Average Revenue Per Paying User (ARPPU)

It means the average amount of cash you generate from a single paying customer during a specific period.

What Is The Average Revenue Per Paying User (ARPPU)?

An abbreviation for 'Average Revenue per Paying User', ARPPU means the average amount of cash you generate from a single paying customer during a specific period. Those customers could pay for your services through subscribing, downloading, or in-app purchases.

This article is written to cover the definition and the difference between ARPPU, ARPU, and ARPDAU.

In addition, it will cover its formula, how to calculate it, and what three common mistakes people make when calculating it. It will also cover factors that will impact this KPI and why it is important, in addition to five ways to enhance it.

This metric doesn't involve those customers who don't pay for your services even though they are engaging with it through free downloads, trial periods, or limited feature usage. Instead, this metric is usually used by mobile application businesses to identify their valuable users.

It is usually a very accurate metric to be generated as it needs to differentiate between customers or users who pay on different plans, for instance, those who pay annually VS quarterly.

The value of this metric is not only to identify those who pay for your services but also to identify those who will need to see more tweaks and new features of your services with time to ensure their retention and loyalty to your product, service, and brand.

Why Is ARPPU Important

This metric is important for you to see the positioning of your products and services in the server market and how it's being adopted by the potential customers or users you are targeting.

We could say that the importance of this metric can be mentioned in five points. Still, the actual value of this metric can vary from one business to another depending on the type of information they want to see and their strategic planning.

Loyalty is one of the valuable insights you can extract from your ARPPU, as it will directly show you how many of your customers are constantly paying for your products or services. You can also target those paying customers to give them promotions and value-added services.

In addition, it is important because it will demonstrate the value ratio for your products and services and at what price customers and users find your provided services are of value to them. This allows you to see if you need to increase your prices or lower them.

This metric is also important as it will indicate your company's financial performance and overall health. For instance, if your ARPPU is growing, your business is growing, and more customers find great value in what you provide.

On the other hand, if your ARPPU is hitting lower rates, this can mean that either your pricing is too high compared to the provided value, or the problem that it’s solving is not an actual problem and it's merely a trend that resolves itself with time.

Moreover, this metric is important for you to validate the performance of your marketing and sales teams. The metric will demonstrate this achievement if these teams reach their targets and the targeted segments in your business plan.

Five Ways To Enhance ARPPU

1. Increase your prices wisely. This approach will enhance your metric, but to do so, you need to make sure not to create tension between you and your already paying customers unless you add new features or have a strong justification for this increase.

Another approach to increasing prices is micro-increases, this will allow you to see the reaction of your already paying customers by causing major friction, and also it will allow you to enhance this metric.

2. Identify major touch points that will allow you to attempt to up-sell. This involves inviting potential customers or users to upgrade their plans to higher-priced plans with more valuable features.

You can also try to conduct a cross-sell action where you offer additional relevant products or services to your customers or users.

In addition to up-selling or cross-selling, you can provide limited free trial plans for your products and services, which will require users or customers to sign up for these limited plans, which will require fees.

The idea behind all these approaches is to study the behavior of your current customers and see where there is a turning point for them in terms of prices, packages, and value and when they are willing to jump from their current plans to others.

Moreover, it gives you insight into your potential customers or users, which key points they are looking for in your products and services, and at what price they are willing to be fully committed to acquiring them.

3. Another approach to enhance your ARPPU is pitching your other products and services to your loyal customer base who already pays for your services or products. They might be more willing to purchase more products from you since they are already paying customers.

4. Focus on your top payers. This simply means those who have been paying for your products and services for a long period of time. They should have your attention so you can design promotions and special memberships for them.

5 - Don't focus on customers or users with low growth potential. Instead, narrow down or segment your customer base and focus on those who will be valuable if you conduct a cross-sell or an up-sell action. This will positively impact your ARPPU.

What Affects Your ARPPU

We need to understand their core source when we mention those two metrics. These metrics tackle elements in the business that deal with the end user and their direct interaction with the product or services through their purchases.

The first element that will impact your ARPPU is your prices. Your prices are one, if not “The” main element that will directly manipulate and impact your ARPPU. Low prices mean low ARPPU, which means slow growth in terms of infrastructure, expansion, and so on.

On the other hand, higher prices mean higher ARPPU, but you need to have a thorough understanding of your pricing in correlation with your customers' purchasing power.

In addition, you need a thorough understanding of your future goals and growth.

The second factor that will impact this metric is your customers and the value-added services in your packages.

This means even if you priced your packages at low prices, they have crucial value or provide valuable features; this can guarantee you a broad customer base.

Your customer base growth is a crucial factor for you if you decide to have low prices for your products and services, or you could provide value-added services that would reside well with your existing customer base, and it would bring in additional potential customers for you.

You could categorize your customer base into different segments, meaning you could provide low-priced products and services to a segment and, simultaneously, high-priced products and services to another part. However, the value would differ from the features provided.

As long as you understand the importance of your customer base and its growth, then you will realize its direct relation with your ARPPU. Simple adjustments in your prices and providing value to your customers will directly impact your ARPPU.

