Valuation Methods

These methods determine the value of an asset or company

What Are Valuation Methods?

Valuation methods determine the value of an asset or company. The value of an asset or a company's value is the amount someone is willing to pay for it. This value can be determined through several methods, including relative and intrinsic.

They are important tools for investors, as they allow them to determine an asset's or a company's fair value and make informed decisions about buying, selling, or holding.

Managers can also use them to assess the value of their company and make strategic decisions regarding the growth and improvement of the business.

The Origin of the Valuation Method can be traced back to the early days of finance and economics.

In the 19th century, economists Adam Smith and John Maynard Keynes developed theories about the value of assets and companies and how factors like supply, demand, market conditions, and the overall state of the economy determine these values.

Over time, these theories were refined and expanded, leading to more sophisticated valuation methods. For example, the discounted cash flow (DCF) analysis, which is a widely used intrinsic valuation method, was first developed by Irving Fisher in the early 20th century.

Today, investors, analysts, and managers use many different valuation methods to determine the value of assets and companies. Moreover, these methods continue to evolve and be refined as new economic theories and models are developed.

Key Takeaways

-

Valuation methods are essential for investors and managers to determine the fair value of assets or companies.

-

These methods fall into two categories: relative (quick comparisons) and intrinsic (based on fundamentals).

-

Common formulas include P/E and P/B ratios for relative valuation and DCF and DDM for intrinsic valuation.

-

Valuation methods find applications in finance, corporate decisions, mergers, accounting, and taxation.

-

They offer both advantages (systematic, objective assessment) and disadvantages (assumptions, complexity, subjectivity) for users.

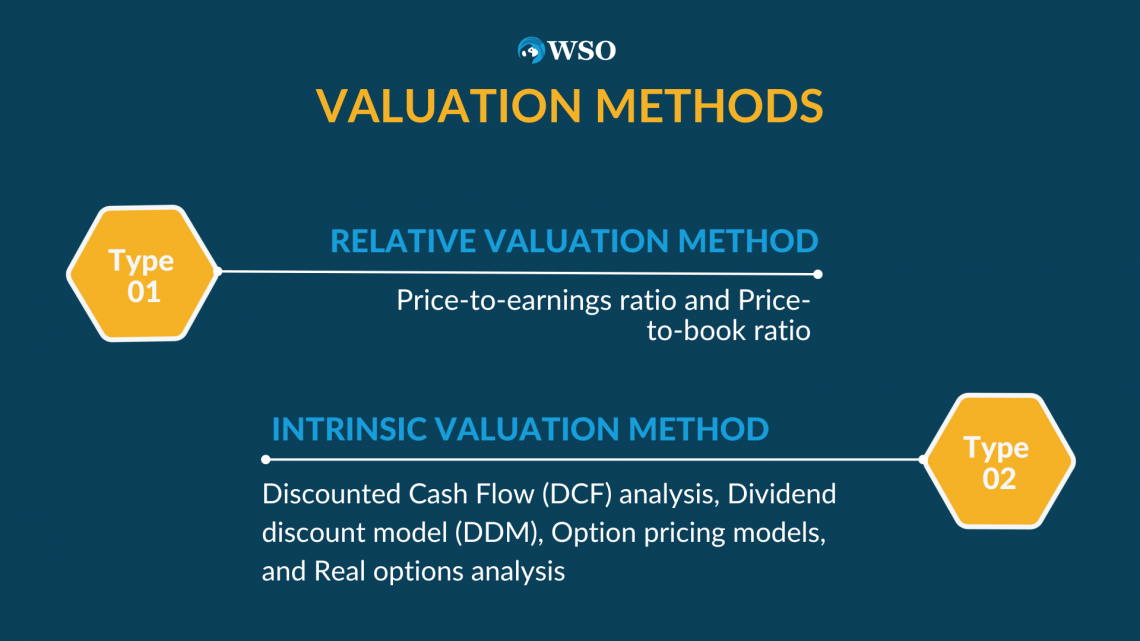

Types of Valuation Methods

These methods can be classified into two broad categories:

- Relative

- Intrinsic

1. Relative valuation

It is a method of determining the value of an asset or a company by comparing it to similar assets or companies.

This is done by looking at metrics such as price-to-earnings ratio or price-to-book ratio, which show how the subject asset or company compares to its peers regarding key financial metrics.

