Private Company Valuation

It is the process of determining the worth of a non-publicly traded company.

What Is Private Company Valuation?

Private company valuation is the process of determining the worth of a non-publicly traded company. It involves assessing various factors like financial metrics, market conditions, and potential future earnings to determine its fair market value.

The market worth of a publicly traded entity is calculated by multiplying its stock price by the outstanding shares, yielding its market capitalization. This method, however, cannot be applied to private companies due to their confidentiality regarding stock prices.

Furthermore, private firms may not strictly adhere to the same accounting regulations as public entities. This discrepancy makes interpreting their financial statements difficult, particularly when these statements lack uniformity or consistency.

Key Takeaways

- Due to their distinct operating features and scarcity of financial data, private enterprises are difficult to value.

- Trading multiples are used by techniques such as Comparable Company Analysis (CCA) for relative valuation; however, these approaches have drawbacks, including a lack of data and a susceptibility to market volatility.

- Although it may not include comparable transactions and ignore company-specific criteria, the Precedent Transaction Method examines recent M&A acquisitions.

- A more thorough and perceptive evaluation of the value of a private firm requires the application of several valuation techniques in a comprehensive manner.

Common Methods for Valuing Private Companies

While there are many different ways of valuing private companies and public companies alike, some common methods in which private companies can be valued are as follows:

Comparable Company Analysis (CCA)

Comparable company analysis, or "trading comps," is a relative valuation technique that looks at trading multiples such as P/E, EV/EBITDA, or other multiples to compare the present worth of a business to other similar businesses.

Based on the current values of other comparable businesses, the "comps" valuation approach yields an observable value for the enterprise. The most popular strategy is comps since the multiples are always current and simple to compute.

For example, if Company X trades at a 10-times P/E ratio, and Company Y has earnings of $3.00 per share, the CCA approach suggests that Company Y's stock should be valued at $30.00 per share.

Target company's enterprise value is equal to its EV/EBITDA multiple times its EBITDA

or

P/E Multiple x Target Firm's Net Income equals the target firm's equity value.

The target company's EBITDA and/or Net Income may be valued using predicted figures or historical data (LTM or Last Twelve Months).

Disadvantages of Comparable Company Analysis

While Comparable Company Analysis can offer insights into the valuation process, especially when there's limited information available, it does come with its own set of disadvantages, such as:

- Limited Comparables: It can be difficult to find public companies that are comparable to private ones. Private enterprises may function inside specialized marketplaces or own distinct business models that lack direct equivalents in the public sphere.

- Market Volatility: Stock prices, influenced by various external factors, may not accurately reflect a company's fundamentals. Public markets, known for their volatility, can distort the valuation of comparable companies.

- Disparities in Capital Structure: Compared to private corporations, public companies may have distinct capital structures, debt loads, or access to various financial markets. Multiples and ratios, two measures of valuation, may be impacted by these discrepancies.

- Disclosure & Transparency: While private organizations may have less transparent financial data, public companies are compelled to release a sizable amount of financial information regularly. It may be more difficult to make an appropriate comparison due to this lack of information.

- Size Discrepancies: Public companies tend to be larger than private ones. Direct comparisons are less trustworthy because differences in scale can result in notable differences in operating efficiencies, cost structures, and market penetration.

- Market Timing: CCA assumes that the public market valuations are accurate at the point of comparison. However, if the comparison is updated frequently, market conditions may change quickly and make it correct.

- Accounting Disparities: Private organizations may employ distinct accounting techniques, but public companies often adhere to established accounting standards. These variations may distort the comparison's financial measures.

- Lack of Control Premium: Since most public firms have a more distributed ownership structure than private companies, which sometimes have concentrated ownership, private company valuations may need to be adjusted to account for control premiums.

Considering these limitations, CCA is often used alongside other valuation methods like discounted cash flow analysis to determine a more accurate estimate of a private company's value.

