Activity-Based Budgeting

A budgeting approach that calculates expenditures based on the potential activities to arise and their intensity.

What is Activity-Based Budgeting (ABB)?

Budgeting for activities in organizations of any size can be a complex process. Nonetheless, it's a crucial process that must be undertaken to ensure the achievement of goals, whether short or long-term.

Accounting and finance professionals often find budget deficits rising as they monitor organizational activities; hence a better approach is needed.

Activity-based budgeting is a budgeting approach that calculates expenditures based on the potential activities to arise and their intensity.

In other words, this approach calculates budgets based on actions or activities conducted by organizations rather than mere estimations.

The basis of this approach is that the company's activities are responsible for consuming resources and creating costs. This differs from other bases of other budgeting approaches where products and services are the sources of these elements.

ABB enables organizations to have a clear understanding of their costs and expenses. As a result of this better understanding, enhanced budgeting can be conducted.

Key Takeaways

- Activity-based budgeting is a budgeting method that forecasts expenditures based on anticipated activities and their intensity, diverging from traditional reliance on historical costs.

- Activity-based budgeting entails analyzing potential organizational activities to estimate costs considering factors like resource requirements, frequency, and intensity.

- Unlike traditional budgeting, ABB doesn't rely solely on past costs but forecasts future activities, offering adaptability to organizations with dynamic operations.

- Activity-based budgeting differs from zero-based budgeting, as it builds upon existing activity levels and adjusts them based on anticipated changes, rather than starting from scratch.

How Activity-Based Budgeting (ABB) Works

Before we conduct this action, we need to remember that the primary goal of this approach to budgeting is to identify, analyze, and optimize cost drivers to make activities more efficient or more cost-effective to drive up profitability.

It is crucial to conduct this budgeting approach with a new mentality. Access to enhanced data analysis tools will significantly change the efficiency level in identifying and cost-driver optimization.

This budgeting approach is a process with three parts:

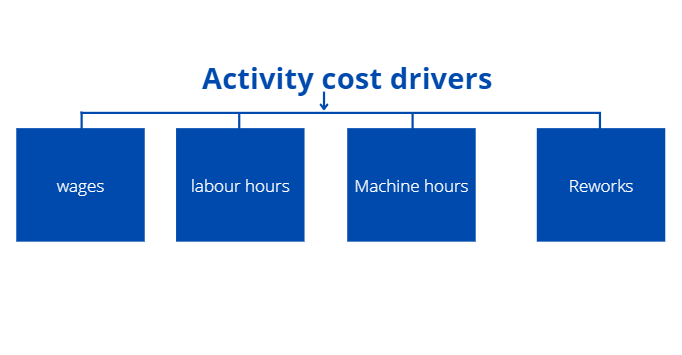

1. Identify all activities in correlation with a specific cost.

They are called "cost drivers." Carefully identify all cost drivers. Cost drivers can be presumed to be the elements of an overall cost.

For instance, some general cost drivers are the number of hours conducted by employees, number of providers, number of machinery working hours, or amount of premises needed.

2. Calculate the benchmark of units needed for every activity.

For instance, how many individuals are needed to conduct activities or tasks at any given period? Who are these individuals? What are their duties and job descriptions?

Do the activities need a set amount of warehouse or premises space? Is there a special requirement for custom elements or products? Keep in mind that the calculation of benchmark units has to be looked upon from the perspective of "barebones" necessity.

3. Determine the cost per unit of every activity and then multiply it by the number of times it will be performed.

The result is an analysis that identifies all cost drivers of business activity and crumbles it down into its minimum requirements.

After that stage, the outcome is used to determine coming or future costs and margins and to identify the break-even for the business during specific situations.

Activity-based budgeting vs. Traditional based budgeting

Depending on the type and stage of the organization, these distinctions emphasize the different methods and factors to be taken into account while deciding between Activity-Based Budgeting and Traditional-Based Budgeting.

| Aspect | Activity-Based Budgeting | Traditional-Based Budgeting |

|---|---|---|

| Cost Analysis | Analyzes multiple cost generators within the organization to identify opportunities for cost optimization through business processes. | Relies on historical costs from previous years. |

| Adaptability | Suitable for businesses with frequently changing operations or new businesses lacking historical data. | Most recognizable and adopted approach; suitable for mature businesses with stable operations. |

| Cost Efficiency | It can be costly due to the need for detailed analysis and ongoing monitoring. | Relatively cheaper due to reliance on historical data. |

| Focus on Activities | Focuses on understanding and managing the level of activities to control expenses effectively. | Adjusts previous year's costs for inflation or activity changes without deep analysis of activity intensity. |

| Suitability | Particularly effective for businesses experiencing frequent changes in activities and goals. | Less suitable for businesses with stable operations and extensive historical data. |

| Alignment with Goals | Aligns budgeting with the organization's current activities and goals, ensuring better resource allocation. | It may not always align perfectly with changing business dynamics and goals. |

| Market Competitiveness | Helps businesses respond to changes in competitive markets by adjusting budgets based on current activities. | May lag in responding to market changes due to reliance on historical data. |

Activity-based budgeting vs. Zero-based budgeting

While both ABB and zero-based budgeting are often confused due to their similarities, these approaches have different bases they operate on and bring in different final results.

