Top 5 Stupidest Publicly Traded Companies

I was screening for new l/s ideas yesterday and forgot to filter market cap. Some hilarity ensued, and having a minute this morning, I figured I would share this collection of monkey shit. Yes, these are/were real companies and you can look them up on Cap IQ if you want.

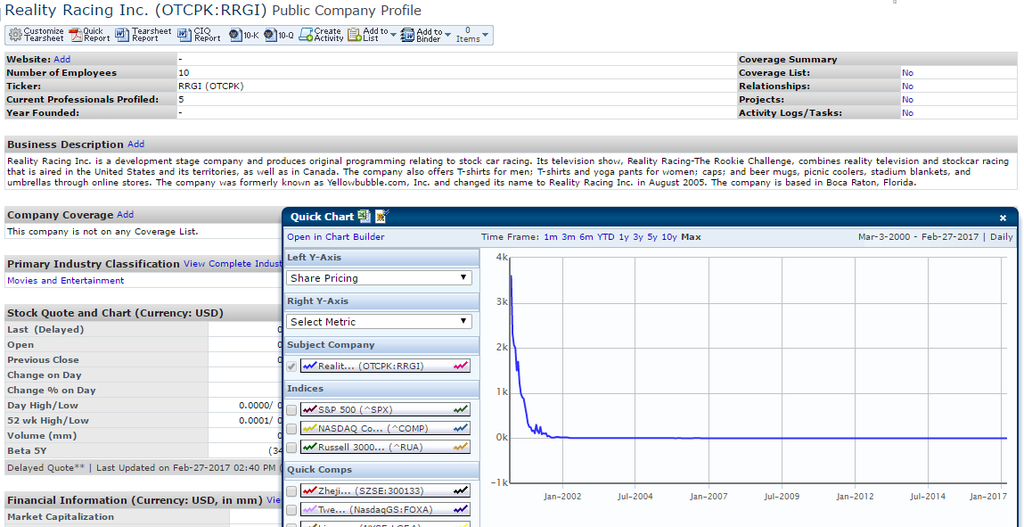

5. Reality Racing (OTCPK: RRGI)

Would love to know the story behind this one...

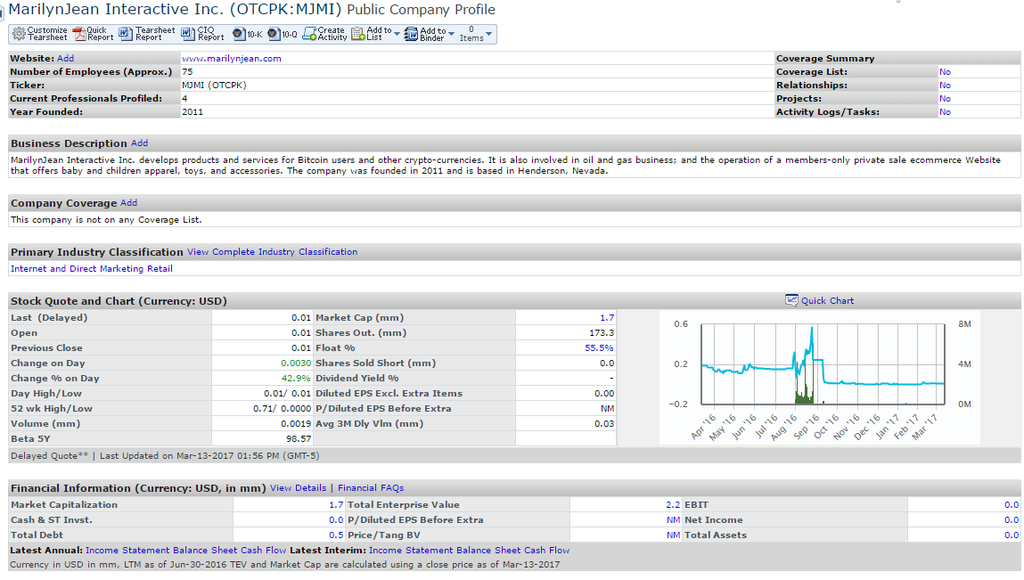

4. MarilynJean Interactive (OTCPK: MJMI)

Sounds fishy to me.....

