Forecasting Finance (Equity, Debt, Interest)

Process of estimating and predicting future financial conditions based on historical data and trends

Forecasting Finance: Equity, Debt and Interest

The term forecasting finance can sound intimidating when heard. Although it is much simpler than you think it is. In simple terms, forecasting means predicting.

When the weatherman on the news channel forecasts the weather, he intelligently predicts what the weather may be like in the coming weeks, months, etc. He predicts from the data that he has collected.

Well, with finance, we do the same. Although instead of weather, we are predicting numbers that have to do with our finances. Some simple examples are the firm’s sales and revenues.

People who may forecast finance may work in management, own their businesses, are investors, etc. All these people, like meteorologists, predict possible outcomes based on their data.

Weathermen may use scientific data. For example, businesses use their financial data, such as:

- The numbers from their income statements

- Balance sheets

- And/or flow of cash statements

These can help them make intelligent predictions about the firm’s financial stance.

When there is a chance of a storm or hurricane, the weather person tells people to take precautions and plan ahead of time. For example, if they have a forecast of low sales and not enough profits, management will know how to prepare the firm’s work environment so they won't be too affected financially.

If there is a prediction that sales will go up, management can plan ahead of time. For example, they can plan to have more employees and supplies. In addition, planning ahead of time can help the firm create its overall goals.

Having goals can help firms stay on task and work hard to achieve their goals. It helps them stay on track, and if they are not meeting their goals, they can see a review of what they need to improve to achieve them.

There are various forecasting methods one can use. It is important to know what you are trying to forecast, so you can choose the best method for your task and produce the most accurate results.

Key Takeaways

- Forecasting finance involves predicting financial outcomes based on collected data, similar to how weather forecasters predict the weather based on scientific data.

- Financial forecasting models, such as those available in Excel, can be used to forecast equity, debt, and interest in financial statements.

- Forecasting debt involves considering short-term and long-term debt, interest expenses, and using methods like manual projections and rolling averages.

- Equity forecasting includes predicting stock issuance, repurchases, and changes in retained earnings, which impact a company's financial position.

- Target leverage ratio is a metric used when forecasting interest, particularly for debt financing, while equity financing typically uses opening debt values.

The Model To Use For Forecasting Finance

Excel provides a financial forecasting model to use. When working on Excel, they provide models to assist us with certain tasks. With this, you can forecast equity, debt, and interest.

Forecasting finances is the 3rd step you would do in your income statement and balance sheet.

- The first step you would have done already is completing revenue forecasts down to EBIT(earnings before interest and taxes) for the income sheet.

- In the second step, you would forecast your balance sheet with the operating assets.

- For this step, you will complete the balance sheet and income statement by forecasting debt and equity finance.

You will do the following steps to access the forecasting option on Excel.

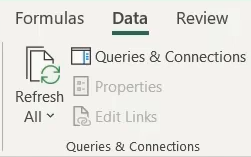

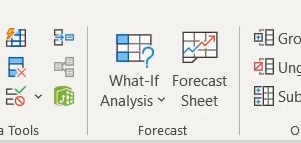

1. Go to the Data tab

2. Find the “Forecast Sheet” option (it should be next to What-if Analysis)

Go to the Microsoft forecast tutorial for assistance on customization and more on creating your model.

Some users might not have that option due to its availability only for windows users. Although you can go to your add-on options and add the analysis toolpak. This will add the toolpak option to your Home tab section.

You may find other models that are not within Excel. Excel is the most common and free to use. These models are either offered through your company or for a fee. Some of it includes software such as:

- Cube

- Oracle Bl

- Jirav

There are also templates out there that can be used. There are plenty of options, but picking one you may be more comfortable working with is important.

Note

Other models offered by different software may come at a subscription cost or fee.

Forecasting the Financial statements

Whenever we forecast the capital structure, which is the amount of debt and/or equity used to fund the business operations, it will impact the balance sheet and the income statement. It will impact them through dividends and interest expenses.

Forecasting debt requires forecasting short-term and long-term debt and interest costs. You can use the formula:

Opening balance + interest expense - repayments= closing balance.

When you forecast short-term debt, you can use manual projections, receipts and/or disbursements method, rolling average, and allocation method. Here, we want to minimize short-term debt, idle cash, and cash buffers.

Short-term forecasting can help cut working capital costs, measure a company's financial health, and perform what-if scenarios.

With long-term forecasting, we can see a company's financial needs from an aerial perspective. Long-term can help with steering clear of any last-minute problems. It can help a company improve its asset management and multiply its gains by maintaining cash reserves.

A method used for this is the adjusted net income method. You would need data from the corporate budgets to prepare the adjusted net income forecast. The only bad part about using this method is that it does not permit tracing individual cash flows.