Zero-based budgeting relies more on identifying expenses, analyzing expenses, justifying costs, and discontinuing expenses if needed.

For instance, a corporation might be planning or setting one of its current goals to pay off its debts during the current year. Hence, any amounts identified or saved in the zero-based budgeting will be allocated to this justified and transparent spending.

The confusion between activity-based and zero-based budgeting occurs due to their similarities in identifying expenses. Still, ABB is more concerned with identifying essential costs and increasing profitability. In contrast, zero-based budgeting is more concerned with identifying costs and finding justifications.

As we have mentioned, the action of identifying costs and expenses creates the misconception that these two approaches are the same.

However, we need to realize that activity-based budgeting is more involved in optimizing activities, which drives costs and expenses and increases profitability through this optimization action.

We can put the differences between these two approaches in a table to understand the differences clearly.

| Activity-based budgeting | Zero-based budgeting |

|---|---|

| Define activities that directly contribute to costs. | Define every cost and expense. |

| Calculate the minimum required to conduct these activities. | Analyze if this cost is necessary. |

| Based on this minimum, this will be the budget needed next year if activity X is conducted. | If this cost or expense is unnecessary, it is not needed to be continued. |

This table shows that ABB and Zero-based budgeting might be similar in identifying costs. Still, the differences emerge once it goes beyond the identifying stage. Hence they are both used for different results.

As a reminder, one element is concerned with justifying costs or expenses. If not justifiable, it will omit these expenses. The other element is concerned with optimizing activities and cost drivers so it can increase productivity and profitability.

Advantages Of activity based budgeting

ABB offers many advantages that can greatly help firms by emphasising the cost-effectiveness of initiatives and the optimal use of resources. Now let us explore the benefits of Activity-Based Budgeting:

- Resource Optimization: It helps in avoiding wastage by aligning resources with relevant activities, ensuring efficient utilization.

- Cost Reduction: Through meticulous examination, it identifies cost-effective ways to maximize sales, thereby increasing profits.

- Operational Efficiency: By focusing on bottleneck elimination and ensuring smooth operations, it enhances business performance.

- Identifying Inefficiencies: It highlights areas of inefficiency, enabling management to make necessary adjustments for improvement.

- Management Agility: It enhances decision-making, contingency planning, performance measurement, and evaluation processes.

- Enhanced Performance Evaluation: With clearer visibility into resource allocation and activity performance, it facilitates more effective performance evaluation.

- Accountability: It enables management to hold employees accountable for their actions and activities, fostering a culture of responsibility.

Disadvantages Of Activity Based Budgeting

Although Activity-Based Budgeting (ABB) offers a viable framework for improving performance and optimising resources, there are specific obstacles and factors to take into account when putting it into practice.

ABB has a number of drawbacks that companies should carefully consider, ranging from implementation complexity to the requirement for specialised knowledge. Now let's examine some possible disadvantages of activity-based budgeting:

- Costly Implementation: It requires significant resource allocation due to its complexity, making it a costly endeavor.

- Time-Consuming: Conducting ABB demands time and effort from personnel involved, impacting operational efficiency.

- Need for Expertise: It requires experienced personnel with deep knowledge of business operations, risking inaccuracies if applied without expertise

- Heavy Workload: It necessitates meticulous monitoring and observation, adding to operational costs and complexity.

- Short-Term Focus: It primarily addresses short-term goals, limiting its long-term applicability and usefulness.

Conclusion

Efficiency is one of the most noticeable and essential things in this budgeting approach. Therefore, it carefully examines cost drivers and their importance, ensuring that only relevant and high-priority activities to the company's success exist.

Activity-based budgeting is an approach to estimating next year's costs and eliminating activities based on their importance and priority. It allows you to lower your burn rate and increase profitability.

Compared to other budgeting approaches, it may be more expensive and complex. Still, the result is accurate and relevant to your expenditure in a way that allows significant savings for you and your organization.

Focusing on cost drivers and activities that create high costs will make organizations' operations more efficient and cost-effective. Efficiency in any organization is much needed as it means fewer expenses and fewer wasted resources.

NOTE

Budgeting should be a tool used to allow companies of any size to foresee their needed resources and capital needs so they can plan accordingly and achieve their short- or long-term goals.

One of the significant downsides of this approach is that it doesn't enable those who conduct it to plan for long-term goals as it only assists them in reaching short-term goals, but does this mean it's not a suitable tool?

ABB is still a valuable tool as it allows increased efficiency within organizations, even if it incurs costs, yet it saves other hefty costs. A hybrid approach can exist for short-term and long-term goals.

We should always be aware of the budgeting tool we are planning to use and understand the nature of the results of these budgeting methods. In addition, we need to understand our goals and what type of budgeting will assist us in reaching these goals.

Everything You Need To Master Financial Statement Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?