Economies of Scale

The cost advantage optimized by an organization as its output increases

What Are Economies Of Scale?

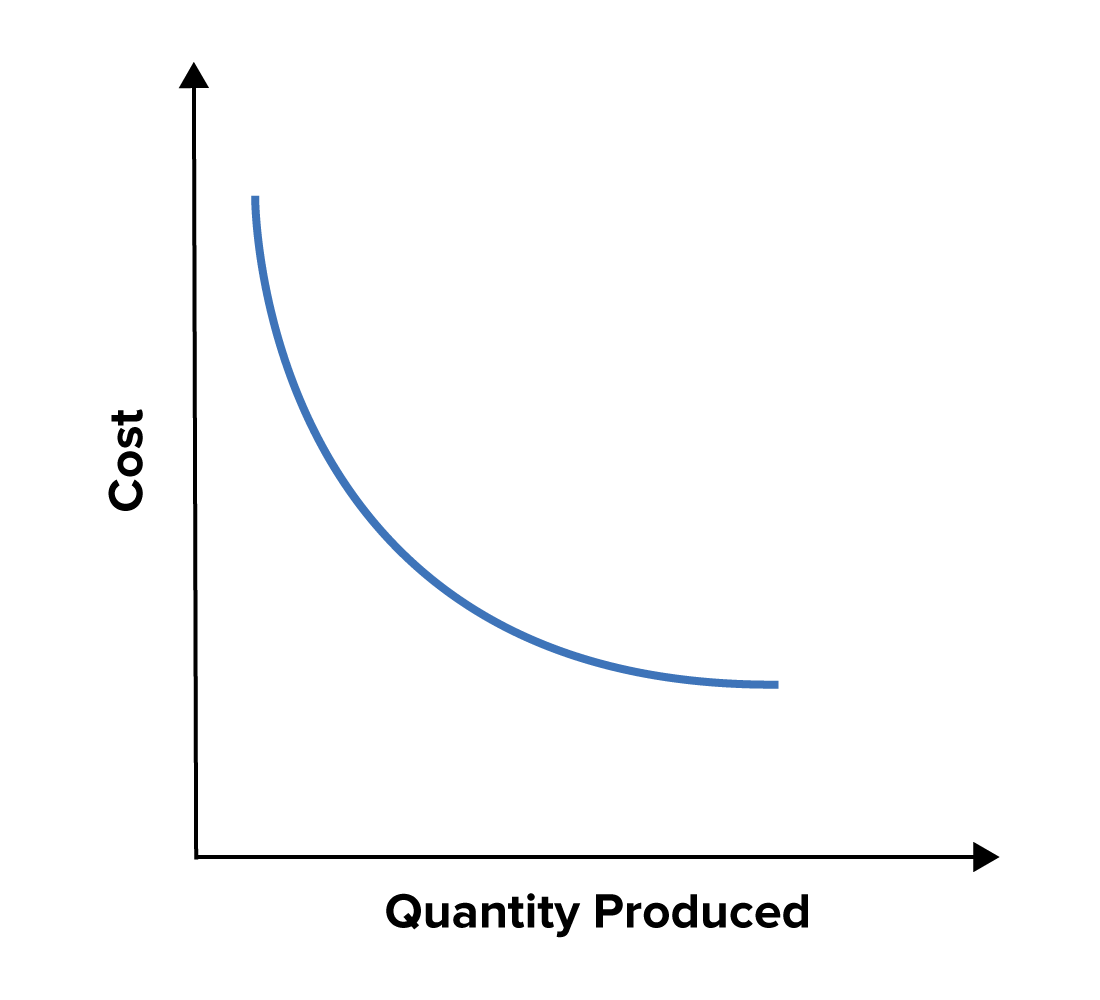

Economies Of Scale are the cost advantages optimized by an organization as its output increases. Quantity produced and unit costs are inversely related to each other. As quantity increases, unit costs decrease, and vice versa.

The above cover image shows the downward sloping curve where costs are initially high when few units of a product are produced; however, as it goes on, costs decline with the quantity produced.

Economies of scale can be applied to a wide range of organizational and commercial situations and at different levels, such as production, facility, or an entire company. A decline in average costs signals the emergence of economies of scale as output rises.

Some economies of scale have a physical or engineering foundation, such as the capital cost of manufacturing facilities and friction loss in transportation and industrial equipment.

Adam Smith, known as the father of economics, developed two important methods for workforce productivity: labor specialization and division of labor.

Both these concepts focused on enhancing operational efficiency and improving worker concentration on tasks. Division of labor involves the breakdown of tasks for each worker in the organizational unit to focus on and then, through repetition, become an expert in their field.

This would lead to specialization. The specialization focuses on labor efforts on particular production types to create a competitive advantage in the economy and improve labor efficiency.

Economies of scale frequently reach their limits when costs per extra unit start to rise after the optimal design point. Common constraints include going over the supply of locally available raw materials, such as wood, in the timber, pulp, and paper industries.

