Only in a perfect world do all of our investments work out the way we want. No amount of planning or research can protect investors against the future, which is one of the most unpredictable forces in existence.

Last summer someone recommended that I take a look at the First Bank of Delaware as an investment. I took a look and quickly passed. I saw a bank that was losing money at an increasingly fast rate, and that had experienced some legal issues in their recent past.

The bank was digging itself into a hole that seemed hard to recover from, that was until I found a news release on the bank's website that explained they were looking into the possibility of winding down operations and liquidating. Suddenly I was interested, here was a bank trading for $22m with a book value of $44m. The trade seemed attractive, especially with such a large discount to book value, if the company's book value was anywhere close to reality I had the chance to double my money.

The downside seemed somewhat limited as well, at 50% of book value what could possibly go wrong? What sort of event could destroy this investment? I was initially worried about a bad loan book, but then First Bank of Delaware sold their entire loan book to Bryn Mawr Bank at a 3% discount to book value. My biggest concern had been cleared up, investors were now set to double their money right?

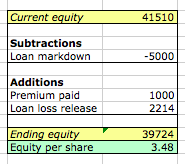

Here are two spreadsheets I put together last summer showing the value of the bank:

What went wrong?

What I neglected to mention above is that the bank didn't willingly decide to enter liquidation, they were forced into it by the FDIC. The FDIC issued a consent order that forced them to either submit a plan of reorganization or to voluntarily liquidate. The company missed a few deadlines on submitting a strategic plan of reorganization, and was forced into liquidation. This should have been my first warning sign, that bank's management was unable to submit a plan of action to satisfy the FDIC's request. At the time I didn't think much of this, but in retrospect is speaks volumes to the speed and reactive nature of management.

The First Bank of Delaware's troubled past had finally caught up with them. In their recent history they had been known

as a subprime enabler, they were a clearing bank for subprime credit cards. They were also involved in a supposed security incident where the bank processed a large number of fraudulent

Visa and Mastercard transactions. The bank was also involved in a check cashing company from California that was accused of lending at usurious rates. And lastly the bank was involved in an online check cashing and payment system that was allegedly used to send fraudulent payments that they bank was aware of.

On the last point the bank was facing action from the US Attorney General regarding the check cashing scheme. Based on some cases and settlements dug up from the internet it seemed that the bank would be able to settle, and even in the worst case scenario I could imagine shareholders would end up with a small positive gain. I had estimated a settlement in the range of $1m-$5m, with a potential worst case scenario at $10m.

Shareholders never received the full story behind the fine, but the bank was slapped with a $15.5m fine for their involvement in the illegal check cashing scheme. My gut tells me that there was more to the story than just what the filings said, but unless a prosecutor's lips become a little loose we will never know.

The $15.5m judgement was 50% higher than my worse case guess, it knocked the value of the bank's equity from $39m to $23.5m. The bank had also incurred close to $5m in liquidation costs at this point as well meaning that their book value was further reduced to $18.5m. My initial investment was in a bank with $40m in equity at the $22m level. With book value reduced to $18.5m my

margin of safety quickly vaporized.

When news of the US Attorney General's fine was released the stock sold down sharply, I realized that I had no hope of a gain on the investment and sold for $1.70 a share, locking in a 15% loss. It was shear luck that I was able to limit my loss to 15%, the stock continued to fall and I know a lot of shareholders who experienced a 50% loss on paper before their shares were converted into liquidating trust shares.

The company is still working through the liquidation. According to the latest mailing I received last week they have $1.37 in net assets per share, but it's very likely the company is over-reserving and might have a little bit more to distribute.

Lessons learned

It's always painful to review a losing investment, but I think the pain is necessary to improve our investment processes. There was no way I knew what the government fine would be, but I had enough warning signs that indicated I should beware.

My biggest mistake was ignoring the company's past. I glossed over their involvement in subprime lending, and questionable short term lending practices. Because the bank was liquidating I didn't think any of the past mattered, but it did. The past spoke to the quality of management, and to their character. The type of management who would willingly engage in illegal activities, or would turn the other way when illegal activities are occurring isn't one I want running a company I own. Whatever the bank actually did was egregious enough that the government didn't back down on their fine, they refused to negotiate a lower settlement with the bank.

My second mistake was that I estimated too many variables for this investment. At one level this investment was simple, $40m worth of value being liquidated at $22m. The gap between the two values was what the market was assuming a settlement plus some legal costs would be. I had estimated costs to be less, and while I believed my guess was scientific, it was after all just a guess. The best investments are ones where there are only one or two assumptions that need to happen for the investment to work in the investors favor. With the First Bank of Delaware there were many assumptions that needed to work as planned for me to earn a return.

I firmly believe that each loss in my portfolio has a lesson attached to it. I will never avoid losses entirely, but there is always something to be learned. Even if the lesson is something I can't avoid in the future, there is value in awareness.

I also once invested in a company that I thoroughly analyzed from a financial point of view, but it ultimately crashed. My takeaway was different than yours. I no longer invest because the numbers look good. I now only invest if I really like the products, services or business model that the company offers. Don't get fooled by attractive financials. Even poorly managed companies that sell great products will be successful. The best management in the world can't rapidly expand a company in a mature industry where products or services are difficult to distringuish from the competition (i.e. banks).

Look for companies that are doing something completely different. I visited a Family Dollar Store for the first time a year ago and then bought the stock - now up about 40%.

Perhaps I can interest you in a few shares of Tesla?

Quia eum ut laborum aut consequatur voluptatem. Ut doloremque aut provident velit. Aliquam debitis commodi dolor est ut est sint.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...