Sales & Trading Interview Questions

How to Answer the Top Sales & Trading Interview Questions

Sales and trading (S&T) professionals determine the pricing strategies for trading assets. S&T is a part of investment banks. As a result, traders and sellers frequently work together and interact with clients to address their needs.

For instance, they check if orders are processed and identify the best investment approaches for higher return and profitability. Some of the assets S&T works on include fixed-income products, commodities, derivatives, equities, and bonds.

Breaking the S&T into two divisions, salespeople and traders, we can decipher the exact responsibilities each has.

Salespeople usually directly communicate with their clients to understand their objectives. Then, they devise plausible and fitting trade ideas, market updates, and investment approaches, which the trader executes while minimizing price impact.

Since S&T positions require deep technical knowledge of their services, the interview process assesses the candidate's analytical abilities.

Moreover, sales and trading require excellent communication and social skills. Therefore, in the interviews, many behavioral questions will test your interpersonal skills, consistency, and reliability as an employee.

Companies with the biggest and most reputable sales and trading divisions include:

Interview Tips

- Sales & Trading Roles involve pricing strategies, working with clients, and handling various assets like fixed-income, commodities, derivatives, equities, and bonds.

- Technical and Analytical Interviews focus on deep technical knowledge and analytical abilities related to trading.

- Research the company, understand the role, and be specific in your responses to stand out.

- Communication and social skills are crucial in interviews; be authentic and confident.

- Use STAR method to answer questions effectively, and show proper etiquette during the interview process.

Sales & Trading Interview Considerations

When approaching a sales and trading interview, you should be able to showcase your understanding of the trading floor, specifically, the distinction between desks, how S&T employees work, and how banks make money.

Some examples to demonstrate your knowledge include explaining how traders provide liquidity and manage a book of risk for their clients. Furthermore, knowing more technical concepts like the Volcker Rule would make you stand out from other applicants.

However, beyond grasping a proficient understanding of the role, you should know what desk you are interested in and research the companies. For instance, JP Morgan and Morgan Stanley have fixed placements, whereas Goldman Sachs has rotational placements for S&T summer analyst programs.

Note

Although you may never know which desk suits your interest and strengths, it still leaves a good impression if you have a general preference at the early stage of your S&T career, especially during interviews. This shows that you have done your research.

As always, be prepared for technical questions. Although no interviewer expects you to ace your interview and answer every question correctly, trying your best to prepare and answer every question well significantly increases your chances of receiving an offer.

Some questions may require you to do some calculations, such as finding the yield to maturity of a treasury bond. If the interview is in person, bring a pen and paper just in case; if remote, have a calculator nearby.

Regarding the behavioral portion of the interview, ensure being authentic and confident in your answers. You want to articulate the stories clearly and show interviewers your character, work experience, and fit with the company. Have a plan and structure in advance, but do not memorize answers.

Sales and Trading Interview Questions and Answers

In this section, we have found some common questions asked in sales and trading interviews. Please use the sample answers as a reference to guide you when you practice and formulate responses. In the actual review, make sure to be more specific and insightful.

Sales and Trading Interview Questions and Answers

It is imperative to demonstrate interest when answering this question. You should find stories and examples leading to this career decision and show why sales and trading excite you. Make sure to come prepared with an event or activity in mind to back up your statements.

Sample answer:

“Since high school, I have been involved in many pitching competitions, including a mock Shark Tank event. Thus, I developed a passion for salesmanship and eventually began exploring ways to serve others best.

In college, I have become more involved in finance clubs. In these events, I learned the mechanics of selling mock financial securities in simulated case studies. I like finding solutions to fix problems and working with different people.”

This question aims to assess your ability to work in stressful situations. Salespeople and traders often encounter high-intensive situations, whether immediate deadlines, difficult clients, or tight schedules.

Thus, you should devise a specific example of how to handle those difficulties.

Sample answer:

“In my previous role, I was responsible for helping firms strategize their investment so they could have a more healthy balance sheet. However, I was assigned to finish a report for a client with only a two-day notice. After hearing this, I immediately set out a time schedule.