Note

The idea behind relative valuation is that the value of an asset or a company should be similar to that of similar assets or companies. So, for example, if two companies have similar earnings, dividends, and growth prospects, their values should also be similar.

By comparing the subject asset or company to its peers, investors can determine whether it is undervalued or overvalued.

Relative valuation is often used with intrinsic valuation methods, such as discounted cash flow analysis (DCF analysis) or the dividend discount model (DDM), to provide a complete picture of an asset's or company's value.

2. Intrinsic valuation

It is a method of determining the intrinsic value of an asset or a company, which is the value that is inherent in the asset or company based on its fundamentals, including:

- Earnings

- Dividends

- Growth prospects

This value is then compared to the asset's or company's current market price to determine whether the asset/company is undervalued or overvalued.

The intrinsic value of an asset or a company is estimated using a discounted cash flow (DCF) analysis, which involves forecasting the future cash flows of the asset/company and then discounting them back to their present value. This present value is considered the intrinsic value of the asset or company.

The intrinsic value of an asset or a company is different from its market value, which is the price at which it is currently trading in the market and may be higher or lower than its market value, depending on the assumptions used in the DCF analysis and the market's perception of the asset or company's prospects.

Difference between Relative and Intrinsic Valuation Methods

Let us take a look at the main distinctions between the two primary methods below:

| Relative Valuation | Intrinsic Valuation |

|---|---|

| It involves comparing the subject asset or company to similar ones. | It involves estimating the asset's or company's intrinsic value based on its fundamentals. |

| It is often used to quickly and easily determine the value of an asset or a company by comparing it to its peers. This can be useful for investors and managers who must make quick decisions based on limited information. | It is a more detailed and rigorous approach that involves estimating the asset's or company's intrinsic value based on its fundamentals, such as earnings, dividends, and growth prospects. |

| It is subject to the limitations of the assets or companies being compared. Therefore, it may not always provide an accurate or complete picture of the subject asset's or company's value. | This method can provide a more accurate and complete picture of the asset's or company's value, but it can also be more complex and time-consuming. |

Overall, both relative and intrinsic methods have their strengths and weaknesses. Nevertheless, it is often useful to use both methods to understand an asset's or company's value.

Formulas used in valuation methods

Many formulas are used, depending on the type of method and the specific circumstances being considered.

Some common formulas include:

1. Price-to-earnings (P/E) ratio

This relative valuation method compares the subject company's current market price to its earnings per share (EPS). The formula for the P/E ratio is:

P/E ratio = market price per share / EPS

For example, let's say that a company has a market price of $50 per share and earnings per share of $5. The P/E ratio for this company would be calculated as follows:

P/E ratio = $50 / $5 = 10

This means that the company's stock is trading at a P/E ratio of 10, which means that investors are willing to pay $10 for every $1 of the company's earnings.

This can be compared to the P/E ratios of other companies in the same industry to determine whether the subject company's stock is undervalued or overvalued.

2. Price-to-book (P/B) ratio

This relative valuation method compares the subject company's current market price to its book value per share (BVPS). The formula for the P/B ratio is:

P/B ratio = market price per share / BVPS

For example, let's say that a company has a market price of $100 per share and a book value per share of $50. The P/B ratio for this company would be calculated as follows:

P/B ratio = $100 / $50 = 2

This means that the company's stock is trading at a P/B ratio of 2, which means that investors are willing to pay $2 for every $1 of book value that the company has.

This can be compared to the P/B ratios of other companies in the same industry to determine whether the subject company's stock is undervalued or overvalued.

3. Discounted cash flow (DCF) analysis

This intrinsic valuation method estimates the subject asset's or company's intrinsic value based on its future cash flows. The formula for the DCF analysis is as follows:

DCF value = future cash flows / (1 + discount rate)number of years

For example, let's say that a company is expected to generate the following cash flows over the next five years: $10 million in year 1, $15 million in year 2, $20 million in year 3, $25 million in year 4, and $30 million in year 5.

If the discount rate is 10%, the DCF value of the company would be calculated as follows:

- Year 1: DCF value = $10 million / (1 + 0.1)1 = $9.09 million

- Year 2: DCF value = $15 million / (1 + 0.1)2 = $13.64 million

- Year 3: DCF value = $20 million / (1 + 0.1)3 = $17.67 million

- Year 4: DCF value = $25 million / (1 + 0.1)4 = $21.13 million

- Year 5: DCF value = $30 million / (1 + 0.1)5 = $24.00 million

The total DCF value of the company would be $85.43 million. This value can be compared to the company's current market price to determine whether it is undervalued or overvalued.

