Tangible Net Worth

A company's total net worth excluding intangible assets

What Is Tangible Net Worth?

The net worth of any individual or corporation is their total assets minus the total liabilities they owe. Tangible net worth (TNW) is a company's total net worth excluding intangible assets like goodwill, patents, intellectual property, etc.

TNW is essentially any fixed/tangible assets such as property, plant & equipment, land & building, etc., owned by an individual or a company.

Types of assets included in TNW:

-

Property Plant & Equipment (PPE)

-

Land & Building

-

Cash & Cash Equivalents (C&CE)

-

Inventory

-

Other Current Assets

-

Investments

TNW is calculated by deducting the firm's total liabilities and any intangible assets on the balance sheet from the firm's total assets. The formula for calculating it is as follows:

Tangible Net Worth (TNW) = Total Assets - Total Liabilities - Intangible Assets

All the variables are taken at book value and any off-balance sheet liabilities like forex transactions. Items such as hedging contracts are excluded from the calculation.

Any leased assets are included in the calculation of total assets.

TNW gives an idea of how many tangible assets the company has on its books. Lenders use this formula to calculate the borrower's actual net worth and the borrower's creditworthiness.

The calculation can ignore deferred tax assets as they are not liquefiable assets.

Key Takeaways

- Tangible Net Worth (TNW) represents a company's total net worth, excluding intangible assets like goodwill and patents.

- Tangible Net Worth is calculated by deducting a company's total liabilities and intangible assets from its total assets.

- Lenders use TNW to assess a borrower's creditworthiness and the collateral available for loans.

- Tangible Net Worth is advantageous for businesses with high debt and some intangible assets, aiding in estimating liquidation assets.

- Tangible Net Worth has limitations and may not suit asset-light businesses with significant intangible assets or modern tech companies.

Understanding and Interpreting Tangible Net Worth

TNW shows a company's many tangible assets and is always calculated at book value.

This metric is generally used by lenders to determine the actual net worth of the borrower and, at a liquidation event, how the recovery process can be done.

Being preferred because of its accuracy, the company assets are already valued, and unlike intangible assets, physical assets are easier to value and re-value externally just in case.

Lenders will use the company's physical assets as collateral to lend funds. If the company fails to make interest payments, the lenders have the first claim on the tangible net worth of a company.

Other assets like cash & fixed investments, etc., are also included in the calculation. Even though they are not strictly physical, they can be liquidated and used to pay back the debt, unlike intangible assets.

The TNW is a good metric, but it works better on companies with significant fixed assets and debt like telecom, power & utility companies. It gives an exact idea of how strong the company's balance sheet is and how efficiently it is leveraging its assets and managing its debt.

If the TNW is higher than debt, it is usually looked at as positive, but for asset-heavy companies, it would mean that they are not leveraging the assets at their disposal to fuel growth.

Similarly, if the company has very high debt concerning its TNW, it would mean the firm is in a risky position in the event of liquidation. This means that the company is overleveraged and has a weak balance sheet.

TNW can reflect a company's approach to running its operations and business model. If the TNW is very low, we can see that it's an asset-light business and vice versa.

Advantages of Tangible Net Worth

TNW as a ratio can be helpful in many cases for analyzing and interpreting a business's balance sheet and liquidity.

-

Useful for businesses with high debt and a decent amount of intangible assets on the books.

-

TNW is used for estimating what assets can be liquidated to pay creditors in the event of a default.

-

Creditors, while giving loans, can use TNW to get an idea of how the business will be able to pay back. Rating agencies can also use it to judge the liquidity and quality of the balance sheet.

-

Instead of accounting only for fixed assets, TNW also considers other assets like investments, inventory, cash & bank, and receivables.

-

Accounts for short-term and long-term debt obligations are used, giving a clearer picture of the liquidation value of a firm.

-

TNW is dynamic enough to make adjustments to the formula. E.g., assets like trade payables can be adjusted at a more conservative level, and deferred tax assets can be completely excluded as there is no liquidation value to those assets.