Working tirelessly and communicating with the client throughout the day, I got the necessary information and conferred with my managers to ensure I stayed on the right track. Eventually, I was able to finish the report, and the clients were very satisfied.”

This question wants to see if you truly know the basics of the S&T role and who you work with. As a general suggestion, ensure to make your responses as detailed but concise as possible.

Sample answer:

“Some of S&T’s clients include hedge funds, large asset managers, pension funds, endowments, sovereign wealth funds, and even corporations. However, this largely depends on which desk is in question.

For instance, rates trading desks will mostly work with institutional clients, while distressed debt trading desks will work with hedge funds.”

This question wants to see if you know the difference between the type of asset people trade and sell. Knowing the distinction between two assets is crucial to excelling in the position. As previously mentioned, having a solid foundation in S&T is mandatory to suggest and perform the best investment decisions.

Sample answer:

“A major difference between a mortgage-backed security (MBS) and a treasury bond is the payment schedule. Whereas bonds have pre-determined maturity dates and coupon rates, mortgage holders get to decide how to finance.

For example, if they decide to prepay their mortgage or spend more money on the house, then the cash flow will change. Still, MBS has monthly principal and interest payments.

Another difference is that a bond’s yield fluctuates with the interest rate, but the coupon remains constant. On the other hand, interest rate changes can either positively or negatively impact MBS payments.”

This is another technical question to see how much you know about the industry. But, again, make sure to state your claim and back it up with logical reasons.

Sample answer:

“A convertible bond is considered a debt instrument but can be converted to a predetermined number of shares at a specific strike price, making it have features like equity. Thus, it is somewhere in between the two financial instruments.”

If you are going to sell, mastering the arts of salesmanship is a must. By answering this question, the interviewer can see how knowledgeable and skilled you are, similar to what would happen if you got the position.

Please note that the sample answer is talking about a real company.

Sample answer:

“Company A has been performing well, with its financial statements indicating an ARR growth rate of 150%. Even more, Company A’s industry is very fragmented; therefore, it is more likely for the business to succeed without a dominant competitor.

The company also has a very experienced executive team with years of previous leadership experience running mid to large-scale Fortune 1000 companies. Some were acquired by Fortune 300 companies.

Looking at the stock performance, the P/E ratio is at 2.5. The chart also shows a bullish double-bottom pattern, which hints at an upcoming increase in stock price. Without too many investors talking about the company yet, I would purchase Company A’s stock now.”

This is an example of a brain teaser question. Interviewers like to know if you have quick computational skills. Bring a piece of scratch paper to the interview, just in case.

When answering the question, tell them how you got your answer and show your work.

Sample answer:

“Since the order does not matter and all coins have a 50/50 chance of landing on either side, we can simply do the following:

For all possible outcomes: 2^4 = 16

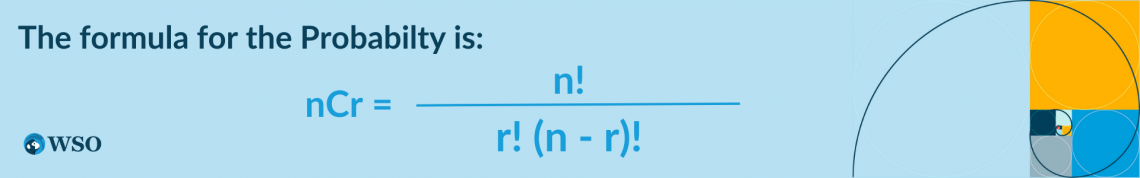

Since the order of the flip’s outcome does not matter, we can use the combination formula to find the number of times when we get 3 heads and 1 tail with 4 coins.

Where:

- nCr = number of possible combinations

- n = number of total items in set

- R = number of chosen items from set

So:

nCr = 4! / 1! (3)! = 4

Therefore 4/16 = ¼ or 25% of it happening.”

