Price to Sales Ratio

A metric used to compare a company’s stock price to its revenue, indicating how much to pay in stock price for each dollar of revenues.

What Is The Price-to-Sales (P/S) Ratio?

The price-to-sales ratio, or P/S ratio, is a metric used to compare a company's stock price to its revenue. This valuation ratio indicates the value financial markets assign to each dollar of a company's sales or revenues.

The ratio indicates how much investors are willing to pay per dollar for a company's sales. Because it compares a company's trading price to its actual revenue, it is a useful tool to indicate the value of a company.

It is calculated by dividing the stock price by the underlying company's sales per share. It can also be calculated by dividing the market capitalization by the company's total sales or revenue over the past 12 months.

It is a useful tool for investors to gauge the relative value of the underlying company. A low ratio could mean that the stock is undervalued. A high ratio could indicate that the stock is overvalued.

One of the limitations of the ratio is that it does not consider earnings. Since it only focuses on sales or revenues, it doesn't consider whether the company makes any or will ever make earnings.

The ratio can also be referred to as the sales multiple or revenue multiple. It shows the price that investors are willing to pay for a company's sales or revenues.

A ratio is essentially a tool in your valuation toolbox. Depending on the company or situation, you might want to use the P/S ratio as one of your tools for valuing the company. Of course, as an investor, the more tools you have available, the better.

Understanding the ratio is important because it can be a handy tool to have in your valuation toolbox and can provide you with a very insightful valuation metric in certain situations.

Key Takeaways

- The Price-To-Sales ratio compares a company's stock price to its revenue, reflecting the market's valuation of each dollar of the company's sales.

- The ratio indicates how much investors are willing to pay for a company's sales, serving as a tool to gauge the relative value of the underlying company.

- A low P/S ratio suggests undervaluation, while a high ratio may indicate overvaluation.

- A good P/S ratio is generally higher than the S&P 500 average, indicating investors' willingness to pay a premium for the company's revenue.

Understanding Price-to-Sales (P/S) Ratio

The ratio is a key analytical tool for investors and analysts. It shows how much investors are willing to pay per dollar of company sales.

It can be calculated in two ways. You can divide the company's market cap by total sales to get the ratio, or you can divide the stock price by sales per share to get the ratio on a per-share basis.

Valuation ratios are most useful when comparing companies in the same sector. The ratio is no different. It can gauge whether a company is undervalued or overvalued based on if the ratio is higher or lower than the sector average.

The typical time period used to measure sales for the ratio is 12 months, or four quarters, and is also called trailing 12 months (TTM). Sales can also be measured in the most recent or current fiscal year.

A P/S ratio that is based on projected future sales for the current year is called a forward P/S ratio.

Comparing companies in different industries can be very difficult. This is because companies turn sales into profits differently depending on their goods and services. For example, it would be very hard to use the ratio to compare a technology company with a grocery retail company.

The ratio also does not take into account earnings. It is not the best tool when you need to use earnings as a key valuation metric for a company.

It also does not account for debt loads or a company's balance sheet condition. A company with no debt will be more attractive than a company with high debt with the same ratio.

While it doesn't take debt into account, the enterprise value-to-sales ratio does. The EV/sales ratio uses enterprise value instead of market cap, like the P/S ratio. Enterprise value adds debt and preferred shares to the market cap and subtracts cash.

Some people think the EV/sales ratio is superior to the P/S ratio, but it involves more steps and is not always applicable.

Calculation for Price-to-Sales (P/S) Ratio

The ratio is calculated by dividing the stock price by sales per share.

You can find the stock price of any publicly-traded company on many websites online such as Google Finance, Yahoo Finance, and The Wall Street Journal.

Sales per share is revenue divided by the number of shares outstanding. Analysts usually use a company's revenue over an entire fiscal year or trailing twelve months.

Revenue and number of shares outstanding can be found in the 10-k of any publicly-traded company. The 10-k is an annual filing with the Securities and Exchange Commission (SEC) that details a company's financial information.

You can find any company's 10-k on the investor relations section of their website or the SEC's EDGAR online database. Look for the top line on a company's income statement to find revenue. The outstanding shares should also be listed at the beginning of the 10-k document.

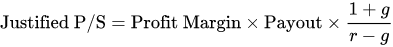

The actual calculation of the ratio is the division of the company's market capitalization by revenue. It is also the per-share stock price divided by the per-share revenue. The calculation looks like this:

![]()

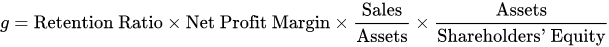

You can also calculate the justified ratio using the Gordon Growth Model to calculate the price-to-sales based on the company's fundamentals. In this formula, g is the sustainable growth rate, and r is the required rate of return.

The ratio is always referring to the trailing 12 months unless stated otherwise. The smaller the ratio, the more attractive the investment is since the investor is paying less for each unit of sales. A ratio of less than 1.0 is considered a "small" ratio.

However, sales do not reveal the whole picture of a company. A company might be unprofitable with a low ratio. This metric can be used to determine the value of a stock relative to its past performance or the relative valuation of a sector or the market as a whole.

Examples of the Price-to-Sales (P/S) Ratio

Let's calculate the ratio of three hypothetical companies.

For all three companies, companies A, B, and C, we'll assume they are all trading at $10 per share and have 200 million shares outstanding.

With these assumptions, we can calculate the market capitalization for each company. The market capitalization =

$10 share price x 200 million shares outstanding = a market cap of $2 billion

Next, we'll assume the hypothetical sales of each company in the last twelve months.

- Company A: Sales of $1.6 billion

- Company B: Sales of $1.2 billion

- Company C: Sales of $2 billion

Let's say these companies have very different earnings numbers, and company C has negative earnings. In this case, the P/E ratio provided very minimal insight into the valuation of the three companies, so we need to use the P/S ratio.

