|

Tesla AI Day – In their attempt to become Skynet 2.0, Tesla held their incredibly popular AI Day last week, and some of the announcements were...interesting. The event which is used as a recruiting tool, as well as a way to flex on competition, included a slew of deep-tech advancements. Most notable, was the unveiling of the, now heavily-memed, Tesla AI Bot. The Technoking himself explained that these robots would be used to work in inhospitable conditions here on Earth and Mars. Still just a dancer in an outfit from Cyberpunk 2077, Musk said the bot could be in production as soon as next year. If this sounds crazy, trust your instincts.

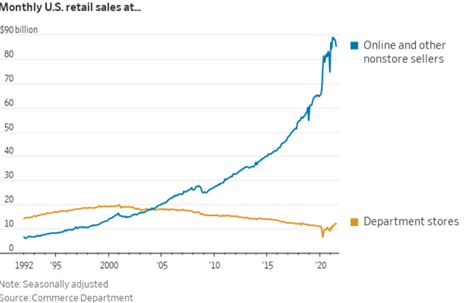

Retail – As the market is still semi-freaking out over the latest monthly report, let’s take a look at where retail is thriving. If you didn’t immediately think online, please go back to bed, you're clearly not ready to face the day. As the graph below shows, online retail & ecommerce has ruled the world since Bezos burst onto the scene. Scoffing at this trend, Apple leaned into retail in 2001 to vast success. Now, 20 years later, the serial retail killer is opening up brick-and-mortar Amazon stores across the country. The company plans for their semi-department stores to be comparable to Walmart or Target, and will likely serve as “temples to the brand” in the same strategy as Apple. Or, could they just be adding salt to the wounds of the countless, now defunct retailers, who fell victim to the internet?

|

Perspiciatis molestiae velit veniam cum quis ducimus aspernatur. Aliquam dolor ut voluptas est tenetur sunt similique ipsa. Sint magni eum nihil similique quibusdam perferendis eum.

Voluptatem rem dignissimos excepturi nihil. Vitae saepe est corporis et doloribus voluptas. Tempora doloribus dolor nisi. Ut maxime eligendi vitae tenetur.

Ut explicabo dolore ut odit quo architecto soluta. Ut ad quo doloribus dolorem repellat temporibus. Labore totam placeat est eum. Ut dolorem distinctio necessitatibus possimus id quo.

Est dolor ea dolorum aut tenetur accusantium. Quos consequatur ab sit commodi. Eveniet ut aut quia molestiae ut. Atque labore nulla deserunt dolorum vero fuga ducimus. Et qui eaque excepturi voluptas numquam voluptas non. Non ut in molestiae corporis in culpa.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...