-

The exclusion of intangibles gives an idea of how the business uses its tangible assets by calculating profitability ratios like return on TNW.

Limitations of Tangible Net Worth

It is a ratio primarily used for asset-heavy manufacturing businesses. Because it is a particular ratio, it has certain limitations regarding its application and usage.

-

TNW (Total Net Worth) doesn't provide a complete view of a business's assets, especially intangible assets, which are vital for cash flow and competitive advantage.

-

It's less relevant for asset-light businesses relying on intangibles for cash flow.

-

TNW struggles to evaluate new-age sectors like social media, gaming, and pharmaceuticals, where patents are significant investments.

-

Inapplicable to banking and financial firms with different accounting practices.

-

TNW overlooks cash flow, crucial for lending and repayment assessment.

-

Includes leased assets, inflating TNW even if the company has no control over them during liquidation.

-

Inaccurate valuation of current assets like inventories and receivables can inflate TNW.

Calculating Tangible Net Worth

It is calculated by deducting liabilities and intangible assets from total assets.

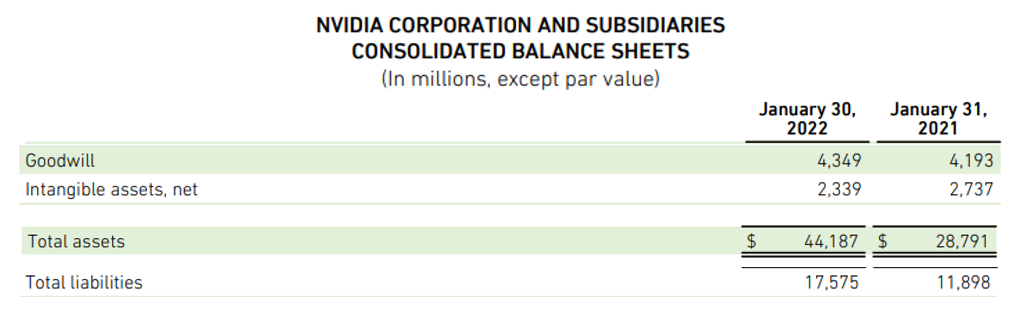

Example 1: Nvidia Corporation (NVDA)

Data is pulled from the 10-K filings of Nvidia Corp.

NVDA has total assets worth $44 Billion. The complete intangibles stand at $7 Billion and have $17 Billion worth of outstanding liabilities.

TNW = $44 - $7 - $17

Nvidia has a TNW of $20 Billion against a total liabilities of $17 Billion. This means that Nvidia has a solid balance sheet and, at the same time, very manageable debt levels against its total assets.

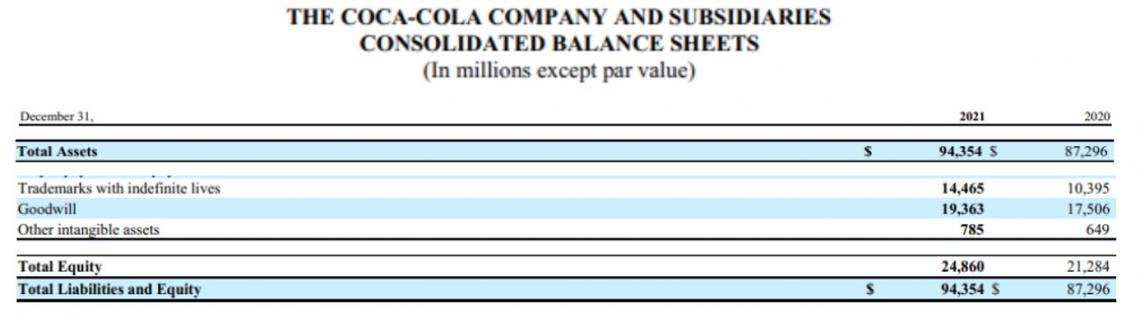

Example 2: The Coca-Cola Company (KO)

Data is pulled out from the 10-K filings of The Coca-Cola Company.

