Houlihan Lokey RX or Natixis IBD for FT

Have a really tough choice in front of me, I know both groups are highly lauded, particularly Houlihan RX. I do value lifestyle though, so I'm not really that concerned with prestige as long as I'm at a top caliber bank that will allow me top caliber exits. Right now I'm leaning towards the 'tixis, not just because of lifestyle but because I feel like their M&A deals will give me a better chance to exit to UMM LBO PE, whereas I've heard HL RX exits are heavily weighted towards HF / Debt / Distressed seats.

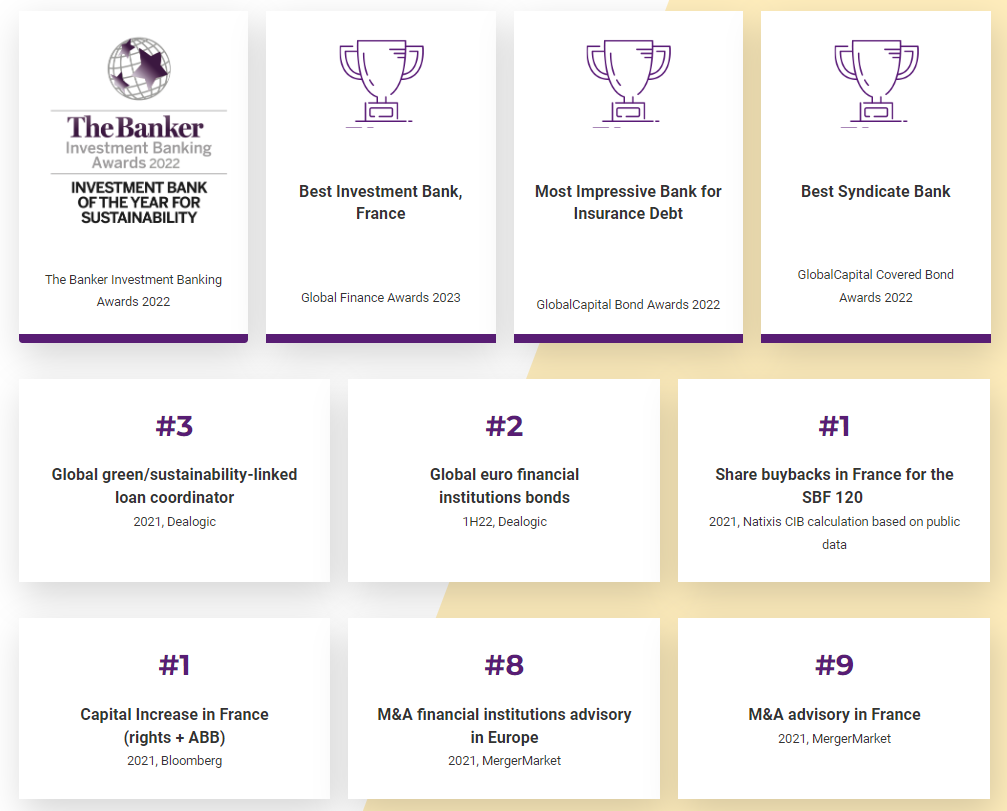

In addition to this, I feel like 'tixis, the purple touch, has been on the come up for a while. Not only were they recently crowned Investment Bank of the Year (in France) by The Banker's investment banking awards, but they were also ranked the Most IMPRESSIVE Bank, all around, for Insurance Debt by Global Capital's bond awards. HL on the other hand, has never been ranked the Investment Bank of the Year (France) nor are they the Most Impressive Bank for Insurance Debt (in France), which feel pretty weak to me honestly.

I didn't read most this post but is the second place another boutique like HL? I haven't heard of them

Two different leagues. Take HL offer and run.

I agree that the 'tixes, the purple touch, is probably closer to a BB and Holleran Lockey is more like a regional boutique just starting to grow out they're special servicing capabilities, but idk if I'd say it's as black and white as one should run away from a Holleran Lockey offer. It appears to be a decent boutique, granted they lead with their balance sheet and lending capabilities

Did you read his comment?? He said to take the HL offer, lol. But tbh if you plan to stay in France, then take the Natixis Partners offer. I heard they are a big player in midcap/upper midcap m&a in France.

Lmao solid troll

“Most impressive” That’s what my coach said to me while sitting on the bench.

take natixis and don't look back. HL RX has really poor exits, they are more well-known for their DCM capabilities

That is what I was thinking HL typically leads with they're balance sheet and lending capabilities whereas the 'tixis (Most Important Bank in France, years 2021, 2022 consecutively) is more of a true advisory shop.

*There

Bump

HL RX 100%

I think you know my answer. Take Natixis and run.

Honestly would take Nextis because of its balance sheet compared to HL (HL mainly working on extending amendments, etc

[@ThatMD12] – let's hear from your wealth of wisdom

Natixis blows HL Rx out of the water

Come on James, enough is enough…

'tixis? Who calls it that lmao

Seasoned Wall Street Professionals

Truly elite bankers and seasoned intellectuals.

Hey intern, first of all: congrats on your Natixis offer!

I wanted to share a little insider insight that might sway your decision in favor of Natixis over Holleran Lokey, since you truly value lifestyle and its indeed part of the equation.

Beyond the crisp suits and serious discussions, Natixis bankers have a secret alter ego that comes to life every Friday night. Picture this: vodka shots, tie-as-a-headband fashion statements, and a rallying cry that echoes through the Paris financial district - "'Tixis gets litty!"

It's a legendary tale of bankers shedding their corporate armor and diving into a world of unrestrained revelry, all while protected by the bank confidentiality. This unique culture sets Natixis apart, making it not just a workplace but an unforgettable experience. And don’t forget that they pull it off while being the best investment bank in France for many consecutive years! Truly inspiring. Imagine being restricted from participating to analysts’ surveys because you would skew the work-life balance and culture data and set unrealistic expectations for prospect monkeys.

So, if you're up for a wild ride that transcends the office walls, I'd say Natixis might be your ticket to a Friday night adventure you won't find anywhere else. The allure of being part of the 'Tixis legend adds an extra layer of excitement to the professional journey.

Best of luck with your decision, and here's to hoping your Fridays are as legendary as 'Tixis!

This comment thread is some serious bizarro mindfuck

'tixis all the way. After all, there not the NUMBER 1 Global Investment Bank (in share buybacks in France for the SBF 120 as of 2021, per internal calculations by Natixis) for no reason. Why would you not work for literally the best bank in the world?

Quos voluptates ad dolorem rerum ex. Et inventore quam beatae ducimus voluptatem laborum. Porro qui molestiae veritatis inventore consequuntur enim id.

Vitae dicta nesciunt eligendi error placeat quas quis. Sunt porro ut aut deserunt voluptatem. At doloremque quo rem reiciendis quidem. Inventore sit rem unde impedit. Maiores veritatis maxime provident.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Aperiam impedit ipsam cum odit. Nam perferendis voluptatum est accusantium. Veritatis voluptatem dolorum est non qui excepturi amet non. Est reprehenderit eos perspiciatis et recusandae.

Aliquid sint repudiandae qui dolor sequi voluptatibus libero. Ipsum voluptatem occaecati aut sunt modi pariatur ut. Quia minus asperiores quia et molestiae. Quasi minima sed non.