|

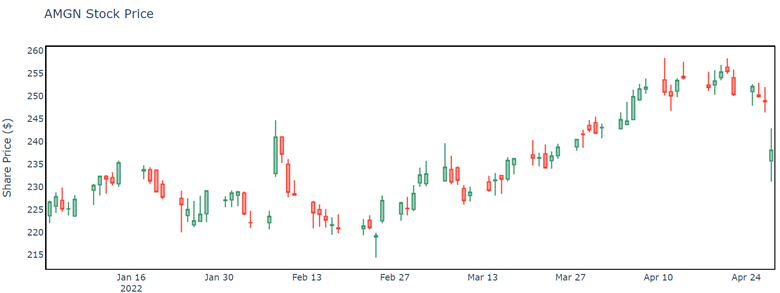

Amgen Inc ($AMGN) — By traditional metrics, Amgen had pretty decent earnings. Their non-GAAP EPS beat estimates just like their revenues, showing strength even compared to the first quarter a year ago in a drastically different macro environment. Amgen also reported stronger than expected free cash flow.

So what gives? Apparently, Amgen is on the hook for $5B of adjustments and penalties with the IRS *allegedly*. Under this cloud, shares of $AMGN retreated 4% pre-market and ended yesterday down 4.28%.

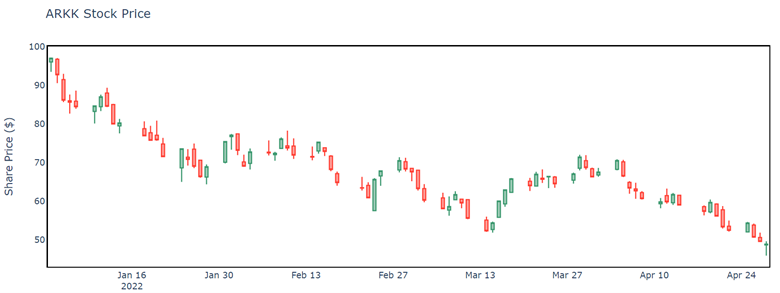

Cathie Wood — As you guys know, in this section, we usually cover an individual stock or a sector that showed some weakness compared to the broader market. Today, we will mix it up and talk about Cathie Wood, or as South Korean retail investors know her, “Money Tree.”

ETFs aren’t exactly sexy, but I’ll give Wood some credit. I’d consider her an uber bull on some intangibles that you can’t see either: innovation, magic internet money, making the world a better place.

But if recent performance is any indicator of future returns, her future is not looking bright. Wood runs ARK Investment Management as their Chief Investment Officer and Portfolio Manager, and, well, things are not going great.

Her flagship fund ARK Innovation ETF ($ARKK) is down 49.61% YTD. The rest of ARK’s baskets are down between 25 and 50% this calendar year.

In spite of this awful performance, Wood had the lady-balls to double down, affirming expectations for 50% returns compounded annually after this recent rough patch. These comments came shortly after a Morningstar downgrade of ARK’s premier fund.

While her clients have been hemorrhaging cash, she has been galavanting around the world, probably collecting Hilary Clinton-sized speaking fees. She was recently spotted in the wild in Miami and Bahamas, peddling her bull$hit.

$ARKK’s third-largest holding is (was?) Teladoc, comprising almost 7% of the fund. Yesterday we watched $TDOC shed over 40% of its market cap. We saw this move wipe away around 3% of $ARKK’s value between the close on Wednesday and the opening on Thursday.

Wood’s critics love to hammer her for crappy risk management and her contrarian views on investing, reality, and the future. To me, it sounds like her alleged denigrators might be more than a little bit right.

|

Explicabo quis minima cupiditate dolorem tempore officia. Quas excepturi doloribus qui quia.

Quisquam quisquam expedita aut sed voluptatem similique est. Magnam id voluptatem et architecto mollitia doloribus facere.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...