governance standards.

- Trading and security ownership are becoming more institutionalized.

- Insider Trading and Market Integrity.

- Disclosure: Standards for disclosure have been extended to other issue-related communications, such as advertisements, in addition to accounting information.

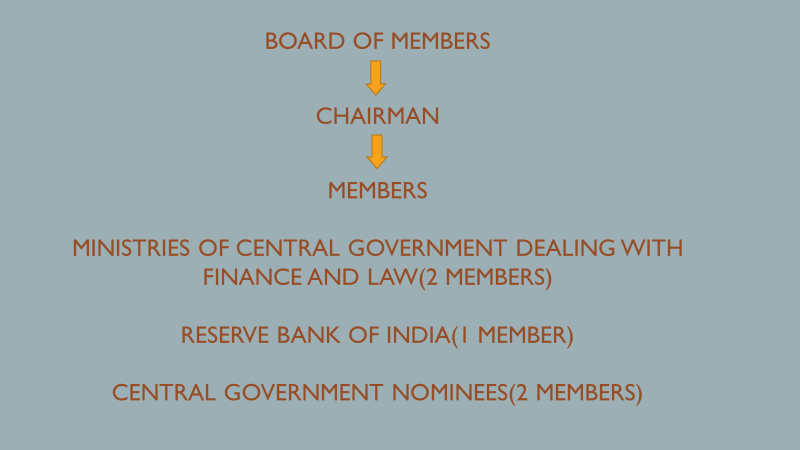

Structure

The Board comprises nine members-

- The Indian government appoints one Chairman of the Board of Directors.

- One member of the Board is appointed by the Reserve Bank of India (RBI).

- Two members of the Board come from the Union Ministry of Finance.

- The Central Government of India elects five members to the Board.

After becoming a legally recognized market regulator, the Securities and Exchange Board of India's first chairman was G.V. Ramakrishna.

Ajay Tyagi was named Chairman on 10th January 2017 and took over as CEO on 1st March 2017, replacing U.K. Sinha.

In the organizational structure, there are four full-time members. Members who work full-time are assigned to several departments to manage.

A separate executive director leads each department. The executive directors are accountable to full-time members.

Foreign Portfolio Investors and Custodians (FPI & C), Corporation Finance Department (CFD), Information Technology Department (ITD), and Department of Economic and Policy Analysis (DEPA-I, II & III) are among SEBI's more than 25 departments (NISM).

Also, the Investment Management Department, Legal Affairs Department, Treasury and Accounts Divisions (T&A), and National Institute of Securities Markets (NISM) come on this list.

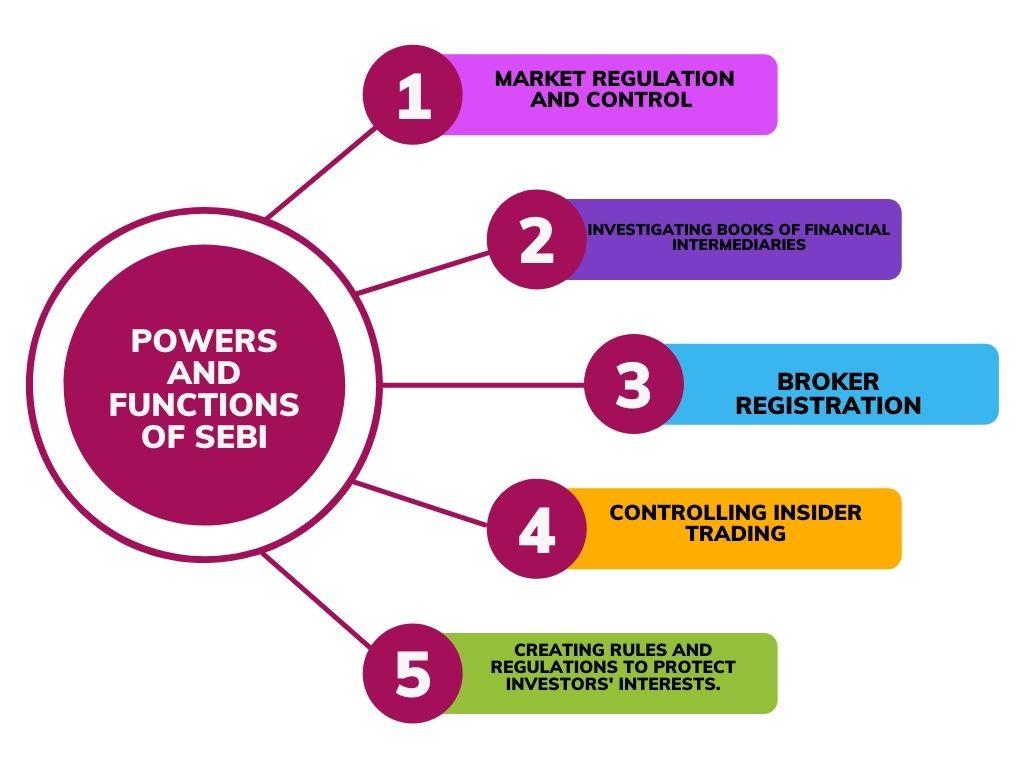

Powers

There are several powers given. Of course, being the regulator, it needs a lot of power to control such a gigantic system.

- Stock exchange bylaws must be regulated and approved.

- Examine the accounts of well-known stock exchanges and request frequent returns.

- Examine the financial intermediaries' books.

- Obligate certain businesses to list on one or more stock exchanges.

- To take care of broker registration.

- Insider trading powers: It has the authority to control insider trading and the functions of merchant bankers.

- Securities Contracts (Regulation) Act powers: On 13th September 1994, the Ministry of Finance issued a Notification delegating certain of its authorities under the Securities Contracts (Regulation) Act to SEBI to regulate stock exchanges effectively.

- The Finance Ministry has also given SEBI the authority to nominate three members to each stock exchange's Governing Body rather than the government, which has been doing so previously.

- Implementing legislation is also covered under SEBI's quasi-executive functions. This means that SEBI has complete jurisdiction to create rules and regulations to protect investors' interests.

Researched and Authored by Rishav Toshniwal

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?