RECEIVED Function

It helps to compute the amount received by the fully invested security.

What is the Maturity RECEIVED Function?

When utilizing the maturity received function on excel, it is important to note why and when the function would be necessary. To briefly define, the maturity received function is the total amount received once a fully invested security has matured.

The excel formula is as follows: RECEIVED(settlement, maturity, investment, discount, [basis]). 'Basis' is an optional input and is accounted for the day count basis of the security.

As you may already know, examples of security are financial assets that comprise mutual funds, stocks, and bonds.

Whether you are looking to find the total amount received from an investment project personally or in your day-to-day work, this article will highlight some key facts about using the maturity received function.

Throughout the article, we will be discussing the specifics of the function and going over an example to apprehend the dynamic of the excel function fully.

First, a formula breakdown will provide a clearer understanding of each category input. Then, the article will discuss the meaning of each and its association with the received amount of a fully invested security.

Key Takeaways

- The main purpose of the maturity received function is to compute the amount received by the fully invested security.

- There are four required entities: settlement, maturity, investment, and discount.

- The day count basis is an optional input.

- Double-check your returns and reevaluate entities if functions receive errors

Maturity Received Formula

To reiterate, the formula used to calculate a matured security's total amount is as follows:

RECEIVED(settlement, maturity, investment, discount, [basis]).

Before inputting each category into its required placement of the excel formula, understanding the purpose of each classification will be crucial. To break down the formula, the received function consists of the following:

- Settlement: The first category in the formula is settlement. It is the date of agreement of the fully invested security.

- Maturity: Next, the maturity is calculated to determine the date on which the security is fully invested.

- Investment: Investment refers to the amount of funding in the security. The following section will look at an example of inputting each category.

- Discount: The discount simply implies the discount rate of the security.

- Basis: Lastly, the basis is the day count basis. As mentioned earlier, the basis is an optional calculation but accounts for the accrued interest of the fully invested security.

Note

All four required factors of the maturity received function are crucial in calculating the accurate amount received from security.

Maturity RECEIVED Function Example

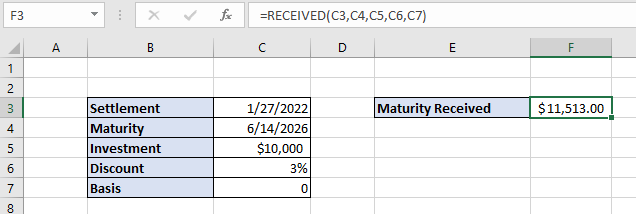

Let's do an example of a maturity received function to practice calculating the received amount of an invested security.

Looking over the excel problem above, also note that the format of the settlement and maturity utilize the DATE function on excel. The settlement date also occurs before the maturity date, preventing calculation errors.

After the inputs are entered for both the settlement and maturity dates, let's move on to the following factors of the excel function.

A $10,000 investment is inputted in the example and a 3% discount rate for the fully invested security.

Again, as an optional use for the "basis" category, the example inputs 0.

If you are utilizing the "basis" component of the function, be sure only to input a numerical set of 0 - 4, as it makes the most logical sense in calculating.

Once each category of the function is organized, properly format the function, as provided above, and now accurately calculate the amount received of the security.

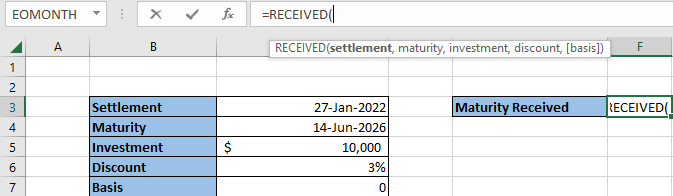

You can simply input "=RECEIVED" into the desired cell or table. In the example, we have the function located within the maturity Received table to easily navigate the security's total amount.

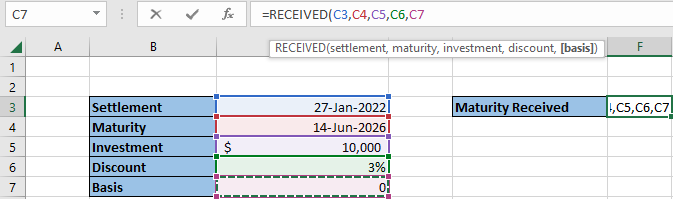

Afterward, you may highlight the corresponding variables needed to complete the function, as pictured below.

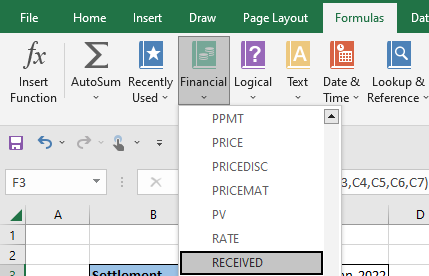

Another way to locate the maturity received function is to follow the steps as directed in the instructions:

- In the Excel sheet, find the Formulas tab at the top bar

- Click on Financials

- Another drop-down bar will appear with functions in alphabetical order. Simply scroll down and locate "RECEIVED."

For reference, the "Maturity Received" row within Excel also displays the function format in which the order of components is organized. If encountering problems in receiving an accurate answer, received function errors can be further evaluated.

Remember that an optional input can be simply set to 0. If the basis is calculated, please insert the necessary calculations as needed.

Reviewed & Edited by Ankit Sinha | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?