Precedent Transaction Method

Another relative valuation method is precedent transaction analysis, in which the company under consideration is contrasted with other recently purchased or sold companies in the same sector.

The take-over premium that was factored into the acquisition price is included in these transaction figures.

The figures are a company's total worth, not simply a portion. They are helpful in M&A deals, but over time, they can easily become antiquated and no longer accurately represent the state of the market.

Disadvantages of the Precedent Transaction Method

The particular disadvantages of the Precedent Transaction Method of valuing private companies are as follows:

- Limited Availability of Comparable Transactions: It might be difficult to locate comparable prior deals, particularly in industries with little M&A activity or where transactions are not made public. This scarcity may limit the analysis's applicability and accuracy.

- Time Sensitivity: Previous transactions are historical agreements and may not accurately reflect the current state of the market or future expectations. Rapid industry or market conditions changes can quickly render these transactions obsolete for valuation.

- Deal-Specific considerations: Every transaction may have its own set of deal-specific considerations, such as synergies, strategic goals, or particulars that influence the deal price. Accurately accounting for these peculiarities may not be possible when extrapolating a valuation from these transactions.

- Inclusion of Premiums: The method includes takeover premiums paid in acquisition prices, reflecting market sentiment rather than the fundamental value of the company being valued.

- Lack of Transparency: Not all transaction information is made available to the public. A portion of the most important data regarding previous transactions may be private or unreported, which would restrict the scope and precision of the study.

- Variations in Geography and Regulation: Transactions may involve businesses located in disparate geographic regions or be subject to disparate regulatory frameworks. These differences may affect how relevant and comparable the transactions are for valuation purposes.

- Not Taking into Account Company-Specific Factors: The approach largely concentrates on market trends and transactions, failing to consider company-specific elements like the caliber of management, the value of intellectual property, or other competitive advantages.

Due to these limitations, it's usually best to triangulate a more accurate valuation for a private company by combining the Precedent Transaction Method with additional valuation techniques.

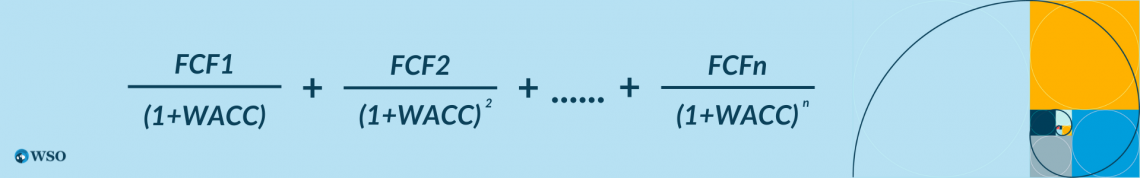

Discounted Cash Flow (DCF) Method

A business's unlevered free cash flow is forecasted into the future and discounted back to the present at the firm's Weighted Average Cost of Capital (WACC) in a process known as discounted cash flow (DCF) analysis, which is an intrinsic value technique.

A DCF analysis necessitates a great deal of depth and analysis and is carried out by creating a financial model in Excel. Of the three methods, this is the most in-depth and necessitates the greatest guesswork and estimation.

Because so many inputs are involved in creating a DCF model, the effort necessary to prepare one may frequently provide the least accurate assessment.

A DCF model enables the analyst to project value according to various scenarios and even conduct a sensitivity analysis.

Unlevered free cash flow is calculated as follows:

Free cash flow = EBIT (1-tax rate) + (depreciation) + (amortization) – (change in net working capital) – (capital expenditure)

The weighted average cost of capital (WACC) of the company is typically used to determine the proper discount rate. We need to know a company's capital structure, tax rate, cost of debt, and cost of equity to calculate its WACC.

The Capital Asset Pricing Model determines the cost of equity (CAPM). We can calculate the firm's beta by using the industry average beta. The interest rate at which a private firm incurs debt is influenced by its credit profile, which also determines the cost of debt.