Three Mistakes While Calculating ARPPU

When calculating our ARPPU & ARPU, a mistake can occur, and this is because they both measure and calculate users' contribution to the aggregated revenue. They have relatively close names but are different metrics and provide different results and information.

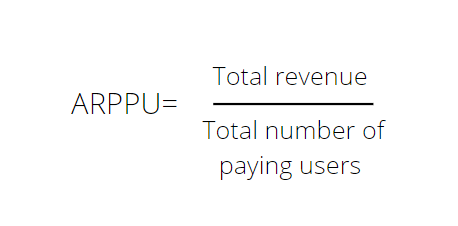

ARPPU is counted as the monthly recurring revenue (MRR) divided by the total number of active paying customers. So the a need to focus on the keyword ‘Paying Customers’ who pay for features in your app or services and not only one-time subscribers or users.

Contrary to ARPPU, Average Revenue Per User (ARPU) is measured or counted by dividing monthly Recurring Revenue / All users (paid + free). For instance, if you attract 200 customers, out of which 100 are paying users, your monthly recurring revenue is $4000.

So, your ARPU will be 4000/100 = $40.

This means one user brings you $40 per month.

To calculate your ARPPU, which is 4000/40 = $100, this means one paying customer brings you $100 per month. This means a major difference between both of these calculated values. Hence, if you are utilizing both ARPPU and ARPU, clarify that.

ARRPU = Total Revenue / Total users

Rather than considering monthly recurring revenue, people may consider the total revenue earned. But for subscription-based endeavors, the monthly recurring revenue shows your business's actual performance.

So, in both these cases, the total user count will always be greater than the paying. Therefore, the average Check and ARPPU are the same.

Moreover, one of the common mistakes businesses make while calculating ARPPU is that they take the Average Check as ARPPU.

The result may not be unpleasant; hence it could mislead the business.

Average check = Revenue/Transactions

Average Check is the average transaction value, and the number of transactions can’t be the number of paying customers. So, for example, if one customer regularly pays in a month, his number of transactions will not be taken in ARPPU, but it will be part of the Average Check calculation.

We could try to understand this with an example.

Imagine we have 100 users who paid $100 each, then 20 of them again paid $20 each. In this case, the ARPPU will be (20 x $20 + 20 x $100)/100 = $24.

On the other hand, for the Average Check calculation, we will divide the revenue by the number of transactions, which is (100 x $24 + 20 x $100)/20 = $220

ARPPU Vs. ARPU Vs. ARPDAU

ARPPU focuses exclusively on paying customers and their contribution to the generated revenue, but it's not the only measure of users' contribution to the generated revenue. For example, there is ARPU and ARPDAU, which also measure this factor.

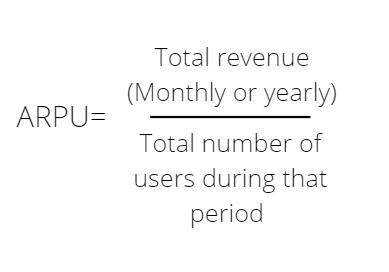

What is ARPU?

This term stands for 'Average Revenue per User,' and it measures the average paid cash or generated revenue by all the users of a service or all the downloads of an application.

This metric, in its calculations, will include both types of users: those who pay for the service and those who did not pay.

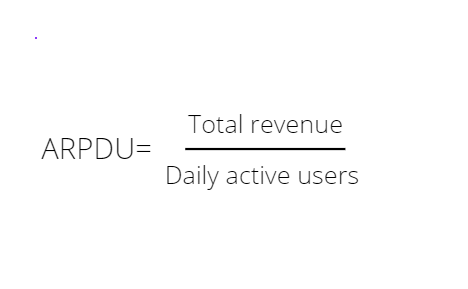

What is ARPDAU?

This is an abbreviation for 'Average Revenue per Daily Active User,' and it's a metric that measures users' interaction or paid interactions with your services or application on a daily basis.

This metric differs from ARPU and ARPPU in terms of the period it calculates users' contribution to the generated revenue.

The formula for ARPPU, ARPU, and ARPDAU & how to calculate them?

How to calculate it and its formula?

ARPPU is calculated once you have your total revenue and the number of paying users. To calculate your total revenue or monthly recurring revenue (MRR), you need to include your:

- upgrade revenue

- existing paying users' revenue

- revenue earned from new subscriptions (Full price + non-zero discounted)

- Normalize revenue on a monthly basis for annual/quarterly subscriptions

- Deduct revenue lost from downgrades and cancellations

Once you have these two factors, it will be easy to calculate the ARPPU by simply dividing them.

How to calculate ARPU and its formula?

The average revenue per user is simply calculated by calculating the yearly generated revenue or the annual generated revenue divided by the total customers or users you have during a month or a year.

Contrary to ARPPU, to calculate your generated revenue for ARPU, you are not required to know the paying customers or users; you simply need to count all the users you have on a monthly or annual basis.

How to calculate ARPDAU and its formula?

As ARPDAU calculates users who engage with your services or applications daily and generate revenue for your business daily, you need to count the number of users who use your services daily and make daily payments basis.

Once you have this number, you will divide your total revenue by your daily active users to have your ARPDAU.

Researched and authored by Ahmed Fagiry | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?