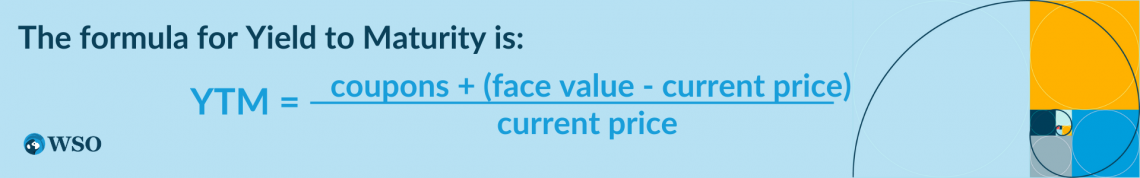

When answering this question, show how you got your answer. You do not need to walk them through the calculations step by step, but inform them of the equations you used to arrive at the result.

Sample answer:

“Using the YTM formula for one year, we can do the following:

So:

YTM = 10+(100-70) / 70 = 4/7 or 57.14%.”

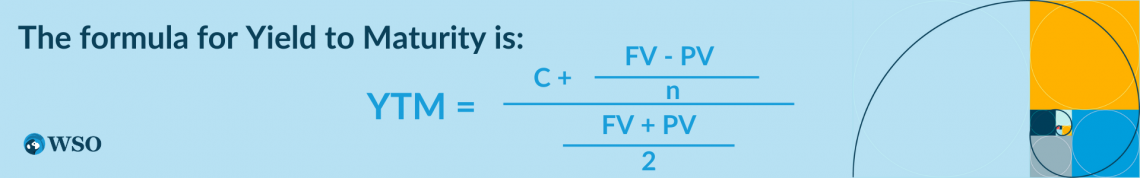

NOTE

If the question asks for a bond with a maturity date that lasts more than one year, use the following:

Where:

- C = coupon rate

- FV = par or face value

- PV = present value

- N = number of compounding periods

This question assesses how knowledgeable you are at deciphering how a financial asset works. Although there is no clear answer to this question, you want to demonstrate that you know what convertible bonds are and provide reasoning for your statement.

Sample answer:

“A convertible bond is considered a debt instrument but can be converted to a predetermined number of shares at a specific strike price, making it have features like equity. Thus, it is somewhere in between the two financial instruments.”

Final Tips

Beyond preparing answers and knowing what type of questions S&T companies ask, prepare in advance. Before your next interview, here are some final suggestions for you to consider.

1. Arrive early for the interview

Arrive early to the interview, typically 10-15 minutes. Showing up late or just on time is never a good first impression. So make sure to be early and organize your thoughts one last time before entering the interview.

2. Pinpoint the most relevant activities

Try to be concise and clear with your responses by choosing only the most impressive and fitting parts of your resume when asked to do so. Being straightforward is crucial as it demonstrates how prepared you are.

3. Think before you respond

Think before you respond, and speak with confidence and clarity. Your answers should be authentic and not memorized.

Note

You should have already established a general framework or approach to answering different types of questions beforehand. Speaking unclearly, whether due to stutters or speed can leave a negative impression.

4. Research the company and your position

You want to demonstrate interest and commitment by researching the job you are applying for and the company you want to work at. By doing so, you can develop insightful questions or stories that tie to the company's values or profile.

5. Dress appropriately and ask questions politely

Showing up in the proper attire and having manners are instrumental in showing your character and ability to present yourself accordingly. If you are confused about a question, wait for the interviewer to finish before asking them to clarify.

6. Do the formal greetings

Asking “How are you” and saying “Thank you” go a long way. The interview does not always have to be serious, and showing kindness is key.

Note

You can even bring up stories that may not directly tie into finance or business that are relevant to answering the question. Do so only when showing the interviewer a different side of your profile is important.

7. Show, do not tell

Use examples and the STAR method when formatting your answers. The STAR (Situation, Task, Action, Result) method is a way for applicants to organize their responses so that they are structured and informative. Here is what it means:

- Situation: Provide examples and details to set the scene.

- Task: Describe your responsibilities in the situation, story, or scenario.

- Action: Explain the ways and steps you took to resolve an issue.

- Result: Share the results of your actions.

Use this approach when encountering questions such as:

- Tell me about a time when…

- What do you do when…

- Have you ever…

- Give me an example of…

- Describe a situation…

or Want to Sign up with your social account?