4. Dividend discount model (DDM)

This intrinsic valuation method estimates the subject company's intrinsic value based on its future dividends. The formula for the DDM is:

DDM value = future dividends / required rate of return

For example, let's say that a company is expected to pay dividends of $1 per share in the next year, and the required rate of return for the company's stock is 10%. The DDM value for the company would be calculated as follows:

DDM value = $1 / 0.1 = $10

This means that the intrinsic value of the company's stock is $10 per share. This value can be compared to the company's current market price to determine whether it is undervalued or overvalued.

Option Pricing Model

Option pricing models are a valuation methods used to determine an option's fair value. This financial derivative gives the holder the right to buy or sell an underlying asset at a predetermined price on/before a specified date.

These models use various techniques and assumptions to estimate the value of an option based on factors such as the underlying asset's price, expiration date, and strike price.

These models are a type of intrinsic valuation method , as they involve estimating the value of the option based on its inherent characteristics rather than comparing it to other options or assets. Some common option pricing models include the Black-Scholes model and the binomial model.

These models are used by investors, analysts, and market makers to determine the fair value of an option and make informed decisions about whether to buy, sell, or hold the option.

Managers can also use them to assess the value of their company's options and make strategic decisions about managing and hedging their risks.

One example of an option pricing model is the Black-Scholes model. This widely used model uses a mathematical formula to estimate the value of a European call or put option. The formula for the Black-Scholes model is:

Call option value = S * N(d1) - X * e(-rT) * N(d2)

Put option value = X * e(-rT) * N(-d2) - S * N(-d1)

Where:

- S is the underlying asset's price

- X is the option's strike price

- T is the time to expiration

- r is the risk-free interest rate

- N(d) is the cumulative standard normal distribution function.

To use the Black-Scholes model to value an option, you would need to input the relevant values for S, X, T, and r, then use the formula to calculate the option's value.

For example, let's say that the underlying asset's price is $100, the option's strike price is $95, the time to expiration is 0.5 years, and the risk-free interest rate is 2%. Then, the value of a call option using the Black-Scholes model would be calculated as follows:

Call option value = $100 * N(d1) - $95 * e(-0.02 * 0.5) * N(d2)

Where d1 and d2 are calculated as follows:

d1 = (ln(S / X) + (r + (sigma2 / 2)) * T) / (sigma * sqrt(T))

d2 = d1 - sigma * sqrt(T), where sigma is the underlying asset's volatility.

Once you have calculated the values of d1 and d2, you can plug them into the formula for the call option value to obtain the option's value. This value can then determine whether the option is undervalued or overvalued and whether it is a good investment.

Real options analysis

Real options analysis is a valuation methods used to estimate the intrinsic value of an asset or a company based on its potential future growth opportunities.

It is based on the idea that the value of an asset or a company is determined by its current cash flows and the potential future benefits it can generate. These potential future benefits, known as "real options," can include expanding, contracting, innovating, or adapting to changing market conditions.

It uses various techniques and assumptions to estimate the value of an asset or a company based on its real options.

This can include using financial models to simulate the potential future cash flows that the asset or company could generate based on different growth scenarios and using option pricing models to determine the value of the asset or company's real options.

It is a relatively complex and sophisticated valuation method that requires specialized knowledge and expertise to use properly. Nevertheless, managers and executives often use it to assess the value of their company and make strategic decisions about how to grow and improve the business.

Investors can also use it to determine the value of an asset or company with potential future growth opportunities.

The process of real options analysis involves several steps:

- Identify the real options available to the asset or company being valued, such as expanding, contracting, innovating, or adapting to changing market conditions.

- Develop a financial model that simulates the potential future cash flows the asset or company could generate based on different growth scenarios and real options.

- Use an option pricing model, such as the Black-Scholes model, to determine the asset's value or the company's real options based on their potential future benefits.

- Sum the value of the asset or company's real options to determine its intrinsic value, which can be compared to its current market value to determine whether it is undervalued or overvalued.

Overall, real options analysis involves using financial modeling and option pricing techniques to estimate the asset/company's intrinsic value based on its potential future growth opportunities.

Note

The formulas and techniques used in real options analysis can vary, but they are generally designed to reflect the potential future benefits of the asset or company's real options.

Fields of Usage and Related Studies

Valuation methods are used in various fields, including finance, economics, accounting, and business.

