Real Estate Investment Trust (REIT)

A company whose revenue is mainly derived from real estate or real estate income instruments

What Is a Real Estate Investment Trust (REIT)?

If you’re over 24 years old, have a decent passion for finance, and have an Instagram account, you’ve probably seen videos of passive income being the hidden (not so hidden) secret to financial freedom.

Some people will tell you to invest in stocks, but others will tell you to invest in property - it rarely depreciates, and it’s much more tangible than something like crypto. It’s also probably safer than stocks because it’s the property and who doesn’t need property?

You look into your bank account with just under $10,000 and decide to look at real estate prices. What in the world? The average house price in New York City is over $700,000.

You’ve only started paying back your student loans from studying at NYU and have a negative net worth. At this rate, it will probably take over 20 years before you can even consider buying property (the average age is 45 years old), or so you thought.

You complain to your buddy from Wharton that the system is flawed, and he tells you that if you still want to generate passive income from real estate, you should look into real estate investment trusts (REITs).

As the name suggests, a real estate investment trust is a company whose revenue is mainly derived from real estate or real estate income instruments. If a single house already costs more than $700,000 on average, imagine how much a 40-storey skyscraper would cost.

It is unlikely that single investors are capable of owning large properties, and this is where REITs come in. There is a good chance that some of the large buildings you frequently visit belong to a REIT.

Real estate is a big part of the finance world, and many lucrative careers exist in this space. For this space specifically, there will be unique financial modeling involved, and if you want to break into a career like real estate private equity (REPE), you need to know real estate modeling.

Key Takeaways

- REITs allow investors to invest in real estate without needing large amounts of capital by pooling funds from multiple investors.

- There are three types of REITs: Mortgage REITs, Equity REITs, and Hybrid REITs.

- REITs offer benefits like tax advantages, guaranteed dividends, diversification, liquidity, and lower barriers to entry.

- However, there are also disadvantages, including limited control, lower growth opportunities, interest rate sensitivity, potentially lower returns, and management fees.

- Thorough analysis of a REIT's financial metrics is crucial before investing.

How REITs Work

The concept is straightforward. Real estate (huge ones) is expensive and often cannot be bought by a single person. Real estate investment trust companies will pool capital from investors and subsequently use it to generate real estate-related income.

This is mainly done by leasing out floor space to specific individuals depending on the type of REIT - employers as office space, store owners as retail stores, tenants as residential homes, etc. Some industrial REITs can even rent out hospitals and factories!

Similar to stocks, REITs issue shares, and the value of your shares divided by the market capitalization dictates your percentage ownership in the company.

However, one of the key differences (also a significant advantage) between buying REITs rather than stocks is that REITs almost always guarantee dividends, while stocks don’t (more on this later).

There are three main kinds of REITs:

- Mortgage REITs: Loan money for mortgage purposes, or they invest in mortgage-backed securities. They derive income in the form of interest payments on these fixed-income instruments. You can think of mortgage-backed securities as a fixed-income instrument that uses housing as collateral to guarantee income to the bondholder.

- Equity REITs: Invest in actual properties by owning a stake in them and receive money from rent or resale in property appreciation.

- Hybrid REITs: Consists of a mix of both mortgage & equity REITs.

Although REITs are different from stocks in that they are mainly centered around real estate properties, they should not be randomly bought without thorough analysis (they should be treated as normal stocks).