Since company C is not yet profitable, we can better understand these companies' values by calculating the ratio.

- Company A: $2 billion / $1.6 billion = 1.25x

- Company B: $2 billion / $1.2 billion = 1.67x

- Company C: $2 billion / $2 billion = 1x

In this comparison, company C is the most attractive investment because it has the lowest ratio. This means that it is the cheapest stock to buy for the number of sales the company has.

This example shows why the ratio is more useful for companies struggling to make a profit or are unprofitable. The P/E ratio cannot determine which company is the most valuable when the companies are not making consistent earnings.

The P/S ratio, on the other hand, can easily determine the relative value of companies that are not profitable because it does not take into account earnings. Even though company C has negative earnings, it is the most attractive company out of the three in terms of sales.

Why Is the Price-to-Sales (P/S) Ratio Useful to Investors?

The ratio shows how much value the market says each dollar of a company's sales is worth. This can be useful in valuing growth stocks that have not yet become profitable or companies that have suffered a minor setback in earnings.

For example, if a company has not earned any profit yet, but investors still want to determine if it is undervalued or overvalued, they can look at the P/S ratio.

If the ratio is lower than comparable companies in the same industry, investors might want to consider buying the stock because it has a low valuation. The P/S ratio needs to be used with other financial ratios and metrics to determine a company's value properly.

Some industries have years where only a few companies, such as the semiconductor industry, produce earnings. This is a highly cyclical industry that is hard to be profitable 100% of the time.

This does not mean that you should avoid semiconductor stocks, however. In this case, you can use the price-to-sales ratio instead of price-to-earnings to determine how much investors are paying for a dollar of the company's sales rather than earnings.

The P/E ratio is not optimal if a company's earnings are negative because it will not be able to

value the stock since the denominator is less than zero.

The price-to-sales ratio can be used to identify stocks in recovery or to ensure that a company's growth has not been overvalued. It is useful when a company begins to suffer losses and its earnings dip below zero.

When evaluating a firm that has not made any money in the past year, you have limited options.

The P/S ratio is one of your best tools to use in this scenario because unless the firm is going out of business, it will show whether its shares are undervalued compared to others in its sector.

For example, let's say a struggling business has a ratio of 0.7, and all of its peers have a ratio of 2.0. If the struggling business can turn things around and become profitable, it will have a substantial upside as the P/S returns to the average value of its peers.

On the other hand, a company that goes into a period of negative earnings may also lose its dividend yield. In this case, there are a few methods of valuing this company aside from the ratio.

The bottom line is that a low ratio can mean good news for investors, and a high ratio can be a warning sign.

What Are the Limitations of the Price-to-Sales (P/S) Ratio?

The price-to-sales ratio can be useful for valuation in certain scenarios. However, the valuation metric has a few limitations.

This ratio should not be used every time you are trying to value a company because of these limitations. The limitations that make the price-to-sales ratio less than optimal include

Failing To Account For Debt And Expenses

One of the biggest limitations of the price-to-sales ratio is that it fails to account for capital that may come from debt sources. The ratio only accounts for capital that comes from equity sources, which is the price per share.

Aside from raising capital in the stock market by offering shares, companies can also raise capital by taking out loans to finance projects and investments. The ratio does not account for this. It does not consider the weighted average cost of capital (WACC).

The WACC is a weighted measure of the cost of capital from debt and equity sources. The WACC is a measure used to determine whether an investment's return exceeds its cost.

Failing To Account For Profitability

Another ratio limitation is that the gross revenue doesn't account for a company's profitability. A company's profit may be negative, but revenue is always positive. Only measuring revenue does not account for the expenses required to achieve that revenue.

Varies From Industry To Industry

The P/S ratio varies from industry to industry because each industry converts sales into profit differently. Two companies with different revenue recognition practices may not be accurately compared with the ratio.

The ratio does not even consider whether the company makes any or will ever make earnings. Some companies that appear very attractive from the lens of the ratio are companies that are failing to become profitable and may never actually turn a profit.

If you are going to use the ratio to value non-profitable companies, you must use other valuation metrics alongside the ratio to determine the company's future value.

You also must make sure that the company will be able to become profitable in the future; otherwise, you will waste your time determining the valuation of a business that will become bankrupt.

What is a good Price-to-Sales (P/S) Ratio?

Generally, a good price-to-sales ratio is higher than the P/S ratio of the S&P 500. This may seem contradictory because, usually, a lower ratio is better.

However, when the ratio of a company is higher than the S&P, that means investors are willing to pay a higher premium for the company's revenue than for the revenues of the stock market as a whole.

The average price-to-sales ratio of the S&P 500 is 1.55 for the period between January 2001 and June 2020. During this time, the ratio has ranged from a bottom of .8 in March 2009 and a peak of 2.28 in December 2019.

This means that if a stock's ratio was higher than 1.55 on average during this period, it was considered to have a good price-to-sales ratio.

However, these ratios vary per industry and should be used in context with additional analysis. For example, you can track the performance of a company's ratio over time and compare the ratio against those peers in the same sector.

Comparing performance over time and relation to peers are two useful practices to determine if a ratio is good or bad.

Let's look at some examples of P/S ratios by industry. These ratios are from the first quarter of 2020. In the consumer discretionary industry, Amazon had a ratio of 13.15. In the communication services industry, Facebook had a P/S of 1.8.

In the financial industry, Berkshire Hathaway had a ratio of 2.45, while Johnson & Johnson in the healthcare industry had a ratio of 3.66.

This shows how the ratio varies greatly from industry to industry.

Researched and authored by Nick

Reviewed and edited by Colt DiGiovanni | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?