Once the financing forecast is done, you can proceed to the cash section, and you will have finished the balance sheet.

When working on equity, you must forecast stock issuance and repurchases. Stock issuances are the total amount of money a company gets when selling its stock. Another term you may see is new capital issuance which could be the new issuance of either stocks or bonds, to which they raise the capital for a company.

Another item included is the changes in retained earnings. Retained earnings can also be referred to as earnings surplus and are the company’s accumulated portion of the company’s profits used for reinvestment.

A helpful formula is

Opening balance + new capital issuance - capital repurchases

If there are changes in the retained earnings, they will be motivated by the forecasted net income and dividends. When these change, you must complete a retained earning supporting schedule section.

Target Leverage Ratio

You might have to work with the target leverage ratio when working with interest. The target leverage ratio is the market value of debt to the company's total market value.

When working with debt financing, you will use a target leverage ratio. You will then use the average debt to calculate the interest.

You do not need to use a target leverage ratio for equity financing. Therefore, you will use the opening debt to calculate the interest.

If you are uncertain whether you need to use it, you can ask yourself if you must forecast the debt levels as a multiple of equity. If you do not, you won’t need to use it.

If you do, the next step would be determining the accuracy level to model the capital structure. Modeling the debt can be anywhere from high complexity to low complexity.

Your goal is to make the model at an intermediate level. If your model starts to be on the high complexity end, you will run into circular reference errors.

Tips for forecasting equity, debt, and interest

There are things you can do to make the forecast simpler for you. You want to keep the goal in mind to shrink your chances of circular reference since the error can be difficult to solve.

Some of the things you can do to make the forecast simpler are:

- Suppose forecasting debt levels such as multiple of equity. You may want to use opening debt to calculate the interest.

- Keeping the model simple.

- Leverage ratios are used to calculate debt.

- Opening debt is used to calculate the interest.

Using the average debt to calculate the interest will give you the most accurate interest expense. However, it can cause a circular reference. A circular reference is a warning on Excel. These can be seen as problematic.

You can also choose to use an opening debit/ last year’s closing debt, or this year’s closing debt, to avoid getting the error. However, avoiding error can also lead to less accurate results.

The circular reference error is an error that creates an infinite loop. It will result in a formula that visits its own or another cell more than one time. It can go from the last cell to the very first one, resulting in a circle or loop.

NOTE

Keeping the model simple will help you from running into many circular errors.

If you picked to use the average debt to give you the most accurate interest expense, there is a tip you can follow. A tip to help with the circular reference is to solve it with iteration. Iteration will help you find a solution.

It will proceed with finding different values for the model variable. This function can be found in the “options” section in Excel. You will then follow “Formulas” and enable the iteration setting.

A good side note to be aware of is that once you have used this solution, Excel will not notify you again about other circular errors that you may have again. This does not mean they will be left as an error. It means that Excel will go ahead and try to solve it, which can be risky if there are other solutions to the circular error.

Correcting the Circular Reference Error

As mentioned before, you can correct the error with iteration. It will try to find different values for the model variable with iteration. This function can be found in the “options” section in Excel. You will then follow “Formulas” and enable the iterative calculations setting.

If you are unsure or the iterative method for solving the error is not working for you, there are other options. Before checking different options, it is important to ensure you are giving them a test run to see if you can get accurate results.

There is another option for correcting the error. Whenever a downstream calculation occurs, your model should show an error. A finance modeler may use the “IF” condition formula to avoid errors.

Note

Beware of the Circular Reference due to the many complications it can bring if you do not correct it properly. It’s good practice to do a test run when solving.

This “IF” formula is made to help forward the actual value. To get the result, it needs to be set to “ON.” The value zero will be passed on if the model is set to OFF. Finance modelers do this to avoid too many errors.

Circular reference errors can be difficult to deal with. For example, there is a way that an incorrect value can be passed into the cell as an input. You may avoid this by using the function called Jumpstart that Excel provides.

The Jumpstart function is a two-part formula. It will check the value's accuracy before passing it into the model.

Note

Always try to test your methods to solve the error to avoid future miscalculations.

A good rule of thumb would be that it is best to apply the methods that have been tried and tested to ensure you get the most accurate results.

This is because of the complexity of these correlation errors. There may be a lot more solutions that you find if you begin to browse online. Although, these should be taken with precaution because some solutions can send you down a rabbit hole.

They might cause a problem later with some of your other calculations. An experienced financial modeler should identify where these errors are coming from if they are part of the model or have come in due to a calculation error. Then you will be able to apply the standard solutions to get rid of the error.

or Want to Sign up with your social account?