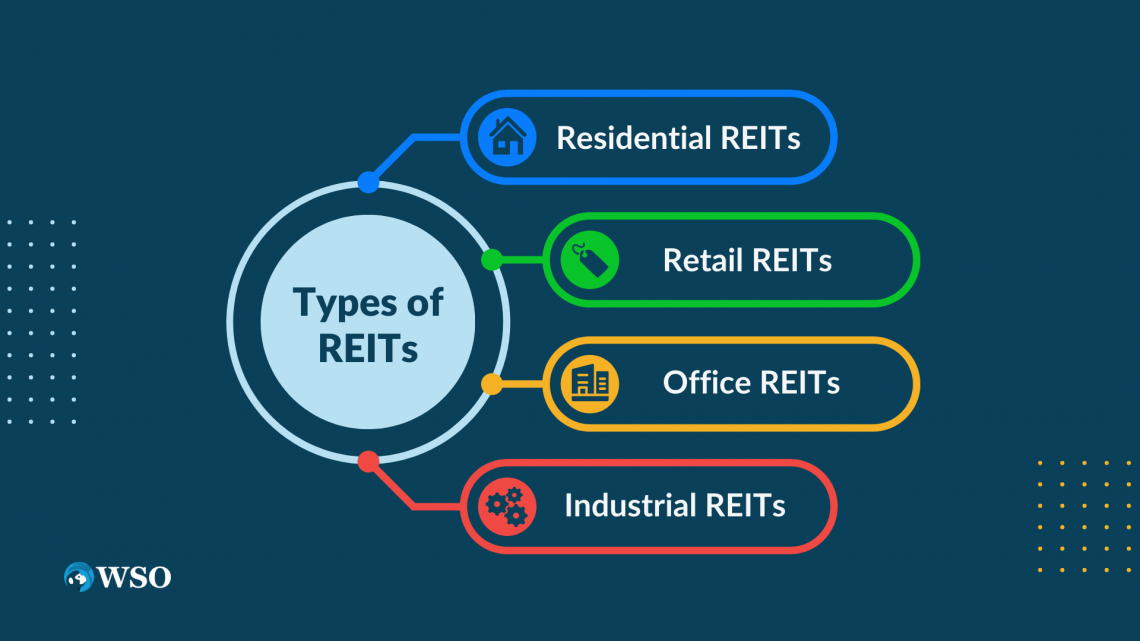

Equity REITs themselves can be further broken down into several types depending on the type of properties that the company manages. Here is a list (non-exhaustive) of the different kinds of REITs you could expect:

1. Residential

Residential REITs operate various forms of residential spaces and lease them out to residential tenants. They manage buildings such as apartments, student dormitories, and single-family homes.

There could also be some specialization within geographical markets or property classes.

2. Retail

Retail REITs manage retail real estate spaces and rent them out to store owners, franchisees, etc. They focus on large regional malls, grocery shopping outlets, and even free-standing retail-related properties.

While some retail REITs offer to pay for utility expenses such as electricity or gas, there are also net lease REITs that structure the terms of the contract in a way that most of the operating expenses are simply passed on to the tenant.

An interesting characteristic of companies operating in this space is that sometimes the terms of their tenancy agreements could include a base rent and a variable rent, dependent upon the tenant's revenue.

In this way, the REIT would have exposure to their tenants' sales performance, where they could share the profits and losses.

3. Office

As the name suggests, these real estate investment trust companies own office-related properties. Examples include skyscrapers and office parks. Companies within this space are likely to focus on different markets, such as business districts in high-traffic areas or suburban areas.

Because different businesses may have different property requirements, there can also be segregation between the classes of tenants that these companies focus on, e.g., government organizations or biochemical firms.

4. Industrials

The scope of the type of properties for companies operating in this area has started to become wider. These REITs focus on a multitude of unique types of properties, including warehouses & large distribution factories.

They play an important role for companies that require storage space (such as e-commerce) and are strategically placed to assist online delivery more quickly.