Saturating the local market and having to ship goods over long distances is a common constraint for low-cost per unit-weight commodities. Other restrictions include a lower energy efficiency or a higher defect rate.

Understanding Economies of Scale

Economies of scale have an important contribution to determining the nature of an industry, such as its effect on increasing the industry cost.

It also impacts the analysis of the cost of production. When an industry expands based on product demand, external economies and diseconomies of scale are experienced by the firm.

External economies of scale reduce the cost of production, while external diseconomies of scale increase the costs. Therefore, when external diseconomies of scale surpass the external economies of scale, it is known as an increasing cost industry.

In addition, variable costs are reduced as the number of goods produced increases. Since the scale of production is improved, so are the operational efficiencies. Thus, as a firm develops proficiency in production, creating products becomes cheaper.

Companies with economies of scale develop a sustainable competitive advantage over time, positioning the firm to become a market leader that can exploit its benefits.

There are many reasons for economies of scale creating lower individual unitary costs. Labor specialization and technological advancement heighten volume production.

Bulk orders emerging from suppliers, bigger advertising purchases, and fewer capital costs are reasons for this trend. In addition, the function costs within create unit production to minimize costs.

An organization can utilize internal economies of scale by managing its resource distribution and usage within the company. External economies of scale can be sorted by maximizing the growth of competitors using a more extensive scale to enhance competitive activities.

An example of economies of scale is the comparison between supermarket stores against small grocery shops.

Bigger supermarkets attract customers and have large cash reserves; therefore, they purchase more bulk and can re-sell the bulk at a low price per unit to achieve economies of scale. In contrast, the opposite is true for smaller grocery stores.

Types of Economies of Scale

Alfred Marshall determined the distinction between internal and external economies of scale. The distinction lies between the concentration of economies of scale , either in the company or outside the company, and in the industry.

1. Internal

The organization itself controls it and applies it internally to the company. It can happen due to several areas of organization operations when there is an increase in either the scale of production or plant size. On a Long Run Average Cost curve, it is shown as a movement.

Since there is a movement, it would indicate a fall in the LAC curve since the output is increased and costs decline. The key benefit is better to market standing and positioning to achieve a competitive advantage.

2. External

On the other hand, external economies of scale is caused by a growing number of organizations within the industry. It is shown as a shift on the LAC curve. There is a downward shift in the curve resulting from organizational growth.

A significant advantage is that the organization can defend itself against competitive forces, survive, and benefit from lower threats. As a result, it can achieve greater market positioning due to its ability to minimize risks—the causes leading to large changes in a firm.

There are a few sources of external economies of scale, including:

- Infrastructural.

- Government influence.

- Suppliers.

Infrastructural emerges from government or private investment sources. Companies benefit from new roads and schools in the community. The firms surrounding them will be able to access more talent, knowledge, and skills directly.

Government influence is when a firm increases in size, they can influence policies determined by the government. Big companies can impact jobs and put them at risk, so a government favors a large firm’s demands to function and regulate the economy.

Moreover, a company’s supplier can relocate to adjust and operate near the company itself. For certain suppliers, their customers can become so big that starting a factory closer to the main plant is more favorable.

An example of this is Coca-Cola which has its suppliers and manufacturers close to its main plant because of high demand, and thus it benefits suppliers and the company that enjoys low costs.

Sources of Economies of Scale

Understanding the underlying sources of economies of scale is vital for business strategists, policymakers, and economists alike.

The sources can be categorized as:

- Technical

- Managerial

- Financial

1. Technical

As a company’s size increases, it can utilize the latest and most recent technology. The mechanical advancements and optimization of large-scale production cause cost savings, resulting in technical economies of scale.

A big factory facility can invest in robotic machinery that decreases labor costs, yet the same investment is impossible to achieve when the company is smaller.

This type derives from a development in a production process. The efficiency is maximized within the production process as a firm’s outcome increases, and there is a higher investment in machinery to support the output level.

Big companies can justify a large investment in production lines due to their high capacity, reducing unit costs. However, this method uses expensive equipment that large organizations can only capitalize on. Thus, fixed costs are spread over several products.

Average costs are also reduced. However, small companies do not have this advantage because they cannot operate despite having the necessary capital due to low demand. As such, unit costs would increase.

An example would be the mass production of motor vehicles that incorporate elements of both division of labor and specialization; such scaling leads to technical economies of scale.

2. Managerial

The next type is managerial, based on employing and selecting a solid workforce. Then, when a company succeeds in the market, it can hire a more efficient labor force with the necessary technical knowledge, skills, and core competencies.

This happens when a company can afford specialized labor to manage the company’s operations and tasks effectively. The firm can hire managers who create a positive and strong workplace culture and environment and encourage employee well-being.

Specialization of labor will reduce labor costs and improve company performance and productivity. Specialist manager skills allow them to work faster without any errors due to their advanced knowledge and skills, which a large firm benefits from.