We also consult the target's public peers to determine the industry standard for capital structure and tax rate. We can calculate the WACC after we obtain the cost of debt, cost of equity, and weights of debt and equity.

With all the above steps completed, the valuation of the target firm can be calculated as follows:

Disadvantages of the Discounted Cash Flow Method

A popular technique for evaluating businesses is the Discounted Cash Flow (DCF) method, which involves projecting future cash flows and discounting them to present value. However, there are some drawbacks to using it to value private businesses.

- Future Cash Flow Projections: Predicting future cash flows is difficult, particularly for private businesses with scant historical data or hazy outlooks. This could result in erroneous estimates, undermining the value's validity.

- Sensitivity to Assumptions: Determining growth rates, discount rates, terminal values, and other variables is a major component of DCF. Little modifications to these presumptions might greatly affect the valuation, rendering it vulnerable to subjective inputs.

- Difficulty in Estimating the Discount Rate: Assessing the company's risk profile is necessary to determine the proper discount rate (cost of capital), which might be difficult for private companies to do. A lack of available data to the public may make it more difficult to calculate the discount rate.

- Terminal Value Assumptions: In DCF, estimating the terminal value after the stated projection period is essential. However, assumptions regarding exit multiples or perpetuity growth rates can greatly impact the ultimate valuation and may not always accurately reflect market conditions.

- Absence of Market-based Inputs: Instead of using inputs based on the market, DCF projects cash flow internally. This may be a drawback, particularly in sectors of the economy where market-based data is more trustworthy for determining valuation.

- Changes in the Business Environment: The precision of cash flow forecasts may be impacted by modifications in the regulatory environment, industry dynamics, or economic situations. The intrinsic uncertainty of long-term forecasting affects the validity of the valuation.

- Incapacity to Capture Non-Financial Factors: Although DCF mainly concentrates on financial indicators, it may not sufficiently consider qualitative elements that have a substantial impact on a company's value, such as competitive advantages, management quality, and brand value.

- Complexity and Time-Intensiveness: DCF analysis is time-consuming and complex because it calls for thorough financial modeling and analysis. It can be difficult for modest businesses with little funding or experience to conduct a thorough DCF analysis.

- Difficulty in Assessing Cash Flow Risk: Due to the lack of readily available information, private organizations may find it more difficult to evaluate the risk associated with cash flow projections, including market, operational, and liquidity concerns.

Given these drawbacks, it's usually advised to add sensitivity assessments and other valuation techniques to DCF to account for uncertainty and offer a variety of possible valuations for a private company.

Alternative Methods

The multiple-based valuation approach and the DCF method are combined to create the First Chicago approach.

This method's unique selling point is that it considers multiple reward scenarios for the target firm. Creating three scenarios is typically the first step in this process: the best case, the base case (the most likely situation), and the worst case.

Every case has a probability assigned to it. The probability-weighted total of the three scenarios represents the final valuation.

Venture capitalists and private equity investors can use this form of private company valuation since it provides a valuation that accounts for the firm's upside potential and negative risk.

Conclusion

The valuation of private companies is a multifaceted task, shaped by their unique characteristics and the challenges posed by limited financial data accessibility.

Trading multiples and approaches like Comparative Company Analysis (CCA) and Precedent Transaction Method have limitations concerning data availability, market volatility, and varying capital structures.

Additionally, while comprehensive, the Discounted Cash Flow (DCF) method faces challenges in predicting future cash flows, sensitivity to assumptions, and difficulty in estimating discount rates.

Considering these limitations, a comprehensive valuation approach is recommended, combining various methods to address uncertainty.

While each method has its strengths and weaknesses, integrating sensitivity assessments and alternative techniques can provide a range of valuations, ensuring a more informed and balanced evaluation of a private company's worth.

The First Chicago approach, for instance, merges multiple-based valuation with DCF, offering a probability-weighted assessment that caters to both potential upside and risk, making it relevant for venture capitalists and private equity investors.

Everything You Need To Master Valuation Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?