Advantages of Investing in REITS

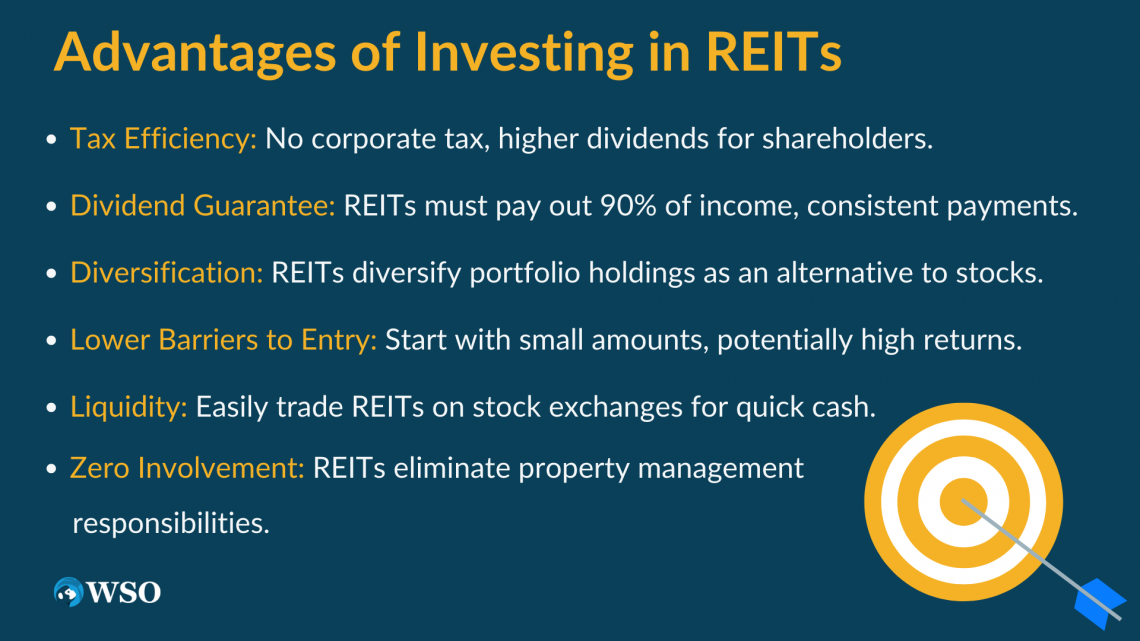

As with any revenue-generating instrument, it is essential to understand the main benefits and disadvantages of different types of assets. Here is a list of pros when investing in REITs:

-

Tax implications: REITs are typically not subjected to corporate tax. This results in more income that will be passed on to shareholders as dividends. However, this doesn't mean there are no capital gains or dividends taxes at the shareholder level.

-

Dividend Guarantee: one of the requirements to be characterized as a REIT is that the company must pay out 90% of its income to shareholders. No matter what, shareholders will get a dividend payment (unless the company goes insolvent, which is extremely rare)

-

Diversification: traditional finance theory mathematically proves that it is important to diversify. REITs pose an alternative to stocks and allow investors to diversify portfolio holdings. Never put all your eggs in one basket.

-

Liquidity: REITs are traded on stock exchanges and are much easier to buy and sell than real estate property. This makes for a more liquid asset that can be quickly converted to cash during emergencies.

-

Lower barriers to entry: instead of using your life savings to put a 20% down payment on a property followed by a 30-year loan to own an asset worth $700k, you could simply buy as little as one share worth $30 from your monthly paycheck. The commitment is much lower, while the % return could potentially be as high.

-

Zero involvement: imagine that, instead of having your property professionally managed, you manage it yourself. You could expect regular 3 AM phone calls from your tenant about a faulty sink, broken furniture, etc.

Disadvantages of Investing in REITS

Here is a list of cons when investing in REITs:

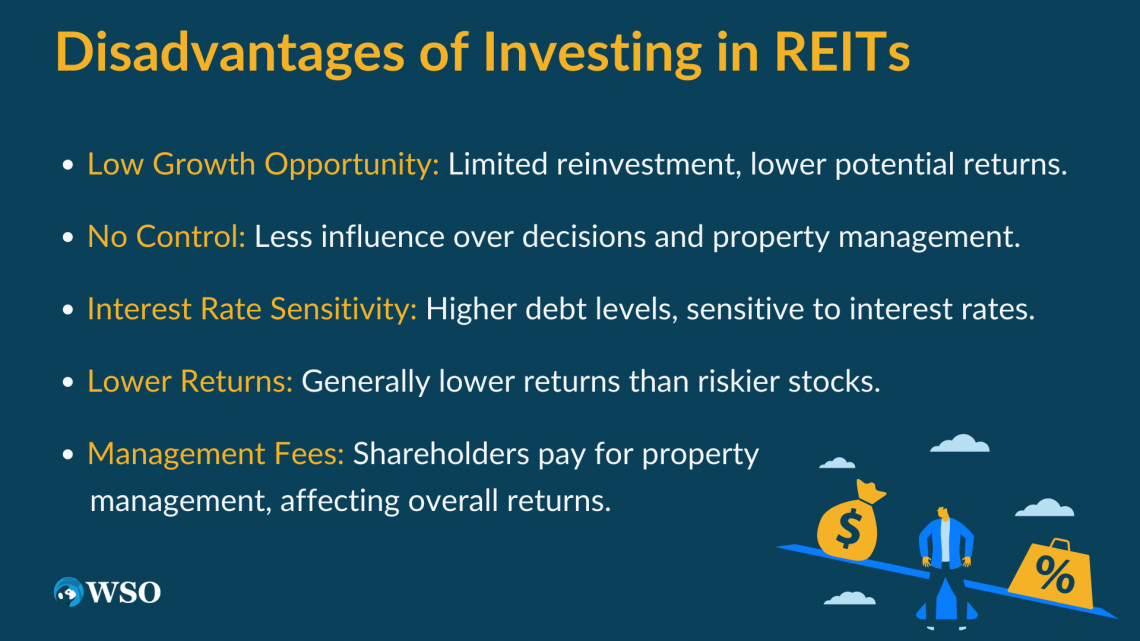

1. Low growth opportunity

When most of the company's net income is paid out in dividends, it gives the company very little opportunity to reinvest earnings for growth purposes.

Hence, it is quite unlikely that you will expect to gain as much return as you would buying growth stocks such as FAANG (despite taking on higher risk).

2. No control

If you decided to buy your real estate and rent it out yourself, you'd have full control; over who to rent it to, how much to rent it at, the terms of the contract, etc.

Owning a REIT effectively gives you less control over what the company does (this is justified because you put up less money to buy real estate).

Therefore, if you don't like the tenants of the REIT that you own, it is quite unlikely that you will be able to do anything about it.

3. Interest rate sensitivity

Because these companies revolve around real estate, you could expect relatively higher debt levels than regular companies.

This makes REITs more sensitive to interest rates, particularly if the company has adjustable rates. While debt does shield taxes, it admittedly puts pressure on free cash flow.

4. Lower returns

While these companies are riskier than the risk-free rate, they are often considered less risky than regular stocks mainly because they center around real estate.

Because of this, investors should expect to generate lower returns. However, this is not always true.

5. Management fees

While the benefit is that you have zero involvement in day-to-day activities, the truth is that you are paying people to manage property for you.

This allows management to operate the company and charge high fees at the shareholders' expense.

