Trafigura Hedging Question - Interview

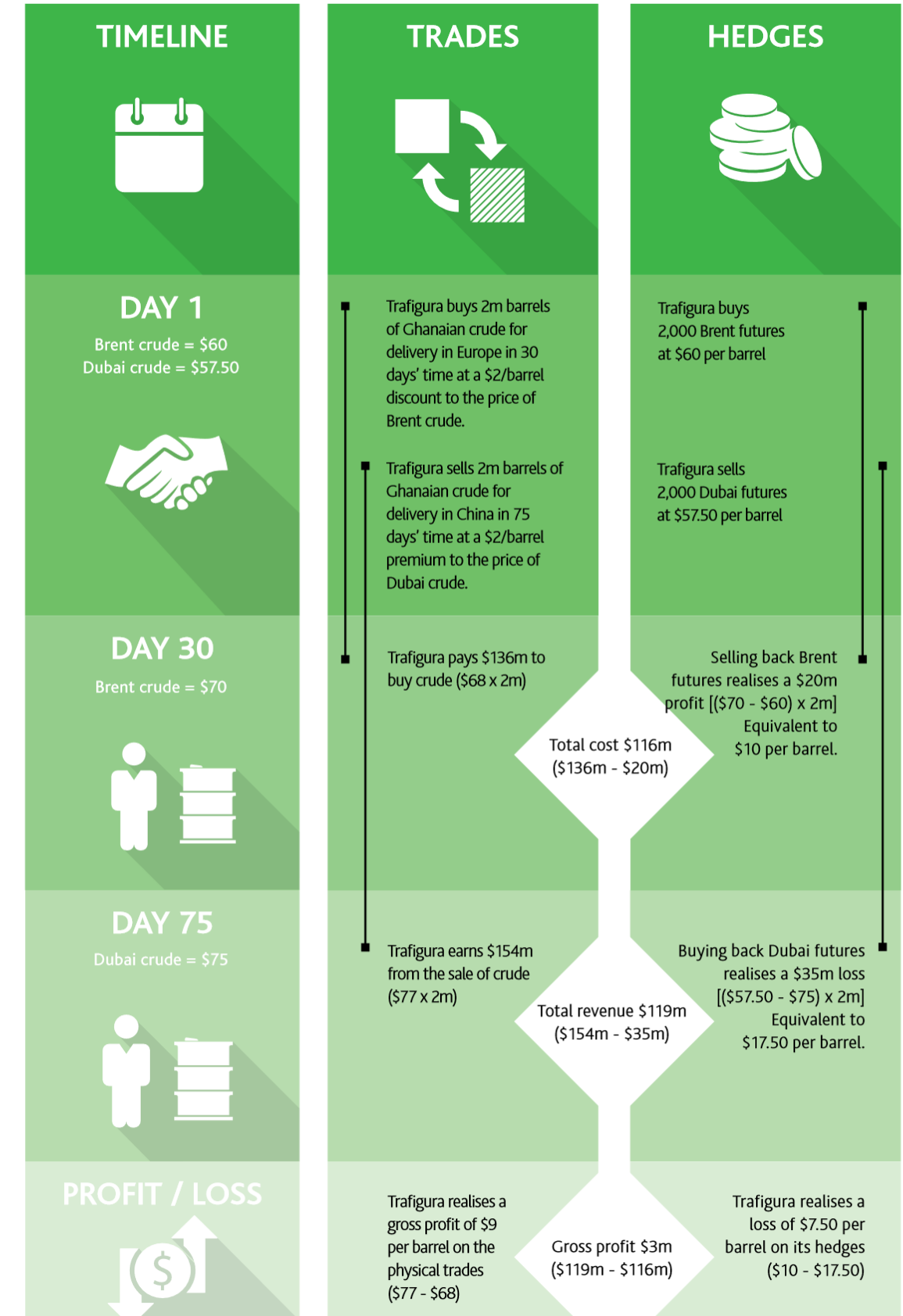

Prepping for interviews and heard they focus on hedging a lot, so want to get this understood. Is the hedge for the "buy" side of the deal (buying Ghanaian oil) simply done to reduce the cost of buying the commodity given that the selling of the future happens after Traf actually pays for the physical oil? Additionally, how would one find the basis spread/risk for this trade (I am quite lost given this is a more complicated example involving two different exchange markets). Any help would be appreciated!

Prepping for interviews and heard they focus on hedging a lot, so want to get this understood. Is the hedge for the "buy" side of the deal (buying Ghanaian oil) simply done to reduce the cost of buying the commodity given that the selling of the future happens after Traf actually pays for the physical oil? Additionally, how would one find the basis spread/risk for this trade (I am quite lost given this is a more complicated example involving two different exchange markets). Any help would be appreciated!

The point of the hedge is to negate basis risk. The physical cargo is implicitly short brent, long Dubai because you are buying basis brent and selling basis Dubai. So if Brent goes down you get it for cheaper, and if Dubai goes up you sell it for higher. But the opposite can easily happen. So rather than take the risk on the basis, you go long brent and short Dubai futures to cover your implicit exposure. Once you buy the cargo, you are no longer exposed to brent because of it so you sell your futures. And once you sell the cargo, you are no longer exposed to Dubai so you cover your short dubai futures position.

Are you currently in the physical crude side, or, as your name suggests, are you on the paper side?

This is OP. I am having a bit of trouble understanding this comment (perhaps because of my misunderstanding of what basis is), so I would appreciate some further insight if you have time. What I get from the graphic is that the hedges basically ensure a fixed spot price ($58, from the $2 discount of $60, for the buy and $59.50, from the $2 premium of Dubai, for the sell) and so they protect against flat price risk (especially given the floating settlement where the spot price of Brent/Dubai can either go up or down). So the implication would be one is protected against the spot price risk in this example but exposed to basis risk as, if I understand it correctly, basis is the spread between the underlying price of the commodity (the spot price) and the value of the futures contract. It would be very helpful if you could perhaps show how to calculate the basis for the buy and sell.

Re-read, much slower this time. "The point of the hedge is to negate basis risk." Also best when starting out to draw this on paper as a T-ledge.

Basically financially Day1; We bought brent/dubai for $2.50. So now we have $4 of premium to close on our trade.

Also, looking at the day30 vs day75 timing. We are net long physical crude for a certain amount of time (ignore financial leg).

Praesentium dolores aliquam sed nostrum consequuntur laudantium corrupti. Rerum neque ea enim. Est voluptatem officiis necessitatibus itaque. Alias ad expedita at non.

Architecto illum quam nobis consequuntur est explicabo temporibus. Dicta vitae officiis quasi vitae autem.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...