Help, is IB a Career Worth Pursuing Out of College?

I'm a 2nd-year Finance student at a top 30 Business School in the Twin Cities (Nothing close to Ivy-worthy). I'm near the point where I need to decide on a career path, does anyone have any advice on pursuing IB, Public Accounting at the Big 4, Consulting, or Corporate Finance? I need some career advice from any business professionals who would advise themselves on a career path when they were 19-20 yo.

Thank you, any help is so very much appreciated.

It is obviously a better option than big 4 accounting

Can you elaborate on that? Is it simply because of the compensation of roughly $30/hour and career opportunities? I'm truly curious if the insane amount of hours and lifestyle chaos is worth the pursuit...

IB is a huge grind to get into especially from a non-target. Pay is nice but I don't think anyone is sitting there at 3am saying "gee whiz, at least I make six figures formatting power points". Opens a lot of doors career-wise and generally only a 2-year commitment.

Big 4 accounting is popular at my school, lifestyle is better than IB and they all compete with each other to be the best place to work. You won't make six figures until at least 5-7 years out of college. Career options are more limited than IB but you can do financial analysis type roles forever.

I don't know much about consulting or corp finance. If you have time this summer or fall you might benefit from calling some school alumni in each role to get their thoughts on what direction you want to go in.

The thing with IB is that most people do it for the Exit opportunities. The same is true with BIG 4 accounting. During tax season you work a lot, sometime comparable to IB with less pay, but having BIG 4 in your resume give you exit opportunity. Corporate Finance is a little like IB, more flexible but less exit opportunities, consulting is good, the entry level harder, you work a lot of hours but less than IB. So to answer the question yes IB is a career worth pursuing out of college, (I assume by career you mean staying in the bank and reaching MD level.)

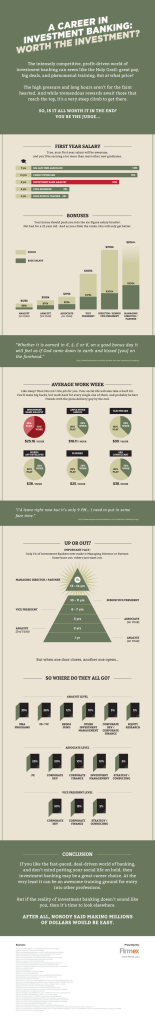

A Career in Investment Banking: Worth the Investment? (Originally Posted: 10/08/2012)

Moderator Note (Andy): This is an infographic created by Firmex. It’s targeted toward those considering a career in investment banking, highlighting the reality of the profession. Drawing on some stats from WSO, as well as other sources, it includes everything from starting salaries (in comparison to other careers), annual bonuses, hours worked and typical career progression.

Each year, thousands of the brightest minds, from the world’s best schools, decide to venture into the world of Investment Banking. Entering the competitive world of high finance has some clear advantages; great pay, high-profile deals and phenomenal training.

But, it’s definitely not a career choice for the faint hearted. Intense pressure to get the deal done, and long hours, means that personal and leisure time are often sacrificed. And while tremendous rewards await those that reach the top, it’s a very steep climb to get there.

Having supported thousands of M&A deals, and answered hundreds of late night calls from exhausted Analysts, Firmex Virtual Data Rooms decided to take a closer look at the profession with the following infographic...

Embed this on your own site using the following code:

Presented by Firmex Data Rooms

nothing new here...

nice graphics though.

This is similar to what bankerella posted. Interesting.

This is similar to what bankerella posted. Interesting.

hm MD 20+ mil huh, which bank do I need to join to make Llyod money as just an MD/Partner.

Only thing that stood out to me is 25% of Associates exiting to PE (only 1% lower than Analysts). That doesn't seem right from reading here, but I thought I'd point it out

Well done, thanks! The average work week graph still makes me kind of depressed..

Umm only 1% of bankers ever making it to MD? I think Bankeralla's data had 33% of Associates making it to MD (and if we assume, say, 33% of Analysts make it to Associate, that means 11% of Analysts end up as MDs, or 1 in 9......and that's not counting Analysts who go get an MBA and later return to banking as associates)

Firmex test

How much is IBD worth? (Originally Posted: 12/01/2009)

I'm at a boutique for banking and I was wondering, if one truly wants to be a banker, is it worth giving up different jobs but at "better" firms? I personally moved out of a top BB's PWM to be where I am today but I was wondering what the board thought about this.

For example, would it make sense to take Piper Jaffray IBD over Citi S&T? How about Goldman S&T?

What about taking HLHZ/Harris Williams IBD over MBB?

The obvious answer is that it really depends on what you enjoy and what your futre goals are (i.e. exit opps). If you want to work in IB what would be the benefit of working in PWM or S&T even if the job was at a more elite place? If you wanted to be a college basketball player would you play hockey in high school?

Voluptas sed sit libero aut autem repellat laudantium odio. Et nihil vel enim alias tenetur nisi eum iusto. Autem in eos beatae. Sit natus aut nihil omnis rem at.

Officiis aut voluptate qui. Qui ex omnis recusandae in molestias. Expedita maxime quae rem aut. Et ad aut excepturi et sit quibusdam. Vel quas nihil maxime cum quam.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...