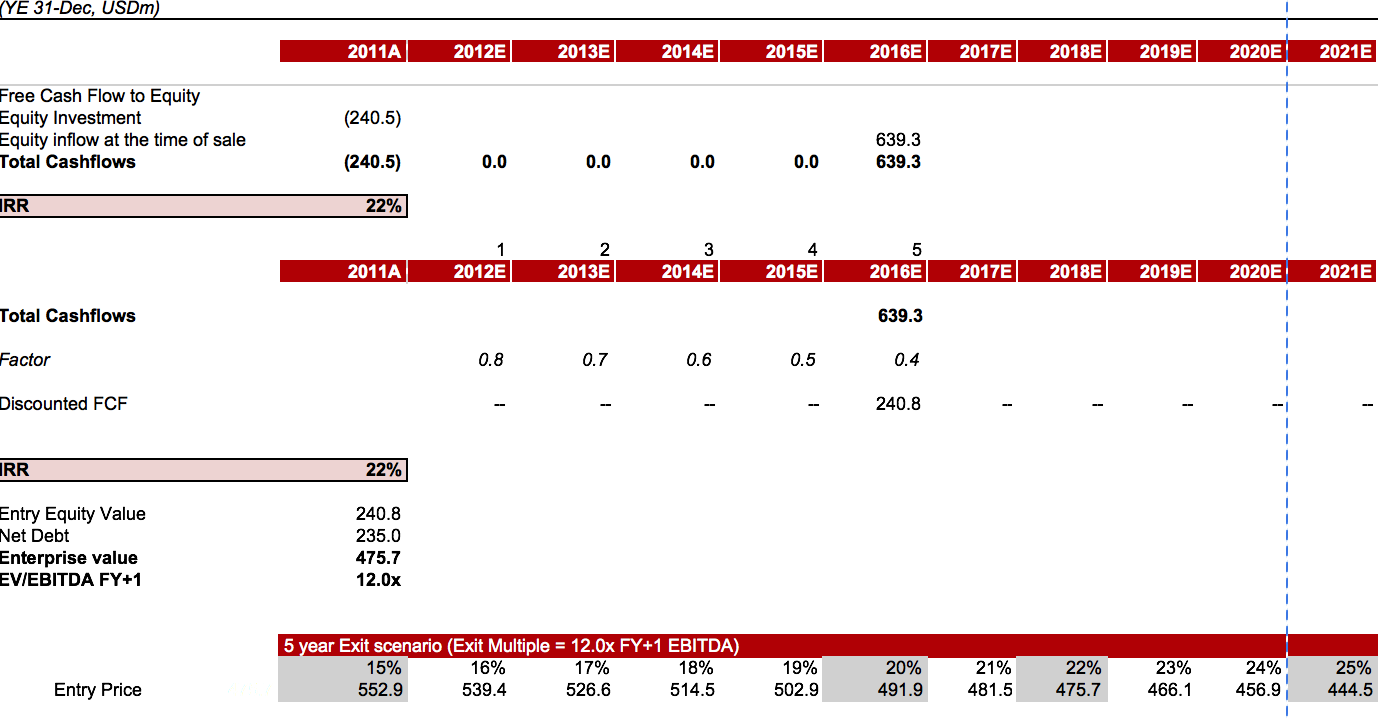

Private Equity Returns Model Template

Build PE models showing various IRR parameters

Download WSO's free Private Equity (PE) Returns model template below!

This template allows you to build a private equity model showing various Internal Rate of Return (IRR) parameters.

The template is plug-and-play, and you can enter your own numbers or formulas to auto-populate output numbers. The template also includes other tabs for other elements of a financial model.

According to the WSO Dictionary,

"Internal Rate of Return or IRR is a financial metric used to discount capital budgeting and to make the net present value of all future cash flows equal to zero. For this reason, it is used alongside a Discounted Cash Flow analysis.

IRR is an estimate of the rate of return that an investment is expected to provide. Usually a higher IRR means a more profitable investment."

A screenshot below gives you a sneak peek of the template.

More Resources:

We hope this template helps you excel at your job! Please check out the following additional resources to help you advance your career:

or Want to Sign up with your social account?