Some specific examples of fields in which these methods are used include:

- Investment analysis

These methods are used by investors and analysts to determine the value of assets and companies and to make informed decisions about whether to buy, sell, or hold these assets. - Corporate finance

Managers and executives use these methods to assess the value of their company and make strategic decisions about how to grow and improve the business. - Mergers and acquisitions

These methods are used by buyers and sellers to determine the fair value of a company or asset being acquired or sold and to negotiate the terms of the transaction. - Accounting

Valuation methods are used by accountants to determine the value of a company's assets and liabilities and to prepare financial statements that accurately reflect the company's financial position. - Taxation

Tax authorities use this method to determine the value of assets and companies for tax purposes and ensure that individuals and businesses pay the appropriate taxes.

Many academic studies have explored different aspects of valuation methods, including their strengths and weaknesses, limitations, and how they can be improved or enhanced.

Some specific examples of studies related to valuation methods include:

- A study published in the Journal of Financial Economics examines the accuracy and reliability of different valuation methods and how they can be improved.

- A study published in the Review of Financial Studies examines the limitations of relative valuation methods and how they can be overcome.

- A study published in the Journal of Accounting Research examines the role of assumptions in intrinsic valuation methods and how they can affect the accuracy of valuations.

- A study published in the Journal of Financial and Quantitative Analysis examines the performance of different valuation methods in different market conditions and how they can be used to forecast future returns.

These are a few examples of the various studies published on valuation methods. There is a rich and diverse body of research on this topic, and new studies are constantly being published.

Valuation Methods Advantages

Some of the advantages are:

- They provide a systematic and objective way to determine the value of an asset or a company. This can help investors and managers make more informed decisions about buying, selling, or holding the asset or company.

- They can help investors identify undervalued assets or companies, potentially providing higher returns than overvalued ones.

- They can provide a framework for comparing the relative value of different assets or companies, which can help investors and managers make more informed decisions about where to allocate their capital.

- They can help managers assess the value of their company and make strategic decisions about how to grow and improve the business.

- They can provide a basis for negotiating an asset or company price, which can help buyers and sellers reach fair and mutually beneficial agreements.

Valuation Methods Disadvantages

On the other hand, there are some potential disadvantages to using valuation methods:

- They are based on assumptions and estimates, which can introduce uncertainty and potential error into the valuation process. This can make it difficult to accurately determine an asset or company's true value.

- They can be complex and require specialized knowledge and expertise to use properly. This can make it difficult for inexperienced investors or managers to understand and apply.

- They can be subject to biases and other psychological factors influencing the valuation process results. This can make it difficult to obtain objective and unbiased valuations.

- They can be affected by market conditions and other external factors, making it difficult to determine the true value of an asset or a company over time.

- They can be time-consuming and resource-intensive, disadvantageous to investors and managers under pressure to make quick decisions.

Conclusion

In conclusion, valuation methods are critical for investors, managers, and other professionals who need to determine the value of assets and companies.

They provide a systematic and objective way to estimate the value of an asset or a company based on its fundamentals. As a result, they can help investors and managers make informed decisions about buying, selling, or holding the asset or company.

They can be used in various fields, including finance, economics, accounting, and business, and there is a rich and diverse body of research on this topic. But, overall, they play a vital role in helping investors and managers make strategic and informed decisions about their investments and businesses.

Valuation Methods FAQs

VMs are techniques and approaches used to determine the value of an asset or a company.

For example, these methods can be used to estimate the intrinsic value of an asset or company based on its fundamentals or to compare the asset or company to similar assets or companies to determine its relative value.

There are many different VMs, including RVMs (such as the price-to-earnings ratio) and IVMs (such as discounted cash flow analysis).

Other examples include the dividend discount model, option pricing models, and real options analysis.

Some advantages include

- providing a systematic and objective way to determine the value of an asset or a company,

- helping investors identify undervalued assets or companies,

- providing a framework for comparing the relative value of different assets or companies, and

- helping managers assess the value of their company and make strategic decisions.

Some potential disadvantages include

- being based on assumptions and estimates, which can introduce uncertainty and potential error,

- being complex and requiring specialized knowledge and expertise,

- being subject to biases and other psychological factors,

- being affected by changes in market conditions and other external factors, and

- being time-consuming and resource-intensive.

VMs are used in many fields, including finance, economics, accounting, and business, and include investment analysis, corporate finance, mergers and acquisitions, accounting, and taxation.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?