Coca-Cola has Total Assets worth $94 Billion. The total intangibles of the company include trademarks, goodwill, and other intangible assets, which come to $34 Billion. The total liabilities after deducting equity capital stood at $70 Billion.

Thus, the TNW of Coca-Cola is:

TNW = $94 - $70 - $34

TNW = -$10 Billion

The TNW of coca-cola is negative $10 Billion. This showcases a significant drawback of TNW. It cannot be used to value businesses with intangible assets as their most productive and important assets.

Net Worth vs. Tangible Net Worth

The net worth is the value of the assets after all the liabilities are deducted. In contrast, TNW is the value of assets after liabilities and intangible assets are removed.

As an individual, your net and TNW are the same because no individual can possess intangible assets. But since companies can possess intangible assets, these two values can vary in value.

Net worth essentially tells us the worth of the equity capital of the firm since:

Equity/Net Worth = Assets - Liabilities

While TNW tells in the event of liquidation what assets the company can liquidate to pay off creditors.

A return on net worth or RONW is the firm's return on equity (ROE). The ROE tells how efficiently the business is using its common share capital. ROE does not include retained earnings, preferred shares, etc.

If a business can generate a high return on equity, the management is making efficient use of the equity capital at hand.

A return on tangible net worth (ROTNW) is calculated by dividing the net profit by the TNW.

ROTNW = Net Income / Tangible Net Worth

A ROTNW can showcase how efficiently a business uses its TNW, including the tangible fixed assets like PPE, Plant & Machinery, fixed investments, and current assets like inventory, cash, etc.

Net Worth Vs. Tangible Net Worth Example

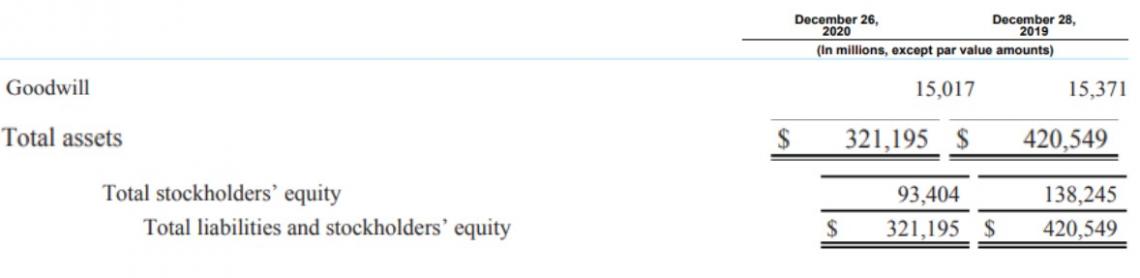

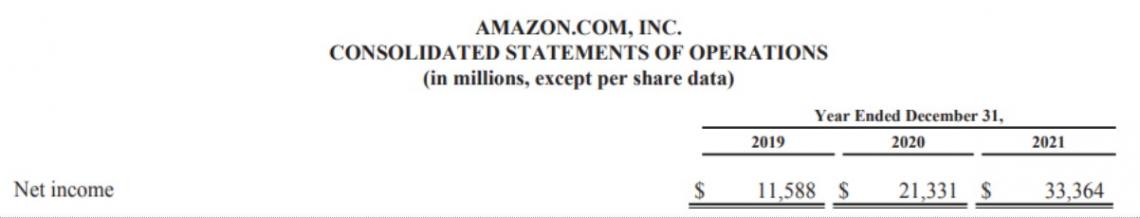

Data is pulled from 10-K filings of the company.

Total Liabilities for Amazon are: $227,791

The Return on Net Worth or Return on Equity for Amazon is:

ROE = Net Income / Equity

ROE = 11588 / 93401

ROE = 12%

The TNW for Amazon is:

TNW = Total Assets - Goodwill - Liabilities

TNW = 321195 - 15017 - 227791

TNW = 78387

The ROTNW will come to:

ROTNW = Net Income / Tangible Net Worth

ROTNW = 11588 / 78387

ROTNW = 15%

The ROTNW for Amazon for FY 2021 is 15%.

Researched and authored by Aditya Salunke I LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?