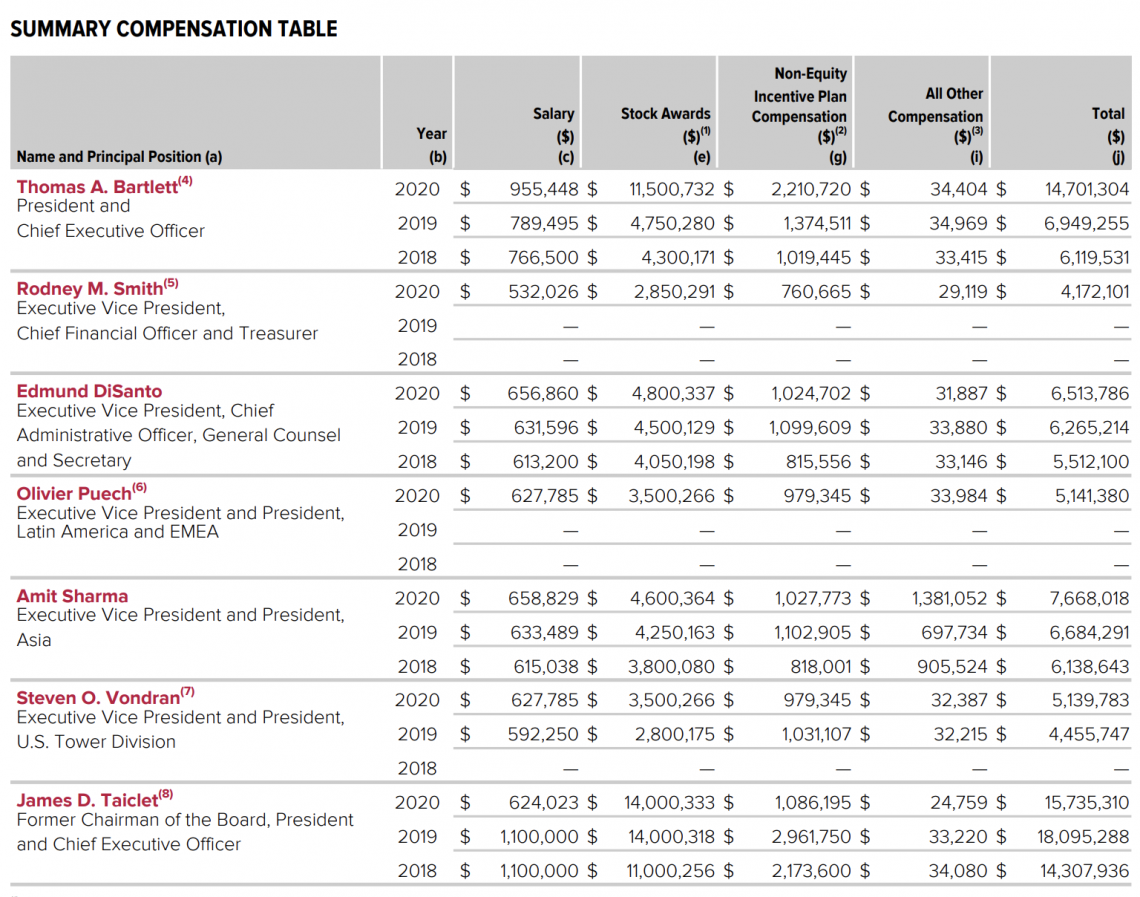

American Tower, one of the world's largest REITs, paid its CEO $14 million in salary, stock awards, non-equity incentive compensations, and other compensations for 2020.

Any company's executive director's compensation in their annual reports. The image below shows the executive compensation for the rest of the C-Suite positions.

Real-World Example of a REIT

To get an idea of some of the largest REITs in the world and what they do, take a look at the table below:

| Company | Market capitalization (March 2022) | Country | Description |

|---|---|---|---|

| Prologis | $107.92 Bn | USA | Logistics-related real estate; owns warehouses that are positioned to allow businesses to have easy access to shipping ports or execute one-day shipping |

| American Tower | $103.31 Bn | USA | Wireless communication sites; operate towers that are designed to improve wireless or broadcasting networks. Operates in 20+ countries |

| Crown Castle | $72.00 Bn | USA | Wireless communication sites; operate communications infrastructure to increase wireless coverage, including voice & data signals, wireless broadband, etc. A similar area of expertise as American Tower |

| Equinix | $64.38 Bn | USA | Digital infrastructure; manages data centers for businesses relating to the consumers' consumption and connection of network services on demand. Clients include Netflix, AWS, Zoom, etc. |

| Public Storage | $62.29 Bn | USA | Self-storage facilities; operates self-storage facilities for consumers to store items, furniture, valuables, etc. |

Just for reference, Cuba's annual total GDP in 2020 was $107.6 billion. Some of these REITs have a higher market cap than countries, including Luxembourg, Costa Rica, Kenya, Sri Lanka, and many more.

Important investment metrics to look at before investing in rEITs

With all the millionaires who've built an empire of real estate, you've probably gotten some interest in investing in them yourself. However, as with all investment opportunities, it is important to look at a company's financials before you decide to invest in them.

There is no guarantee that REITs generate the best returns. While you probably wouldn't buy a house without carrying out the proper due diligence, you should look at a company's annual reports before investing in them.

