My Hours As A First Year Associate in PE

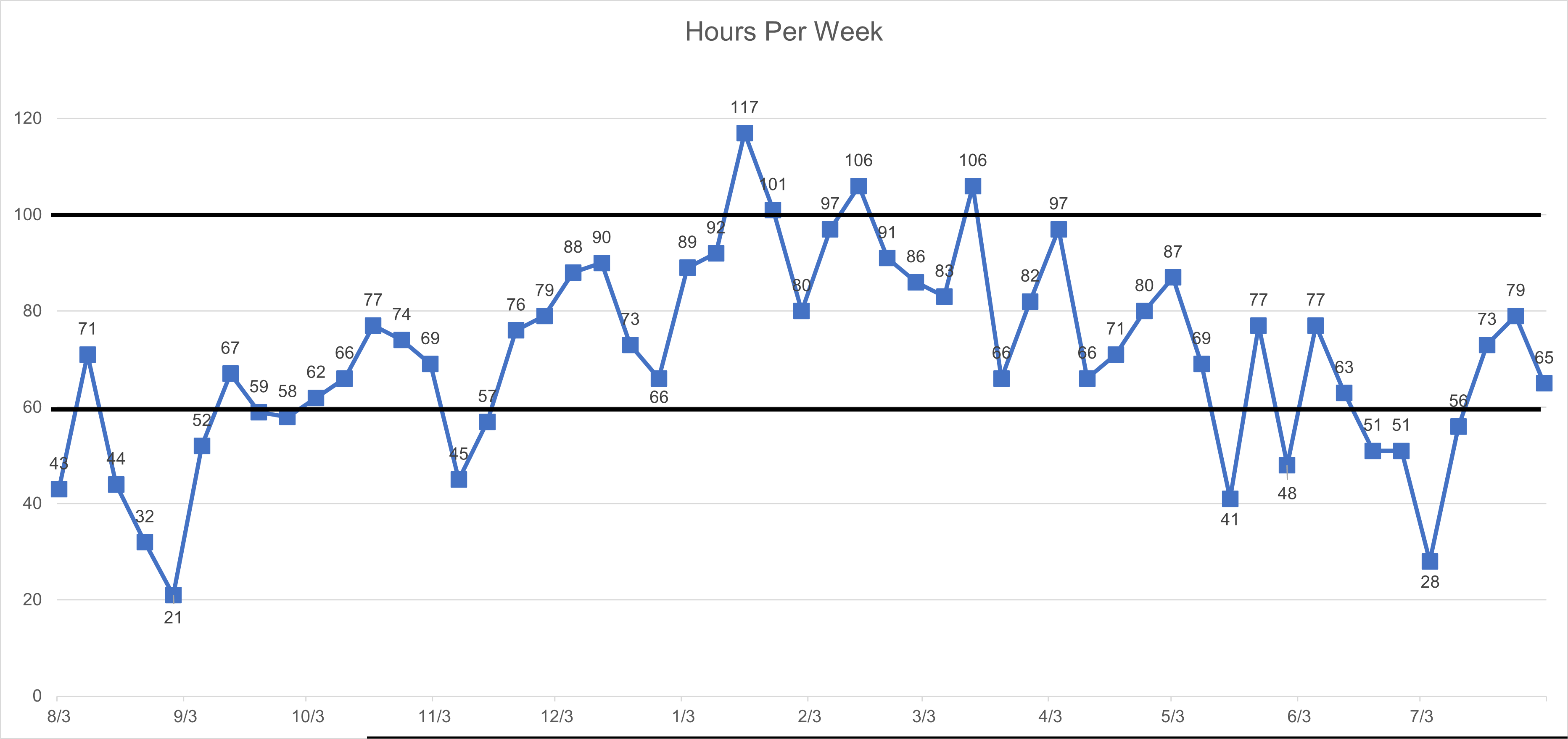

In an attempt to let others interested in joining the industry know what they are getting into, I consolidated my hours throughout my first year in PE. 72 hour average over the year with a 93 hour average from Jan. - Apr. Overall find the hours far more draining than banking but the work slightly more interesting.

Wow thanks for sharing - what type of fund are you at?

Buyout

Cool, MF or MM? Could you see yourself staying at the firm long term? Fwiw currently deciding if I want to pursue on cycle next year from an EB

What’s up with those 20 hour weeks? Were you on vacation or just had nothing to work on / no comments to turn?

The first was after just joining - was only staffed on one portco and that was quiet. The second was over July 4th (only reflects Weds - Friday of that week as firm was off that weekend - and I was actually able to take off as well).

Thx very helpful

This truly makes me wanna not going into PE after 2 years of banking. Fuck wasting my life away.

Im not giving my youth to spend it an office with sycophantic fucks for barely decent money.

Then… don’t?

The hours really are not always better. Generally, the shittiest tasks can be handed off to a bank, but if the bankers suck (advisors are usually chosen for something that benefits the bigger picture, not you), you have to make it work.

And lord help you if one of your portcos runs into financial trouble.

Also... tasks always get old. Even diligence gets old if you're joining a sector team. On the flip side, there's pressure from needing to pick up every new industry fast in a generalist team.

What I'm looking at is wage slavery

Interesting to see, thanks for sharing. Just to get an indication, how busy has this year been for the fund in terms of deals? Know that many firms haven't really done much in the last year and have mostly been focusing on PortCo's.

This is great info, thanks for sharing.

Are you in NYC? And do you mind sharing what your comp is? Curious because like you said, feel like things vary a lot, have heard several friends at MF who had better hours this past year.

Cool chart (absent the underlying realities) - not to be annoying, but distribution chart would be a good complement to this just to better visualize how many weeks fall into certain buckets

How much time did you spend reading research / trying to understand something vs modeling, slide building, diligence and meetings?

And, how many of your late nights were caused by your own inexperience? If you had the exact same amount of work, would you work the same hours? Or would you be a little/lot more efficient?

Looks like my stock portfolio return

If you dont mind me asking, how well are you compensated for these golden handcuffs?

Amongst your analyst class or friends that went into PE, would you say your hours are similar to theirs?

This was a great idea and wish I had thought of something like this. I can say that mine were definitely somewhat similar, starting slow and spiking in Q1-Q2 of this year. Lot of “slow” 60-70 hour weeks and then easily 90-100+ on deals.

Repudiandae consequuntur quisquam pariatur rerum ullam sit consequatur. Quia commodi et sit laboriosam. Maxime recusandae et in ad.

Reprehenderit quis labore officiis consectetur similique odit tempora. Corrupti eligendi eos omnis et.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...