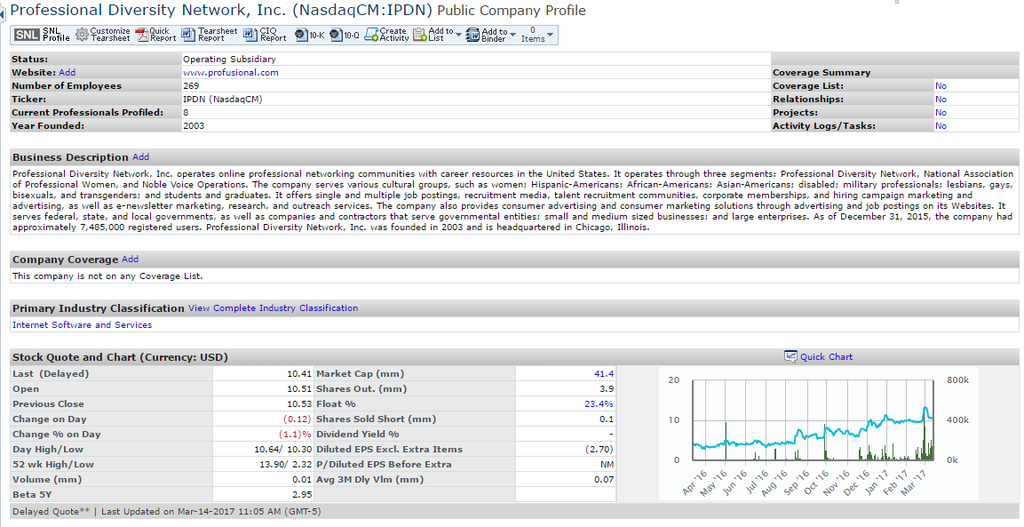

3. Professional Diversity Network (NasdaqCM: IPDN)

If you weren't sick to the back teeth about being brow beaten constantly about diversity, you can now invest in it...

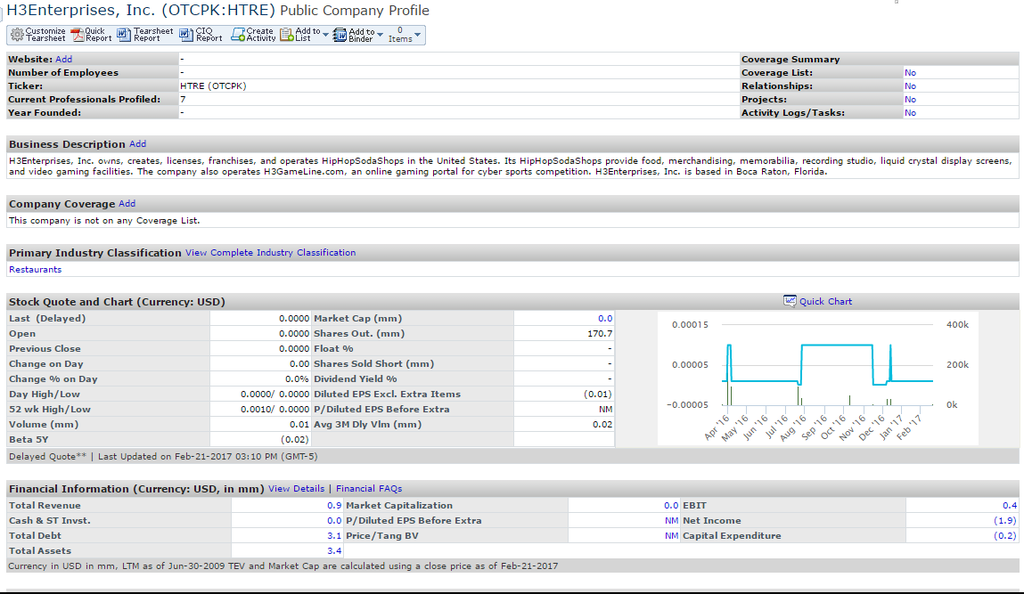

2. H3Enterprises (OTCPK: HTRE)

This link says it all:

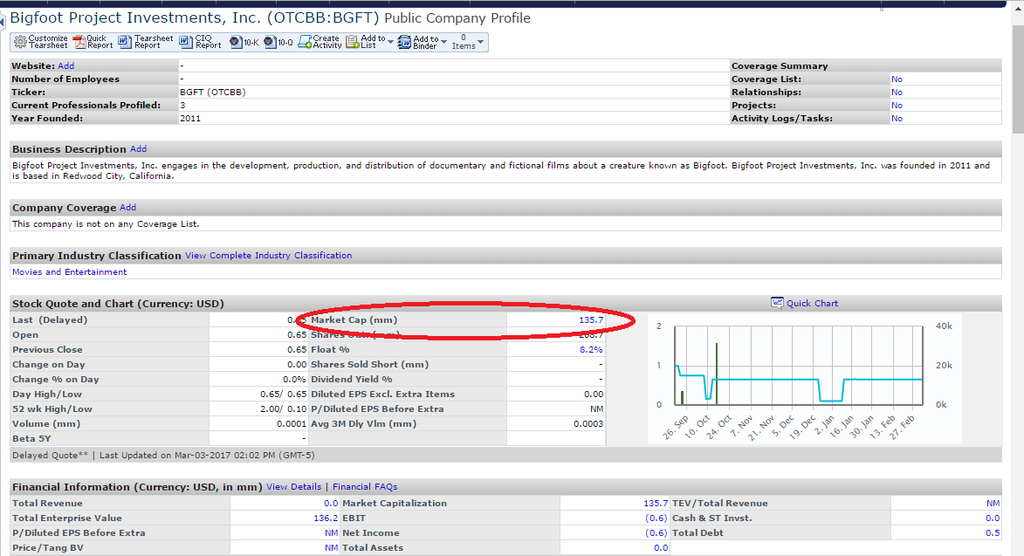

- Bigfoot Project Investments, Inc. (OTCBB: BGFT)

Yeah yeah before you start getting off in the comments about how only 8% floats... the market cap is still as stupid as the pursuit

PS efficient markets my ass... and before you start stroking yourself to how well you did on your last finance exam and start lecturing me about market cap & liquidity vs. efficiency go to your local grocery store, buy some Freshpet (NasdaqGM: FRPT) dog food for $80, eat it, and then you go put your money in a company that sells human grade dog food at 50x TEV/EBITDA

Have nice day.

When they discover Bigfoot you will be jealous that you missed out on this opportunity. My understanding is that the squatch shits gold and pisses light sweet crude.

Boys, we are officially dealing with . . . a fucking samsquanch. Looks like a ten footer by the looks of that stuff. Boy I hate those smelly bastards . . .

"Oh it's just a big stoned kitty."

Jim_Lahey Curious to hear your thoughts on the samsquanch

I wonder why Aerotyne didn't come up? It's awaiting imminent patent approval on next-generation radar detectors that have both huge military and civilian applications.

http://aerotyne.com/

Two brothers?

SB's to anyone who shorts any of these and reports the results.

Anything based out of Florida is a scam. Nearly every investment fraud story starts with some location in Florida.

And serial killer too LoL

A sunny place for shady people

Nice. Seriously though, I was watching some CNBC show called: "Scams, Scoundrels, and Suckers," every plot began in Florida (mostly Miami and Boca Raton).

Take a look at TLLT. Someone sent them to me recently because they are, in theory, a competitor. Had never heard of them. I was surprised when I noticed their $90M market cap...curious, I pulled up their latest 10q. Revenue = $0, cash = $6k and current payables = $200k. Seems legit, where do I invest?

LMAO! Just one big bear flag since IPO. When's delisting? What a joke.

The funniest part is that it's somehow run up on no real news! They claim to have signed their first commercial contract, and in reading an article on it...they are making $175 per month (not thousands or millions, $175). That's a sick revenue multiple.

TONS of stupid publicly traded companies. Check out a delisted sucker called Motivating the Masses MNMT. Dafuqqqq? I'm frankly rather embarrassed for them.

Someone is dumb/gullible enough to invest in anything. Especially when you got the Jordan Belforts of the world out there peddling these.

Look at CSLGBT, it measures the performance of US companies recognized for supporting and promoting equality for members of the Lesbian, Gay, Bisexual, and Transgender community.

So I looked this up. It's basically an index of LGBT friendly companies and when you google it you get wall to wall spin stories like this one: http://www.hrc.org/blog/credit-suisse-index-strengthens-business-case-f…

Yeah... Underperformed the S&P 500 on a 10 year horizon by about 220 basis points....