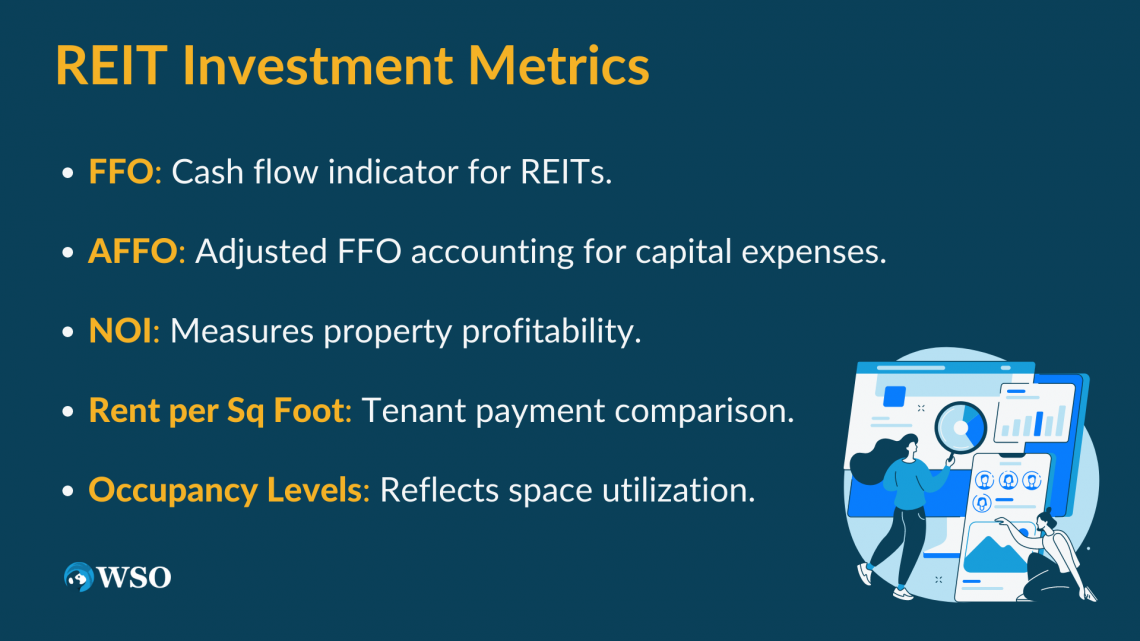

Here are some important investment metrics to look at before investing in a REIT.

1. Funds from operations (FFO)

Although it is a non-GAAP financial measure, it is widely recognized (even by the SEC) as a good indicator for REITs. It defines the cash flow from overall operations and can also be expressed per share.

It is calculated as:

Funds from operations (FFO) = net income + depreciation + amortization - gains from sales of assets - interest income.

-

Depreciation and amortization are initially subtracted from revenue when deriving the net income as an accounting method to spread out the cost of the company's tangible and intangible assets across years.

They are added back to reflect the revenue or income of the company more accurately.

-

Gains from sales of assets are considered a non-recurring event and do not reflect income generated from operations. They should be subtracted from the net income.

-

Interest income is not considered a part of the REIT's operations; therefore, it must be subtracted from the formula.

2. Adjusted funds from operations (AFFO)

Adjusted FFO is an extension of FFO, which considers the recurring capital expenses needed to uphold the quality of the company's underlying assets. There isn't any standardized formula; however, the concept remains the same.

Adjusted FFO is considered a better indicator because it accurately depicts the cash available to shareholders.

The formula is given as follows:

Adjusted Funds from operations (AFFO) = FFO - recurring property maintenance expenses - straight-line rent adjustments.

3. FFO & AFFO example (simplified)

Concepts are always easier to grasp when given an example. Consider ABC REIT, which had a net income of $5 million last year. Part of the $5m included purchasing a $300,000 building and divesting multiple apartment buildings worth $500,000.

Its depreciation & amortization was $50,000 yearly; they spent $75,000 on maintenance costs of all their properties. They also had straight-lined rent costs worth $25,000 annually.

Funds from operations (FFO) = $5m+$0.3m-$0.5m+$0.05m

FFO = $4.85m

Adjusted Funds from operations (AFFO) = $4.85m-$0.075m-$0.025m

AFFO = $4.75m

4. Net operating income (NOI)

Net operating income is a measurement used to ascertain the profitability of any real estate property. You can find this by subtracting gross operating expenses from the gross income found in the company's income statement.

5. Rent per sq foot

Knowing the rent per sq foot, you'd know how much tenants pay for every square foot of the property. If the rent per sq foot of the REIT you are researching is lower than its peers, there might be a reason, and you should find that out.

6. Occupancy levels

Occupancy levels reflect the ratio of space rented by tenants to the maximum available space to be rented. The higher the occupancy levels, the better for the company; however, a REIT with low occupancy levels has the potential to increase its earnings as soon as they manage to sign more tenants.

Conclusion: Should you invest in REITs or not?

When a property is generally unattainable to the average American, those who still want to invest in property should consider REITs as a viable option. Real estate investment trusts allow investors to "prorate" their own in large buildings and receive their share of the profits.

However, do not treat REITs as riskless assets. There are various real estate investment trusts, and they all will have some distinct feature that separates them from others. Please ensure you carry out the proper analysis before buying REITs.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?