Those with such expertise improve company decision-making in contrast to those who are not managers. Using growth, a company can avoid task duplication in several organizational departments, enhancing its overall efficiency.

An example would be Apple, the tech giant and leading software company, developing its research and development and product innovation of Apple products and hiring specialists with the right knowledge, skillset, and competencies to create exceptional products and upgrades.

3. Financial

And lastly, financial economies of scale occur when sufficient finance is raised. Large organizations can benefit from extensive borrowing at low interest rates. Thus, a low interest rate promotes higher profits, less risky than for small businesses.

The financial economies of scale lead to cost savings in the long run and enhance the organization's operational efficiency. Lower interest rates also provide the company with more spending on assets.

More prominent companies with solid financial credentials are inclined to back loans on time and thoroughly. They also have more collateral in the event of loan repayment. Lenders prefer to lend to large companies with a proven record and diverse product offerings.

Small companies do not have the same advantage as they struggle to raise finance and are charged a higher interest rate. As a result, there is intense competition between financial institutions for lending to big companies. A lender with low interest rates is selected in this case.

Advantages and Disadvantages of economies of scale

There are various benefits for companies and industries since it allows them to decrease costs, pass cost cuts to customers, and achieve competitive standing in the market.

With a focus on companies, the first benefit is less long-term costs per unit as lower costs improve price competition in international markets.

Another advantage is higher profits since economies of scale enhance profits, creating a higher ROI or return on investment and helping business growth.

Business scalability is also improved since a firm’s risk exposure significantly declines; this leads to new financing and capital investment opportunities due to a positive impact on the share price.

Additionally, as an organization grows bigger, its market presence also improves. The company enables consumer awareness and forms brand trust; this lets the firm establish a strong market positioning. There is also more credit availability and lower interest rates charged.

Economies of scale help a company improve its product offerings because a firm can reinvest its current capital savings in research and development for its products; this will lead to higher efficiency and better prototypes of goods.

Wages are also increased. Therefore, employees are better paid due to higher profits and cost savings produced; employees are then incentivized to contribute more to the company, and it motivates them to produce better results to benefit from a higher standard of living.

Economies of scale happen when the cost of production reduces, whereas due to diseconomies of scale, sales are increased.

Cost advantages are obtained due to operational scales. Diseconomies are cost drawbacks that a company builds up due to increasing a firm size or output. This causes the production of commodities to have a higher unit cost and leads to a reduction in costs.

Diseconomies of scale also raise the costs. When economies of scale exceed the diseconomies, the return to scale also increases. When both are balanced, there is a constant in the return to scale. Diseconomies exceeding economies of scale cause a decrease.

Diseconomies of scale refer to the concept that when a company becomes too big, the cost per unit increases. It can be a potentially wide-scale drawback for the growth of an organization.

It is caused by a lack of communication, loss of business control, low morale, and other factors.

The first disadvantage is poor and incoherent communication. A lack of good communication and failure to send an intended message to the receiver can cause bureaucracy and ineffective coordination of a big labor force when the size of an organization increases.

There is also a loss of control since when a company grows, it is harder to manage the quality and productivity of all employees; this can lead to an efficient process of managing the entire company and the production of goods and services due to a lack of proper control.

Another reason is that morale can be weakened since when a company becomes bigger, the employees incur feelings of isolation, detachment, alienation, lower motivation levels, and less productivity. Thus, there is less output for the company and a decline in morale.

There can also be negative backlash from the public due to scandals in wage payments and using cheap labor. An example of this was McDonald’s facing negative publicity for not paying its employees enough, it led to boycotts.

A small company is not under such scrutiny and public observation as a larger firm. As such, bigger companies are held in high regard.

Key Takeaways

- Economies of scale is caused by lower production costs arising from an increase in the operational business size.

- As a company grows, its overall fixed and variable costs reduce to an extent. The decline in costs gives rise to several benefits including higher wages, better market positioning, a competitive advantage, higher productivity, more research, and development, etc.

- When a company grows too big, it may experience diseconomies of scale which can harm the business. The costs start to rise and it can adversely affect wages, jobs, and employee morale, and weaken the business’s health.

- The various types of economies of scale explored in this article include technical, managerial, and financial. They all result in a competitive advantage for the organization.

- For a business to remain successful, it must always remain to achieve economies of scale at a considerable and sustainable growth rate over a while.

- It is important to balance both economies and diseconomies of scale to sustain the factors of production.

Economies Of Scale FAQs

It is when an organization benefits from lower average costs as output rises. The phenomenon of reduced costs when output is enhanced is known as EOS.

What is the name given to the phenomenon when organizations grow too large?

These companies experience diseconomies of scale such that when they expand too rapidly and suffer from economic inefficiencies and slowdowns, they miss the benefits of EOS and instead, have rising average costs as their output increases.

Economies of Scale only happen due to ever-changing factors of production over a gradual and longer period of time.

or Want to Sign up with your social account?