$NDLS Noodle & Co. It’s hilarious. These guys just punch out noodles in retail shops with 800 square feet or maybe 1,000 square feet. They sell basically, my words — not theirs, high sodium noodles. People are addicted to it. stock is down over 90 percent and lost a billion dollars in market cap. $100m current valuation

Did all the work on it already. Totally stupid and near restructuring if I recall correctly. But we couldn't get a borrow... ¯_(ツ)_/¯

$NDLS Noodle & Co. It’s hilarious. These guys just punch out noodles in retail shops with 800 square feet or maybe 1,000 square feet. They sell basically, my words — not theirs, high sodium noodles. People are addicted to it. stock is down over 90 percent and lost a billion dollars in market cap. $100m current valuation

Noodles and co makes 400 million dollars more in profit than Snapchat on the same revenues

Lol this has got to be one of the stupidest comments I have ever read on WSO. Snap also has close to $1B in cash and little debt. Noodles doesn't make enough CFO to cover it's capex, even when you adjust out for lower capex in the future. Snap reaches an elusive demographic.... Noodles serves... noodles in a bowl.. It also has over $400M in contractual obligations on a company that is just a $115M market cap and makes just $25M in cash from operations.

Really they are both stupid but apples & oranges... I'd stick to commercial banking tho

My toddlers LOVE Noodles & Co. Granted when I take them there they rarely even get a noodle on their plate - only get Chicken breast or sometimes mac & cheese with broccoli and apples, but they're insane over that place.

Funny you're not even in their target demographic. But I'd take them there while you can because I wouldn't be surprised if it goes belly up or is in restructuring in 24 months.

What blows my mind about this story is that NDLS was backed by Catterton Partners (basically LVMH group) and PSP Investments.

Bigfoot is exactly the type of investment I've been looking for to diversify my shipwreck-salvage portfolio

Oh yeah forgot to mention Odyssey Marine.. They ain't gonna be around much longer

nah dude Don Diego is gonna come through. i'm staying long

I'd like to know which bank took these guys public? What was the road show like? What poor schmuck has these IPOs as deal experience on their resume?

So many questions...

I believe it was vik2000

Probably a Reg A/Reg A+. Getting listed on the OTC/BB markets isn't tough..

Most of the shady public companies I have seen went public through a RTO (reverse takeover aka reverse merger).

It happens often in Canada/Toronto and most RTOs of this caliber have a hilarious ending. The popular scams are the ones that revolve around "gold/platinum exploration".

AndyLouis any thoughts on taking WSO public? Hell if the above examples could at least you guys have a steady income stream!

Never seen JAMN?

I'd say TSLA raising $1Bn today and investors buying it up to $260+ from $252 is one of the stupidest things ive seen.

So Bigfoot DOES EXIST!!

Twitter!

What's DCF though? Please advise

Need to make an informed decision on these names

Thx

Enim quibusdam aut porro porro sunt nihil odit. Sint enim ipsam velit voluptas animi.

Ea voluptatem ea veritatis quo. Numquam earum et laboriosam dolorem.

Est rem eos maxime consequuntur dolores. Quisquam corporis numquam sed non quibusdam vitae expedita commodi. Accusamus nobis quis est placeat non libero aut. Facere perspiciatis unde voluptatem modi dolorum illo et ullam. Aut aspernatur ex et unde repellendus iusto. Doloribus repudiandae beatae vel inventore.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Magnam sit inventore repellendus quos vel dolorem aperiam. Accusantium odit asperiores quo a. Vel voluptatem ut iure rerum sunt repudiandae.

Ut aliquam magnam recusandae omnis. Quae in ab odio tempore enim id quasi. Debitis at est facere soluta vel. Sed libero architecto ut iste ducimus aut nobis. Ut nostrum laborum accusamus tenetur magnam cupiditate dolore omnis.

Qui impedit maiores perspiciatis corrupti. Sit ad beatae alias hic. Quo nam ut quis minima id debitis. Quo omnis voluptate ut delectus voluptatem id.

Voluptates error aliquam incidunt. Autem in rerum dolores maxime. Occaecati reiciendis voluptas mollitia voluptatum fugiat quaerat est. Id eligendi aspernatur tenetur earum dolore eius quis. Repellat totam accusamus voluptates magni sit.

Aperiam enim ut enim et voluptas hic. Porro reiciendis qui cupiditate deleniti omnis. Reiciendis deserunt et unde dolore.

Odio reiciendis corrupti natus deleniti est unde. Vel saepe qui repudiandae qui ut magnam. Iusto et incidunt vel quae id facere.

Deserunt quasi voluptatem vel ullam ut et eius. Ut mollitia quo cupiditate dicta mollitia. Repellendus et id facilis.